Payment order and its details

A payment order is a document whose purpose is to transfer funds from the sender's bank account to the recipient's account.

It is the most frequently circulated document in the financial sector. For budgetary institutions, the form of the document is approved by the Bank of Russia in the rules for transferring funds (Regulations of the Central Bank of the Russian Federation dated June 19, 2012 N 383-P). Payment order details must include all the necessary identifiers of the payer and recipient. For transfers in favor of tax agents, funds or other budget payments, you must fill in fields numbered 106 and 107.

Why is field 106 necessary in a payment order?

The rules for filling out payment slips from September 10, 2021 are enshrined in the Bank of Russia Regulation “On the Rules for Transferring Funds” dated June 29, 2021 No. 762-P.

The so-called basis for payment is entered in the field, or, in other words, the code of the reason for which the payment is made is indicated.

This field requires completion in the following cases:

- transfer of payment for taxes and fees (including penalties, fines);

- payments related to foreign economic activity (FEA) (customs duties, duties, etc.).

IMPORTANT! When generating payments that do not relate to tax and customs duties, this field is set to 0.

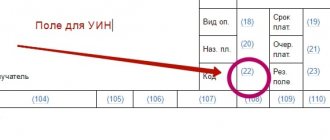

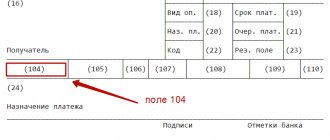

Below is the location of field 106 in the payment order:

Samples of completed payment slips for payment of various taxes are available in ConsultantPlus. If you have access to the system, proceed to the samples. If you don't have access, get free online access to the system.

For details that fall into the remaining fields of the payment document, read the article “Basic details of a payment order.”

What to write in field 106

These details contain information about the basis and tax period for which the payment is made.

Field 106 in the 2022 payment order is filled in with two characters and can take values from the list approved by the Central Bank.

So, to help you figure out how to correctly fill out field 106 (basis of payment) in a payment order, we have compiled a special table with explanations. It will help you understand the designations that can be indicated in the basis of payment 106; the decoding for 2022 is given in the left column.

| Props name | Payment basis 106: decryption of details |

| TP | Indicates payments for the current year for debts and accruals |

| ZD | Indicates that you yourself found an arrears or a payment error and, without waiting for the tax authorities, contributed the missing amount to the budget |

| BF | Set when the payer is an individual and funds are debited from his bank account |

| TR | It is necessary to put when the debt was discovered and presented for payment by the tax authority |

| RS | Denotes the repayment of a debt that can be paid in installments |

| FROM | Must be applied in case of repayment of debt that has been deferred |

| RT | Repayment of restructured debt |

| PB | Indicated in case of debt repayment by bankrupt organizations |

| ETC | Filled out when repaying a debt that has been suspended for collection |

| AP | Indicates that it is necessary to repay the debt after checking the organization and issuing an inspection report |

| AR | Placed in case of repayment of debt under a writ of execution |

| IN | Applicable for repayment of investment tax credit |

| TL | Used in bankruptcy cases where the debt is paid by a third party |

| ST | Indicated for repayment of current debt by bankrupt organizations |

What are the requirements for filling out field 106 in a payment order in 2022 - 2022?

Regulation No. 762-P stipulates that the entry in this field should not be longer than 2 characters representing capital letters of the Russian alphabet.

Basic codes:

- TP - payment of taxes for the current year;

- ZD - repayment of debt for expired tax, settlement (reporting) periods, including voluntary.

From 10/01/2021, the following codes are no longer used in field 106:

- TR - repayment of debt at the request of the tax authority to pay taxes (fees, insurance contributions);

- PR - repayment of debt suspended for collection;

- AP - debt repayment according to the inspection report;

- AR - repayment of debt under a writ of execution.

Instead, you need to enter a single tax code - repayment of debts for expired tax, settlement (reporting) periods, including voluntary ones.

Previously, the ZD code was set only for voluntary repayment of debt. This function has also been preserved. And you can distinguish voluntary repayment from forced repayment by field 108. The codes TR, PR, AP and AR previously used in field 106 must be indicated in field 108 before the number of the basis document:

- “TR0000000000000” - number of the Federal Tax Service’s request for payment of taxes, fees, and insurance contributions;

- “PR0000000000000” - number of the decision to suspend collection;

- “AP0000000000000” - number of the decision to prosecute for a tax offense or to refuse to prosecute;

- “AR0000000000000” - number of the executive document or enforcement proceedings.

In this case, in field 109 “Date of document - grounds for payment” you must indicate the date of the corresponding document:

- requirements of the tax authority for the payment of taxes (fees, insurance contributions);

- decisions to suspend collection;

- decisions to bring to justice for committing a tax offense or to refuse to bring to justice for committing a tax offence;

- executive document and enforcement proceedings initiated on its basis.

What other codes are used in field 106, see the table:

| Field 106 | Designation |

| RS | Payment of taxes by installments |

| FROM | Payment of taxes with deferred payment |

| RT | Payment of taxes taking into account restructuring (according to schedule) |

| PB | Repayment by the debtor of debt during the procedures applied in a bankruptcy case |

| TL | Payment by third parties for a creditor due to bankruptcy |

| IN | Payment of investment loan for taxes |

| ST | Payment of current debt of a bankrupt creditor |

Read about how to fill out an order to pay a fine here.

Note! From 01.05.2021, when paying taxes, it is necessary to fill out field No. 15 “Account number of the recipient’s bank.” From January to April 2022 is a transition period. This means that until 05/01/2021 payment orders can be filled out both according to the old rules and the new ones. See details here.

It should be noted that the indicator in this column affects the value of the fields:

- 107 - tax period;

- 108 - date of the document on the basis of which payment is made.

Read about filling out other payment details in this section of our website..

ConsultantPlus experts explained in detail how to clarify a tax payment if there is an error in a payment order. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

What to write in field 107

Field 107 in the payment order has 10 required characters. Eight of them are semantic, and two more characters are dividing points. For example, MS.06.2019.

According to the instructions of the Bank of Russia, the first two characters in detail 107 are filled in depending on the payment period and, accordingly, indicate it:

- MS - per month;

- KV - per quarter;

- PL - for half a year;

- GD - for a year.

The next two semantic characters (4th and 5th) of detail 107 are filled in according to the payment period and, accordingly, according to the previously selected first two parameters. That is, if the payment is monthly, the indicator can be selected from 01 to 12 depending on the month for which it is made. Quarterly - from 01 to 04. Semi-annual - 01 or 02. When transferring funds once a year, “00” is indicated in the 4th and 5th digits.

The last 4 characters are filled in in accordance with the year for which payment is made.

In cases where the legislation provides for a specific tax payment date, field 107 in the payment slip should be filled out indicating this date, for example:

- MS.06.2019;

- KV.02.2019;

- PL.01.2019;

- GD.00.2019;

- 15.07.2019.

If it is impossible to specify the required values, the payment order may not be saved and will generate an error stating that the “payment basis 106” field is not filled in. In this case, it is possible to enter the value “0” in fields 106 and 107 of the payment slip.

Filling out a payment slip: what else is new in 2021

In addition to field 106 in the payment order, the following fields will have to be filled out in a new way:

- 101 – “Status of the originator of the order.” A number of previously used codes are being eliminated. Some of them, from “09” to “12” (those that coded individual entrepreneurs, notaries, lawyers and heads of peasant farms), are being replaced by a single code “13” - previously it was used only by ordinary individuals. In addition, new codes have been added that did not exist before - for example, there is now code “29” - it must be used by politicians who transfer money from the election fund to the budget.

- 108 – “Document number”. This field is filled with codes that previously encrypted information about debt repayment in field 106 in the payment order. The code is indicated before the document number (for example, a writ of execution or a request from the Federal Tax Service) on the basis of which the money is transferred.

- 109 – “Date of document – grounds for payment.” Here you need to indicate the date of drawing up the document, according to which the money is transferred to the addressee’s account.

Samples of filling out fields 106 and 107 in a payment order

Let's look at examples of filling out the fields for payment basis 106 and tax period 107 of the payment order for the most common situations.

Payment of income tax by the organization in the second quarter of 2020

Payment to the organization at the request of the tax authority (penalties on insurance premiums for compulsory health insurance for December 2022)

Instructions for filling out payment orders for paying taxes, fines, penalties and contributions

Status of the payment originator. Can take one of 26 values, including the following:“01”—taxpayer—legal entity;

“02” - tax agent;

“06” - participant in foreign economic activity - legal entity;

“08” - payer - a legal entity (individual entrepreneur, lawyer, notary, head of a farm) transferring funds to the budget with the exception of taxes, fees, insurance premiums and other payments administered by the tax authorities;

“09” - an individual entrepreneur who pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

“10” - a notary engaged in private practice, paying taxes, fees, insurance premiums and other payments administered by the tax authorities;

“11” - a lawyer who has established a law office that pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

“12” - the head of a peasant (farm) enterprise who pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

“13” - an individual paying taxes, fees for the performance of legally significant actions by tax authorities, insurance premiums and other payments administered by tax authorities;

“16” - participant in foreign economic activity - an individual;

“17” - participant in foreign economic activity - individual entrepreneur;

“18” - a payer of customs duties who is not a declarant, who is obligated by the legislation of the Russian Federation to pay customs duties;

“19” - organizations and their branches that transfer funds withheld from the wages (income) of a debtor - an individual to repay debts on payments to the budget on the basis of an executive document;

“21” is the responsible participant in the consolidated group of taxpayers;

“22” - a member of a consolidated group of taxpayers;

“24” - payer - individual. a person who transfers funds to pay fees, insurance premiums administered by the Social Insurance Fund, and other payments to the budget (with the exception of fees for the performance of legally significant actions by tax authorities and other payments administered by tax and customs authorities).

“28” is a participant in foreign economic activity and a recipient of international mail.

When transferring a tax or contribution for another person, the status of the person whose obligation to pay taxes or contributions is fulfilled is indicated.

Field 108

You can distinguish voluntary repayment from forced repayment by field 108, where, from October 1, 2022, the codes TR, PR, AP and AR previously used in field 106 are indicated before the number of the basis document.

EXAMPLE 1

In field 108 in the document number, the first two characters indicate the type of document. For example:

- TR0000000000000 – number of the tax authority’s request for payment of tax (fee, insurance contributions);

- PR0000000000000 – number of the decision to suspend collection;

- AP0000000000000 – number of the decision to prosecute for committing a tax offense or to refuse to do so;

- AR0000000000000 – number of the executive document (executive proceedings).

The document number is indicated after the letter value of the document type. It must clearly correspond to the values and number of characters specified in the relevant requirement, decision or executive document.

EXAMPLE 2

When paying off the tax authority's demand for payment of tax (fees, insurance contributions) No. 41797, the following must be indicated in field 108 of the payment:

TR41797

In field 108 indicate “0” in the case of:

- voluntary repayment of debt on tax payments in the absence of a document, collection;

- indicating in field 106 the value of the payment basis “ZD”.