Changes from 11/30/2020

The Bank of Russia published instruction No. 5587-U dated October 5, 2020, which adjusted the procedure for issuing and spending accountable amounts in 2021 and conducting cash transactions.

The changes are technical, but fundamental. They are aimed at simplifying the circulation of accountable cash. Now organizations will be able to issue an administrative document for several payments of money to one or more accountable persons. The document should indicate the surnames and initials and the amount of cash and the period for which the money was issued. In an application for the issuance of accountable money, it is no longer necessary to indicate the amount of the advance and the period for which the accountable amounts are issued. The requirement to compile an advance report no longer applies. The organization will independently establish the period during which settlements with accountable persons are made in 2022, taking into account the latest changes, and when the accountable person is obliged to report on the amounts used and return the balance to the cash desk.

The requirements for the work of cashiers have changed. It has been established that if a separate division does not store cash and, after completing cash transactions, hands it over to the organization’s cash desk, then such separate divisions have the right not to maintain a cash book 0310004. When accepting cash at the cash desk, the cashier monitors their solvency in accordance with the instructions of the Bank of Russia dated December 26. 2006 No. 1778-U. The cashier must accept valid banknotes and coins. These are, in particular, banknotes and coins that do not contain any signs of counterfeiting and are not damaged. Money that has the following damage cannot be accepted at the cash desk:

- in the case of banknotes - dirty, worn, torn, with abrasions, small holes, punctures, extraneous inscriptions, stains, stamp impressions, missing corners, edges;

- in the case of coins - with minor mechanical damage.

They should be handed over to the bank.

Basis for issuing money for reporting

Until August 19, 2017, funds were issued on the basis of a written application from an employee or other person in accordance with clause 6.3 of the instruction of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U. But after changes in the procedure for conducting cash transactions by legal entities and individual entrepreneurs (directive of the Bank of Russia dated June 19, 2017 No. 4416-U) and amendments to paragraph 6.3 of the instructions of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014, the list of documents for confirming accountable expenses was updated. Changes to accountable amounts from 2022 allow you to justify the transfer of money to an employee in two ways:

- issue an administrative document on the issuance of accountable money (as a rule, this is an order);

- issue a written statement from the accountable person, endorsed by the manager (as was done previously).

If previously the only mandatory basis for receiving money was an application, now the organization has the right to independently choose the basis for issuing funds. Whether it is necessary to write an application for the issuance of money for reporting in 2022 depends on what is stated in internal regulatory documents. If the provision requires writing a statement, you will have to write it.

In many cases, it is more convenient to issue an order for the issuance of accountable amounts: for example, when several employees receive funds regularly or simultaneously. In this case, you do not have to fill out an application from each person, but rather issue a general order to issue them cash.

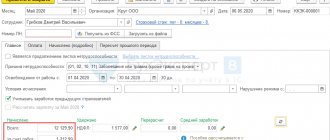

An example of an employee’s application for the issuance of accountable money:

Sample order for the issuance of money for reporting:

Can they be punished for this?

First of all, it is worth recalling that paragraph 1 of Article 15.1 of the Code of Administrative Offenses of the Russian Federation punishes an ordinary organization only for:

- for cash settlements with other organizations or entrepreneurs in amounts exceeding those established by the Directive of the Bank of the Russian Federation No. 3073-U dated 07.1013. cash payment limit – i.e. 100 thousand rubles (in Russian currency) and an amount equivalent to 100 thousand rubles if payments are made in foreign currency. It should be borne in mind that this limit applies to settlements under any civil contracts concluded between organizations and (or) entrepreneurs;

- for complete or partial failure to receive cash to the cash register, any money, not just revenue;

- for violating the procedure for storing available funds. According to paragraph 7, clause 2 of Bank of Russia Directive No. 3210-U dated March 11, 2014. free cash means cash that exceeds the cash limit established by the enterprise and is actually in the cash register. And such funds should only be stored in a bank account;

- for the accumulation of cash in the cash register in excess of the cash limit established at the enterprise. The exception is the accumulation of funds on days when salaries, scholarships and other remunerations are paid that are included in the wage fund (according to the methodology used to fill out statistical observation forms), and when social funds are paid. On these days, when paragraph 8 of clause 2 of Directive No. 3210-U is allowed to exceed its limit at the cash desk, they also include the day of withdrawal of cash from the bank account to make the specified payments. In addition, it is allowed to store money in excess of the limit in the cash register on non-working holidays and weekends, but only if organizations and entrepreneurs conduct cash transactions on these days.

Among the above violations, there is no liability for violations of the rules for issuing accountable funds .

In particular, this is confirmed by the conclusions made in the Resolution dated March 26, 2014 of the Seventh Arbitration Court of Appeal of the Russian Federation in case No. A67-5875/2013.

The essence of the issue considered in this Resolution was that the enterprise periodically issued, on account to its manager, funds that exceeded the established cash limit. The head of the company did not provide a report on the accountable funds he had previously received.

The tax inspectorate considered this behavior to fall under Article 15.1 of the Code of Administrative Offenses of the Russian Federation. But the court expressed the opinion that in the actions of the head of the company there are violations only in the procedure for issuing cash on account, but there are no violations, which are provided for in paragraph 1 of Article 15.1 of the Code of Administrative Offenses of the Russian Federation, i.e. there is no reason to believe that in this way the enterprise accumulated money in excess of the limit and violated the procedure for storing available funds.

Moreover, the Court concluded that cash is free until it is issued for reporting to an authorized person for the purpose of the company’s activities.

Thus, after these funds are issued for reporting, they lose their “free” status, which means that these amounts are not subject to the obligation to store them in the company’s bank account and the punishment provided for in paragraph 1 of Article 15.1 of the Code of Administrative Offenses of the Russian Federation does not apply.

However, it is too early to rejoice . The court in the considered Resolution rejected the tax inspectorate only because it charged a violation in the form of accumulation of excess funds by issuing an endless sub-account, but in fact proved that the enterprise did not have the right to issue money to its manager on account without providing a report on previously issued amounts.

But there are decisions in favor of the tax authority . For example, the Decision of the Moscow City Court dated August 14, 2013 in case No. 7-1920/2013. In this case, an infinite sub-account was also identified, i.e. the head of the company handed over the accountable money to the cashier and immediately received it in a larger amount again on account. These transactions were documented with incoming and outgoing cash documents.

The tax authority concluded that the company was violating the procedure for storing available funds. And the court supported this conclusion, citing the fact that:

- cash issued on account was not spent, including on the needs listed in Directive No. 3073-U of the Bank of Russia;

- the head of the company did not submit advance reports, from which the very fact of spending funds and their intended or inappropriate use would be visible;

- the funds “left” the cash register for a short period of time and were returned in full.

Thus, the head of the company, in the opinion of the court , when registering the excess balance of money as issued on account for business needs, acted fictitiously and actually replaced himself with a credit institution, keeping free funds (i.e., above the limit) at home. As a result, the company and its director were punished on the basis of clause 1 of Article 15.1 of the Code of Administrative Offenses of the Russian Federation .

Why aren't entrepreneurs punished for such offenses ? Because they do not allow them: unlike a legal entity, an entrepreneur can write off for his own needs at the end of the day all the cash from the cash register, down to the penny! And he doesn’t need to file endless reports. Moreover, Bank of Russia Directive No. 3073-U does not even provide for a limit when issuing cash to an entrepreneur for personal purposes.

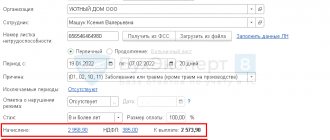

Registration of cash documents in electronic form

Thanks to the decisions of the Central Bank, it has become easier to conduct settlements with accountable persons in 2022, taking into account the latest changes: now cash documents when issuing and returning money can be drawn up in electronic form (clauses 5.1 and 6.2 of the Central Bank of the Russian Federation Directive No. 3210-U dated March 11, 2014) . Thus, when registering cash receipt order 0310002 in electronic form, the recipient of the money has the right to put an electronic signature. And when registering a cash receipt order 0310001 (when returning unspent money to the cash desk), the depositor of the money is allowed to send a receipt to his email address, without paper registration. For how long you can issue accountable money depends on the organization’s policy; this is stated in the regulations on the issuance of accountable money and in the order.

These innovations, which have changed the procedure for issuing and spending accountable amounts, are very convenient for those companies that have already acquired electronic document management tools.

Use free new instructions and samples from ConsultantPlus experts to properly organize your work with accountants.

Registration of the cash book by an authorized person

Amendments are made to paragraph. 3 clause 4.6 Procedure for conducting cash transactions. In accordance with the previously existing procedure, all entries in the cash book were made strictly by the cashier. The cashier made entries in the book for each incoming and outgoing cash order issued for cash received and issued.

Now the circle of people who can fill out cash books has been significantly expanded. In fact, any authorized employee of the organization can keep books. To do this, you will need to issue an appropriate order or order authorizing the employee to make entries in the book.

BUKH.1S is now in the Telegram messenger! You can join the channel

via the link: https://t.me/buhru (or type

@buhru

in the search bar in Telegram).

Money accountable to debtors

The new 2022 accountability rules remove the previous prohibition on transferring money to accountables who have not repaid previous debts. From the new version of clause 6.3 of the instruction of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014, the condition that money is allowed to be issued is excluded subject to the full repayment by the accountable person of the debt for previously received amounts. But management and accountants should use these changes carefully. Whether an institution can issue a new accountable amount to an employee who has previously been issued an accountable amount is decided by the manager or chief accountant. If there is an objective need, it is permissible to give the employee several advances in a row, without waiting for reporting documents on previous amounts. For example, an authorized employee paid in advance for an upcoming event for clients as part of entertainment expenses, and accordingly, reporting documents have not yet been provided to him. At the same time, the employee was urgently sent on a business trip, and therefore he needed money for travel expenses with an outstanding debt on the previous advance.

It is necessary to limit the circle of persons who are allowed to have debt, and set a debt limit for them for a certain period, so that for accountable persons the changes do not become a reason for systematic violation of financial discipline. Is it possible to issue money for an account if you have not accounted for the previous one? It is undesirable without objective reasons, although there is no direct prohibition on this now.