Who submits Form 1-Services

Form 1-Services is used to report to everyone who provides paid services to the population. This applies to organizations, individual entrepreneurs and legal entities (with the exception of law offices).

Individual entrepreneurs who are engaged in the fields of agriculture, insurance, retail trade or public catering do not need to report on the form. Also, data on the form is not provided by residential complexes, housing cooperatives, homeowners' associations and TSN.

As for small businesses, not all of them will have to submit a report for 2022. In accordance with Art. 5 No. 209-FZ, statistical observation of the NSR is carried out on a selective basis. If your company is included in the sample, you will be sent a letter. But Rosstat does not always do this, so it is better to call the statistics service department in advance or check all mandatory reports on the official Rosstat website. Ignorance of the need to report will not exempt you from fines.

Report easily and without errors. A convenient service for preparing and submitting reports via the Internet. We are giving access to Extern for 14 days!

Deadlines and procedure for submitting Form 1-Services

Form 1-Services is submitted annually. In 2022, you need to report for 2021. The deadline for this is no later than March 1.

If you are a small enterprise, but were not included in the list of those required to report before this deadline, it means that you managed to avoid the survey this year.

The form can only be submitted electronically. Place of delivery - territorial bodies of Rosstat:

- for organizations and their separate divisions - at the place of actual activity;

- for individual entrepreneurs - at the place of its location or at the place of actual activity, if they do not coincide.

For organizations with separate divisions, several forms are required. It all depends on the area where you are located. If a legal entity and separate divisions are located in the same subject, then data is provided for the legal entity, taking into account the divisions; if in different ones, separate reports are submitted for each OP to the territorial authorities at their location.

Deadlines for submitting the statistical form

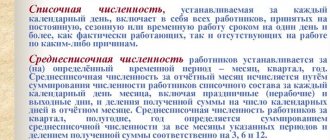

Despite the fact that both report forms are very similar to each other, the deadline for submitting them to the statistics body is different.

| Report form name | Deadline for submitting the report to the statistics body | |

| Form P (services) | Number of employees no more than 15 people | The report is provided on a quarterly basis, no later than the 15th day of the month following the reporting quarter |

| Number of employees more than 15 people | The report is submitted monthly, by the 4th of the month | |

| Form 1-services | The deadline for submitting the report to the statistics department does not depend on the number of employees | The form is submitted once a year, before March 1 |

It must be borne in mind that the number of company employees is determined based on the results of the past year. That is, if at the end of 2022 the number of employees of the organization was 17 people, then a report on Form P (service) must be submitted every month.

It is difficult to miss the due date for service 1; the report is submitted only once a year.

How to fill out form 1-Services

Report form 1-Services is otherwise called OKUD 0609703 and approved in Appendix No. 7 to Rosstat Order No. 458 dated July 30, 2021.

Form 1-Services is small, it includes a title page and two sections. In them, organizations and entrepreneurs must talk about the types and volumes of paid services for the population and make a breakdown by territory (for legal entities, except for small businesses).

Before proceeding to filling it out, it is worth considering several nuances that determine the need to enter information into the form. Information in the report should include service providers who provided services directly to the public for a fee. The total cost of services will take into account the cost of services paid by the consumer himself. The scope of paid services must include the cost of materials, components, spare parts and parts used in the provision of services, unless they were provided by the customer himself.

The volume of paid services is given in actual market sales prices, including VAT. Requires detail down to one decimal place.

There is no need to take into account revenue in the volume of paid services in the following cases:

- the service is provided to legal entities or entrepreneurs for their business;

- the service was paid for from the budget or extra-budgetary fund;

- sale of food and non-food products;

- catering services;

- services in the field of compulsory medical insurance;

- financial and insurance services (except for voluntary health insurance);

- services of gambling establishments, pawnshops, banks;

- cost of lottery tickets sold;

- services for religious rites and ceremonies;

- the amount of initial payments, as well as subsequent repayments of the cost of apartments purchased by citizens in apartment buildings under an equity participation agreement or individual apartment buildings built at the expense of investors, sold to the public;

- amounts received by medical institutions under birth certificates.

Let's take a closer look at the process of filling out the form.

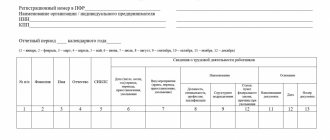

Title page

On the title page you must disclose all the basic information about yourself. The data for organizations and entrepreneurs is slightly different.

In the address part of the company indicate its full name, as indicated in the constituent documents, and its abbreviated name. For separate divisions, indicate its name and the name of the legal entity to which it belongs. Individual entrepreneurs indicate only their full name.

In the “Postal Address” line, the legal entity indicates the legal address and the actual address, if they do not match. Separate divisions without a legal address provide a postal address and zip code. The individual entrepreneur indicates the postal address at the place of registration.

Section 1

In the first section, the respondent must talk about the volume of services provided to citizens on a reimbursable basis during the year. The scope of services is indicated:

- in prices valid at the time of payment;

- in thousands of rubles;

- including VAT and other payments;

- taking into account the cost of materials necessary to provide the service;

- with one decimal place.

Receipts are distributed by type of service line by line.

Line 01 is the result. It contains the total volume of services that the respondent provided to the population during the year on a reimbursable basis. Consumers of services can be citizens of the Russian Federation and other countries.

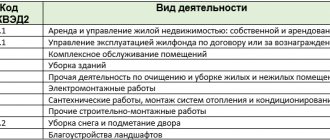

The volume of services from line 01 is distributed across lines 02 - 34 by type of service based on OKPD2.

In lines 02 - 15, indicate household services to the population. From the nuances:

- on line 04 it is necessary to indicate the cost of certificates for additional maintenance of equipment and equipment that the population purchases to extend warranty service;

- line 05 indicates repair services for vehicles and motorcycles, which are provided at the expense of insurance companies;

- on line 13 of line 12, it is necessary to highlight services for rental and leasing of cars and light vehicles, including car sharing.

In lines 16 - 19, indicate transportation and communications services: transportation, mail, couriers, telecommunications services.

Line 20 indicates payments for housing services, for example, for the use of premises, maintenance, routine repairs, intercom. This line does not need to reflect contributions for major repairs (for owners of premises in apartment buildings) and the amount of utility resources for the maintenance and use of common property.

In line 21, the volume of services is shown by organizations and local authorities that supply residents with resources: electricity, heat, water. This includes utility payments from the population, as well as the supply of fuel and household gas to citizens.

Line 22 shows the services of cultural institutions. Organizations that only sell entrance tickets and subscriptions show their agency, commission, etc. remuneration in the line.

In line 23, travel agencies show the full cost of the tourism product sold directly to the public. It could be formed by both a resident and a non-resident of the Russian Federation. Payments to foreign service providers do not need to be included here.

Lines 24 and 28 are very similar in content - both involve population placement. But line 24 is for hotels, hotels, hostels, etc. that clean their rooms every day. Line 28 - for campsites, camps, recreation centers, resorts, etc. Line 29 from line 28 highlights the services of sanatorium and resort organizations, including year-round and seasonal health camps.

Line 31 is relevant for legal entities. It reflects remuneration for legal assistance to citizens and compensation for expenses. Other organizations providing similar services enter data in line 34.

Line 34 indicates all other paid services that were not included in the previous lines. Line 35 identifies electronic services and services: online cinemas, game subscriptions, cloud storage, etc.

Section 2

The second section is intended only for organizations (except small businesses). In it, companies distribute paid services to urban districts and municipal areas. The section is completed for each separate division.

The new section is quite simple. The first column indicates the name of the entity where the service was provided. In the second column is the OKTMO code. The third column shows the volume of paid services for this education.

When filling out, do not forget about the control ratio: the sum of the lines in column 3 of the second section must be equal to the number in line 01 in column 4 of the first section.

Form 1-Services Sample form 1-Services

In 2014, data collection on the volume of paid services to the population will be carried out quarterly according to the state statistical reporting form 4-un “Report on the volume of paid Industrial and agricultural products” (parts 1 and 2), approved by Resolution of the State Standard of the Republic of Belarus dated June 28, 2007 No. 36 (hereinafter referred to as OKRB 007-2007) (posted on the official website of Belstat in the “Classifiers” section).

When distributing volumes of services by type, use only five-digit codes OKRB 007-2007, with the exception of construction services, which are coded with a two-digit code, and services in the field of health care and social services, which are coded with a three-digit code.

When filling out the report in column A of table. 1 “Volume of paid services for rental of sports equipment and equipment,” code 93.04.1 “services to ensure physical comfort.”

Explanations for filling out individual indicators in the table. 2 and 4

In table 2 reports reflect the actual amount of payment by the population for the provided housing and communal services. Please note that the report does not reflect the amount of compensation from the republican and local budgets to housing and communal services organizations for subsidies and social support provided to certain categories of citizens for the payment of utility services, if subsidies and social support are awarded to citizens in the form of discounts from the payment amount.

Indicators table. 2 reports must be linked to the indicators in the table. 1 “Volume of paid services to the population”: data on page 20 must be less than or equal to data on page 01 of the report.

In table 4 reports reflect data on the number of roadside service facilities and the volume of paid services provided through roadside service facilities.

Roadside service facilities include buildings and structures located on the roadside and intended to serve road users along the route (hotels, motels, campsites, car wash stations, service stations, medical centers, communication points, etc.).

On page 42 of the report, reflect data on the volume of paid services provided through a roadside service facility, regardless of who they were provided to: legal entities or individuals, residents or non-residents of the Republic of Belarus.

At the same time, the volume of paid services should include not only the volume of basic types of services, but also the volume of additional services provided through a roadside service facility, for example, hotel accommodation, billiards, use of a sauna, massage, etc.

Zero form 1-Services

The Statistics Service provided for the submission of a report on services even if activities were not carried out or suspended during the year.

If an organization or individual entrepreneur has not worked all year, then they submit a report in the general manner, but enter zeros in the lines.

Organizations that have been operating for only part of the year submit the form on a general basis and indicate since when they have not been operating.

Report easily and without errors. A convenient service for preparing and submitting reports via the Internet. We are giving access to Extern for 14 days!