Financial investments in the balance sheet structure

In the structure of the balance sheet, financial investments are assets recorded in lines 1170 and 1240. Line 1170 is located in the first section of the balance sheet “Non-current assets”, and line 1240 is in the second section (“Current assets”).

In line 1170 the amounts of long-term financial investments are recorded (for a period of more than a year), and in line 1240 - short-term (for a period not exceeding a year). In accounting, a breakdown of financial investments by the period for which they are formed must be carried out, as this is provided for by the instructions for using the chart of accounts (Order of the Ministry of Finance dated October 31, 2000 No. 94n, hereinafter referred to as Order 94n) and PBU 19/02.

The main part of the financial investments reflected in lines 1170 and 1240 of the balance sheet is recorded in accounting in the form of a debit balance of the account. 58, on which financial investments are recorded. To it is added the debit balance of financial investments in accounts 55 and 73 (in terms of deposits and loans to employees of the enterprise, respectively). In addition, the amount of debit balances of accounts 58, 55, 73 should be reduced by the credit balance of account 59 (formation of reserves for financial investments).

IMPORTANT! It is advisable to account for assets reflected in accounts 55 and 73, classified as financial investments, in separate sub-accounts depending on the investment period. Then, when creating a balance, there will be no problems filling out lines 1170 and 1240.

Read about the basic principles of drawing up a balance sheet for an enterprise in the material “Balance Sheet (Assets and Liabilities, Sections, Types).”

An example of filling out line 1170 “Financial investments” from ConsultantPlus Indicators for accounts 58, 59 and 73, subaccount 73-1, in accounting (indicators for account 55, subaccount 55-3, are missing) ... See in K+ a fragment of the balance sheet on line 1170 , as well as other reporting indicators. Trial access is available for free.

Let's take a closer look at what assets are reflected in account 58.

Financial investments. Line 1170

This line shows information about the organization’s financial investments, the circulation (repayment) period of which exceeds 12 months after the reporting date (clause 19 PBU 4/99, clause 41 of the Accounting Regulations “Accounting for Financial Investments” PBU 19/02, approved by the Order Ministry of Finance of Russia dated December 10, 2002 N 126n).

What is included in financial investments?

An organization's financial investments may include:

— state and municipal securities, securities of other organizations, including debt securities in which the date and cost of repayment are determined (bonds, bills);

— contributions to the authorized (share) capital of other organizations (including subsidiaries and dependent business companies) <*>;

— loans provided to other organizations, deposits in credit institutions;

— receivables acquired on the basis of assignment of the right of claim;

- contributions of a partner organization under a simple partnership agreement, etc.

The amount of funds transferred as a contribution to the authorized capital of another organization, before the state registration of the relevant changes in the constituent documents, is reflected in the balance sheet as financial investments (Appendix to the Letter of the Ministry of Finance of Russia dated 02/06/2015 N 07-04-06/5027).

To include the above-mentioned assets in the organization’s financial investments, the following conditions must be simultaneously met (clauses 2, 3 of PBU 19/02):

— the presence of properly executed documents confirming the existence of the organization’s right to financial investments and to receive funds or other assets arising from this right;

— transition to organizing financial risks associated with financial investments (risk of price changes, risk of debtor insolvency, liquidity risk, etc.);

- the ability to bring economic benefits (income) to the organization in the future in the form of interest, dividends or an increase in their value (in the form of the difference between the sale (redemption) price of a financial investment and its purchase value as a result of its exchange, use in repaying the organization’s obligations, an increase in the current market cost, etc.).

Attention!

Interest-free loans issued by the organization, received from buyers (customers) of goods (works, services), interest-free bills accepted for accounting at face value, as well as similar assets are not financial investments of the organization and are shown on line 1230 “Accounts receivable” in section. II Balance Sheet.

At what cost are financial investments reflected in accounting?

Financial investments are accepted for accounting at their original cost, which is determined in accordance with clauses 9 - 15 of PBU 19/02, clause 13 of PBU 20/03.

- Financial investments for which the current market value is determined (which are traded on the ORS) are reflected in accounting and reporting at the end of the reporting year at the current market value by adjusting their valuation as of the previous reporting date. The organization can make this adjustment monthly or quarterly (clause 20 of PBU 19/02).

For reference: The current market value of securities means...

The current market value of securities is understood as their market price, calculated in the prescribed manner by the organizer of trading on the securities market (paragraph 2 of clause 13 of PBU 19/02).

To determine the current market value of financial investments, all available sources of information on market prices for these financial investments must be used, including data from foreign organized markets or trade organizers (Appendix to the Letter of the Ministry of Finance of Russia dated January 29, 2014 N 07-04-18/01) .

In this case, the cost of securities at which they are reflected in accounting and financial statements is adjusted on reporting dates in accordance with their market price, regardless of the total quantity of these securities that are the subject of transactions, as well as the ratio of the specified quantity to the number of securities , which is owned by the organization (Appendix to the Letter of the Ministry of Finance of Russia dated January 29, 2014 N 07-04-18/01).

Question: In what cases is it permissible not to adjust the value of securities traded on the Ordinary Securities Market in accordance with their market value as of the reporting date?

Answer: 1. Small business organizations, with the exception of issuers of publicly offered securities, have the right to carry out a subsequent assessment of all financial investments, including securities traded on the Ordinary Securities Market, at their original cost (paragraph 2, clause 19, clause 21 of PBU 19 /02). This method of subsequent assessment of financial investments should be enshrined in the accounting policy of a small enterprise and applied sequentially from one reporting year to another (clauses 5, 7 of PBU 1/2008).

From November 16, 2014, simplified methods of accounting, including simplified financial statements, are not allowed to be used by commercial organizations - small businesses, if they are microfinance organizations or if their financial statements are subject to mandatory audit (clause 1, 4 parts. 5, Article 6 of Law No. 402-FZ).

- According to paragraph 36 of PBU 4/99, the rules for assessing individual items of financial statements are established by the relevant accounting provisions. In particular, the rules for evaluating securities traded on the Ordinary Securities Market are provided for in clause 20 of PBU 19/02.

At the same time, the organization has the right to decide to deviate from the rules of PBU 4/99 in exceptional situations (for example, in the case of nationalization of property), when the application of these rules does not allow the generation of financial statements that give a reliable and complete picture of the financial position of the organization, the financial results of its activities and changes in its financial position (paragraph 3, paragraph 6 of PBU 4/99).

To make a decision on the specified derogation, the organization must:

— clearly establish the conditions (circumstances) under which the application of the rules of PBU 4/99 does not allow the formation of financial statements that give a reliable and complete picture of the financial position of the organization, the financial results of its activities and changes in its financial position;

— make sure that the application of rules different from the rules of PBU 4/99 will allow the formation of financial statements that give a reliable and complete picture of the financial position of the organization, the financial results of its activities and changes in its financial position.

Such clarifications are contained in Letters of the Ministry of Finance of Russia dated 02/26/2015 N 07-01-06/9818, dated 02/27/2015 N 07-01-06/9966.

Based on the foregoing, we can conclude that in exceptional cases it is possible to deviate from the requirement of clause 20 of PBU 19/02 on adjusting the value of securities traded on the Ordinary Securities Market in accordance with their market value as of the reporting date, if this requirement is met does not allow the generation of financial statements that provide a reliable and complete picture of the financial position of the organization, the financial results of its activities and changes in its financial position.

For information on the requirements for disclosure in financial statements of information about significant deviations from the rules of PBU 4/99 made by the organization, see Section. 3.5.10 “Other information disclosed in the Explanations to the Balance Sheet and the Statement of Financial Results.”

- Financial investments for which the current market value is not determined (which are not traded on the securities market) are subject to reflection in accounting as of the reporting date at their original cost. For such financial investments, the organization is required to test for impairment and create an impairment reserve.

Question: When is a test for impairment of financial investments carried out?

Answer: An impairment test is carried out at least once a year as of December 31 of the reporting year if there are signs of impairment of financial investments. The organization has the right to carry out this check on the dates of preparation of interim financial statements.

Question: In what cases is a reserve created for the impairment of financial investments?

Answer: If the impairment test confirms a sustained significant decrease in the value of financial investments, the organization creates a reserve for impairment of financial investments in the amount of the difference between the book value and the estimated value of such financial investments (clauses 21, 38 of PBU 19/02). Let us recall that the creation of estimated reserves is considered as a change in estimated values in accordance with paragraphs 2, 3 of PBU 21/2008.

For debt securities for which the current market value is not determined, the initial value may change by increasing (decreasing) it by the difference between the original and nominal value during their circulation period (clause 22 of PBU 19/02).

In which accounting accounts are financial investments reflected?

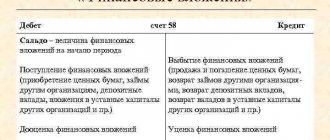

According to the Instructions for using the Chart of Accounts, financial investments are reflected in the corresponding subaccounts of account 58 “Financial Investments”, analytical accounting for which should also provide information on long-term and short-term assets.

At the same time, the Instructions for the application of the Chart of Accounts stipulate that such financial investments as deposits can be accounted for in account 55 “Special accounts in banks”, subaccount 55-3 “Deposit accounts”, and interest-bearing loans issued to employees of the organization can be reflected in account 73 “Settlements with personnel for other operations”, subaccount 73-1 “Settlements for loans provided”.

FOR MORE on this issue see:

Section “Accounting for financial investments (accounts 58, 59)” of the Guide to IB “Correspondence of accounts”

Section “Accounting for settlements on loans and borrowings in rubles from the lender” of the Guide to Information Security “Correspondence of Accounts”

Section “Accounting for settlements on loans and borrowings in foreign currency from the lender” of the Guide to Information Security “Correspondence of Accounts”

Section “Accounting for settlements on loans in conventional units from the lender” of the Guide to Information Security “Correspondence of Accounts”

Section “Accounting for loans issued by property from the lender” of the Guide to Information Security “Correspondence of Accounts”

Section “Accounting for the termination of an obligation under a loan agreement by compensation, novation, offset from the lender” of the Guide to IB “Correspondence of Accounts”

What accounting data is used when filling out line 1170 “Financial investments”?

Regardless of which accounting account reflects assets that, in accordance with the requirements of PBU 19/02, are financial investments, information about them must be shown in the Balance Sheet as part of financial investments. Line 1170 “Financial investments” of the Balance Sheet indicates the value of long-term financial investments as of the reporting date, as of December 31 of the previous year and as of December 31 of the year preceding the previous one.

For long-term financial investments traded on ORTSB, their current market value is shown (i.e., the initial cost taking into account adjustments) according to analytical accounting data for account 58 (clauses 20, 24 of PBU 19/02).

For long-term financial investments for which the current market value is not determined, their initial value is shown minus the reserve created for them, for which analytical accounting data is used for accounts 58 (55, subaccount 55-3, and 73, subaccount 73-1) and 59 “Provisions for impairment of financial investments” (clauses 24, 38 PBU 19/02, clause 35 PBU 4/99).

Attention!

If significant, the contribution of the partner organization to joint activities is shown in the Balance Sheet as a separate item (clause 16 of PBU 20/03).

Line 1170 “Financial investments” = Debit balance on account 58, subaccounts 55/3 and 73/1 (analytical accounts of long-term financial investments) - Credit balance on account 59 (analytical account for the reserve created for long-term financial investments).

The indicators of line 1170 “Financial investments” as of December 31, 2012 and as of December 31, 2011 are transferred from the Balance Sheet for the previous year.

The “Explanations” column provides an indication of the disclosure of this indicator. If an organization draws up Explanations to the Balance Sheet and the Statement of Financial Results according to the forms contained in the Example of Explanations given in Appendix No. 3 to Order of the Ministry of Finance of Russia No. 66n, then in the column “Explanations” on line 1150 “Financial investments” tables 3.1 and 3.2.

Example of filling out line 1170 “Financial investments”

Indicators for accounts 58, 59 and 73, subaccount 73-1, in accounting (indicators for account 55, subaccount 55-3, absent): rub.

| Index | As of the reporting date (December 31, 2014) |

| 1 | 2 |

| 1. On the debit of account 58, analytical accounts for long-term financial investments | 3 270 000 |

| 2. On the debit of account 73, subaccount 73-1, analytical account for recording long-term interest-bearing loans issued to employees | 130 000 |

| 3. On the credit of account 59, analytical account of the reserve for long-term financial investments | 70 000 |

Fragment of the Balance Sheet for 2013

| Explanations | Indicator name | Code | As of December 31, 2013 | As of December 31, 2012 | As of December 31, 2011 |

| 1 | 2 | 3 | 4 | 5 | 6 |

| 3.1, 3.2 | Financial investments | 1170 | 1080 | 1080 | 560 |

Solution

The cost of the organization’s long-term financial investments minus the created reserve is:

as of December 31, 2014 - RUB 3,330 thousand. (RUB 3,270,000 + RUB 130,000 - RUB 70,000);

as of December 31, 2013 - 1080 thousand rubles;

as of December 31, 2012 - 1080 thousand rubles.

A fragment of the Balance Sheet in Example 1.7 will look like this.

| Explanations | Indicator name | Code | As of December 31, 2014 | As of December 31, 2013 | As of December 31, 2012 |

| 1 | 2 | 3 | 4 | 5 | 6 |

| 3.1, 3.2 | Financial investments | 1170 | 3330 | 1080 | 1080 |

Account 58 “Financial investments”

Order 94n established the following list of subaccounts of account 58:

- 58.1 - shares and shares;

- 58.2 - debt securities;

- 58.3 - loans provided;

- 58.4 - contributions under a simple partnership agreement.

However, the law does not prohibit enterprises from independently establishing a list of subaccounts in accordance with the goals of their accounting policies. At the same time, Order 94n clearly states that the enterprise is obliged to ensure a breakdown of financial investments into long-term and short-term.

Therefore, if the enterprise has financial investments with a period of up to 12 months or more than 12 months, it is necessary to organize their separate accounting, which allows separating the amounts of long-term financial investments from short-term ones.

More information about the procedure for organizing accounting of financial investments can be found in the article “Accounting for financial investments - PBU 19/02”.

Postings for transactions with financial investments in account 58 may look like this:

| Dt | CT | Contents of operation |

| 58.1 | 75.1 | Shares were added to the authorized capital of the enterprise |

| 51 | 58.1 | Received funds for securities (sale of shares) |

| 58.2 | 50 | Purchased bills (debt securities) with cash payment |

| 58.2 | 75.1 | Debt securities are included in the authorized capital of the enterprise |

| 58.1(58.2) | 98.2 | The securities were received by the company free of charge |

Simplified balance sheet asset

The line “Tangible non-current assets” displays the residual value of fixed assets, as well as incomplete capital investments in fixed assets.

The line “Intangible, financial and other non-current assets” contains the sum of account balances for various research developments, patents, copyrights, deferred tax assets, deposits, as well as other investments in certain tangible assets and other non-current assets.

In the line “Inventories” indicate the amount of balances on the accounts of goods, raw materials and materials, work in progress, spare parts, fuels and lubricants, etc.

The line “Cash and cash equivalents” is intended for entering balances in cash accounts at the cash desk, in the company’s bank account in special accounts, as well as in foreign currency accounts. In addition, funds lying in demand deposit accounts, as well as short-term financial investments, are indicated here.

The line “Financial and other current assets” includes all other assets that cannot be included in cash equivalents or inventories. These are accounts receivable for goods and services, input VAT, investments with a maturity of up to 12 months, etc.

Then the liability is filled in so that the sum of all liability lines equals the sum of all asset lines.

Accounting for financial investments in accounts 55.3 and 73.1, standard transactions

Account 55.3 reflects the enterprise's deposits - funds provided to financial institutions for the purpose of receiving interest income. They can also be short term or long term. Account 73.1 reflects loans provided by the enterprise to its employees.

Here are some typical entries when accounting for financial investments in accounts 55.3 and 73.1.

| Dt | CT | Operation description |

| Account 55.3 “Deposit accounts” | ||

| 55.3 | 51 | Funds were transferred to the deposit account |

| 76 | 91 | Interest accrual on deposit |

| 55.3 | 76 | Interest is transferred to a deposit account (if the company does not withdraw it) |

| 51 | 76 | Interest transferred to the company's current account |

| 51 | 55.3 | Closing the deposit |

| Account 73.1 “Settlements with personnel for loans provided” | ||

| 73.1 | 50 | A loan was issued from the company's cash desk to an employee |

| 73.1 | 51 | The loan is transferred to the employee’s card |

| 73.1 | 91.1 | The company has accrued interest on the loan issued to the employee (if the loan agreement provides for this) |

| 70 | 73.1 | Withholding interest or loan amount from the employee's salary |

| 50 | 73.1 | Repayment of a loan by an employee to the company's cash desk |

| 91.2 | 73.1 | The company has written off the employee’s loan debt (if such a decision has been made) |

VI. Impairment of financial investments

37. A sustained significant decrease in the value of financial investments for which their current market value is not determined, below the amount of economic benefits that the organization expects to receive from these financial investments under normal conditions of its activities, is recognized as depreciation of financial investments. In this case, based on the organization’s calculations, the estimated value of financial investments is determined, equal to the difference between their value at which they are reflected in accounting (accounting value) and the amount of such reduction. A steady decline in the value of financial investments is characterized by the simultaneous presence of the following conditions:

- at the reporting date and at the previous reporting date, the accounting value is significantly higher than their estimated value;

- during the reporting year, the estimated value of financial investments changed significantly only in the direction of its decrease;

- As of the reporting date, there is no evidence that a significant increase in the estimated value of these financial investments is possible in the future.

Examples of situations in which impairment of financial investments may occur are:

- the issuing organization of securities owned by the organization or its debtor under a loan agreement has signs of bankruptcy or is declared bankrupt;

- execution of a significant number of transactions in the securities market with similar securities at a price significantly lower than their book value;

- absence or significant decrease in income from financial investments in the form of interest or dividends with a high probability of a further decrease in these income in the future, etc.

38. If a situation arises in which depreciation of financial investments may occur, the organization must check the existence of conditions for a sustainable decrease in the value of financial investments. This check is carried out for all financial investments of the organization specified in paragraph 37 of these Regulations, for which there are signs of impairment. If the impairment test confirms a sustained significant decline in the value of financial investments, the organization creates a reserve for impairment of financial investments in the amount of the difference between the book value and the estimated value of such financial investments. A commercial organization forms the specified reserve at the expense of the organization’s financial results (as part of other expenses), and a non-profit organization - due to an increase in expenses. In the financial statements, the value of such financial investments is shown at book value minus the amount of the formed reserve for their depreciation. A check for impairment of financial investments is carried out at least once a year as of December 31 of the reporting year if there are signs of impairment. The organization has the right to carry out this check on the reporting dates of the interim financial statements. The organization must provide confirmation of the results of this inspection.

39. If, based on the results of an audit for impairment of financial investments, a further decrease in their estimated value is revealed, then the amount of the previously created reserve for impairment of financial investments is adjusted towards its increase and decrease in the financial result of a commercial organization (as part of other expenses) or an increase in expenses for a non-profit organization . If, as a result of checking for impairment of financial investments, an increase in their estimated value is revealed, then the amount of the previously created reserve for impairment of financial investments is adjusted towards its decrease and increase in the financial result of a commercial organization (as part of other income) or decrease in expenses for a non-profit organization.

40. If, based on available information, the organization concludes that a financial investment no longer meets the criteria for a sustainable significant decline in value, as well as upon disposal of financial investments, the estimated value of which was included in the calculation of the reserve for impairment of financial investments, the amount of the previously created reserve for impairment for the specified financial investments is included in the financial results of a commercial organization (as part of other income) or a decrease in expenses in a non-profit organization at the end of the year or the reporting period when the disposal of the specified financial investments occurred.

Accounting for interest on financial investments

Operations for the provision of loans are reflected using subaccount 58.3 “Loans provided”. Such financial investments must be formalized by loan agreements. Essential information in the agreement is the amount and term of the loan, as well as the amount of interest accrued on such obligations.

Typical wiring may look like this:

| Dt | CT | Operation description |

| 58.3 | 51 | The amount provided to the borrower is reflected |

| 76 | 91 | Interest accrued on the loan provided |

| 51 | 76 | The borrower paid interest on the loan |

| 51 | 58.3 | Loan repayment |