How is the procedure for creating a vacation reserve in accounting regulated?

The Ministry of Finance has developed a draft federal standard for public sector organizations “Payments to personnel.” It is this document, after its adoption, that will regulate the procedure for creating and using a reserve for vacation pay.

For your information:

The approval date for this standard was postponed several times.

As of today, it is expected that it will come into force in 2021 ( Order of the Ministry of Finance of the Russian Federation dated March 19, 2019 No. 45n “On approval of the program for the development of federal accounting standards for public sector organizations for 2022 – 2022”

). However, there is a high probability that this deadline will be postponed again.

Before the approval of the federal standard “Payments to Personnel”, when accounting for the vacation reserve, it is necessary to follow the provisions of Instruction No. 157n (see Guidelines for the application of the provisions of the GHS “Reserves”), in accordance with clause 302.1 of which the procedure for the formation of reserves is established by the institution as part of the preparation of its accounting policies .

What should the accounting policy disclose regarding the creation of a reserve for vacation pay?

If the rules for its reflection in accounting have not been established for any accounting object, the institution, in agreement with the founder and financial body of the public legal entity, defines them in its accounting policies (clause 7 of the GHS “Accounting policies, estimates and errors” "). In particular, accounting policies:

– the reporting date on which the reserve is formed (adjusted) must be determined (this can be the last day of each month, the last day of each quarter or the last day of the calendar year); – a methodology for determining the estimated value must be selected (personalized for each employee, for the institution as a whole, for individual groups of employees); – the working chart of accounts 0 401 60 000 “Reserves for future expenses” must be detailed.

It should be taken into account that the reserve for vacation pay is formed regardless of the source of financial support (Letter of the Ministry of Finance of the Russian Federation dated January 14, 2016 No. 02-07-10/604).

How to determine the estimated value when creating a reserve for vacation pay?

Recommendations regarding the procedure for determining the estimated value when creating a reserve for vacation pay are contained in Letter of the Ministry of Finance of the Russian Federation dated May 20, 2015 No. 02-07-07/28998.

According to them, the estimated liability in the form of a reserve for vacation pay for time actually worked can be determined monthly, quarterly or annually, on the last day of the month, quarter or year, respectively, based on the number of days of unused vacation for all employees on a specified date (data provided by the personnel service) .

The reserve is calculated as the amount of vacation pay for employees for the time actually worked on the date of calculation and the amount of insurance contributions for compulsory health insurance, compulsory health insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, as well as contributions for injuries.

Officials recommend determining the amount of expenses to pay for upcoming vacations in one of the following ways:

1) based on the average salary calculated individually for each employee;

2) based on the average salary calculated for the institution as a whole;

3) based on the average salary calculated for individual categories of employees (personnel groups).

Let's look at each of them in more detail.

Method 1. It is used, as a rule, if the institution does not have many employees. When using this method, the calculation is made individually for each employee using the following formula:

P1 = K1 x ZP1, where:

P1 – the amount of contributions to the leave reserve for one employee in terms of wages; K1 – the number of vacation days not used by an employee for the period from the start of work to the calculation date (end of each month, quarter, year) for one employee; ZP1 – the average daily earnings of an employee, calculated according to the rules for calculating average earnings for vacation pay as of the date of calculation of the reserve.

To determine the total amount of the leave reserve in terms of wages, the amounts of contributions to the reserve for all employees are summed up using the formula:

Vacation reserve = P1 + P2 + Pn.

Method 2. This method is used, as a rule, if the institution has many employees. In this case, the average salary is calculated for the institution as a whole using the following formula:

Vacation reserve = K x Salary, where:

K – the total number of vacation days not used by all employees for the period from the start of work to the calculation date (the end of each month, quarter, year); ZPsr. – average salary for all employees of the institution as a whole.

Method 3. When using this method, the average salary is calculated for individual categories of employees (personnel groups) using the formula:

Vacation reserve = K1 x ZPsr.1 + K2 x ZPsr.2 + K3 x ZPsr.3, where:

K1, K2, K3 – the number of all days of unused vacation for each category of employees; ZPsr. 1, ZPsr. 2, ZPsr. 3 – average salary calculated for each category of workers.

The reserve for payment of insurance premiums is calculated taking into account the methodology for calculating the reserve for payment of vacations. That is, the amount of insurance premiums when forming a reserve can be calculated:

1) for each employee individually according to the formula:

P1 = K1 x ZP1 x C, where:

P1 – the amount of contributions to the vacation reserve for one employee in terms of insurance premiums; K1 – the number of vacation days not used by an employee for the period from the start of work to the calculation date (end of each month, quarter, year) for one employee; ZP1 – average daily earnings of an employee, calculated according to the rules for calculating average earnings for vacation pay as of the date of calculation of the reserve; C (hereinafter) – the rate of insurance premiums.

Accordingly, the amount of the reserve for insurance premiums for the institution as a whole is determined by summing up contributions to the reserve for each employee, in the same way as we determined the vacation reserve in terms of wages;

2) on average for the institution according to the formula:

Reserve of insurance premiums = K x ZPsr. x C;

3) for each category of workers according to the formula:

Reserve of insurance premiums = (K1 x ZPsr. 1 + K2 x ZPsr. 2 + K3 x ZPsr. 3) x C.

It must be taken into account that the amount of insurance premiums is calculated taking into account the maximum base for their calculation.

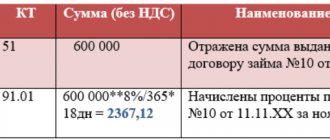

Example 1.

The accounting policy of the institution establishes that the estimated liability in the form of a reserve for vacation pay is determined annually (on the last day of the calendar year) based on the average salary and the number of days of unused vacation for the institution as a whole. As of 12/31/2019:

– the average daily wage is 950 rubles; – the total number of vacation days not used by employees is 190; – the number of vacation days planned in 2022 is 1,400.

To simplify the example, we do not consider the reserve in terms of insurance premiums.

The reserve for vacation pay as of December 31, 2019 will be:

– regarding unused vacation for previous periods – 180,500 rubles. (190 days x 950 rub.); – the amount of monthly contributions to the reserve is 110,833 rubles. ((1,400 days x 950 rub.) / 12 months).

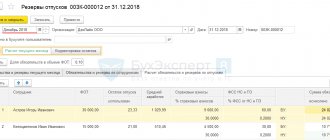

Authorization of salary expenses in 1C: Accounting department of a state institution, 8th ed. 2.0

Published 02/12/2017 21:08 Author: Administrator Keeping records in the “Planning and Authorization” section implies maintaining obligations for all items of the institution’s expenses. Employee salary costs are one of the most mandatory expense items. But, unlike procurement costs from suppliers, the algorithm for authorizing wage costs is not so obvious. In this article I want to tell you how to correctly accept budgetary and monetary obligations for the item of expenses for employee salaries and make accruals for it in the program “1C: Public Institution Accounting 8, edition 2.0”.

As you know, the general scheme for maintaining obligations is as follows: accept budget obligations - accept monetary obligations - fulfill monetary obligations. Let's start with the adoption of budgetary obligations for the expenditure item “Salaries”. To do this, in the reference book “Contracts and other grounds for the emergence of obligations” (section “Planning and authorization”), we create a new element:

In the “Type of agreement” line, select “Other basis for the occurrence of an obligation”:

Then you need to fill in the line “Type of obligation”. After clicking on the selection button, a small form opens, which is a list of primary documents; in this list you need to create a new document: Summary Statement.

After filling out, the new element “Agreements and other grounds for the emergence of obligations” will take the following form:

Based on this document, it is necessary to accept obligations for the amount of the wage fund. After recording, you need to immediately make budget commitments using the creation tool based on:

I would like to draw your attention to the “Accounting transaction” tab: on this tab, by default, the flag “Budget data without details according to KOSGU” is set, you need to clear this flag:

After posting, the document generates the following movements in the accounting accounts for the acceptance of obligations:

With these transactions, obligations were assumed for the expense item in the wage fund. In the same way, it is necessary to accept obligations for the payroll expense item:

I would also like to note that budgetary obligations can be made not monthly, but for a quarter, six months or a year (if the amounts for these periods are known in advance and are more or less stable). To do this, in the document “Registration of obligations and information under contracts” in the tabular section in the column “Plan period”, indicate the required one. The next step will be the acceptance of monetary obligations. Monetary obligations must be accepted in the document “Reflection of salaries in accounting”:

To correctly accept monetary obligations, you need to check whether all the required analytics are in the document:

An accepted obligation is an element of the reference book “Contracts and other grounds for the emergence of obligations”.

Therefore, if there is no contract in the transaction lines, you must manually set the necessary ones. After that, on the “Accounting transaction” tab, set the flag in the “Accept monetary obligation” attribute, and also do not forget to select the personal account section:

The document generates the following entries regarding the acceptance of monetary obligations:

In order to track commitments, the Planning and Authorization section provides various reports:

Since in the given example a budgetary institution was used, we will use the report, which is located in the “Planned Performance Indicators” section:

In the report you can see all amounts for obligations, track their fulfillment and control the correctness of the amounts. For government institutions, reports are provided in the “Budget Data” part. And the last stage of authorizing expenses will be the fulfillment of accepted obligations, which is carried out using monetary documents (for example, an application for cash expenses).

Author of the article: Svetlana Batomunkueva

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Lyudmila 10.26.2020 17:58 The article is very informative, thank you. But there is one difficult point. After the document “Reflection of wages in accounting” was completed, the “Accepted monetary obligation” was automatically generated under Article 213, the agreements were not filled out, although the agreement for each tax was completed. We don't understand what the problem could be?

Quote

Update list of comments

JComments

The procedure for recording transactions for the formation and use of reserves

State (municipal) institutions have an obligation to guarantee employees the right to receive annual paid leave. At the same time, there is no certainty about the time of execution of the upcoming vacation payment for actually worked time due, for example, to a possible change in the planned vacation dates. Moreover, the amount of such liability cannot be determined with precision.

According to clause 302.1 of Instruction No. 157n, to summarize information on the status and movement of amounts reserved for the purpose of evenly attributing expenses to the financial result of the institution, for obligations not determined by the amount and (or) time of execution of the upcoming vacation payment for actually worked time or compensation for unused vacation, including upon dismissal, including payments for compulsory social insurance of an employee (employee) of the institution, is allocated to account 0 401 60 000 “Reserves for future expenses”.

By virtue of clause 308 of the said instructions, the obligations of the institution, the value of which is determined at the time of their acceptance conditionally (calculated) and (or) for which the time (financial period) for their fulfillment is not determined, provided that a reserve for future expenses is created in the records of the institution for these obligations are deferred liabilities.

Accountants often have a question: is it possible to use the reserve for vacation pay to pay compensation for unused vacation?

If the accounting policy for accounting purposes stipulates that when creating a reserve for vacation pay, the payment of compensation for unused vacation is taken into account, the reserve can be used to pay such compensation (clause 302.1 of Instruction No. 157n, Letter of the Ministry of Finance of the Russian Federation dated August 16, 2019 No. 02-06 -10/62943).

Accounting for authorization transactions

It is carried out on the basis of the “primary” adopted in the financial requirements of the relevant budget sector. Clauses 239, 241 and 251 of the Instructions for the Application of the Unified Chart of Accounts require that accounting reflect transactions on transactions authorizing expenses using the following accounts :

- liability limits – account 150201000;

- deductions based on accepted estimates - account 250202000.

The following accounting entries :

- debit 150115000, credit KRB 150113000 - reflection of the amounts under the limits of accepted obligations communicated to recipients, as well as the amount of adjustments during the reporting year;

- debit 150113000, credit 150113000 – breakdown of limits communicated to recipients by codes of articles and subitems of types of budget expenditures;

- debit 150113000, credit 150211000 – accounting for the amounts of accepted obligations (within limits and their adjustments).

If the activities of a budget organization are aimed at generating income, the postings will look like this:

- debit 250411000, credit 250412000 – accounting for the amounts of allocations for the organization’s expenses according to the expense and income estimate;

- debit 250412000, credit 250212000 – reflection of the amounts of the organization’s obligations within the limits of the allocated allocations (in this reporting period).

Vacation reserve: posting transactions for the formation and use of reserves

The following entries must be made in the accounting of autonomous and budgetary institutions:

Vacation reserve: postings

| Contents of operation | Debit | Credit |

| Creating a reserve | ||

| A reserve has been created for vacation pay for actual hours worked: | ||

| – on employee benefits | 0 401 20 211 0 109 60 211 | 0 401 60 211* |

| - on insurance premiums | 0 401 20 213 0 109 60 213 | 0 401 60 213* |

| Reflected in accounting are expense obligations for the formation of reserves for vacation pay**: | ||

| – on employee benefits | 0 506 90 211 | 0 502 99 211 |

| - on insurance premiums | 0 506 90 213 | 0 502 99 213 |

| Using the reserve | ||

| Vacation pay accrued for time worked: | ||

| – at the expense of the reserve | 0 401 60 211* 0 401 60 213* | 0 302 11 737 0 303 xx 731 |

| – if the amount of the reserve is less than the amount of accrued vacation pay (by the amount of the excess of accrued vacation pay over the amount of the reserve) | 0 401 20 211 0 109 60 211 0 401 20 213 0 109 60 213 | 0 302 11 737 0 303 xx 731 |

| Expenditure obligations for the payment of accrued vacation pay are reflected at the expense of the previously created reserve. At the same time, previously recorded liabilities are reduced using the “red reversal” method. | 0 506 10 211 0 506 10 213 | 0 502 11 211 0 502 11 213 |

* Detailing of account 0 401 60 000 is carried out as part of the formation of accounting policies. An example of detail is contained in Letter of the Ministry of Finance of the Russian Federation No. 02-07-07/28998.

** Clarification of the previously formed reserve is reflected on the date of its calculation:

– an additional accounting entry – in case of an increase in the formed reserve; – by reversing an entry – in case of a decrease in the amount of a previously formed reserve.

The following entries will be made in the accounting of a government institution:

| Contents of operation | Debit | Credit |

| Creating a reserve | ||

| A reserve has been created for vacation pay for actual hours worked: | ||

| – on employee benefits | 1 401 20 211 1 109 60 211 | 1 401 60 211 |

| - on insurance premiums | 1 401 20 213 1 109 60 213 | 1 401 60 213 |

| Reflected in accounting are expenditure obligations for the formation of reserves for vacation pay*: | ||

| – on employee benefits | 1 501 93 211 | 1 502 99 211 |

| - on insurance premiums | 1 501 93 213 | 1 502 99 213 |

| Using the reserve | ||

| Vacation pay accrued for time worked: | ||

| – at the expense of the reserve | 1 401 60 211 1 401 60 213 | 1 302 11 737 1 303 xx 731 |

| – if the amount of the reserve is less than the amount of accrued vacation pay (by the amount of the excess of accrued vacation pay over the amount of the reserve) | 1 401 20 211 1 109 60 211 1 401 20 213 1 109 60 213 | 1 302 11 737 1 303 xx 731 |

| Expenditure obligations for the payment of accrued vacation pay are reflected at the expense of the previously created reserve. At the same time, previously recorded liabilities are reduced using the “red reversal” method. | 1 501 13 211 1 501 13 213 | 1 502 11 211 1 502 11 213 |

The clarification of a previously formed reserve is reflected by an additional accounting entry or by reversing the entry (see explanations above).

Important: the reserve is used only to cover those costs for which it was originally created.

Example 2.

Let's use the conditions of example 1. The accounting policy of an autonomous institution stipulates that a reserve for vacation pay is created annually on the last day of the calendar year based on the average salary calculated for the institution as a whole. According to the HR department:

– number of days of unused vacation – 190; – number of planned days of vacation in 2022 – 1,400; – average daily wage – 950 rubles.

At the same time, as of December 31, 2019, there is an unused reserve in the amount of RUB 85,000.

The amount of the accrued reserve for unused vacations as of December 31, 2019 is RUB 180,550. (190 days x 950 rub.). Since at the reporting date there is an unspent reserve on the balance sheet and its amount is less than the newly accrued reserve, the clarification of the previously formed reserve will be reflected in an additional accounting entry in the amount of the difference between the amount of the newly accrued reserve and the amount of the unspent reserve - RUB 95,550. (180,550 – 85,000). The amount of monthly contributions to the reserve will be 110,833 rubles.

The following entries must be made in accounting:

Vacation reserve: postings

| Contents of operation | Debit | Credit | Amount, rub. |

| As of 12/31/2019 | |||

| The reserve for vacation pay for actual time worked has been adjusted | 0 109 60 211 0 401 20 211 | 2 401 60 211 | 95 550 |

| Obligations for the formation of reserves for vacation pay have been adjusted | 0 506 90 211 | 2 502 99 211 | 95 550 |

| As of 01/31/2020 (and further on the last day of the month) | |||

| A reserve has been accrued for vacation pay for actually worked hours | 0 109 60 211 0 401 20 211 | 2 401 60 211 | 110 833 |

| Deferred obligations for the formation of reserves for vacation pay are reflected | 2 506 90 211 | 2 502 99 211 | 110 833 |

Account 40160 Reserves for future expenses and Account 50209 Deferred liabilities

Letter of the Ministry of Finance of the Russian Federation No. 02-07-07/28998 dated May 20, 2015.

supplemented information on accounting for transactions with deferred liabilities and accounting for reserves for future expenses.

Let us remind you that changes to Instruction No. 157n as amended by No. 89n dated August 29, 2014.

touched upon such a section of the Unified Chart of Accounts as “Financial Result”.

In particular, a “new” account for “public sector employees” has appeared: 040160000 “Reserves for future expenses”

. What does the Instruction say about it?

The account is intended to summarize information on the status and movement of amounts reserved for the purpose of uniform inclusion of expenses on the financial result of the institution, for obligations of uncertain magnitude and (or) time of execution:

arising as a result of accepting another obligation (transactions, events, operations that have or are capable of influencing the financial position of the institution, the financial result of its activities and (or) cash flow):

§ upcoming payment of vacations for actually worked time or compensation for unused vacations, including upon dismissal, including payments for compulsory social insurance of an employee of the institution;

§ upcoming payment at the request of buyers for warranty repairs, routine maintenance in cases provided for in the supply agreement;

§ other similar upcoming payments;

arising by virtue of the legislation of the Russian Federation when making a decision on restructuring the activities of an institution, including the creation, changing the structure (composition) of separate divisions of the institution and (or) changing the types of activities of the institution, as well as when making a decision on the reorganization or liquidation of an institution;

arising from claims and claims based on facts of economic life, including within the framework of pre-trial (out-of-court) consideration of claims, in the amount of amounts presented for the establishment of penalties (penalties), other compensation for damages (losses), including those arising from the terms of civil law agreements (contracts), in the event of claims (claims) being made against a public legal entity: for compensation for damage caused to an individual or legal entity as a result of illegal actions (inaction) of government bodies or officials of these bodies, including including as a result of the issuance of acts of public authorities that do not comply with the law or other legal act, as well as expected legal expenses (costs), in the event of claims (suits) being presented to the institution in accordance with the legislation of the Russian Federation, and other similar expected expenses;

for the institution’s obligations arising from the facts of economic activity (transactions, operations), the accrual of which there is uncertainty in their size at the reporting date due to the lack of primary accounting documents;

for other obligations of uncertain magnitude and (or) time of fulfillment, in cases provided for by an act of the institution adopted when forming its accounting policies.

The procedure for the formation of reserves (types of reserves formed, methods for assessing liabilities, date of recognition in accounting, etc.) is established by the institution as part of the formation of accounting policies. The reserve should be used only to cover those costs for which the reserve was originally created. Recognition in accounting of expenses for which a reserve for future expenses has been formed is carried out at the expense of the amount of the created reserve.

Analytical accounting of the account is maintained in a Multigraph Card or in a Funds and Settlements Accounting Card, by type of reserves created.

In Appendix No. 1 to letter No. 02-07-07/28998 dated May 20, 2015.

The Ministry of Finance gives separate recommendations on the formation of a working chart of accounts of an institution, in particular, it recommends introducing details of the type of reserves into the 23rd category.

Based on the definition of the account, the list of proposed transactions in correspondence with account 040160000 Instructions No. 174n and 183n

(see draft orders on the website of the Ministry of Finance of the Russian Federation), as well as the latest

Letter of the Ministry of Finance of the Russian Federation No. 02-07-07/28998 dated May 20, 2015.

You can list the following business transactions that must be described in the Accounting Policy of the institution and applied in the economic life of the institution:

1. Formation of a reserve for payment of vacations (deferred obligations to pay for vacations for actually worked time) - KOSGU 211.

2. Formation of a reserve for payment of vacations in terms of insurance premiums (deferred obligations to transfer insurance premiums) - KOSGU 213.

3. Formation of a reserve for the restoration of the consequences of the operation of fixed assets, included in the cost of fixed assets (estimated values) - KOSGU 225.

4. Formation of a reserve for expenses incurred for which settlement documents have not been received (based on estimated values) - KOSGU group 200.

5. Formation of a reserve for payment of obligations contested in court (in court proceedings) - KOSGU 290.

6. Formation of a reserve for deferred income tax liability. There are a lot of questions on this point, because... Instructions No. 174n and No. 183n do not explain what KOSGU account 240160000 will have; based on the definition of the reserve account, there should be an expense KOSGU 200 (for example, KOSGU 290), but income tax is paid from income, i.e. KOSGU 100 (for example, KOSGU 130). The result is a rather strange correspondence Dt 240110130 Kt 240160290. And most likely problems may arise with the automated generation of balance sheet form 0503721.

In the Tax Code of the Russian Federation, reserves for future expenses are described in Chapter 25, Articles 266, 267.

Business operations for the formation of reserves are carried out on the last day of the period preceding the one for which the reserve is calculated. Business operations for the formation of reserves for the next financial year are carried out on the last day of December 31 of the current year

to reflect reserves for the next financial year with the addition of entries to authorization accounts 050209000 “Deferred liabilities”.

During the financial year, the accumulated reserves are written off as liabilities are confirmed and deferred liabilities are also written off. At the end of the year,

there may be some balance left on account 040160000. There is no need to write it off, but you need to create new reserves for the difference, i.e. so that the balance on account 040160000 is equal to the calculated amounts of new upcoming expense reserves for the next financial year. The same applies to authorization accounts so that the credit balance on account 040160000 is equal to the credit balance of account 050209000.

For 2015 The Ministry of Finance of the Russian Federation in its Methodological Recommendations dated December 19, 2014. No. 02-07-07/66918

about reporting for 2014 “allowed” not to form reserves (since most institutions did not prepare their Accounting Policies and did not make decisions on the formation of reserves accordingly), therefore, this year 2015, most institutions do not keep these records, but on December 31, 2015. It is already necessary to be ready to form reserves for the upcoming expenses of the 2016 financial year.

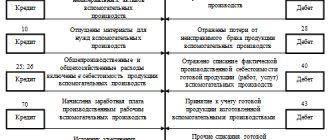

Let us present the entries for reserves for future expenses and deferred liabilities in accordance with the Methodological Recommendations of the Ministry of Finance of the Russian Federation dated December 19, 2014. No. 02-07-07/66918 and Letter No. 02-07-07/28998 dated May 20, 2015.

Postings for accounting for reserves for future expenses

| No. | the name of the operation | DEBIT | CREDIT | Primary document |

| 1. Formation of reserve | ||||

| 1.1 | Accrual of reserves for vacation pay | 0.109.60.211 (0.401.20.211) | 0.401.60.211 | Accounting certificate with calculation application |

| 1.2 | Accrual of deferred liabilities for formed reserves for vacation pay | 0.506.90.211 | 0.502.99.211 | Accounting certificate with calculation application |

| 1.3 | Accrual of reserves for vacation pay in terms of insurance premiums | 0.109.60.213 (0.401.20.213) | 0.401.60.213 | Accounting certificate with calculation application |

| 1.4 | Accrual of deferred liabilities for formed reserves to pay for vacations in terms of insurance premiums | 0.506.90.213 | 0.502.99.213 | Accounting certificate with calculation application |

| 1.5 | Accrual of reserves for expenses incurred for which settlement documents were not received as of the reporting date | 0.109.60.200 (0.401.20.200) | 0.401.60.200 | Accounting certificate with calculation application |

| 1.6 | Accrual of deferred liabilities for formed reserves for expenses incurred for which settlement documents were not received as of the reporting date | 0.506.90.200 | 0.502.99.200 | Accounting certificate with calculation application |

| 1.7 | Accrual of reserves for payment of obligations contested in court | 0.401.20.200 | 0.401.60.200 | Accounting certificate with calculation application |

| 1.8 | Accrual of deferred liabilities against formed reserves for payment of liabilities contested in court | 0.506.90.200 | 0.502.99.200 | Accounting certificate with calculation application |

| 2. Accrual of expenses from reserves and in excess of them | ||||

| 2.1 | Accrual of vacation pay from created reserves | 0.401.60.211 | 0.302.11.730 | Payroll payroll |

| 2.2 | Write-off of deferred liabilities for formed reserves for vacation pay | 0.502.99.211 | 0.506.90.211 | Payroll payroll |

| 2.3 | Accrual of vacation pay obligations | 0.506.10.211 | 0.502.11.211 | Payroll payroll |

| 2.4 | Accrual of vacation pay in an amount exceeding the formed reserve | 0.109.60.211 (0.401.20.211) | 0.302.11.730 | Payroll payroll |

| 2.5 | Accrual of obligations to pay vacation pay in an amount exceeding the formed reserve (can be combined with posting 2.3) | 0.506.10.211 | 0.502.11.211 | Payroll payroll |

| 2.6 | Accrual of vacation pay in terms of insurance premiums at the expense of created reserves | 0.401.60.213 | 0.303.00.730 | Payroll statement, statement of accrued insurance premiums |

| 2.7 | Write-off of deferred liabilities for formed reserves to pay for vacations in terms of insurance premiums | 0.502.99.213 | 0.506.90.213 | Payroll statement, statement of accrued insurance premiums |

| 2.8 | Accrual of obligations to pay vacation pay in terms of insurance premiums | 0.506.10.213 | 0.502.11.213 | Payroll statement, statement of accrued insurance premiums |

| 2.9 | Accrual of vacation pay in terms of insurance premiums in an amount exceeding the formed reserve | 0.109.60.213 (0.401.20.213) | 0.303.00.730 | Payroll statement, statement of accrued insurance premiums |

| 2.10 | Accrual of obligations to pay vacation pay in an amount exceeding the formed reserve (can be combined with posting 2.8) | 0.506.10.213 | 0.502.11.213 | Payroll statement, statement of accrued insurance premiums |

| 2.11 | Accrual of expenses for which settlement documents were received at the expense of previously formed reserves | 0.401.60.200 | 0.302.00.730 0.303.00.730 | Act/Invoice/Act of reconciliation of mutual settlements |

| 2.12 | Write-off of deferred liabilities for formed expense reserves for which settlement documents have been received | 0.502.99.200 | 0.506.90.200 | Act/Invoice/Act of reconciliation of mutual settlements |

| 2.13 | Accrual of obligations for which settlement documents have been received | 0.506.10.200 | 0.502.11.200 | Act/Invoice/Act of reconciliation of mutual settlements |

| 2.14 | Accrual of obligations for which settlement documents have been received in an amount exceeding the formed reserve | 0.109.60.200 (0.401.20.200) | 0.302.00.730 0.303.00.730 | Act/Invoice/Act of reconciliation of mutual settlements |

| 2.15 | Accrual of obligations for which settlement documents were received in an amount exceeding the formed reserve (can be combined with posting 2.13) | 0.506.10.200 | 0.502.11.200 | Act/Invoice/Act of reconciliation of mutual settlements |

| 2.16 | Accrual of expenses recognized in court at the expense of formed reserves | 0.401.60.200 | 0.302.00.730 0.303.00.730 | Court decision/Act |

| 2.17 | Write-off of deferred liabilities for formed expense reserves recognized in court | 0.502.99.200 | 0.506.90.200 | Court decision/Act |

| 2.18 | Accrual of obligations recognized in court | 0.506.10.200 | 0.502.11.200 | Court decision/Act |

| 2.19 | Accrual of liabilities recognized in court exceeding the formed reserve | 0.401.20.200 | 0.302.00.730 0.303.00.730 | Court decision/Act |

| 2.20 | Accrual of liabilities recognized in court for an amount exceeding the formed reserve (can be combined with posting 2.18) | 0.506.10.200 | 0.502.11.200 | Court decision/Act |

Here are a few of my comments on the recommendations of the Ministry of Finance:

1. The use of the number “9” in the authorization accounts for reserves in the 22nd digit is unjustified; rather, it was necessary to indicate the sign “X”, because When forming a reserve, the institution probably knows for which specific financial year the calculation was made, in particular for vacations it is most likely the next financial year, which corresponds to the number “2” in the 22nd digit according to the Chart of Accounts of Instruction No. 157n

.

2. Not a single software product currently automates the accounting section in question, i.e. it is necessary to maintain completely “manual” records. The difficulty is not even in calculating the reserve for each employee/counterparty, but in isolating the entries for accrual of expenses from the reserves. Let's hope that software developers will offer some kind of tool to automate these processes.

In Appendix No. 3 to letter No. 02-07-07/28998 dated May 20, 2015.

The Ministry of Finance gives an example of calculating the vacation reserve, which can be used in the accounting of your institution by reflecting a link to the letter in the accounting policy.

Let's look at an example:

Establishment at the end of 2015 forms expense reserves for 2016. according to the source “Subsidies for the implementation of government tasks.” As a result of the calculation, the accounting department received the following data from the economist:

1. Reserve for upcoming vacations in 2016. = 3,570,000.00 rub.

2. Reserve for upcoming holidays in terms of insurance premiums in 2016. RUB 1,142,400.00

3. Reserve for upcoming payments for staff reduction in 2016. = 580,000.00 rub.

4. Reserve for expenses for obligations for which supporting documents were not received for 2016. RUB 170,000.00

In March 2016 there was a staff reduction and payments amounted to RUB 540,000.00.

Payment of vacation pay in 2016 amounted to RUB 4,250,000.00. Vacation pay expenses in terms of insurance premiums in 2016 amounted to RUB 952,000.00.

Supporting documents for the previous period were received for the entire reserved amount.

Let's write down the transactions for all operations in the table:

| No. | the name of the operation | DEBIT | CREDIT | Amount, rub. |

| 1. Formation of reserves (posting date 12/31/2015) | ||||

| 1.1 | Accrual of reserves for vacation pay | 4.109.60.211 | 4.401.60.211 | 3 570 000,00 |

| 1.2 | Accrual of deferred liabilities for formed reserves for vacation pay | 4.506.90.211 | 4.502.99.211 | 3 570 000,00 |

| 1.3 | Accrual of reserves for vacation pay in terms of insurance premiums | 4.109.60.213 | 4.401.60.213 | 1 142 400,00 |

| 1.4 | Accrual of deferred liabilities for formed reserves to pay for vacations in terms of insurance premiums | 4.506.90.213 | 4.502.99.213 | 1 142 400,00 |

| 1.5 | Accrual of reserves for redundancy payments in 2016 | 4.109.60.211 | 4.401.60.211 | 580 000,00 |

| 1.6 | Accrual of deferred liabilities for staff reduction in 2016. | 4.506.90.211 | 4.502.99.211 | 580 800,00 |

| 1.7 | Accrual of reserves for expenses incurred for which settlement documents were not received as of the reporting date | 4.109.60.200 | 4.401.60.200 | 170 000,00 |

| 1.8 | Accrual of deferred liabilities for formed reserves for expenses incurred for which settlement documents were not received as of the reporting date | 4.506.90.200 | 4.502.99.200 | 170 000,00 |

| 2. Accrual of expenses from reserves and in excess of them during 2016. (total turnover for 2016) | ||||

| 2.1 | Accrual of vacation pay from created reserves | 4.401.60.211 | 4.302.11.730 | 3 570 000,00 |

| 2.2 | Write-off of deferred liabilities for formed reserves for vacation pay | 4.502.99.211 | 4.506.90.211 | 3 570 000,00 |

| 2.3 | Accrual of vacation pay in an amount exceeding the formed reserve | 4.109.60.211 | 4.302.11.730 | 680 000,00 |

| 2.4 | Accrual of vacation pay obligations | 4.506.10.211 | 4.502.11.211 | 4 250 000,00 |

| 2.5 | Accrual of vacation pay in terms of insurance premiums at the expense of created reserves | 4.401.60.213 | 4.303.00.730 | 952 000,00 |

| 2.6 | Write-off of deferred liabilities for formed reserves to pay for vacations in terms of insurance premiums | 4.502.99.213 | 4.506.90.213 | 952 000,00 |

| 2.7 | Accrual of obligations to pay vacation pay in terms of insurance premiums | 4.506.10.213 | 4.502.11.213 | 952 000,00 |

| 2.8 | Calculation of redundancy payments from formed reserves | 4.401.60.211 | 4.302.11.730 | 540 000,00 |

| 2.9 | Write-off of deferred liabilities for formed reserves for staff reductions | 4.502.99.211 | 4.506.90.211 | 540 000,00 |

| 2.10 | Accrual of obligations for staff reduction | 4.506.10.211 | 4.502.11.211 | 540 000,00 |

| 2.11 | Accrual of expenses for which settlement documents were received at the expense of previously formed reserves | 4.401.60.200 | 4.302.00.730 | 170 000,00 |

| 2.12 | Write-off of deferred liabilities for formed expense reserves for which settlement documents have been received | 4.502.99.200 | 4.506.90.200 | 170 000,00 |

| 2.13 | Accrual of obligations for which settlement documents have been received | 0.506.10.200 | 0.502.11.200 | 170 000,00 |

When forming a reserve for 2022. The institution will create a reserve taking into account the remaining balance of account 040160000 for the following reserves:

— 440160211 reserve for staff reduction = 40,000.00 rub.

— 440160213 reserve for payment of vacation pay in terms of insurance premiums = RUB 190,400.00.

Link to letter of the Ministry of Finance of the Russian Federation No. 02-07-07/28998 dated May 20, 2015.

: https://www.minfin.ru/ru/perfomance/budget/bu_gs/budgetaccounting/?id_57=62408

If vacation is granted in advance...

In accordance with Art. 122 of the Labor Code of the Russian Federation, paid leave must be provided to employees annually. Moreover, the right to use vacation for the first year of work arises for the employee after six months of his continuous work with this employer. By agreement of the parties, paid leave may be granted to the employee before the expiration of six months. That is, in some cases, the employer has the right to grant leave before the employee has worked the corresponding period for which the leave is granted. This is the so-called vacation in advance. No accruals are made for such payments (vacation pay) in the vacation reserve accounts.

Obligations to accrue vacation pay in the current reporting period, if the employee did not actually work the period for which vacation pay was accrued, are reflected (clause 302 of Instruction No. 157n, Letter of the Ministry of Finance of the Russian Federation dated August 16, 2019 No. 02-06-10/62943):

– on the debit of account 0 401 50 000 “Deferred expenses” (the corresponding analytics is selected); – on the credit of account 0 302 00 000 “Settlements for accepted obligations.”