Why is the complementary SZV-M needed?

The supplementary SZV-M allows the employer to clarify and supplement information about insured persons previously transferred to the Pension Fund (Article 15 of the Law of 01.04.1996 No. 27-FZ “On individual (personalized) accounting...").

Using the supplementary SZV-M, the employer submits to the Pension Fund:

- information that is not in the original report (for example, for a forgotten employee);

- correct data instead of erroneous ones (correction of errors in the employee’s full name, TIN or SNILS made in the original SZV-M).

The supplementary SZV-M allows you to generate complete and reliable personalized information on the personal accounts of insured persons.

What to refer to

From 2022, if the territorial body of the Pension Fund, when adopting the supplementary SZV-M, hints at a fine, then you can safely refer to Art. 11 and 17 of the Federal Law of 01.04.1996 No. 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system” (hereinafter referred to as Law No. 27-FZ).

The bottom line is that the policyholder’s independent identification of an error, which was subsequently corrected, before it was discovered by the Fund, by submitting corrected information (SZV-M with the “additional” type), indicates the possibility in this case not to apply appropriate financial sanctions to the policyholder.

For failure by the policyholder to submit within the prescribed period or submission of incomplete and/or unreliable information to SZV-M, they may be fined 500 rubles in relation to each insured person (i.e., a “forgotten” employee) on the basis of Part 3 of Art. 17 of Law No. 27-FZ.

In December 2022, policyholders were able to cancel fines for the addition of SZV-M in the cassation arbitration courts of several districts. In addition, the Supreme Court of the Russian Federation did not .

Thus, since 2022, the practice has turned in favor of employers: the fine for independently adding SZV-M is unlawful .

ADVICE

If the Pension Fund of Russia has fined you for late submission of reports on employees who were “forgotten” in the initial SZV-M form, you can safely go to court. The likelihood of the fine being canceled is very high . Moreover, this is a trend, and not random decisions in judicial practice.

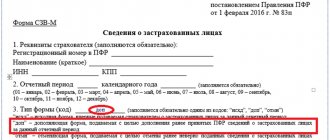

On what form should I fill out the supplementary SZV-M?

There is no separate form for the supplementary SZV-M. This report must be completed on the same form that was used for the original report.

In order for the Pension Fund to distinguish the original report from the corrective one, the reporting form contains a special Section 3 “Type of form (code)”.

For supplementary SZV-M, the code “additional” should be entered in this section:

Instruction 1: they forgot to include the employee in SZV-M

If you forgot to include a person in the SZV-M, you should fill out an adjustment report form. To do this, take the usual form SZV-M, approved. Resolution of the Board of the Pension Fund of 01.02.2016 No. 83p, and fill it out as follows:

- In sections 1 “Insured Details” and 2 “Reporting Period”, indicate the same data as in the original SZV-M, which needs to be supplemented if there were no errors in these sections of the original SZV-M.

- In section 3 “Form type (code)”, enter the code “additional” - this means that the form is submitted to supplement the information about insured persons previously accepted by the Pension Fund for the reporting period.

- In section 4 “Information about insured persons”, include information about the “forgotten” employee. There is no need to repeat information about other employees already reflected in the original SZV-M.

Give the completed adjustment SZV-M form to your manager for signature and then send it to the Pension Fund.

How to fill out the supplementary SZV-M when correcting errors

To correct errors in the original report already submitted to the Pension Fund, it is not enough to issue only a supplementary SZV-M. You must first cancel the erroneous data.

Use the following procedure, if you made a mistake in the full name, INN or SNILS of an employee - fill out two SZV-M:

- with the “cancel” type - transfer into this form from the original SZV-M information about the employees (employee) for whom corrections are required;

- with the “additional” type - in it, indicate the correct data for these employees (employee).

Let us tell you in more detail how to fill out the SZV-M with type “o” when correcting errors in the original report:

Step 1. On the new SZV-M form, fill out Section 1 “Insured Details” and Section 2 “Reporting Period” exactly as you did in the original report.

Step 2. In Section 3 “Form type (code)” enter the code “cancel”.

Step 3. In Section 4 “Information about insured persons”, transfer individual information from the original report only for the employee whose data contains an error.

Step 4. Send the SZV-M with the “cancel” type to the Pension Fund of Russia.

Step 5. On the new SZV-M form, fill out Section 1 “Insured Details” and Section 2 “Reporting Period” exactly as you did in the original report.

Step 6. In section 3 “Form type (code)” enter the code “additional”.

Step 7. In section 4 “Information about insured persons”, enter the correct individual information (full name, INN and SNILS) only for the employee whose erroneous information was reflected in the original report and was canceled in SZV-M with the “cancel” type.

Step 8. Send the SZV-M with the “additional” type to the Pension Fund.

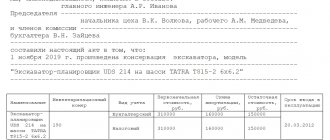

Example 1

When registering SZV-M for October 2022, the accountant of Veter LLC made a mistake in the SNILS number of one employee, Igor Yuryevich Kitaev. In his SNILS, two numbers were swapped and instead of the number 040-298-765 08, the report included the number 040-298-675 08.

In order for the employee’s personal account to reflect reliable information, two reports were sent to the Pension Fund of Russia in the SZV-M form: with the type “o. It reflected information about only one employee, whose individual information contained an error in the original report.

How the error in SZV-M was corrected, see the samples:

Reasons why you may need to generate a supplementary report

There are several reasons, in the presence of which, the accountant has the right to issue an additional form SZV-M. Let's format the information in table form:

| Reason for submitting supplementary SZV-M to the Pension Fund | Example | Report formatting method |

| SZV-M additional for an unregistered employee | Kosmos LLC sent a report to the Pension Fund of the Russian Federation in the SZV-M form on May 27, and on May 31 a new specialist was hired. Since the employment contract was concluded in the return month, the information must be transferred to the Pension Fund branch. | The SZV-M form is filled out with the “Additional” attribute in the 3rd section. The accountant does not have to fill out all forms for the employee. It is enough to enter the last name, first name, SNILS and TIN of the new specialist in the report. |

| SZV-M in case of incorrect TIN – canceling or supplementing | After submitting the form, the accountant discovered an error in indicating the TIN of employee Yu.M. Semenov. It is necessary to amend the data for the Pension Fund | If the accountant in SZV-M indicated an erroneous TIN, the SZV-M form for clarifying and canceling the plan is required. In the first, the accountant will indicate the data of Yu.M. Semenov. with an incorrect TIN. And in the supplementary SZV-M there is also data on Yu.M Semenov, but only correct. Both forms are provided at the same time |

| Supplementary form SZV-M in case of an error in SNILS | After submitting the report, the accountant of Arkada LLC discovered that the SNILS of two employees were mixed up | If the report is not fully accepted by the Pension Fund, then a supplementary form will be required only for those employees for whom incorrect data was entered. If the protocol is completely negative, then it is better to generate the report again with new information. |

Additionally, the accountant should know that, although now there is a reason such as incorrectly indicating the TIN, this number is not required to be filled out in the SZV-M form. In other words, if an employee’s TIN is missing, there is no need to resubmit the form.

If the report is not submitted in a timely manner, the company will be fined in the amount of 500 rubles. for each employee.

We issue a supplementary SZV-M for forgotten employees

Filling out the supplementary SZV-M for forgotten employees takes several steps:

Step 1. On the new SZV-M form, fill out Section 1 “Insured Details” and Section 2 “Reporting Period” exactly as you did in the original report.

Step 2. In section 3 “Form type (code)” enter the code “additional”.

Step 3. In section 4 “Information about insured persons”, indicate individual information (full name, INN and SNILS) only for the employee (employees) whom you forgot to include in the initial report. There is no need to duplicate individual information about employees already indicated in the original SZV-M.

Step 4. Send the SZV-M with the “additional” type to the Pension Fund.

Example 2

Every month, the accountant of Master LLC submitted to the Pension Fund a report in the SZV-M form for 112 employees of the company. In October 2022, three individual contractors were registered to perform one-time work under the GPC agreement. When filling out the SZV-M for October, the accountant, out of habit, reflected all full-time employees, but forgot about the hired contractors. He noticed his mistake after submitting the initial report. He provided information on forgotten persons in the supplementary SZV-M.

How the accountant filled out the supplementary SZV-M for October 2022, see the sample:

Nuances that should be taken into account when filling out the supplementary form SZV-M

When introducing the new reporting form, the Pension Fund of the Russian Federation did not provide the insured persons with any explanations or instructions for filling it out. This was due to the fact that all the necessary recommendations are reflected in the form itself. All that is required from the accountant is to enter information about the employees.

Each section has its own name and it indicates what information needs to be entered in a particular column. You will need to enter information about the employee, details of the employment contract and the amount that was paid under this agreement in the current period.

The accountant should know that if the responsible person did not include the employee when filling out the form, then you can fill out a separate form only for the person who was missed, rather than drawing up the report again. There are no significant differences between the main form and the supplementary one, with the exception of a small note “ADP”:

The mandatory report in the SZV-M form is submitted to the Pension Fund monthly, before the 15th day, however, if the due date falls on weekends or holidays, the report should be submitted to the Pension Fund on the next working day.

In what form should the supplementary SZV-M be presented?

As a general rule, companies with 25 or more employees can submit SZV-M exclusively in electronic form (Clause 2 of Article 8 of Law No. 27-FZ). If the number is smaller, the choice is up to the employer: you can report on paper or via the Internet.

If the initial report is sent based on the number of individuals in electronic form, the supplementary SZV-M should also be sent in the same form. It does not matter that it will provide information on only one or several employees.

Let us remind you that for submitting SZV-M in paper form instead of electronically, the fine is 1,000 rubles. (clause 2 of article 8, clause 4 of article 17 of Law No. 27-FZ, clause 41 of Instruction dated 04/22/2020 No. 211n).

When should the corrective report SZV-M be submitted?

The first question that arises after discovering an error is not “How to fill out the corrective report?”, but “How much time do I have to submit the corrective report?”

First, we need to figure out in what format we should take the SZV-M. To do this, you need to remember the following algorithm: if in the last reporting period the number of employees was less than 25 people, then the report can be submitted both electronically and in paper form. In other cases - only electronically.

Another diagram for ease of memorization.

The law does not establish a deadline for filing a corrective report, but to avoid a fine, it is better to submit it as quickly as possible. The optimal period would be five days. This is the period indicated when an error is detected by the Pension Fund of Russia.

The fastest way to submit your report is in electronic format. “Astral Report 5.0” was created specifically for this: when filling out reports, the service will indicate errors, and the document will be sent to the regulatory authority instantly.

When to submit a supplementary report

The deadline for submitting the supplementary SZV-M depends on who discovered the error - the employer or the Pension Fund:

The PFR notification must contain information about errors and (or) inconsistencies between the submitted individual information and the data available to the PFR (clause 38 of the Instructions, approved by Order of the Ministry of Labor No. 211n, Part 5 of Article 17 of Law No. 27-FZ).

Pension Fund specialists have the right to deliver the notice to the employer personally against signature, send it by registered mail, or send it electronically via TKS.

In order not to be late in submitting the supplementary form (if errors were identified by the Pension Fund) and not to earn a fine, it is important to count the deadline correctly (clause 38 of Instruction No. 211n):

- the notice was sent by registered mail - the date of delivery is considered to be the sixth day counting from the date of sending the registered letter;

- the notification was sent electronically via TKS - the date of receipt is the date indicated in the confirmation of receipt of the employer’s information system.

Instead of notifying that errors have been corrected, the Pension Fund of Russia may send the employer an SZV-M inspection protocol indicating the identified errors and (or) inconsistencies. Both of these documents are legally equivalent (Resolution of the Arbitration Court of the North-Western District of April 23, 2020 No. F07-4647/2020 in case No. A42-9736/2019).

Complementary SZV-M and coronavirus subsidy

During the coronavirus pandemic, SZV-M acquired a special status. Using data from this report, tax authorities determine whether the employer has the right to receive a subsidy from the federal budget.

A company loses the right to a subsidy if the number of its employees in the month for which the subsidy is paid is at least 90% of the number of employees in March 2022 or reduced by no more than 1 person in March 2022 (Rules for provision in 2020 from the federal budget subsidies, approved by Government Decree No. 576 dated April 24, 2020).

Tax officials recalled that small and medium-sized businesses that have reduced their staff by more than 10% (based on an analysis of SZV-M reporting) or by more than 1 person in relation to the number of employees in March 2022 cannot qualify for a subsidy.

Moreover, the submission of the supplementary SZV-M for March 2022 after the deadline for sending applications to the tax authorities for the subsidy provided for by Resolution No. 576, for the purpose of formally implementing the provisions of the Rules, is not a basis for receiving a subsidy.

Who reports on the SZV-M form

All organizations and individual entrepreneurs who have hired employees under employment and civil law contracts. If an individual entrepreneur, lawyer, private detective, notary, arbitration manager does not have employees, then they do not report on this form.

Organizations without hired workers must report, because in any case the organization must have at least a manager. Even if this is the only founder without an employment contract, he is included in the report.

Who to include in the SZV-M report

SZV-M includes information on employees who work:

- under employment contracts;

- working under civil contracts;

- under copyright agreements.

If the contract was terminated in the month for which you are submitting the report, information about such an employee must also be included in the form. The same applies to contracts that began to operate in the reporting month.

For example, in January 2022, two people left the organization, and in the same month three new employees were hired. All five must be listed in the January report.

For inclusion in the report, the fact of the concluded contract is important. This means that if an employee is on maternity leave, leave at his own expense, or with salary retained, he must be included in the report.

There are no zero SZV-M reports.

When will you be fined for supplementary SZV-M?

A fine cannot be avoided if you submitted the supplementary SZV-M for forgotten employees after the legally established deadline. Now this is directly provided for in Part 4, Clause 40 of Instruction No. 211n.

Previously, in such circumstances, it was possible to fight off a fine in court (Resolution of the AS SZO dated 04/06/2020 No. F07-2720/2020 in case No. A56-79354/2019, Determination of the RF Armed Forces dated 02/08/2019 No. 301-KG18-24864, dated 20.12 .2019 No. 306-ES19-23114).

The fine for submitting individual information after the established deadline is 500 rubles. in relation to each insured person (Article 17 of Law No. 27-FZ).

Examples:

- The company submitted the SZV-M for November on December 14, and on December 16 submitted the supplementary SZV-M with five forgotten employees. The fine was 2,500 rubles. (5 people x 500 rub.) - the report was submitted outside the period established by law.

- The company submitted the original SZV-M for November on December 14, and on December 15, 2020, sent the supplementary SZV-M to the Pension Fund for twenty forgotten employees. She will not be fined - the report is submitted before the end of the reporting campaign.

Let us remind you that SZV-M for the reporting month should be submitted no later than the 15th day of the month following the reporting period (clause 2.2 of Article 11 of Law No. 27-FZ).

The amount of the fine for supplementary SZV-M in court can be significantly reduced if the court takes into account mitigating circumstances (Resolutions of the AS TsO dated April 12, 2018 No. F10-760/2018, AS MO dated September 13, 2017 No. F05-12439/2017). Mitigating circumstances may include a slight delay in reporting and a lack of intent and negative consequences for the budget. And also the fact that the offense was committed for the first time and the employer admitted guilt.

Why is it important to submit the SZV-M on time?

Information on employees in the SZV-M form must be submitted every month no later than the 15th day following the reporting month.

Failure to meet the deadline for submitting the SZV-M may lead to unexpected consequences.

An illustrative example of this is the resolution of the Far Eastern District AS of September 20, 2022 No. F03-3587/2018. Example.

Failure to comply with the deadline for submitting SZV-M The company where the pensioners worked did not have time to submit information on the SZV-M form on time. As a result, the reporting was submitted two months late. The Pension Fund decided that the retired employees had quit and indexed their pensions as if they were not working. Which led to overpayment of their pensions. Therefore, the fund obliged the organization to pay a fine for late delivery of SZV-M and compensate for the loss in the form of “excess income” paid to pensioners. The courts of three instances agreed with the decision of the Pension Fund. The reason for the payment of inflated pensions was that the organization submitted information on the SZV-M form untimely. And as stated in the law on insurance pensions, if policyholders submit false information to the Pension Fund for employees or submit it late, this can lead to overspending on pension payments. Insurers who are guilty of this must compensate the fund for the damage caused (clause 2 of article 28 of Law No. 400-FZ). Therefore, the court ordered the organization to reimburse the fund for the overpaid “super pensions”.

Only the parent company can be held accountable for violations of the delivery of the SZV-M “separate section”. This is the conclusion of the Supreme Court of the Russian Federation, made by it in its resolution of December 10, 2022 No. 308-KG18-19977.