About legal entities

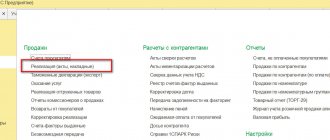

The development of technologies available for use in modern business significantly simplifies routine operations performed on

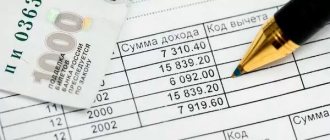

Veterans, citizens with children, disabled people: how much are they entitled to standard deductions for personal income tax?

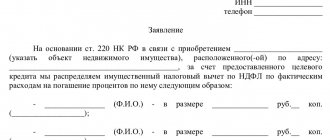

Types of property deductions Property deductions applied to income taxed at a rate of 13% are discussed

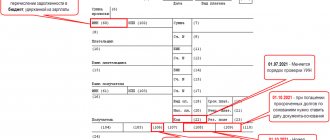

In 2022, the rules for filling out payment orders were updated. Some changes take effect immediately,

What is VAT? VAT is an indirect tax that is paid on the sale of goods, services and

Certificate of income and tax amounts of an individual (previously it was called Certificate 2-NDFL)

Benefits for educational and medical institutions For organizations engaged in the field of education and/or medicine,

In what form should I submit the 2-NDFL calculation? According to clause 1 of Art. 230 Tax Code of the Russian Federation

Art. 178 of the Labor Code of the Russian Federation guarantees resigning employees financial resources to support them during the period of employment

VAT (Value Added Tax) is the most difficult to understand, calculate and pay