Intermediary agreements often frighten accountants because of their complexity: after all, there are 3 parties involved in the transaction. In the 1C program such operations are automated.

The article will help you understand:

- how to transfer goods to commission in 1s 8.3;

- how to draw up a commission agent’s report if it simultaneously reflects the buyer’s advance and its offset;

- what document recognizes the intermediary’s commission as an expense;

- in which reports the principal reflects VAT on intermediary transactions;

- How the sales book and purchase book are filled out during commission trading.

Accounting with the principal in 1C 8.3 Accounting - step-by-step instructions

TEKHNOMIR LLC (hereinafter referred to as the principal) entered into an agreement with VELMART LLC (hereinafter referred to as the commission agent) for the sale of goods. According to the terms of the agreement, the agent's commission is 10% of the sales amount and is retained by the commission agent when transferring the buyer's payment at the end of the month. The principal and the commission agent work for OSNO.

On July 7, the principal transferred goods to the commission agent in the amount of 744,000 rubles. (including VAT 20%):

Name of product Quantity, pcs. Price including VAT, rub. Cost, rub. Lenovo laptop 20 12 000 240 000 Samsung tablet 20 25 200 504 000 Total 40 744 000 On July 31, the commission agent submitted a report on advances received and goods sold to the principal, including:

- advances received - 240,000 rubles;

- offset advances - 240,000 rubles;

- sales - 246,000 rubles.

At the same time, the act and invoice for the commission were submitted.

Step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Agreement with a commission agent for the sale of goods | |||||||

| July 01 | — | — | — | Commission agreement | Directory Agreements - Agreement with a commission agent (agent) for sale | ||

| Transfer of goods for commission | |||||||

| July 7 | 45.01 | 41.01 | 272 447,71 | 272 447,71 | 272 447,71 | Transfer of goods for commission | Sales (act, invoice) - Goods, services, commission |

| Registration of the commission agent's report | |||||||

| July 31 | 90.02.1 | 45.01 | 90 917,43 | 90 917,43 | 90 917,43 | Write-off of the cost of goods | Commission agent's report on sales |

| 60.01 | 76.09 | 24 600 | 24 600 | 24 600 | Deduction of commission from proceeds | ||

| 76.09 | 90.01.1 | 246 000 | 246 000 | 205 000 | Revenue from sales of goods | ||

| 44.01 | 60.01 | 20 500 | 20 500 | 20 500 | Commission accounting | ||

| 90.03 | 68.02 | 41 000 | VAT accrual on revenue | ||||

| 19.04 | 60.01 | 4 100 | 4 100 | Acceptance for VAT accounting | |||

| Registration of SF commission agent | |||||||

| July 31 | — | — | 24 600 | Registration of SF supplier | Invoice received for receipt | ||

| 68.02 | 19.04 | 4 100 | Acceptance of VAT for deduction | ||||

| — | — | 4 100 | Reflection of VAT deduction in the Purchase Book | Purchase Book report | |||

| Calculation of VAT on advances from buyers | |||||||

| payment date in July | 76.AB | 68.02 | 40 000 | Calculation of VAT on advance payment | Invoice issued for advance payment | ||

| — | — | 40 000 | Reflection of VAT in the Sales Book | Sales book report | |||

| Issuance of SF for shipment to customers | |||||||

| shipping date in July | — | — | 246 000 | Issuing SF for shipment | Invoice issued for sales | ||

| — | — | 41 000 | Reflection of VAT in the Sales Book | Sales book report | |||

| Acceptance of VAT for deduction when offsetting advance payments from buyers | |||||||

| July 31 | 68.02 | 76.AB | 40 000 | Acceptance of VAT for deduction | Commission agent's report on sales | ||

| — | — | 40 000 | Reflection of VAT deduction in the Purchase Book | Purchase Book report | |||

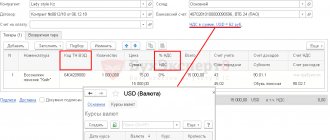

Registration of the commission agent's final report

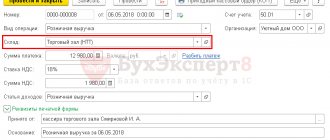

Main tab

On the Main , data about the counterparty and the agreement are filled in similarly to the first report.

The Goods and Services section will be filled in automatically after entering data on the Sales .

Section Commission :

- Payment method will be set automatically according to the contract data;

- % of remuneration - will also be substituted according to the data specified in the contract;

- VAT account — 19.04;

- % VAT - the default value is set to excluding VAT , adjust manually if necessary (in our example - 20% ).

If the agreement stipulates that the commission is paid by the principal in a separate transfer, and is not withheld by the commission agent from the proceeds, remove the default flag:

- Commission is withheld from revenue.

Check the settings for recognizing commissions as expenses:

- Compensation Cost Account - 44.01 default;

- Cost division - when accounting for costs by division, select Divisions from the directory;

- Cost items - Commission agent services - a predetermined item, set automatically to be reflected as part of other expenses.

Here, register the commission agent's invoice issued for the remuneration.

Implementation tab

The upper table contains information about the buyer.

Total column does not need to be filled in; it will be automatically filled in after entering data into the lower table.

For each entry in the upper table (each buyer and commission agent invoice), its own lower table is filled in on the Products and Services , depending on the subject of sale.

So, in our example, Mikron LLC was sold:

- Lenovo laptop – 10 pcs. for the amount of 120,000 rubles.

The table below also shows:

- Reward amount - calculated automatically according to the settings of the Main ;

- Accounting account - 45.01 - accounting account for the principal of goods sold;

- Income account — 90.01.1;

- Subconto - Trade ;

- Expense account — 90.02.1.

Cash tab

Click the Add fill in:

Line 1:

- Type of payment report - Advance offset ;

- Buyer - name of the organization whose advance payment is credited towards the shipment;

- Event date - the date the goods are shipped by the commission agent to the buyer.

Lines 2 and 3:

- Payment report type - Payment ;

- Buyer - name of the organization that paid for the goods;

- Event date - the date of receipt of funds into the commission agent's account.

Postings according to the document

The document generates transactions:

- Dt 90.02.1 Kt 45.01 - recognition of the cost of goods sold as expenses;

- Dt 60.01 Kt 76.09 - deduction of commission from revenue;

- Dt 76.09 Kt 90.01.1 - recognition of income from the sale of goods;

- Dt 44.01 Kt 60.01 - accounting for commissions.

The document generates movements according to the register Book of Income and Expenses (Section I) :

- registration entry for expenses of the simplified tax system in the amount of: commission retained by the commission agent;

- cost of goods sold;

- proceeds offset against commission fees.

Commission trading - regulation

A commission agreement is an intermediary agreement under which the principal instructs a commission agent-intermediary to carry out a transaction for him for a fee: for example, to purchase or sell goods (work, services).

An important feature of commission agreements: the commission agent always acts on his own behalf, but at the expense of the principal (Part 1 of Article 990 of the Civil Code of the Russian Federation).

Let's take a closer look at accounting under a commission agreement for the sale of goods (works, services).

BOO

Goods transferred by the principal to the commission agent remain the property of the principal, therefore, during the transfer, neither income nor expenses are generated (clause 12 of PBU 9/99, clause 16 of PBU 10/99).

The primary document confirming the income and expenses of the principal for the sale of goods transferred to the commission is the commission agent's sales report. The principal, if there are any objections, must notify the commission agent about them within 30 days. Otherwise, the report will be considered accepted (Article 999 of the Civil Code of the Russian Federation). Income and expenses are recognized on the date of acceptance of the commission agent's sales report (clause 12 of PBU 9/99).

Remuneration to the commission agent and expenses reimbursed to him incurred in the interests of fulfilling the contract are also recognized as expenses for ordinary activities or other expenses, depending on the nature of the intermediary transaction (clause 5, clause 11 of PBU 10/99).

WELL

When transferring goods to a commission agent, there is no transfer of ownership, therefore, proceeds from the sale of goods are not determined (Clause 1, Article 39, Article 249 of the Tax Code of the Russian Federation).

The amount of revenue is determined as of the date of sale of goods on the basis of the commission agent’s report (paragraph 5 of Article 316 of the Tax Code of the Russian Federation).

As of the date of approval of the commission agent’s report, the principal acknowledges:

- the cost of goods sold by the commission agent (clause 3, clause 1, article 268 of the Tax Code of the Russian Federation);

- commission (clause 1 of article 264 of the Tax Code of the Russian Federation);

- expenses subject to reimbursement to the commission agent (clause 1 of Article 264 of the Tax Code of the Russian Federation).

The commission agent can fulfill the principal's instructions with additional benefit: sell the goods at a higher price or buy them at a lower price than stipulated in the contract. In this case, unless otherwise provided by the agreement, the principal and the commission agent must divide such income in half (Article 992 of the Civil Code of the Russian Federation).

For the principal, additional income due to a product sold at a higher price is an increase in sales. For the commission agent - an increase in commission or a separate type of income.

VAT

When transferring goods from the principal to the commission agent, there is no object of VAT taxation (clause 1, article 39, clause 1, article 146 of the Tax Code of the Russian Federation). Therefore, VAT is not calculated and no invoice is issued.

Upon notification of the receipt of an advance payment to the account of the commission agent or the sale of goods, the principal calculates VAT and re-issues the commission agent an advance (or for sale) invoice, drawing it up in full accordance with the data of the invoice issued by the commission agent to the buyer (clause 1 of Article 167 of the Tax Code of the Russian Federation , paragraphs "i" - "l" paragraph 1, paragraphs "a" paragraph 2 of the Rules for filling out an invoice, approved by Decree of the Government of the Russian Federation of December 26, 2011 N 1137).

The principal calculates VAT on the date of advance payment or shipment of goods. The tax base is defined as (clause 1 of article 154 of the Tax Code of the Russian Federation):

- the amount of receipt of prepayment, partial payment, including VAT;

- cost of goods sold based on selling prices.

We work under a commission agreement

Permanent representative offices of foreign trade organizations often sell goods under a commission agreement.

Under a commission agreement, one party, the owner of the goods, (the principal) instructs the other party (the commission agent) to sell the goods.

Let us name the main features of a commission agreement for the sale of goods:

- The commission agent acts on behalf of the principal. The commission agent is obliged to execute the accepted order on the most favorable terms for the principal in accordance with the instructions of the principal, and in the absence of such conditions in the commission agreement - in accordance with business customs or other usually imposed requirements;

- The commission agent enters into contracts with third parties on his own behalf as an independent person. All documents are drawn up in the name of the commission agent - agreement, invoices, invoices, etc. There is no reference to the principal in the documents;

- goods received by the commission agent from the principal are the property of the principal (Article 996 of the Civil Code of the Russian Federation). The commission agent, from the beginning to the end of the fulfillment of his obligations, disposes of the goods, but will not be its owner. Ownership of goods at the time of sale passes from the principal to the buyer. The goods accepted from the principal for commission are recorded by the commission agent in off-balance sheet account 004 'Goods accepted for commission' at the prices specified in the contract (clause 14 of PBU 5/01 'Accounting for inventories');

- The commission agent makes transactions at the expense of the principal. The principal is obliged (Article 1001 of the Civil Code of the Russian Federation), in addition to paying the commission, to reimburse the commission agent for the amounts spent by him on the execution of the commission order (for example, customs expenses, costs of insuring goods, etc.). The commission agent does not have the right to reimbursement of expenses for storing the principal's property in his possession, unless otherwise provided in the law or the commission agreement. Expenses reimbursed by the principal are taken into account by the commission agent as funds in the calculations. Costs associated with the business activities of the commission agent (salary, rent, general business expenses, etc.) are not subject to reimbursement. These expenses are taken into account by the commission agent as part of expenses for ordinary activities (clause 3 of PBU 10/99 'Expenses of the organization').

The commission agreement is paid (Article 991 of the Civil Code of the Russian Federation).

The commission agent receives remuneration from the principal for the provision of services for the sale of goods in the amount and in the manner established in the commission agreement. The remuneration can be established in the contract as: - a fixed amount that does not depend on the selling price of the goods,

- percentage of cost of products sold

- the difference between the price set by the principal and a more favorable price at which the commission agent will complete the transaction.

If the commission agent has completed a transaction on terms more favorable than those specified by the principal, the additional benefit is divided equally between the principal and the commission agent, unless otherwise provided by agreement of the parties.

If the commission agent sold the principal's property at a price lower than the agreed price and is not able to prove that he did not have the opportunity to sell the property at the agreed price and that the sale at a lower price prevented even greater losses, he is obliged to compensate the principal for the difference between the agreed price and the actual sales price .

If the commission agreement was not fulfilled for a reason depending on the principal, the commission agent retains the right to a commission, as well as to reimbursement of expenses incurred.

Most often, a commission is paid in the form of the difference between the cost of the goods in the prices of the consignor and its cost in the prices at which it is sold to customers.

The commission agent may or may not participate in settlements between the buyer and the supplier of goods (products).

This article is devoted to accounting for the sale of goods under a commission agreement from the owner of the goods - the principal.

The commission agent participates in settlements

In the principal's accounting, revenue is recognized at the moment of transfer of ownership of the goods to the buyer. The committent learns about the date of sale of the goods from the commission agent's report. Revenue is recognized subject to the conditions provided for in paragraph 12 of PBU 9/99 'Income of the organization'.

In accounting, revenue is taken into account in an amount calculated in monetary terms equal to the amount of receipt of cash and other property and (or) the amount of accounts receivable (clauses 5, 6 of PBU 9/99). The amount of receipt is determined taking into account the amount difference that arises in cases where payment is made in rubles in an amount equivalent to the amount in foreign currency (conventional monetary units).

In accounting, revenue recognition is reflected in the credit of account 90 'Sales', subaccount 90-1 'Revenue' in correspondence with the debit of the account for accounting for settlements with the buyer (commission agent).

What amount should be considered revenue and credited to account 90 “Sales” N In Art. 999 of the Tax Code of the Russian Federation states that all funds received from buyers belong to the principal. Since the commission agent has the right to withhold the remuneration due to him under the commission agreement from all amounts received by him at the expense of the principal (Article 997 of the Civil Code of the Russian Federation), in practice, everything received minus the commission agent's remuneration is transferred to the principal. Despite this, the revenue for the principal is the amount that the buyer paid to the commission agent for the goods. It is this price that the commission agent must indicate in his report. The exception is when the price is increased by the amount of sales tax. Then the commission agent reports the sales price excluding this tax. And based on the amount recorded in the report, the committent calculates VAT and tax on road users.

Turnover taxes

from revenue it is possible to determine “by shipment” or “by payment”. The date of shipment for the principal is the date of shipment of the goods by the commission agent to the buyer or the date of payment (the earlier of the dates is taken, clause 1 of Article 167 of the Tax Code of the Russian Federation). And the payment date is the date of receipt of funds from buyers to the current account or to the commission agent’s cash desk (clause 1, clause 2, article 167 of the Tax Code of the Russian Federation). Therefore, when working under a commission agreement, it is important to pay special attention to the reflection in the commission agent’s report of information about the receipt of funds from buyers, especially advances on which VAT must be paid to the budget.

According to Art. 999 of the Civil Code of the Russian Federation, after the sale of goods, the commission agent submits a report to the committent within the time period agreed with the committent. For most taxpayers, the VAT tax period is a calendar month. Therefore, in order for the principal to be able to correctly and on time calculate VAT on the cost of property sold under a commission agreement, he must receive a notice from the commission agent on a monthly basis.

VAT on services provided by the commission agent in accordance with paragraph 1, paragraph 2, Article 171 of the Tax Code of the Russian Federation, the principal has the right to accept for deduction on the basis of invoices and documents confirming the payment of VAT amounts. The condition for the deduction is the consumption of the service when selling goods sold with VAT.

Commission agents can sell goods to buyers for cash to individuals or individual entrepreneurs who are recognized as individuals in accordance with Article 11 of the Tax Code of the Russian Federation.

If the commission agent sells goods to individuals in a region where sales tax

, and the conditions of Article 349 of the Tax Code of the Russian Federation are met, you must refer to paragraph 3 of Article 354 of the Tax Code of the Russian Federation. If, under the terms of the commission agreement, the actual sale of goods to buyers is carried out by the commission agent, funds from individuals for the sold goods are received directly to the cash desk or to the settlement account of the commission agent, then the responsibility for paying sales tax and transferring it to the budget rests with the commission agent. In this case, he is recognized as a tax agent in accordance with Article 24 of the Tax Code of the Russian Federation. In this case, the tax amount is calculated from the full price of the goods (works, services), including the commission agent’s remuneration. When receiving proceeds from a commission agent, the principal does not pay sales tax if this tax was paid by the commission agent (clause 3 of Article 354 of the Tax Code of the Russian Federation).

This means that the commission agent is obliged to calculate and pay sales tax only if the principal is the payer of this tax. If the principal is not a tax payer, then the goods sold by the commission agent are not subject to sales tax.

When the principal deposits cash into the commission agent's cash desk to pay expenses associated with the execution of the contract, there is no fact of sale of goods (work, services) and, accordingly, there is no object of taxation with sales tax.

In tax accounting

In order to determine the tax base for income tax, the date of reflection of income for the principal depends on the method used for accounting for income and expenses.

As a general rule, when calculating income tax, all taxpayers use the accrual method when accounting for income and expenses (Articles 271, 272 of the Tax Code of the Russian Federation). This method assumes that income and expenses are recognized in the reporting (tax) period to which they relate, regardless of the time of their actual payment.

When calculating income tax using the accrual method, the date of recognition by the principal of income from sales is the day of shipment (transfer) of goods (clause 3 of Article 271 of the Tax Code of the Russian Federation). As part of the principal's income (clause 1, clause 1, Article 251), when determining the tax base for profit using the accrual method, the amounts of advance payment for goods (work, services) are not taken into account.

Another method for recognizing the date of receipt of income and incurring expenses for the purpose of calculating income tax for the principal may be the cash method

. The principals have the right to use it if, on average, over the previous four quarters, the amount of revenue from the sale of goods (work, services) excluding value added tax and sales tax did not exceed 1 million rubles. for each quarter (clause 1 of article 273 of the Tax Code of the Russian Federation). In this case, income and expenses are reflected as they are actually paid. However, income under this method also includes the amount of received advance payment for goods (work, services).

Commission agents can sell goods to buyers for cash to individuals or individual entrepreneurs who are recognized as individuals in accordance with Article 11 of the Tax Code of the Russian Federation.

If the commission agent sells goods to individuals in a region where sales tax

, and the conditions of Article 349 of the Tax Code of the Russian Federation are met, you must refer to paragraph 3 of Article 354 of the Tax Code of the Russian Federation. If, under the terms of the commission agreement, the actual sale of goods to buyers is carried out by the commission agent, funds from individuals for the sold goods are received directly to the cash desk or to the settlement account of the commission agent, then the responsibility for paying sales tax and transferring it to the budget rests with the commission agent. In this case, he is recognized as a tax agent in accordance with Article 24 of the Tax Code of the Russian Federation. In this case, the tax amount is calculated from the full price of the goods (works, services), including the commission agent’s remuneration. When receiving proceeds from a commission agent, the principal does not pay sales tax if this tax was paid by the commission agent (clause 3 of Article 354 of the Tax Code of the Russian Federation).

This means that the commission agent is obliged to calculate and pay sales tax only if the principal is the payer of this tax. If the principal is not a tax payer, then the goods sold by the commission agent are not subject to sales tax.

When the principal deposits cash into the commission agent's cash desk to pay expenses associated with the execution of the contract, there is no fact of sale of goods (work, services) and, accordingly, there is no object of taxation with sales tax.

I would like to say a few words separately about the amount differences in advances.

When concluding a commission agreement for the sale of goods, the price of which is determined

in

conventional units, revenue is taken into account in the amount determined on the basis of the sales price of the goods shipped to the buyer, calculated at the exchange rate of the Central Bank of the Russian Federation established on the date of shipment of the goods to the buyer. Revenue is subject to adjustment if the exchange rate changes on the day payment is received from the buyer.

If the calculations are made by the buyer in advance, with the determination of the exchange rate. on the date of payment, then the amount does not arise. Indeed, for the recalculation of conventional units, the rate and date of recalculation are determined by the terms of the contract. Setting a price in foreign currency or conventional units under civil law is nothing more than determining the transaction price. If the rate is applied on the date of payment, then after payment in advance the price is fixed and is not subject to revision. Consequently, the transaction was completed at this price, regardless of further changes in rates. In accounting, transactions are reflected based on the price at the exchange rate on the date of advance payments, regardless of the exchange rate on the date of sale of goods (work, services).

A similar position is set out in letters of the Department of Taxation in Moscow dated September 15, 1999 No. 03-08/6381 “On the issue of taxation of amount differences” and dated January 12, 2000 No. 03-12/944 with reference to the letter of the Ministry of Taxes of Russia dated July 21 .99 N 02-5-10/271. This position is confirmed by the judicial authorities, for example, in the Resolution of the Federal Antimonopoly Service of the Moscow District dated February 10, 2000 N KA-A40/362-00.

Example 1.

The representative office of a German trading company (committee) instructed Forum LLC (commission agent) in January 2002 to sell 10 refrigerators at a price of $1,500 (including VAT - $500). In accordance with the instructions of the principal, settlements with buyers are carried out in rubles at the official US dollar exchange rate established by the Central Bank of the Russian Federation on the day the buyer pays for the goods.

The agreement states that the commission agent participates in the calculations and his remuneration is, including VAT, 10% of the cost of each TV sold, with payment in rubles at the rate of the Central Bank of the Russian Federation on the day of payment and is withheld by the commission agent from the amount received from the buyer. The principal reimburses the commission agent for the amounts paid to the transport organization for the delivery of televisions to the buyer.

The refrigerators were transferred by the principal on January 17, 2002, the $ exchange rate on the date of transfer was 30.4778 rubles. for 1$. In January, the commission agent concluded an agreement with the buyer for the sale of 2 refrigerators on the terms of 100% prepayment. The advance payment is transferred at the dollar exchange rate established by the Central Bank on the day of transfer of payment by the buyer. The buyer made an advance payment in the amount of 92,055 rubles on January 31. ($3,000 * 30.6850 rubles per $1 exchange rate as of 01/31/02).

The refrigerators were shipped to the buyer on February 7, the commission agent will pay the transport organization for the service of delivering the goods to the buyer 300 rubles, including VAT 50 rubles. The proceeds to the principal, minus commissions and delivery costs, were transferred on March 5, 2002.

The representative office determines income and expenses for the purposes of calculating income tax on an accrual basis; The obligation to pay VAT and road user tax arises “on payment”. Let’s assume that the cost of 1 refrigerator is 30,000 rubles.

Accounting entries for the representative office in January:

Debit 45 Credit 41

— 300,000 rub.

(RUB 30,000 x 10 pcs.) - goods were shipped to the commission agent for sale under a commission agreement;

When the goods are shipped to a commission agent, there is no sale of the goods, therefore, in the accompanying documents, a wording like “Transfer of goods for sale under a commission agreement” is preferable. This posting may not occur if, under the terms of the contract, the goods bypass the warehouse of the commission agent and are shipped directly by the consignor to the buyer. Such a commission agreement with the participation of the commission agent in the calculations also occurs in practice.

Now the question is: is an invoice needed when transferring goods from the consignor to the commission agent? In accordance with paragraph 3 of Article 168 of the Tax Code of the Russian Federation, the seller issues an invoice no later than 5 days from the date of shipment of the goods. Shipment of goods is, as stated in Article 224 of the Civil Code of the Russian Federation, the transfer of goods to the buyer and the transfer of ownership of the goods. Meanwhile, the receipt of goods into the possession of the intermediary does not constitute the shipment of goods. According to Article 39 of the Tax Code of the Russian Federation, the sale of goods is the transfer of ownership of it on a reimbursable basis or on a gratuitous basis. Thus, the transfer of goods to the intermediary is not formalized by issuing an invoice. In this regard, the seller does not have a VAT tax base. Consequently, the tax is not separately indicated in the shipping documents. With the intermediary, this product is listed off-balance sheet at the cost indicated by the seller himself in the shipping invoice, i.e., without VAT.

We draw the reader's attention to the fact that with the introduction of the new Chart of Accounts, the valuation of goods recorded on account 45 “Goods shipped” has changed. According to the previous Chart of Accounts, inventories on the specified account were accounted for at actual cost (at purchase price). From the moment the new Chart of Accounts is applied, accounting of shipped goods is carried out at a cost consisting of the actual cost and expenses for shipping goods (if they are partially written off).

This means that organizations that have established in their accounting policies the method of writing off sales expenses in proportion to the cost of goods sold must increase the actual cost of goods recorded on account 45 “Goods shipped” by the amount of actual costs associated with shipping costs. If, according to the accounting policy of the organization, all sales expenses incurred by it in the reporting period are recognized as expenses for ordinary activities, subject to write-off to the cost of goods sold, no partial write-off of shipping expenses to the debit of account 45 “Goods shipped” should not be made.

Amounts allocated to account 45 “Goods shipped” will be listed on it as long as the principal retains ownership of the shipped goods (products). After the transfer of this right to the buyer in accordance with the purchase and sale agreement concluded by the intermediary, the principal should record the proceeds from the sale and at the same time write off the amounts recorded on account 45 “Goods shipped” as expenses from ordinary activities.

Debit 76/subaccount 6 'Settlements with commission agent' Credit 62/subaccount 3 "Settlements on advances received"

— RUB 92,055 ($1500 * 30.6850*2) - reflects the prepayment received from the buyer (based on the message from the commission agent and a copy of the buyer’s payment order);

Debit 62/3 Credit 68/subaccount “VAT calculations”

— 15345,57 rub.

(

92,055

*16.67%) -

VAT is charged for payment to the budget on the advance received.

In February:

Debit 62/ subaccount 2 “Settlements with customers” Credit 90/ subaccount 1 “Revenue”

— RUB 92,055 — revenue for sold products is reflected;

Debit 90/subaccount 3″VAT” Credit 68/subaccount “VAT calculations”

— RUB 15,342.5 — VAT payable to the budget has been accrued;

In accordance with paragraph 8 of Article 171 of the Tax Code of the Russian Federation, VAT amounts accrued on advance payments are subject to tax deduction. Deductions of tax amounts are made after the date of sale of the relevant goods (clause 6 of Article 172 of the Tax Code of the Russian Federation):

Debit 68 / subaccount “VAT calculations” Credit 62/3

— 15 345,57 rub

.

— VAT charged to the budget upon receipt of an advance is presented for deduction

Debit 62-3 Credit 62-2

— 92,055 rub. —

the amount of advance received from the buyer is credited;

Debit 90 / subaccount 2 “Cost of sales” Credit 45

— 60,000 rub. (RUB 30,000 x 2 pcs.) - cost of products sold is written off;

Debit 44 Credit 68

RUB 167.13 ((92055-15342.5-60000)*1%) - tax is charged on road users on the difference between the purchase and sale prices of goods sold excluding VAT,

Debit 90 - 2 “Cost of sales” Credit 44

— RUB 167.13 — the tax on road users is written off to the cost of products sold;

Expenses for paying for the services of intermediary organizations for the sale of products are sales expenses:

Debit 44 Credit 60 (76) subaccount “Settlements with commission agent”

— 7671,25 rub. (92,055*10% - 1534.25) rub. — based on the commission agent’s report, the costs of selling goods (commission) are included in sales expenses

;

Debit 19 Credit 60(76)

— 1534.25 rub. — VAT on commission fees is taken into account;

Debit 44 Credit 60(76)

— 500 rub. — the costs of delivering the goods to the buyer are taken into account;

Debit 19 Credit 60(76)

— 100 rub. — VAT on delivery services is taken into account;

Let us note that as expenses borne by the owner of the goods (committent), the costs of transportation, forwarding, insurance, customs clearance, support, and advertising of the goods can be taken into account as expenses directly related to the subject of the commission agreement. These expenses cannot be taken into account as commission agent expenses.

Debit 90 / 2 Credit 44

— 8171.25 rub. (7671.25+500) - costs attributable to goods sold are written off as selling expenses,

Debit 68 subaccount “VAT calculations” Credit 19

— 1634.25 (1534.25 +100) is accepted for deduction of VAT on intermediary services provided and paid for.

Debit 90-9 Credit 99

— 7874.12 rub. ( 92,055 - 15,342.5 - 60,000 - 167.13 - 500 - 8171.25) - the final turnover reflects the financial result from sales for the reporting month,

In March:

Debit 51 Credit 62/2

— 82,249.5 (92,055 - 9205.5 -600) rub. — payment was received from the commission agent for the goods sold, taking into account mutual requirements in terms of remuneration and reimbursable costs,

Debit 60 (76) Credit 62/2

— 9805.5 (9205.5 +600) rub. — the services of the commission agent and reimbursable expenses are offset against payments due from him.

If the terms of the contract provide for preliminary partial payment for the goods and an advance payment of less than 100% of the price

agreement, the amount difference will arise.

How to calculate revenue in this case?

Let us turn to the letter of the Department of Tax Administration for Moscow dated January 12, 2000 No. 03-12/944. In this case, for accounting purposes, the amount of revenue is calculated as the result of adding the amount received as a partial advance in conventional units, recalculated into rubles at the exchange rate on the date of receipt of the advance, and the remaining part of the unpaid amount of revenue under the contract in conventional units, recalculated into rubles at exchange rate on the date of shipment (performance of work, provision of services).

The commission agent does not participate in settlements

With this type of commission agreement, the movement of goods is carried out through the commission agent, and the movement of funds is carried out directly from the buyer to the principal. The contract for the sale of goods specifies the details of three legal entities - the principal, the commission agent and the buyer.

Example 2.

Let's change the initial conditions of example 1. The contract states that the commission agent does not participate in the calculations and his remuneration is 10% of the cost of each refrigerator sold. We will not take into account transport services.

The buyer paid the representative office 36,000 rubles, incl. VAT 6,000 rub. for refrigerators in March. In March, the representative office transferred the commission to the commission agent. Let’s assume that the cost of 1 refrigerator is 10,000 rubles. The representative office determines income and expenses for the purposes of calculating profit tax on an accrual basis, revenue for the purposes of calculating VAT and tax on road users 'on shipment'.

Accounting entries for the representative office in February:

Debit 45 Credit 41

— 100,000 rub.

(RUB 10,000 x 10 pcs.) - goods were shipped to the commission agent for sale under a commission agreement at the discount price;

Here the goods will be taken into account until the committent receives a notification (report) from the commission agent about the sale (shipment) of the goods to the buyer.

Debit 62/ subaccount 2 “Settlements with customers” Credit 90/ subaccount 1 “Revenue”

— 36,000 rub. — revenue for sold products is reflected based on the commission agent’s report;

Debit 90/subaccount 3″VAT” Credit 68/subaccount “VAT calculations”

— 6,000 rub. — VAT payable to the budget has been accrued;

Debit 90 / subaccount 2 “Cost of sales” Credit 45

— 20,000 rub. (RUB 10,000 x 2 pcs.) - cost of products sold is written off;

At the time of shipment of goods to the buyer in February, revenue must be reflected in the tax revenue register on the basis of a notice (report) received from the commission agent about the shipment of goods to the buyer. At the same time, remuneration under the contract is accrued:

Debit 44 Credit 60 (76) subaccount “Settlements with commission agent”

— 3,000 (18,000 * 2*10% - 600) rub. — commission was accrued for the sale of goods transferred to the commission

;

Debit 19 Credit 60(76)

— 600 rub. — VAT on commission fees is taken into account;

Debit 26 Credit 68

— 100 ((36,000-6,000-20,000)*1%) rub. — a tax has been charged on road users,

Debit 90 - 2 “Cost of sales” Credit 26

— 100 rub. — the tax on road users is written off to the cost of products sold;

Debit 90 / 2 Credit 44

— 3,000 rubles - sales expenses are included in the cost of sales;

Debit 90-9 Credit 99

— 6,900 rub.

(36,000 - 6,000 - 20,000 - 3,000 - 100) - the final turnover reflects the financial result from sales for the reporting month.

In March -

Debit 51 Credit 62/2

— 36,000 rub. - payment received from the buyer for the goods sold,

Debit 60 (76) Credit 51

— 3600 rub. - commission remuneration is transferred to the commission agent,

Debit 68 subaccount “VAT calculations” Credit 19

— 600 rub. accepted for deduction of VAT on intermediary services provided.

Invoicing

Let's consider the procedure for issuing invoices, maintaining books of sales and purchases.

At the time of receiving the goods from the principal, the commission agent does not make any entries in the purchase book (clause 11 of the Rules for maintaining journals of received and issued invoices, purchase books and sales books for value added tax calculations, approved by Government Decree of 02.12.2000 N 914, hereinafter referred to as the Rules).

When shipping goods to buyers, the commission agent, no later than 5 days from the date of shipment of the goods, issues an invoice in duplicate in his own name to the buyer for the full cost of these goods, including intermediary fees. One copy of the invoice is handed over to the buyer, the second is filed by the commission agent in the journal of issued invoices. This invoice is not recorded in the sales book of the commission agent.

After the sale of the goods, the commission agent submits a report to the owner of the goods - the consignor. Simultaneously with the report, the commission agent issues an invoice to the principal for the amount of his remuneration and files it in the journal of issued invoices. The document must be registered in the sales book of the commission agent (clause 24 of the Rules). And the date of such registration depends on which method of determining revenue for VAT tax purposes was chosen by the commission agent - 'by payment' or 'by shipment'.

The owner of the goods - the committent, after approving the report, issues an invoice in the name of the commission agent for the entire amount of the goods sold, which is indicated by the commission agent in the report. The consignor registers this invoice in the Sales Book. And the commission agent registers it only in the journal of received invoices.

Based on the remuneration paid, the commission agent's invoice is registered in the principal's Purchase Book and VAT is deducted in the general manner.

Fomicheva L.P. , auditor of the Forum Agency; Best Accountant in Russia 2000 E-mail, Published in “Foreign Capital in Russia”

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Agreement with a commission agent for the sale of goods

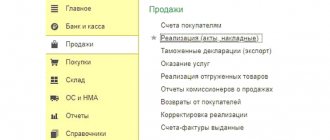

A commission agreement in 1C 8.3 can be registered from the Counterparties directory (Directories - Counterparties) or the Contracts directory (Directories - Contracts). And also create it directly from the document Sales (act, invoice) (Sales - Sales (acts, invoices) - Sales button).

Install:

- Type of agreement - With a commission agent (agent) for sale .

Click on the link Commission :

- Payment method - select one of the options depending on the terms of the contract: Not calculated ;

- Percentage of the difference between sales and receipts;

- Percentage of the sale amount - in our example.

If an organization performs the functions of a paying agent, for example, in retail sales through a commission agent, then click on the Paying agent and check the box:

- The organization acts as a paying agent

and choose

- Agent attribute - one of the options: Bank payment agent ;

- Bank payment subagent;

- Payment agent;

- Payment subagent.

In our example, the commission agent is not a paying agent.

Paying agent is a legal entity (except banks) or individual entrepreneurs who accept funds from individuals in favor of the supplier for goods, works, and services sold by him (part 3 of article 2, part 1 of article 4 of Federal Law of 03.06.2009 N 103 -FZ).

Paying agents are not:

- acquiring banks (Part 3 of Article 2 of Law No. 103-FZ);

- payment aggregators (Yandex.Checkout, etc.);

- intermediaries performing other services other than accepting payments: courier services, transport companies (Part 1, Article 2 of Law No. 103-FZ).

However, within the framework of using 1C, payment agents are considered to be all intermediaries who accept money from individuals in payment for goods (work, services) of the principal for whom records are kept in the program.

Setting up accounts for settlements with counterparties

The main settlement accounts for the commission agent in 1C 8.3 are configured from the counterparty card using the appropriate link. They will be automatically inserted into documents.

Set up separate accounting of settlements on the accounts:

- on commission: 60.01 “Settlements with suppliers and contractors”;

- 60.02 “Settlements for advances issued”;

- 76.09 “Other settlements with various debtors and creditors.”

Commission agent on the simplified tax system - principal on the simplified tax system

If the commission agreement was concluded by companies, each of which applies the simplified tax regime (STS), then the commission agent, if questions arise about how to calculate taxes, must refer to Article 251 of the Tax Code of the Russian Federation. It directly states that when determining the tax base of a commission agent, property and funds received by him in connection with the fulfillment of obligations under a commission agreement are not taken into account as income. Income received to reimburse expenses incurred for the principal is also not taken into account. That is, only commission fees are considered income. Accordingly, revenue for goods sold is not counted as income. If the principal under the simplified tax system compensates the commission agent under the simplified tax system for any expenses, this money is also not subject to tax.

The date of receipt of income from the “simplified” intermediary is the date of receipt of remuneration from the principal into his account. If, under the terms of the contract, the commission agent withholds his remuneration from funds received from buyers, then the date of receipt of income is considered the day the money is received at the cash desk. It does not matter that the report may not have been signed yet, since advances are also included in the income of companies under the simplified tax system.

Expenses are recognized only after they are actually paid. Moreover, those expenses that are legally reimbursed by the principal (for example, for renting a warehouse where the goods are stored) are not considered expenses of the commission agent.

As for the principal, according to the letter of the Ministry of Finance No. 03-11-11/16941 dated May 15, 2013, his income is the entire amount received from the sale of goods, including commissions. Yes, in the scheme “commission agent on the simplified tax system - principal on the simplified tax system,” the remuneration paid by the principal, alas, cannot be attributed to his expenses, and tax will have to be paid on it. But! If the commission agent withholds his commission before transferring funds to the principal, the income will legally be equal to the amount that was actually received into the supplier's account. This means that if the committing company is on the simplified tax system, then it is better to specify exactly this option in the contract.

The day of receipt of income is the moment of receipt of funds to the current account or to the supplier's cash desk.

The principal under the simplified tax system is not obliged to issue an invoice for his goods, because The responsibility for drawing up this document rests only with the VAT payer.

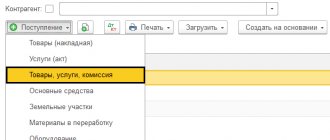

Transfer of goods for commission

The transfer of goods for commission in 1C 8.3 to the commission agent is reflected in the document Sales (act, invoice) transaction type Goods, services, commission (Sales - Sales (acts, invoices) - Sales button).

Fill in:

- Counterparty is a commission agent;

- Agreement - with a view to the commission agent (agent) for sale ;

- Warehouse - the warehouse from which goods are shipped.

In the tabular part in the columns:

- Accounting account - the account in which the transferred goods were recorded, by default it is filled in 41.01 “Goods in warehouses”, adjust if necessary;

- The transfer account - 45.01 “Purchased goods shipped” - is filled in automatically, since there is no transfer of ownership during shipment.

The program automatically sets in the field:

- Invoice - Not required , since there is no VAT subject to taxation.

Transfer of goods to commission in 1C 8.3 postings

The document generates the posting:

- Dt 45.01 Kt 41.01 - transfer of goods to commission.

Typical mistakes in commission agent accounting

Mistake #1. Accounting for money received from the principal for the commission agent to perform his duties in the income of the commission agent's enterprise. Accounting for money spent by the commission agent under the commission agreement, compensated by the principal, among the expenses of the commission agent's company.

Funds compensated by the principal are taken into account exclusively in the accounting of the principal, not the commission agent.

Mistake #2. Failure to reflect in the accounting entries of the commission agent the fact of payment by the buyer for the principal's property, when the commission agent performs the functions of an intermediary, but does not participate in the calculations.

In order for the commission agent to exercise control over the fact of payment by the buyer for the principal's goods transferred by the commission agent as an intermediary not participating in the settlements, two additional entries are made:

1) The buyer’s debt to the principal after he receives the goods is reflected:

D 62 K 76;

2) Repayment of this debt is reflected:

D 76 K 62.

Mistake #3. Absence in the commission agent's accounting department of a register of invoices issued for the principals in order to request the fee due for the work for the fulfillment of the intermediary's obligations under the commission agreement.

From January 1, 2015 The law establishes the obligation of the commission agent to make notes in the register of invoices sent to the employer to receive a fee in order to simplify the tax service’s procedure for assessing VAT on the commission agent’s funds.

Registration of SF commission agent

Registration of an incoming commission invoice is carried out in the document Sales report of the commission agent (agent) on the Main .

To register an incoming invoice, indicate its number and date at the bottom of the document form and click the Register .

Invoice document is automatically filled in with data from the document Sales report of the commission agent (agent) .

- Operation type code : “Receipt of goods, works, services.”

Open the invoice received Invoices received (Purchases - Invoices received).

If the document has the Reflect VAT deduction in the purchase book by date of receipt checkbox , then when it is posted, entries will be made to accept VAT for deduction.

Postings

The document generates the posting:

- Dt 68.02 Kt 19.04 - acceptance of VAT for deduction on commission.

Return of goods to the commission agent from the buyer

Let’s say that a retail buyer wants to return an item for some reason.

Considering that, when selling goods to a client, the commission agent, on his own behalf, entered into a purchase and sale agreement with him, then he formalizes the refusal of this transaction.

If the buyer returns the goods due to detected defects, responsibility for them must be distributed between the commission agent and the consignor. If the goods were damaged due to the fault of the store, then the buyer will reimburse the costs. And if it turns out that the supplier is at fault, the commission agent will be entitled to reimbursement of expenses and remuneration.

The goods can be returned before the commission agent's report is signed by the parties, or after. In the first case, the intermediary makes an entry in the report for the amount of the return with a minus sign. In the second, the wholesale buyer, returning the goods, issues an invoice in the name of the commission agent. If the final buyer is a retailer, then he must write a statement to return the goods. After this, the commission agent returns the goods to the consignor, accompanied by a return note in his name, as well as an invoice. Based on these documents, the principal will be able to reduce his VAT payable.

Calculation of VAT on advances from buyers

After registering advances in the document Sales report of the commission agent (agent), it is necessary to calculate VAT and register invoices for prepayment. To do this, use the 1C processing Registration of invoices for advance payments (Bank and cash desk - Invoices for advance payments).

Set the period and click the Fill .

After filling out, check the settings using the links - these are the links to fill out the form:

- Numbering of invoices - numbering order, one of the options: single - Single numbering of all issued invoices ;

- separate with the prefix “A” - Separate numbering of invoices for advance payments with the prefix “A” ;

Next, click the Run . Invoices issued for advance payments are registered in 1C. PDF

The generated invoices in 1C will need to be adjusted. To do this, follow the link Open list of invoices for advance payment .

Enter:

- Payment document No. ... from - the number and date of the payment order for the buyer's advance according to data from the commission agent's report.

In the tabular part:

- Nomenclature - the name of the product in strict accordance with the wording in the commission agent’s SF.

Automatically installed:

- The transaction type code is “Advances received.”

Click the Print to print the invoice form for the advance payment.

VAT declaration

In the VAT return, the amount of calculated tax on advances from buyers is reflected:

- On page 070 “Amounts of payment received, partial payment...” of Section 3: the amount of prepayment received, including VAT;

- calculated VAT amount.

- invoice issued, transaction type code "". PDF

Reflection of transactions with a commission agent in wholesale trade

Receipt of goods from the principal in 1C 8.3 is reflected in the document Receipt (acts, invoices) with the type Goods, services, commission, selecting the warehouse type Wholesale.

Sale of goods accepted for commission to a wholesale buyer

We will issue an invoice to the buyer for payment. Menu Sales – Customer Account:

Let's create a new document and fill out its tabular part by selecting an item from the Products on commission group:

We will create a sales document by going to the buyer based on the invoice. The document in 1C 8.3 is filled out automatically based on the invoice to the buyer:

Let's run the document and see the movement it makes:

The commission agent issues sales documents and an invoice on his own behalf, but the invoice is registered only in Part 1 of the Journal of received and issued invoices and is not reflected in the Sales Book. Such a sale does not constitute a tax base for VAT for the commission agent:

Movement of the document Invoice:

Invoices are recorded in the Journal of Received and Issued Invoices:

Payment from the buyer

Payment is reflected as a receipt to the current account, which in 1C 8.3 can be entered based on the invoice to the buyer:

Document movement makes the following entries:

Sales report to the consignor

A report to the committent in 1C 8.3 can be generated from the section Purchases - Reports to committents or based on the Receipts document:

Let's create a new report. We fill out the tabs of the Report to the consignor in the same way as in retail sales. We issue an invoice using the link:

The completed document Report to the committent gives the following movement:

The generated invoice does not make a journal entry. Recorded in the Sales Book as revenue:

Registration of a reissued invoice from the principal

Through the menu Purchases – Purchases – Report to the consignor, using the Create on the basis button, select the Invoice received with the form Invoice for receipt:

By clicking on the selection link in Invoices – invoices issued by the buyer, fill in the button of the same name and select the desired invoice:

The issued invoice will take the appropriate place in the document. The basis document will be filled in automatically:

Having received an invoice from the principal, the commission agent registers it in Part 2 of the Journal of Received and Issued Invoices. The following invoices are not reflected in the Purchase Book:

Transfer of funds to the principal for goods sold

Let's create a Bank Statement document with the type Write-off from a current account based on the statement received from the bank:

The posted document gives the following entries:

Settlements with the principal can be checked by generating a balance sheet for account 76.9:

On the PROFBUKH8 website you can find other free articles and video tutorials on the 1C Accounting 8.3 configuration.

We recommend watching our video lesson on reflecting income from commission trading under the simplified tax system in 1C 8.3:

Give your rating to this article: (

4 ratings, average: 5.00 out of 5)

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

Issuance of SF for shipment to customers

Registration of invoices issued for sales is carried out in 1C 8.3 automatically when conducting a Commission Agent (Agent) Sales Report .

In the document Invoice issued for sales, Add button to enter the number and date of the payment order for the advance according to the data from the commission agent’s report.

- Operation type code : “Sales of goods, works, services and operations equivalent to it.”

When reflected in one document, the Commission Agent's (Agent's) Report on sales of advances and sales, the chronological sequence of invoice numbering may be disrupted, especially if all issued invoices are numbered uniformly.

Violation of the sequence not a critical error and cannot entail a refusal to deduct VAT (clause 2 of Article 169 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated January 12, 2017 N 03-07-09/411).

VAT declaration

In the VAT return, the amount of calculated tax on the sale of goods to customers is reflected:

- On page 010 “Sale (transfer on the territory of the Russian Federation for one’s own needs) of goods, works (services), transfer of property rights at appropriate tax rates...” Section 3: tax base;

- calculated VAT amount;

- invoice issued, transaction type code "". PDF

Item

Any transaction has essential conditions, without which it is not considered concluded. The main requirements for a commission agreement are a mandatory indication of the terms of transactions that the commission agent is authorized to conclude.

In order for the wording to be correct, the following must be provided:

- restriction of the powers of the intermediary: it is recommended to make a list of the rights and actions of the commission agent for which he is authorized;

- It is better to limit the field of his actions geographically and in terms of time.

It is important to note that under a commission agreement, the commission agent acts for the principal only regarding the conclusion of the contract, and not during its actual execution.

Acceptance of VAT for deduction when offsetting advance payments from buyers

To deduct VAT on offset advances from buyers, create a second document in 1C 8.3, Report of a commission agent (agent) on sales (Sales - Reports of commission agents on sales - Create button).

- Main tab - fill in the same way as in the first document.

- Implementation tab - do not fill out.

- Cash tab - fill in as follows:

Click the Add to enter:

- Type of payment report - Advance offset ;

- Buyer - name of the organization whose advance payment is credited towards the shipment;

- Event date - the date of shipment of the goods by the commission agent to the buyer;

- Amount including VAT (RUB) - the amount of the offset advance;

- % VAT — 20/120.

Postings according to the document

The document generates the posting:

- Dt 68.02 Kt 76.AV - acceptance of VAT for deduction on offset advance payment.

VAT declaration

The VAT return, the tax subject to deduction, reflects:

- On page 170 “The amount of tax calculated by the seller from the amounts of payment, partial payment, subject to deduction from the seller from the date of shipment...” Section 3: the amount of VAT subject to deduction.

- advance invoice issued, transaction type code "". PDF

We looked at the principal's accounting in 1C 8.3 Accounting, transfer of goods to commission in 1C 8.3 in the principal's accounting, transactions for the transfer of goods to commission in 1C.

Accounting for a commission agent in 1C 8.3 Accounting is described in detail in the following article >>

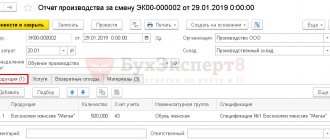

Registration of the interim report of the commission agent

According to the terms of the agreement, twice a month (15th day and at the end of the month) the commission agent submits a sales report, which the principal registers in the program with the document Commission Agent (Agent) Sales Report (Sales - Commission Agents Sales Reports - Create button).

According to the conditions of the example, the commission agent’s report contains data on advances:

- July 14 - LLC "Linasi" in the amount of 120,000 rubles.

In the same month, goods were shipped to customers against the specified advance payment:

- July 27 - Mikron LLC in the amount of 120,000 rubles;

- July 28 - Linasi LLC in the amount of 126,000 rubles.

Reflection of the received advance and its offset is carried out in two separate documents Report of the commission agent (agent) on sales .

If the document flow between the principal and the commission agent provides for several reports per month (for example, a separate report on advances from buyers), then the commission agent’s (agent’s) Sales Report will be filled out separately with the date of the corresponding primary document.

If two commission agent reports are filled out in 1C based on one commission agent report, then in the Comment indicate “advance” or “advance offset.” Then it will be clear to you and other users exactly what operations are reflected in the first 1C document and in the second.

Create the first document Sales report of the commission agent (agent) to reflect the advance payment.

Main tab

On the Main , specify:

- Counterparty - commission agent who submitted the report;

- Agreement - commission agreement (if a given counterparty has one, it will be entered automatically);

- Settlements —settlement accounts specified in the counterparty settings will be automatically entered.

Cash tab

Click the Add fill in:

- Payment report type - Advance ;

- Buyer - the name of the organization that made the advance payment;

- Event date - the date of receipt of funds into the commission agent's account.

Since the money from the buyer has not yet been received into the principal’s current account, income for the purposes of the simplified tax system is not generated, and the document does not generate any movements when posted, it serves only for internal analytics.