In what cases should you indicate the UIN?

In 2022, the UIN must be indicated only in payment orders for payment of arrears, penalties or fines at the request of the Federal Tax Service, Pension Fund or Social Insurance Fund.

That is, to indicate the UIN, organization or individual entrepreneur in the payment:

- first they must receive from the Federal Tax Service, Pension Fund or Social Insurance Fund an official request for payment of arrears, penalties or fines;

- find the UIN code in this requirement;

- transfer it to your payment card in field 22 “Code”.

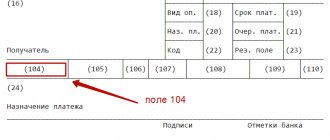

The UIN field can be found at the bottom of the payment order:

Accordingly, to the question “where can I get the UIN?” there is only one answer - in the request for payment received from the regulatory authorities. There is no single UIN for taxes or contributions. In each specific case the code is unique.

What is UIN in a payment order?

Until 2014, taxpayer organizations did not fill out the “Code” field (22) in payment documents.

In 2014, in accordance with clause 1.21.1 of the Regulations of the Central Bank of the Russian Federation No. 383 dated June 19, 2012, when paying for budget transfers (taxes and insurance contributions) payers are required to put the UIN code in the payment slip (we will explain what this is later).

The name of this code stands for a unique accrual identifier. It must be entered for each transfer to the budget in the current year. The UIN was also registered in the 2022 payments: what is this identifier and where should it be indicated?

A unique digital value code is entered into payment orders to further identify the payment made by the institution. The Ministry of Finance of the Russian Federation introduced it in order to reduce the volume of unclear payments received by budgetary and extra-budgetary government bodies. Also, with the help of this code, the system of financial accruals is simplified and control is exercised over the correctness of receipts of payments to authorities and funds.

If you make a mistake in the UIN

Using the UIN number, taxes, insurance contributions and other payments to the budget are automatically recorded. Information about payments to the budget is transmitted to the GIS GMP. This is the State Information System about State and Municipal Payments. If you specify the wrong code, the system will not identify the payment. And the obligation to pay will be considered unfulfilled. And as a consequence of this:

- the company will incur debt to the budget and funds;

- continue to accrue penalties;

- you will need to clarify the payment and find out its “fate”;

- the money will arrive to the budget or funds with a delay.

How to find out UIN

The UIN is formed by the relevant government agency, which is the recipient of the payment. It cannot be considered a constant value for a payment group. One UIN corresponds to a strictly defined accrual. Therefore, the main source of information about the UIN of a specific document is the government agency that established it.

For individuals

UIN is also used when transferring mandatory payments to the budget by ordinary citizens.

Taxes are calculated for them by the Federal Tax Service. These include land tax, transport tax, property tax, etc.

You might be interested in:

Writing off accounts payable with an expired statute of limitations instructions for an accountant

Every year, in due time, all payers who have a taxable object receive notifications that reflect in detail exactly how the tax was calculated, how much must be transferred to the budget, etc.

These letters are sent to individuals at their registered address. The UIN for them is the index of the received payment notification. Citizens just need to transfer it to the payment form.

Recently, the tax authorities, along with the notification, also send a receipt for payment of payments. Therefore, an individual must remember that if he uses a receipt prepared by the authority for payment, then the required UIN is already indicated in it.

If an individual has not received a notification, then he can look up the UIN in the taxpayer’s personal account.

Attention! In addition, on the tax website nalog.ru, an individual can independently request a receipt or fill it out for payment. Then the service will automatically assign a UIN for the transfer.

There is also a rule according to which, if an individual does not know the UIN, he simply needs to indicate his TIN in the field with the UIN on the tax payment.

Organizations and individual entrepreneurs

Business entities in most cases calculate their tax liabilities independently. They are called current payments. To identify them, it is enough to indicate the kbk, tax identification number of the subject and checkpoint, if available.

Such transfers do not require additional verification of details. In these cases, the taxpayer puts “0” in field 22. It is very important that there must be one 0, otherwise the bank will not miss the payment.

The situation is different if organizations accrue liabilities as a result of inspections. Then, based on the decision made, a demand for payment is formed. The government agency that issued it also records in this document the UIN, which the payer will have to indicate when making the payment.

UIN and current payments

When paying current taxes, fees, and insurance premiums calculated by payers independently, the UIN is not established. Accordingly, there is no need to indicate it in field 22. Received current payments are identified by tax authorities or funds by TIN, KPP, KBK, OKTMO (OKATO) and other payment details. A UIN is not needed for this.

Also, the UIN does not need to be indicated on the payment slip when paying arrears (penalties, fines), which you calculated yourself and did not receive any requirements from the Federal Tax Service, Pension Fund or Social Insurance Fund.

When paying all current payments, in field 22 “Code” it is enough to indicate the value “0” (FSS Letter No. 17-03-11/14-2337 dated 02/21/2014). There is no need to use quotation marks. Just enter - 0.

If, when transferring current payments in field 22, you indicate “0”, then banks are obliged to execute such orders and do not have the right to require filling out the “Code” field if the payer’s TIN is indicated (letter of the Federal Tax Service of Russia dated 04/08/2016 No. ZN-4-1/6133 ). At the same time, do not leave field 22 completely empty. The bank will not accept such a payment.

Organizations can indicate both the INN and the UIN on their payments at the same time. Or they can only indicate the TIN, since the UIN is not always known. But then there should be 0 in field 22.

Where is it indicated on the payment order?

The UIN value is entered in the payment order field with code 22:

Where to get?

UIN is a special digital combination that cannot be created independently.

The need to fill out column 22 in a payment order appears only when the taxpayer (individual, legal entity or individual entrepreneur) receives a special notification of a request from the tax authority about the presence of tax debts.

This requirement specifies a unique identifier, which must be rewritten when filling out a payment order in field 22.

If the payer does not know the UIN and at the same time fills out a payment slip to pay the arrears, penalties or fines identified by the Federal Tax Service, then you need to clarify and obtain the identifier from the tax service.

If the subject has no debts on taxes, contributions, fees and makes all payments on time, then the question of where to get the UIN does not arise.

If payment is made on time, “0” is filled in field 22 of the payment order, and the indicators of other fields of the payment order (KBK, INN) are used to identify the payment.

Decoding the numbers in the UIN code

As a rule, the UIN consists of 20 digits, each of which has its own meaning.

Decoding the numbers in the UIN:

- from the first to the third - three digits indicate the institution to which the payment is intended (182 - for tax payments);

- fourth - 0 is put, since the value of this number does not indicate anything;

- from fifth to nineteenth - the payment number assigned to it by the tax office corresponds to the document index;

- The twentieth is a control number, the calculation of which is carried out in a special order.

UIN for individual entrepreneurs

Individual entrepreneurs, notaries, lawyers, heads of peasant (farm) households and other individuals indicate either the Taxpayer Identification Number (TIN) or the UIN (UIN) in their payments. If both of these details are not filled in, the bank will not accept the payment order. That is, the principle is this (letter of the Federal Tax Service of Russia dated 04/08/2016 No. ZN-4-1/6133):

- if the individual entrepreneur indicated his INN in the payment, then in the “Code” field instead of the UIN, 0 is entered;

- if the UIN is specified, the TIN is not filled in.

Can the field with code 22 be left blank?

Filling out the field with code 22 in the payment order is mandatory when transferring funds to the budget.

The value of column 22 can take the following meaning:

- Digital multi-digit UIN code - in case of filling out a payment slip based on the requirement of the Federal Tax Service for repayment of arrears, payment of fines and penalties.

- 0 – in other payments to the budget.

- Not to be filled in for other payments not to the state budget.

Empty field 22 when paying money to the budget is equivalent to a zero value, however, in accordance with the rules for filling out payment orders, it is necessary to put 0 in this field if there is no UIN, without leaving the column empty.

Payment orders in which field 22 is not filled in may not be accepted by the bank and the tax authority.

If the subject makes a payment to the account of an individual, legal entity or individual entrepreneur who is not related to government agencies, then the field is not filled in.

How is the column filled in when paying taxes?

If an organization, individual or individual entrepreneur pays taxes on time or pays off the debt on its own initiative, and not at the written request of the Federal Tax Service, then 0 must be entered in field 22.

To identify such tax payments in the payment slip, you need to fill out the KBK correctly; it is from this that the Federal Tax Service learns about the purpose of the received amount.

If a subject fills out a payment order for the payment of arrears of taxes, a fine or penalty imposed in connection with the debt, and has received a written notification from the tax office with a requirement to repay the debt, then in field 22 the UIN specified in the tax notice is filled in.

The UIN identifier is expressed digitally and can have up to 25 digits. When filling out field 22 in a payment order, you must accurately rewrite the entire code without making mistakes.

Errors in the UIN will lead to the payment not being accepted, since the purpose of the amount cannot be identified correctly.

If the payment order is filled out with an error in the UIN, the payer will face the following problems:

- the tax debt will not be repaid or will be received late;

- Penalties will continue to accrue for each additional day overdue.

Filling samples

Sample of filling out field 22 of a payment order when paying tax:

A sample of filling out the UIN in field 22 of a payment slip when paying tax arrears based on the requirements of the Federal Tax Service:

Conclusions for 2022 about UIN

In field 22 of the payment slip, indicate the UIN (unique accrual identifier), if you know it (for example, indicated in the inspection request for tax payment). It consists of 20 or 25 characters, and all of them cannot have the value “0” at the same time.

In other cases, put “0” (zero) in field 22 (clause 12 of Appendix No. 2 to Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n, Explanations of the Federal Tax Service of Russia), including:

- when paying current tax payments;

- when transferring arrears not at the request of the inspection;

- if the request does not indicate the UIN.

What it is?

The abbreviation UIN is explained as follows - a unique accrual identifier. This indicator allows you to track cash flows coming from organizations, individuals, and individual entrepreneurs into the budget of the Russian Federation.

The identifier is unique and allows the non-cash payment being made to be identified in the GIS system (state information system).

By the number you can determine the exact purpose of the payment.

Until 2014, this identifier was not included in the payment order. Since February 2014, such an obligation has appeared.

In this case, the specific numerical value of the UIN is indicated only when making certain payments to the state:

- the amount of arrears on taxes, fees, contributions after receiving the corresponding request from the Federal Tax Service or the fund;

- fines and penalties for identified arrears.

In other cases, the UIN takes on a zero value, including in the case when the amount of arrears is repaid by the taxpayer independently without the requirement of a regulatory authority.

How to fill out a payment order at the request of the Federal Tax Service?

Why is field 22 needed?

Let's figure it out, code 22 in the payment card - what is it and how is it used? Each payment order consists of many fields that must be filled in with relevant information. For example, in area 3 the number of the payment document is entered, in the fourth - the date, and the name of the payer is indicated in cell No. 8. The payment with field numbers for 2022 is available for download at the end of the article.

Since March 31, 2014, an innovation has been introduced in the payment order form - cipher number 22. Payment with fields for 2022 already includes an identifier. The obligation to indicate it is fixed by Order of the Ministry of Finance of the Russian Federation No. 107 of November 12, 2013.

When filling out field 22 in the payment slip, assign a code to those payments that are sent to regulatory authorities and state extra-budgetary funds - the Federal Tax Service, the Pension Fund of the Russian Federation, the Social Insurance Fund.

Many employees responsible for filling out documents are wondering: what is (payment) code 22, what should I write in this cell? This cell is reserved for a unique digital cipher known as UIN (unique accrual identifier) or UIP (unique payment identifier). Each payment is assigned its own special digital value, according to which one or another budget transfer will be carried out.

A special code is necessary for operators processing receipts to speed up the process of crediting payments. Previously, each operation took much longer: it was necessary to check the details of the paying organization, the purpose of the payment order, the cash register, and only after that the transfer was credited. After the appearance of unique codes, the process of processing and entering payments into the database became much easier. If the payer makes a mistake when entering the UIN, then the funds paid will go to unexplained payments, and then a lengthy procedure will follow to clarify or return the money transferred to the budget authorities.

More detailed information about what a UIN is is presented in the article “Instructions: how to correctly indicate the UIN code in a payment.”