Every day, the organization itself issues and accepts dozens, or even hundreds of primary accounting documents. But not every document can be accepted for accounting, much less confirm expenses to reduce the tax base. In this article we will talk about:

- What details are necessary and sufficient for a document to become significant for accounting and tax accounting?

- Which forms are mandatory and which are recommended?

- Why is UPD convenient?

- What signatures on a document make it legal?

- Is printing on a primary document always unnecessary?

Primary documentation in accounting - what is it?

Primary documents confirm the facts of economic life. Without them, it is impossible to reflect a business transaction in accounting.

The primary is of interest primarily to tax authorities. They have the right to request documents to verify you or other companies you have worked with. In legal disputes, primary documentation usually becomes powerful evidence.

The primary report is compiled at the time of the operation to confirm its reality. For example, a delivery note confirms the fact of acceptance and transfer of inventory items, and an act confirms the completion of work under the contract.

Question 5: Are corrections allowed in primary accounting documents?

Corrections are allowed in the primary accounting document.

The correction must be supported by the date of the correction, as well as the signatures of the persons who compiled the document in which the correction was made, indicating their last names and initials. If incorrect information is provided, it must be crossed out with a thin line and the correct information indicated next to it. Next to each correction there should be a footnote “Believe the corrected”, with the date and signatures.

6 common mistakes in primary documentation:

- The use at the enterprise of forms of primary documents that are not approved by the order on accounting policies.

- Lack of required details in the documents.

- Lack of a list of persons authorized to sign primary documents approved by the head of the organization.

- Errors in calculations.

- Blank lines. If there is no data, you must put a dash; leaving lines blank is prohibited.

- Incorrect correction of errors in source documents.

Persons responsible for processing documents may be fined for errors in primary documentation in the amount of 2-3 thousand rubles. The absence of a primary document can cost a company 10-30 thousand rubles, but a fine is not the biggest nuisance in this situation. Not finding primary accounting documents in the accounting system, Federal Tax Service employees can remove part of the expenses from the taxable base, as a result, the company will be subject to additional income tax charges.

Details of primary documentation

Primary documents must contain the required details:

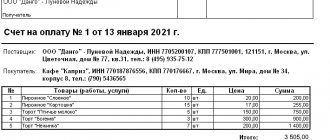

- name - agreement, account, act, etc.;

- Date of preparation;

- details of the company or individual entrepreneur who compiled the document;

- the essence of the operation is sale, provision of services;

- unit of natural measurement - pieces, packages, kg;

- unit of monetary measurement - rubles, dollars;

- names of persons who made the transaction;

- signatures of responsible persons.

The document can be drawn up on paper or electronically.

Primary documents by transaction stages

A deal is not a one-time event; it is spread out over time. There are three stages in it.

1. Negotiate terms. At this stage, company representatives discuss the terms of the future transaction: price, product range and quantity, timing, force majeure, and so on. As a result, the seller issues two primary documents: an invoice for payment and a contract.

2. Payment by invoice. Next, the seller undertakes to pay the invoice. The following will help you confirm your payment:

- bank statement or payment order - for non-cash payments;

- cash receipts, expense cash orders, strict reporting forms - when paying in cash.

3. Transaction execution. After payment, the goods are shipped or the service is provided. The sale of goods and materials is confirmed by a delivery note or sales receipt. The parties confirm the completion of work and provision of services by signing the relevant act.

The second and third stages are sometimes swapped if the parties agree on post-payment. But the set of documents does not change:

- contract;

- check;

- payment order, check, strict reporting form;

- invoice or certificate of completion of work;

- invoice.

Agreement

A contract is an agreement between the parties that defines rights and obligations. It establishes the subtleties of the future transaction: delivery times, prices, quantity, quality of goods, and so on.

It is better to draw up a separate agreement for each transaction. But the parties more often record only their rights and obligations in the contract, and the work performed or goods and materials shipped, with quantities and prices, are recorded in the application - specifications.

An agreement is not always necessary, but it makes it easier to prove your case in court. For example, a purchase and sale agreement is considered duly concluded if the buyer is given a cash receipt or sales receipt.

A contract is often confused with a primary document. However, by itself it does not create any movements or entries in accounting. This is only a list of obligations of counterparties to each other. This is true for sales and service contracts.

At the same time, the contract can be approved as a primary agreement by the head of the organization if it meets all the requirements. For example, an invoice is an invoice for payment, which includes elements of a contract - a primary document. And sometimes an agreement can become a primary agreement if, on its basis, an entry can be made in the accounting registers. For example, a guarantee or loan agreement.

Design features significant for administrative documents

In administrative documents, under the details at the left border of its field (but it is also allowed to be centered), a title to the text is placed, briefly reflecting the content of this text. The title should answer the question “What?” and begin with the prepositions “O” or “About”. In short documents (4-5 lines) such a header may not be present.

The main text of the document begins with a reference to the reason for its appearance (at the same time, references to legal norms, provisions of previously enacted organizational and administrative documents are given with the details of the relevant documents) and a keyword reflecting the essence of the administrative document:

- “I order” - when issued by the sole executive body;

- “We order”, “Decided”, “Resolved” (you can indicate the name of the body that made the decision - “The Council decided”) - if the decision was made collectively.

Attachments may be provided to the administrative document. Their mention in the text is accompanied by the note “Appendix” made in brackets, next to which, if necessary, its number is indicated (including with a number icon).

On the application itself (in the upper right corner on its first sheet) a record appears reflecting its status, number and details of the document to which the application relates, indicating among these details the name of the author of the administrative document (“Appendix No. ... to...”). If the application is one of those approved by the administrative document, then the entry made on it after the word “Appendix” (with its number) will contain the word “Approved” (“Approved by order ...”).

The person (persons) giving the order must sign the administrative document with his own hand, while his position must be deciphered (it is located on the left border of the sheet, but can also be centered) and his last name with initials is given (at the right border of the sheet). The initials are placed before the surname here. The signature is located between the entries about the position and the full name or on the same line with the full name if the position title is located in the center of the sheet. The title of the position may be accompanied by an indication of the name of the author of the document, if the document is not drawn up on the form developed by him. If the administrative document is drawn up collectively, then the signatures of the corresponding number of persons will be affixed to it, and they will be located taking into account the hierarchy of positions held.

If the actual signing of a document already prepared for this purpose is carried out by another person, then information about his position and full name in the administrative document must be entered by hand, crossing out the data relating to the person for whom the signing is being done. In a document signed with an electronic signature, the mark on this method of signing should be located in the place of a regular signature, be clearly readable, not interfere with the text of the document and not overlap marks on other electronic signatures. The authenticity of the signature can be certified by a seal, which is affixed so as not to overlap the signature.

The administrative document may have a mark about the actual executor, containing his full name and telephone number. It is possible to supplement this data with the name of the position he holds, the name of the department and his email address. Options for placing this mark:

- on the last sheet of the document at its left border;

- on the back of the last page at the bottom left;

- as a footer using a smaller font.

When making a certified copy of an administrative document or an extract from it, a mark (it can be made using a stamp) confirming the compliance of the contents is affixed under the place where the document was signed and is formed from the word “True”, position, signature, decoding of this signature and the date of certification. When transferring such a copy to a third party, the certification record is supplemented with a seal.

Invoice

An invoice is needed to accept VAT as a deduction. Only VAT payers use the invoice. This document itself is not issued - the buyer receives an invoice from the seller along with a delivery note or a certificate of completion.

An invoice is not the basis for drawing up an accounting entry. It does not reflect any business transaction, but only gives the right to reduce VAT payable. Therefore, contrary to popular belief, it is not a primary document.

Let's sum it up

- Administrative documents are part of the organizational and administrative documentation required by each employer and regulate issues of its current activities. Their main task is to specify the objects of application of the norms of current legislation or their internal documents that establish general rules for the work collective. As a rule, an administrative document is issued by a sole executive body (order, instruction, instruction), but it can also be the result of a collective decision (resolution, decision).

- An administrative document requiring the implementation of specific actions has the nature of a primary document and often becomes the basis for the occurrence of business transactions that require reflection in accounting. Therefore, the requirements regarding the presence of required details for the primary document are applicable to it.

- Certain forms for administrative documents may exist in public sector organizations. The legislation does not provide for such forms for other employers. The employer can use standard forms approved by the State Statistics Committee for some situations. However, usually the administrative document form is developed by each employer independently.

- When drawing up an administrative document, it is necessary to take into account the presence of the rules applicable to it established by GOST for organizational and administrative documentation. These rules require compliance with certain general principles for placing information included in a document on the sheets (sheet) of which it consists, as well as rules for reflecting this information. A special set of rules contained in GOST applies to administrative documents.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Who works with primary documentation

The accounting department receives invoices, delivery notes and certificates of work performed so that employees can process them and reflect them in accounting. In practice, working with primary accounts takes up a huge amount of an accountant’s time, since each document must be manually transferred to the accounting system.

There are disadvantages to manual entry. Firstly, it takes a lot of time - there may not be enough employees, then the accounting department begins to expand. Secondly, there is a high probability of error, since by the end of the working day, even a professional accountant begins to “blur his eyes” and does not notice typos.

To automate the entry of primary data, you can connect additional services to the accounting system that will help save time and reduce the risk of errors:

- electronic document management - will help you accept documents in electronic form and enter them into accounting without errors and almost instantly;

- accounting document recognition service - can read data from a delivery note, act, invoice, etc. from a scan or photograph and transfer it to a draft accounting document - the accountant can only check the correctness of recognition and post the document.

The Kontur.Accounting web service has an electronic document management module and a recognition system - all this greatly simplifies the entry of primary data. The service makes it easy to keep records, automatically calculate taxes and salaries, generate reports and send them via the Internet. All newbies test the system for free for 14 days.