About legal entities

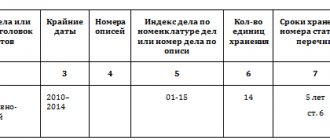

Documents have accumulated: what to do with them so as not to break the law Our lives are closely connected

From this article you will learn: What are the risks of blocking a current account? How does the tax office make a decision?

What is non-operating income? Non-operating (other) income is those incomes that are received from

Financial investments in the balance sheet structure In the balance sheet structure, financial investments are assets included in

Legal regulation Taxpayers now have the opportunity to write a complaint against the tax inspectorate online after the adoption of

Why do you need an inventory? This simple paper allows you to immediately record all documents during employment.

Payment order and its details A payment order is a document whose purpose is to transfer

The concept of a tax audit The control of the Federal Tax Service on the correct and timely calculation and payment of taxes is called

Statistical report on occupational safety and health for employers Over the past few years, employers have been reporting on the status of

Planning the use of annual leave The Labor Code of the Russian Federation (Article 123) requires the employer to plan the leave of its employees