Documents have accumulated: what to do with them so as not to break the law

Our life is closely connected with a huge amount of papers.

Even in an ordinary apartment you can find deposits of various types of waste paper (for example, invoices or copies of personal documents). In companies and institutions, paper waste is generated in incomparably large volumes (administrative, administrative, economic, accounting, personnel and other documents). An ordinary citizen can get rid of unnecessary papers without any problems - do a general cleaning and throw away all the unnecessary paper trash. There is no need to follow any special procedures - even if something valuable is accidentally destroyed, no punishment will follow. True, in such a situation you will have to spend time and money to restore the lost document.

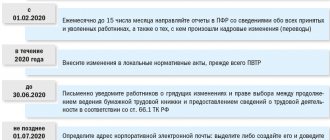

Completely different requirements apply to the destruction of documents generated during the activities of various companies. It will not be possible to get rid of orders, instructions, personnel and primary accounting documents, as well as many other documents without following a special procedure. In addition, documents can be destroyed only after the expiration of the legally established storage periods.

IMPORTANT! The responsibility for preserving archival documents (including personnel) during their storage periods is assigned to state bodies, local governments, organizations and citizens engaged in commercial activities, in accordance with paragraph 1 of Art. 17 of the Law “On Archiving in the Russian Federation” dated October 22, 2004 No. 125-FZ.

In case of non-compliance with this law, various types of liability are provided (Article 27 of Law No. 125-FZ).

Description of the destruction procedure - is it possible to do it with one act?

What is the procedure for destroying documents with expired storage periods?

For any documents (no matter administrative, accounting or personnel) there is a uniform procedure for their destruction. It is as follows:

- It is necessary to check whether the storage period for documents has expired, as well as the presence of documents that have lost their practical significance.

- An Expert Commission (EC), the composition of which is approved by the head of the company, must conduct an examination of the value of the documents (documented in the minutes of the EC meeting).

- An act for the destruction of documents is drawn up, approved by the head of the enterprise.

- The cases reflected in the act are destroyed, which is documented in a separate document.

To learn about the storage periods for documents, read the article “Retention period for accounting documents in an organization.”

You can’t do this with just one act, and you won’t be able to get rid of the documents alone. The role of the expert commission should not be underestimated in this case. For example, if during the examination it is revealed that in one case documents with an expired storage period are filed simultaneously with papers that have permanent or long storage periods, then such a set of documents will need to be expanded and disassembled. Documents that are not subject to destruction by a certain date are registered as separate files.

Or another example: if an examination of permanent storage documents reveals the presence of both originals, copies or their duplicates (that is, duplicate information), then the originals are subject to further storage, and the remaining documents are destroyed. All this is decided by an expert commission.

Her responsibilities also include determining whether the text of damaged documents can be recovered. Documents may be selected for destruction if most of the text is unreadable and cannot be restored. If text restoration is possible, the damaged document is not destroyed, but is subsequently restored or photocopied.

The results of the examination of documents must be reflected in the EC protocol, the form of which is not regulated by law. And when drawing up an act for the destruction of documents, it is better to use the form given in Appendix No. 4 to the Basic Rules for the Operation of Organizational Archives, approved by the decision of the Rosarkhiv Board of 02/06/2002.

Procedure for destroying expired documents

The procedure for destroying expired documentation for state bodies and municipalities is established by the rules approved by Order of the Ministry of Culture of the Russian Federation dated March 31, 2015 No. 526 (hereinafter referred to as the rules). Private companies can develop and approve their own procedure, the development of which is recommended to rely on these rules. Let's look at the procedure for recycling accounting, personnel and other documentation step by step.

Step 1. Creation of an expert commission

The personal composition of the commission is approved by the general director of the company by his order (resolution, order). Its main task is to select documents for subsequent disposal. The commission must include specialists who can assess the practical significance of the documentation.

For example, to examine the value of accounting papers, an accountant is included in the commission, to examine the value of personnel documents - a personnel manager, to examine the value of legal documentation - a lawyer, and so on.

If the company has branches and representative offices, then it is additionally possible to create a central expert commission that will coordinate the work of the expert commissions (clauses 4.7, 4.9 of the rules).

The commission is usually assigned responsibilities such as:

- selection for destruction of papers that are not subject to further storage, with the drawing up of appropriate acts;

- participation in the documentation disposal procedure with the drawing up of a corresponding act;

- preparation of proposals to determine the storage periods for documents not established by law;

- participation in the development of the organization’s document flow;

- organization of ensuring the safety of documentation.

The tasks and functions of the expert commission can be fixed in a special regulation, which is approved by the management of the company.

Right now at Clerk we are recruiting a group for a refresher course on the topic “FSBU 5/2019: “Inventories”!

After the course you:

- learn to understand and put into practice the requirements of the new standard;

- you will know what to do when orders arrive, materials become depreciated, and materials are released into production;

- you will be able to choose the method of application of new standards that suits your company;

- You will only make the necessary wiring.

You can view the course program here.

Step 2. Conducting an examination

During the inspection, the commission examines documents and determines their storage periods. According to its results (clause 4.11 of the rules):

- compiles an inventory of papers selected for permanent storage;

- selects documents whose storage period has expired.

When evaluating documents, the expert commission may extend the period during which the company will store them at its discretion if it considers that the document is of any scientific or historical value or is still of practical importance. For example, a trial is planned and documentation may be useful there.

It is possible to extend the deadlines relative to those established by the state, but it is prohibited to shorten them. Administrative liability is established for violation of this rule. A fine of 1 to 3 thousand rubles may be imposed on citizens, from 3 to 5 thousand rubles on officials, from 5 to 10 thousand rubles on legal entities (Article 13.20 of the Administrative Code).

Also, during the examination, the commission can identify the presence of both originals and copies of documents. Then she may decide that only originals will be stored further, and copies must be disposed of. In addition, her responsibilities include determining whether the text of damaged papers can be restored. Documents may be selected for destruction if most of the text is unreadable and cannot be restored. If text restoration is possible, then the damaged document is not destroyed, but is subsequently restored or photocopied.

The results of the examination are reflected in the minutes of the commission meeting, the form of which is not regulated by law, that is, each company includes in it the information that it considers necessary.

Step 3. Drawing up an act on the allocation for destruction of documents that are not subject to storage.

Next, the papers selected for recycling must be described. For this purpose, an act on the allocation for destruction of documents that are not subject to storage is intended (clause 4.11 of the rules). There is no need to describe each case - just indicate their total number. You can use the form given in the rules (Appendix No. 21) or a self-developed form.

The list of documentation included in the act should be agreed upon at a meeting of the expert commission. After this, the act must be approved by the head of the company.

Step 4. Destruction of documentation

As mentioned above, papers can be destroyed independently, for example, by an expert commission, or a specialized organization can be involved. The transfer is formalized with an acceptance note, which indicates:

- date of transfer;

- number of cases;

- weight of waste paper.

We recommend that documents be destroyed directly under the supervision of an expert commission or a company employee designated for this purpose. Such supervision will ensure the confidentiality of information contained in the documents being destroyed.

To record the fact of destruction of waste paper, an act should be drawn up. There is no approved form for such an act, so a free form is used. We’ll tell you how to compose it correctly at the end of our article.

How to draw up an act for the destruction of documents

Until documents with an expired storage period are destroyed, those responsible for their destruction will have to work hard. Firstly, the selected documents must be organized and described - this is what the act “On the allocation for destruction of documents not subject to storage” is intended for.

The act does not need to describe each case - it is enough to indicate their total number and deadlines for completing the paperwork. For example, in an act regarding orders for administrative and economic activities, it is enough to provide the following information:

In addition to filling out the tabular part of the act, it is required to indicate other important information: the total numbers of storage units to be destroyed, indicating the time period of the cases; a note confirming the agreement of the information given in the act with the expert commission (including the date and number of the EC protocol on the approval of inventories of permanent storage files). The act is approved by the head of the company. A special place in it is given to the date of compilation - this detail deserves special attention. We'll talk about this further.

Document destruction act

The destruction of files from the moment of selection to sending to the shredder is documented in one document - an act on the allocation for destruction of archival documents that are not subject to storage. The form is approved by the Rules for organizing the storage, acquisition, recording and use of documents of the Archival Fund of the Russian Federation and other archival documents in government bodies, local governments and organizations in Appendix No. 21 (Example 3).

As can be seen from the example, the document destruction act conditionally consists of two parts. The first is a list of cases and documents allocated for destruction, the second informs about how exactly the documents were destroyed.

Let's go through the act and consider the basic rules for filling out its unified form.

The first part of the act: registration rules

1. The name of the organization can be either full or short. The main thing is that the name stated in the act corresponds to the organization’s charter.

2. Acts on the destruction of documents must be registered, like other documents. The act is assigned a serial number according to the corresponding registration form. The date of the act must correspond to the date of its approval.

3. The act is approved by the general director.

4. Documents are selected for destruction on the basis of regulations establishing storage periods. And this is not only the 2010 List. We have included as an example an industry document containing retention periods to show what several such documents look like in the act.

5. Information about the documents being destroyed is summarized in a table.

• Each entry in the table is assigned a serial number.

• The group heading of the case is placed in the second column: “Invoices” or “Orders...”. In this case, there is no need to list things by storage unit. Moreover, if the same file is destroyed over several years at once, then it is enough to make only one entry in the act (see entry No. 3 in Example 3).

• The third column indicates the years for which documents are destroyed.

• The inventory, as already mentioned, is the main accounting document of the archive. If the documents being destroyed were included in the inventory, its number is indicated in the fourth column, and the serial numbers of the storage units being destroyed according to this inventory are indicated in the fifth column (see entry No. 1). Documents with five-year or shorter storage periods are not described, so dashes are placed in these columns (see entry No. 2). If this is the first destruction of documents in the organization, and the inventory has not yet been compiled, then both columns (fourth and fifth) can be removed from the table - there is nothing to add to them yet.

• The number of storage units to be destroyed is indicated for each case.

• The seventh column indicates the storage period for each file and a link to its source. Since the word “List” in the column heading means the 2010 List, the full or abbreviated name of the remaining sources will have to be placed in the table (see entry No. 4).

• The “Note” column is traditionally used for all kinds of notes. For example, that the case is electronic (see entry No. 5).

6. The following is a summary: the total number of storage units destroyed, total paper and electronic media, is written in numbers and in words.

7. The first part of the act is signed by the employee responsible for the archive and submitted to the expert commission for approval. Then a visa is issued with a link to the minutes of the EC meeting, which records the agreement.

It is advisable to submit the document destruction act for approval to the general director now, despite the fact that the second part of the act is still empty. The manager must know which documents will soon be destroyed. Moreover, it is he who makes the decision to destroy and records this in the approval stamp. Destruction of documents is an irreversible process. It is impossible to return papers after they have been recycled.

The second part of the act: design features

This part indicates exactly how and on what basis the documents were destroyed. The form of the destruction act approved by the 2015 Rules implies that the destruction is carried out by a contractor. Therefore, the second part indicates the weight of the documents (they will be accepted by weight, and not by pieces of storage units), registration data of the contract, and method of destruction.

If the organization destroys the documents itself, the record will look like that shown in Example 4.

Please note: documents were destroyed in the presence of officials - members of the EC. In this case, there is no need to draw up a separate act, but it is also impossible to destroy the papers without supervision.

If only paper documents are destroyed, then the phrase “on electronic media” is excluded from the act. O means that after the destruction of the documents, the archivist took up the inventories, the documents from which were sent for destruction, and made the appropriate notes (Example 5).

Please note: in the inventory, unlike the act of destruction, each storage unit is presented separately. They also receive notes separately. If documents were destroyed that were not in the inventory, or when drawing up the act, columns 4 and 5 of the table were excluded, no mark is placed in the inventory.

How not to make a mistake with the act date

In order not to violate the requirements of the law and not to accidentally get rid of documents whose storage period has not yet expired, it is necessary to correctly calculate these periods. The following must be taken into account:

- Before destroying files with a registration date of 2010 or later, their storage periods must be checked against the list approved by Order No. 236 of the Federal Archive of Russia dated December 20, 2019, or Order No. 558 of the Ministry of Culture dated August 25, 2010.

- Documents created before 2009 (inclusive) can be destroyed only if the storage period specified in the List of standard management documents approved by Rosarkhiv on 10/06/2000 has expired. This is due to the fact that Order No. 558, which put the 2010 list into effect, does not have retroactive force, that is, it does not apply to previously established relationships - otherwise it is not directly stated in it. And the individual terms of the 2000 list and the 2010 list do not coincide for the same types of documents.

When specifying the date of destruction of documents, it should be remembered that the destruction act is allowed to include those documents whose storage period has expired by January 1 of the year the act was drawn up. For example, a case from 2015 with a storage period of 5 years can be included in the act no earlier than 2022.

How long to store

The legislation of the Russian Federation obliges the management of enterprises to ensure proper storage for 5 years:

- "primary";

- accounting registers;

- audit reports, etc.

And for some documents there are no deadlines. For example:

- payroll statements;

- annual financial statements;

- liquidation balance sheet;

- certificate of receipt of legal entity status and registration with the Federal Tax Service.

A number of documents with a shelf life of up to 10 years are considered current and are not sent to the archive. They lie in the structural divisions of the company, and then, after a period of time, they are liquidated. When solving this problem, one must be guided by the following legal acts:

- List of the Ministry of Culture of 2010 No. 558;

- Law “On Archival Files” No. 125-FZ;

- by order of the Ministry of Culture No. 526 of 2015.

According to the law, the destruction of accounting documents is possible under one condition: their storage period expired before December 31 of the previous year (inclusive). Otherwise, it will be possible to get rid of them only next year.

If the company's operating results turned out to be negative and the loss is carried forward to future periods, documents confirming its amount are relevant throughout the entire period of such tax optimization. This rule is established in clause 4 of Art. 283 Tax Code of the Russian Federation. acts for the destruction of accounting documents are usually drawn up .

Electronic documents placed in the archives of an enterprise may also lose their practical significance over time. According to Art. 5 of the Law “On Archiving”, the method of their creation and the type of media does not matter. Therefore, the optimal shelf life is 5 years from the date of last use.

For more information, see “How long should accounting documents be kept?”

When to draw up an act if the storage periods for documents are unknown

In the course of business activities, an organization may acquire documents that are not listed in legally defined lists. Sooner or later the question of their destruction also arises.

In any case, before issuing a destruction certificate, it is necessary to specify the storage period for such documents. In accordance with clause 2.2.5 of the Basic Rules for the Operation of Organizational Archives, to determine the storage periods for documents not provided for in the lists, the organization's EC has the right to make a request to the specialists of the archival institution.

Only after the storage period has been determined can the future fate of such documents be decided (destroyed or continued to be stored).

Reasons for destroying documents

The main reason for disposal, if no emergency has occurred, is the expiration of the document's shelf life. This deadline must occur by January 1 of the following year.

In addition, the following circumstances are highlighted:

- Damage to documentation as a result of fire or flooding;

- Theft of papers;

- Complete or partial damage due to a natural disaster (tornado, hurricane, landslide, earthquake, volcanic eruption, etc.).

Any of the above reasons must be officially confirmed. So, for example, if an offense occurs (illegal entry into an office and theft of a document), you need to obtain a certificate from law enforcement agencies stating that this actually happened.

Particularly important documentation should be stored in a cabinet with a secure lock or in a safe. If these conditions are not met, an administrative penalty in the form of a fine is imposed on the head of the company. Such conditions also apply to documents damaged as a result of fire or flooding. To confirm the incident, you will need certificates from the relevant departments.

In this article you can learn how to draw up a power of attorney to receive a work book upon dismissal and download a sample of it.

Nuances of drawing up an act for the destruction of accounting documents

It is necessary to dwell separately on the features of destruction of accounting documents. Despite the fact that their storage periods are also established by the 2010 list and they are subject to the general procedure for storing and destroying documents in accordance with Law No. 125-FZ, there are still a number of regulatory documents whose requirements must be taken into account.

So, in Art. 23 of the Tax Code of the Russian Federation establishes that the taxpayer is obliged to retain accounting data and other papers necessary for the calculation and payment of taxes for 4 years. A Art. 29 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ establishes a retention period of 5 years for primary accounting documents, accounting registers, accounting policies, accounting records and other documents related to the organization and maintenance of accounting.

For more information about the period for which documents such as invoices must be stored, read the material “What is the storage period for invoices?” .

That is, if the accounting register, certificate or other paper in any way belongs to the accounting category, it is impossible to issue a destruction act before the expiration of the 5-year period. If this happens, the head of the company will be held liable for unlawful destruction.

However, that's not all. The above applied to those companies and enterprises whose activities during the entire period of their existence were break-even. If a loss is received and it is transferred to subsequent periods, all documents confirming the amount of such loss are prohibited from being destroyed during the entire period of transfer (Article 283 of the Tax Code of the Russian Federation).

When all legally established storage periods have expired, a destruction certificate is issued in the usual manner.

Destruction of electronic copies of documents in the EDMS: answers to questions

It is advisable to document any destruction of documents, not least because this protects both the organization and the archivists themselves and those responsible for the EDMS in the event of any claims being made against them. I encountered this in my personal work practice back in the mid-2000s.

Accordingly, the destruction of documents in the electronic document management system should be formalized by an act in strict accordance with the requirements of office work and archiving. In the future, in order to avoid repeated efforts when drawing up an act using paper originals, you can immediately mention in it electronic copies in the EDMS.

I note that, unlike many colleagues, I take copies of paper documents stored in the EDMS more seriously. Firstly, if it was on the basis of these copies that important decisions were made, then they should be considered independent documents, sometimes playing a large role in the “debriefing” in connection with the activities of employees. Secondly, the value of electronic copies may be higher than the value of paper originals, since they are an information resource from which it is convenient to obtain analytical information and can be quickly searched (perhaps even full-text).

A more difficult question may be how to reflect all these volumes of documents in the act, the solution of which must be approached creatively. In this case, the following options are possible, for example:

- include in the act an inventory of all documents being destroyed;

- divide the documents into conditional volumes (by month, quarter, etc.) and list them in the act, possibly also indicating the number of documents in the conditional volume. Ideally, the information system should allow, if necessary, to make “cut-offs” and automatically create volumes of cases (for example, from January 1 of the next year, automatically create a new case or begin to create a new volume every month, quarter, etc.);

- indicate the details identifying the documents to be destroyed, as well as the volume of information to be destroyed.

The advice of lawyers and representatives of business units working with documents can be useful here. For example, in the banking industry, it is important to prove to regulatory authorities the destruction of files on specific clients, purchases, transactions - and acts can be drawn up, taking into account this need, in more detail.

The position of the Federal Archival Agency of Russia (Rosarkhiv) is reflected in the Rules for Office Work and in the Methodological Recommendations for the development of instructions for office work. According to Rosarkhiv, a separate act of destruction should be drawn up for electronic documents:

The act has been completed - how to get rid of waste paper

The law does not define specific methods for destroying documents with an expired storage period. Since at the time of drawing up the act, these documents no longer represent any value for the company and, in fact, are waste paper, any way to get rid of them is possible. For example, you can:

- send documents for processing (disposal) to a specialized organization;

- get rid of unnecessary papers using a special shredder (office shredder, paper shredder, etc.);

- burn (however, this may cause problems with firefighters).

The first method can result in significant material costs for the company to pay for disposal services, and the transfer of documents will have to be formalized with an acceptance certificate or invoice indicating the number of cases and their weight. To ensure confidentiality, you will need to send your employee to a special organization to monitor the document destruction procedure.

In all other cases, you also cannot do without completing additional documents - we’ll talk about this in the next section.

We formalize the fact of destruction of documents

The act “On the allocation for destruction of documents that are not subject to storage” is not the only document that needs to be drawn up in such a situation. Another document (usually also called an act) is drawn up to confirm the very fact of destruction of documents that have lost practical significance and are outdated. There is no standard form for this act, so it is drawn up in any form. It is important to include all the necessary information.

To ensure that there are no complaints about this document later, it must reflect the following:

- the name of the document and the name of the company on behalf of which it is drawn up;

- date of execution of the act;

- description of the fact of destruction of documents (indicating the volume or quantity, as well as the method of destruction);

- signatures with transcripts, full names of responsible persons.

A sample document destruction act was developed by ConsultantPlus experts. Get a free trial of K+ and proceed to the sample.

Document destruction process

Document destruction is usually carried out in one of two ways: by burning or shredding. The latter is only provided that the documents cannot be restored. Documents should not be sent to the nearest landfill, torn into pieces, or used as drafts.

As a rule, special organizations are hired to destroy documents . Most often, these organizations offer shredding as a method of destruction, and the resulting waste can be immediately accepted as waste paper, thereby returning part of the cost of their services. At the request of the customer, the contractor can film the destruction process. Representatives of the customer organization may also be present when documents are destroyed.

A standard contract for the provision of services for a fee is drawn up with the organization that deals with the destruction of documents. The contractor will propose a standard form of the contract at the negotiation stage. All that is required of the archivist is to ensure that the contract contains a clause stating that the executor undertakes to ensure the confidentiality of the documents being destroyed, since among them there may be cases that contain personal data, commercial or other types of secrets. To avoid wasting time sorting classified and unclassified documents that will soon be nothing more than shavings, contractors ensure confidentiality by default.

You can destroy documents on your own if production capacity allows, for example, a furnace or industrial shredder is operating in the workshops of the enterprise. An attempt to get rid of documents using an ordinary office shredder is doomed to failure if the volume of papers exceeds one folder.

Documents were destroyed according to the act - can the manager be punished?

If the act of allocating documents for destruction is formed correctly (in compliance with the entire procedure for organizing and conducting the examination of documents and recording the results of the EC’s work), the manager can still be held accountable if the documents were destroyed prematurely and their storage periods were not respected .

IMPORTANT! In accordance with Art. 15.11 of the Code of Administrative Offenses of the Russian Federation for gross violation of the terms of storage of accounting documents, a fine in the amount of 5,000 to 10,000 rubles is possible.

If a legal entity does not have the funds to organize and maintain a separate archival service, but does not want to be punished, it is necessary to appoint responsible employees whose functions will include continuous monitoring of the storage of documents and the timely destruction of files with expired storage periods.

How to draw up an act if you need to destroy documents in electronic form

In accordance with Art. 5 of Law No. 125-FZ, the reflection of documents in the archival fund does not depend on the method of creation and type of media.

In paragraph 2 of Art. 29 of Law No. 402-FZ states that documents and means that reproduce electronic media, as well as verify the authenticity of digital signatures, must be stored for at least 5 years after the year in which they were last used to prepare accounting reports.

Currently, huge volumes of documentation can be stored in a company in electronic form, as well as on special media (disks, flash cards, etc.). If the EC determines that electronic documents have no practical significance and (or) their storage period has expired, the information must be destroyed along with the media. In this case, the same destruction methods can be used as for paper documents (shredding, burning, changing shape, etc.).

In addition, special methods can be used - erasing or overwriting files (paragraph 2, section 9.9 of GOST 15489-1-2007, approved by order of Rostekhregulirovaniya dated March 12, 2007 No. 28-st).

The law does not provide for a special procedure (including for drawing up an act), so it is necessary to adhere to the general procedure described earlier for paper documents. However, we should not forget the following:

- It is prohibited to get rid of unnecessary files and documents without authorization and without drawing up an act;

- documents related to legal proceedings (ongoing or upcoming) must not be destroyed;

- the requirement for confidentiality of information contained in destroyed documents and their copies cannot be ignored;

- it is necessary to destroy all copies of documents (including personal and backup ones), if such duplicates are permitted for destruction.

For information on how seals are destroyed, read the article “Procedure for writing off and destroying seals (nuances).”

Results

The destruction of documents with expired storage periods occurs after the completion of the work of the expert commission with the mandatory execution of a report. Then, in relation to all documents reflected in the act, a physical liquidation procedure is carried out - this action is also formalized in a separate act.

Methods for getting rid of documents may be different; this point is not regulated by law. It is permissible to hand them over for recycling to a specialized company, use an office shredder, or use another method.

Sources:

- Basic Rules for the Operation of Organizational Archives

- Tax Code of the Russian Federation

- Federal Law of December 6, 2011 No. 402-FZ

- Code of Administrative Offenses of the Russian Federation

- Order of the Ministry of Culture of Russia dated August 25, 2010 No. 558

- Order of Rosarkhiv dated December 20, 2019 No. 236

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Documenting

After the review procedure is completed, an act on their allocation for destruction is created. In this act you need to enter information about the papers being destroyed: name of the folder with the file, storage period, number of sheets. At the end of the act, the chairman must affix his visa. After the act is completed, you can place all the documents in a separate cabinet. It is possible to destroy them at any time.

The second document that needs to be filled out is an order for the appointment of the procedure. It should contain this information:

- Date of.

- Grounds for destruction (previously drawn up act).

- Order.

- A way to get rid of papers.

The order requires a visa. After this, destruction is carried out.

Destruction Act

The last document that completes the procedure is the act of destruction. There is no approved form. The document is drawn up in free form. However, it must contain this information:

- A way to get rid of documents.

- The performer responsible for the event.

- Inventory of papers that were destroyed.

If documents are sent for waste paper, a corresponding entry must be made in the act. In addition, a copy of the transfer deed must be attached to it.