Any legal entity has its own registration data necessary to determine the place of registration with the tax office and display other individual data. Each number has its own meaning, which will help you understand many issues. The company has the right to open many additional offices and each division is registered with the tax authority and assigned a checkpoint. However, there may be many reasons for this, as well as the procedure for changing the code, its determination and identification in other tax offices.

Why do you need to know the gearbox code?

Any large company may have several branches (separate divisions), which have different territorial affiliations, but this does not exempt them from registering with the tax office at their location.

Thus, each subsidiary will be assigned its own code, which can tell about a specific company and officially confirm the following data:

- recognize the identification of a legal entity based on a specific feature;

- determination of the fact of carrying out activities or the presence of own property on the territory;

- indicate the main place of activity of the organization and its branches in other regions.

However, to determine all these signs, you must be able to decipher the checkpoint.

OKPO code structure

By the number of numbers in OKPO you can judge who it belongs to. The enterprise code (for LLC, CJSC, OJSC, etc.) is eight-digit. For it it is longer, since there are much more individual entrepreneurs themselves than firms and organizations.

The first two numbers reflect information about the direction of the subject's activities. The division is made into four broad areas:

- Extraction and exploitation of resources (natural and labor);

- Production of various goods and other commercial products;

- National economic activity;

- Management and work with documentation.

It should be noted that OKPO is assigned “for life,” but if the direction of activity changes radically or expands so much that it goes beyond the boundaries of the initially specified profile, then the code needs to be changed.

The last figure is intended to control the correctness and reliability of the details provided. In the nineties, when mandatory assignment of OKPO was introduced, information capabilities were much more modest than they are now. Today, thanks to the Internet, it is easy to make inquiries about a company and individual entrepreneur - this can be done without complex calculations.

Nowadays, it would be possible to do without a check digit, but since it was initially adopted, it remains part of the OKPO code.

All numbers in the range from the third to the penultimate form the registration serial number.

The main reasons for registering using a checkpoint code

Also, specific data in the checkpoint indicate the following signs:

- state the fact that the organization has its main place of accounting;

- 05 and 31-32 - indicates the presence of structural divisions and their legal form;

- availability of property in a specific territory;

- 10-29 – registered vehicles;

- 30 – the organization was not registered as an existing taxpayer;

- over 51 are large companies, including foreign ones.

Thus, the reasons that allow the organization to register are confirmed by the corresponding code.

We can summarize the following reasons for obtaining a code when registering:

- Confirmation of registration of a legal entity and its location.

- Due to a change in tax authority and registration address.

- Opening of other divisions of the company.

- Finding the office or real estate of the organization with its documentary evidence.

These are the most common reasons, but they are not the only ones. A full list of reasons for obtaining a checkpoint is discussed in the Tax Code of the Russian Federation.

Checkpoint of a separate unit: decoding

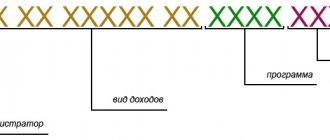

The abbreviation itself stands for “registration reason code.” It consists of nine Arabic numerals, which carry information about the registered structural unit.

- The first two digits serve to designate the subject of the Russian Federation. The value “99” is used to designate interregional inspections. It is used when assigning a code to the largest taxpayers.

- The number of the tax office that registered the OP is encrypted in the third and fourth characters.

- The next two signs serve to indicate the reason for setting.

- The remaining three characters are the serial number of the OP for the specific reason for registration with the tax office.

Some companies and their affiliates may have the same digital values. This is quite common and normal. This means that economic entities registered on the same basis are registered with the same inspectorate.

As an example, consider the abstract OP code 780945123 775002001. It follows from it that the OP is registered in St. Petersburg, registration was made at the tax inspectorate No. 09. Thus, the first four digits are the Federal Tax Service code. The structure in question is registered at the location of the OP. The number “45” indicates that the code is assigned according to the location of the OP.

How to find out the checkpoint of a foreign organization?

The work of foreign companies on the territory of the Russian Federation is not prohibited. Moreover, their activities must be officially registered with the tax authority at their location. Since foreign organizations have an unofficial legal address in Russia, the tax authority can only issue them a checkpoint or KIO.

This activity accounting system allows you to maintain a single directory. When paying taxes to the state treasury, such organizations are required to use the reason for registration code.

Using this code you can determine:

- The reason for registering the foreign organization, as well as its separate divisions. The formation of the Unified Directory is carried out by the Federal Tax Service. This document contains information about the checkpoint and tax identification number, and you can only find it out here by sending the appropriate request. Other information about foreign companies is contained in the tax office at the place of registration, including: Open and closed current accounts indicating bank details and other data.

- The name of the department indicating the first four digits of the KIO.

To obtain all the necessary information about a foreign organization, including the reason code for registration, you should order an extract from the Unified State Register of Legal Entities, which can be provided by tax authorities or authorized representatives with access to the all-Russian unified directory.

The KIO directory is maintained by the Migration Service. With this code, foreign organizations can open bank accounts in the Russian Federation, work through a branch, and purchase real estate and vehicles. Also, obtaining all the necessary registration data allows you to engage in activities in Russia for more than a month.

NO CODE IS ANYWHERE NOW

Codes (indices) of the organization's divisions are present in almost all areas of its activity: from time sheets to product release.

In office work, department codes are necessary, for example, to create a nomenclature of cases, maintain a register of governing documents (instructions, regulations, rules), to create, periodically update and supplement a set of templates for frequently used documents (the so-called album of forms).

Department codes will also be useful when introducing electronic document management, even in its minimal implementation.

In addition, department codes are necessary for various technical services to organize production. For example, technologists use codes to draw up technological routes for the manufacture of products, technical archive workers use them to print and issue technical documentation in accordance with the routes, and personnel officers use them to create a staffing table. In short, coding departments is necessary and important work.

WHAT CAN YOU FIND OUT ABOUT THE DIVISION BY CODE?

• subordination;

• number;

• location;

• functions performed.

How to find out the code of a separate division of an organization

Any large company with impressive financial turnover needs to register additional working branches in other regions. It is these subsidiaries that should be called separate divisions.

Any registration authority must accept “isolated organizations” as full-fledged organizations and assign them the appropriate checkpoint, regardless of their reflection in various organizational and administrative documents and assigned job responsibilities.

Registration of separate divisions is carried out with the Federal Tax Service at their location. This type of taxpayer can register itself as a company or division.

A representative office can be registered at the most remote points from the main place of work of the parent organization, and a branch, as a rule, operates at a short distance, performing the main functions of its company. It is the first four digits of the checkpoint that will indicate the location of the registration authority, namely, a specific tax office.

All additional companies have an identical INN , but different checkpoints depending on the region code of registration, determining their affiliation with a specific tax authority.

To find out the checkpoint of a specific separate division, you need to make a request to the tax authority. This information is entered into a special notice no later than five working days from the date of registration of the branch, and this document is issued to the authorized representative.

If the parent organization decides to close its branch or representative office, this must be reported in writing to the tax authority at the location of the closing company. No more than one month must pass from the date of closure.

It must be taken into account that separate divisions do not belong to independent taxpayers. All documents indicate the TIN of the main organization, but with the checkpoint of a specific representative office.

WHERE TO BEGIN?

Stage I: visualize the organizational structure

If there is no approved structure in the organization, this omission can be corrected, and the organization’s personnel service will help with this.

Contact them with a request to provide a working version of the current structure, explain why it is needed. HR officers, as a rule, respond willingly, since they themselves need the department codes. At the same time, you may be pleased that they are already using a simple encoding (looking ahead, I will say: do not ignore this, try to understand the indexing system, think about it and suggest your improvements later).

The structure proposed by the HR department might look like Example 1.

From the example it is clear that each of the departments has its own leader - the head of the department. Groups of divisions form directions, each headed by a director for the corresponding direction.

For approval, it is better to present the structure in the form of a block diagram in which the subordination will be clearly visible (see Diagram 1).

As can be seen from the block diagram, the following blocks are subordinate to the director: administrative, commercial, logistics and transport, technical, production, and operational. They can be called differently: departments, departments, directorates, etc., but the meaning does not change - these are groups of divisions, united according to their functional purpose and subordinate to a senior manager who heads a specific area of the enterprise's activity.

Next, you should expand the structure of each block. For example, the administrative block (see Diagram 2). The organizational structures of each division must be attached to the order approving the organizational structure of the enterprise.

What is it for? A logical question, because we already have a structure described verbally “in a column.” However, drawing flowcharts allows you to identify errors in the hierarchical structure and, therefore, correct the connections between elements and levels of subordination.

Stage II: we approve the organizational structure

The structure of the organization is approved by order (Example 2).

Stage III: assigning codes

• Basic coding rule. Assign only digital codes! Avoid slashes, hyphens, letters and other special characters and punctuation marks.

Letters are a source of errors and discrepancies; slashes can become an obstacle when creating an electronic archive, since the computer perceives a slash in a file name as an order to create a subfolder.

It will also not be possible to create a directory or file whose name will contain symbols and punctuation marks. To avoid such troubles, it is better to use only Arabic numerals.

• Encoding example. The structure of our enterprise has several investments, namely 4 levels. This can be seen from the numbering, which consists of a maximum of 4 digits: “3.1.3.2. Warehouse No. 2 for imported components” (see Example 1).

The number of investments at each level can be indicated by a single-digit number, but it is better to set a two-digit number for each level, since young successful organizations tend to grow, small divisions tend to grow and split, etc. Thus, the full department code will consist of 8 digits.

The emergence of new blocks or divisions in the organization is reflected in the structure. For example, your management decided to create a representative office of the organization in another region. Depending on the functionality of the division, it will need to be added either as a separate block or as a separate division within the block.

An example of indexing divisions of a hypothetical organization is shown in Table 1.

TABLE 1

Example of subdivision indexing

| Department code | Division name |

| 1 | 2 |

| 01* | Administrative block |

| 01010000 | Office |

| 01010100 | Documentation Sector |

| 01010200 | Archive |

| 01010300 | Expedition |

| 01020000 | Accounting |

| 01020100 | Personnel settlements sector |

| 01020200 | Material accounting sector |

| 01020300 | Tax sector |

| 01020400 | Implementation sector |

| 01030000 | Legal department |

| 01030100 | Contract sector |

| 01030200 | Claims sector |

| 01040000 | Human Resources Department |

| 01040100 | Recruitment and Personnel Accounting Sector |

| 01040200 | Time sheet |

| 01050000 | Technical control department |

| 01050100 | Incoming control sector |

| 01050200 | Manufacturing control sector |

| 02 | Commercial block |

| 02010000 | Purchase department |

| 02010100 | Procurement sector in the Russian Federation |

| 02010200 | Foreign procurement sector |

| 02020000 | Sales department |

| 02030000 | Advertising department |

| 03 | Logistics block |

| 03010000 | Logistics Department |

| 03010100 | Freight sector |

| 03010200 | Customs clearance sector |

| 03010300 | Transport and warehouse operations sector |

| 03010301 | Warehouse No. 1 (sales) |

| 03010302 | Warehouse No. 2 (imported components) |

| 03010303 | Warehouse No. 3 (semi-finished products) |

| 03010304 | Warehouse No. 4 (secure storage) |

| 03020000 | Transportation Department |

| 03020100 | Domestic transport sector |

| 03020200 | External transport sector |

| 03020300 | Vehicle rental sector |

| 04 | Technical block |

| 04010000 | Chief Designer Department |

| 04020000 | Chief Technologist Department |

| 04030000 | Computer support department |

| 05 | Production block |

| 05010000 | Workshop No. 1 |

| 05010100 | Plot No. 1 |

| 05010200 | Section No. 2 |

| 05020000 | Workshop No. 2 |

| 05020100 | Plot No. 1 |

| 05020200 | Section No. 2 |

| 05030000 | Workshop No. 3 |

| 05030100 | Section No. 3 |

| 05030200 | Section No. 3 |

| 06 | Operation block |

| 06010000 | Chief Mechanic Department |

| 06020000 | Chief Power Engineer Department |

| 06030000 | Workshop No. 4 (repair) |

| 06030100 | Plot No. 1 |

| 06030200 | Section No. 2 |

| 06040000 | Maintenance department |

*The full eight-digit department code can be shortened by removing leading and trailing zeros, leaving only significant digits. In this case, in the technological routes, the logistics department will have code 301, and the semi-finished products warehouse will have code 3010303.

Stage IV: approving the code book

The assigned department codes must be approved by order and posted on the organization’s public resource (Example 3).

Main cases of code changes

The procedure for changing one checkpoint to another occurs if the company changes its main place of business. In this case, the TIN will remain unchanged, but the code will correspond to the new region at the location of the tax authority.

When changing the main legal address, in order to officially and correctly change the checkpoint code, you should perform a series of sequential actions:

- submit the necessary documents to the registration authority at the location of the company;

- notarize documents containing signatures of the manager;

- pick up a copy of the company's Articles of Association with the appropriate marks from the tax office, as well as a certificate of relevant changes.

Then, within five working days, the organization must receive:

- notice from the Statistical Register of the Federal State Statistics Service or view the new OKTMO code on their official website;

- notification of deregistration with the Pension Fund and the Social Insurance Fund.

Then all banks and counterparties are sent a corresponding notification about the change of legal address. The tax service must promptly notify other registration authorities of a change in the company's legal address, but it would be useful to monitor this process independently.

Why do you need the OKPO code?

The code will be needed during many other actions that accompany the financial activity of an enterprise or individual entrepreneur. It is indicated in the details when opening a bank account, issuing and paying invoices, concluding contracts, and also in the event that a dubious counterparty needs to be checked using OKPO. It should be remembered that the data of the reporting organization is also required to be submitted to statistics (Rosstat) regularly. The accountant and employees of a company that is a legal entity know well how to find the necessary numbers in the details - they are indicated on letterheads, seals and other company attributes intended for documentary circulation with official structures and business partners.

The approved forms of some documents (in particular, orders) contain the inscription “form according to OKUD and OKPO” on the right side of the “header”. The corresponding set of numbers is entered at this place.

It is rare that a code is needed only for those individual entrepreneurs who operate under a simplified scheme, a single tax or a patent.

It happens that an employee needs to find out the employer’s OKPO, and he has difficulties. How to overcome them will be discussed below.

Justification for accounting for a separate division with OKPO

In the vast majority of cases, companies are faced with the fact that they need to conduct their activities not at the place where they were originally registered, but at some other address, but before starting such activities, you need to check the need to create a separate units in each individual situation. If such an obligation was initially prescribed in the Tax Code, but the company’s management does not fulfill the obligation assigned to it, then in this case it may be brought to tax liability in the future, and the director may receive an administrative fine.

If a company is going to open its own separate division, then the lawyer may be responsible for describing the main advantages and disadvantages of each individual type of such division. In such a situation, the lawyer’s main task will be to provide his management with explanations about what types of units are best created in certain situations.

The characteristics by which separate divisions are identified are quite precisely stated in paragraph 20 of paragraph 2 of Article 11 of the current Tax Code. Thus, the company will need to create separate divisions if two conditions are met simultaneously.

The first condition is planning to conduct activities at an address that differs from the place of state registration. The main feature of an OP is its territorial isolation from the parent organization, and if the address of the division that conducts activities on behalf of the parent company does not coincide with its legal address, it will be considered territorially separate.

The second condition is the presence of at least one equipped stationary workplace, which means a specific facility in which employees will work for more than one month. The law provides a fairly detailed and understandable explanation of what is meant by the term “stationary workplace”.

If we consider the established norms literally, we can conclude that several stationary workplaces can be created in a separate unit, and in the case of equipping only one place it cannot be considered separate, but in fact such a conclusion is incorrect, since even in the case of one stationary location, the unit will automatically be considered separate.

OKPO branch and parent organization

In addition to the taxpayer identification number (TIN), in connection with registration with various tax authorities on the grounds provided for by the Tax Code of the Russian Federation, a registration reason code (RRC) is used for organizations, which consists of the following sequence of numbers from left to right:

If an organization has a territorially separate division that is engaged in the sale of products produced, in turn, by another division, then the “Turnover” indicator is reflected for the territorially separate division that produces these products, while the average number and payroll of the separate division that engages in the sale of products and is accounted for by the production code of the product.

Where can I find out the Rosstat territorial code for electronic reporting?

Despite the prevalence of transmitting statistical reporting in electronic format, Rosstat has not yet developed a centralized database of TOGS codes or official legal acts where they would be listed. Nevertheless, it’s quite easy to find out the required code, and there are several ways to do this:

- You can call the territorial representative office of Rosstat in the region - using the contact information on the agency's website - and ask for the code from any specialist.

- Find out directly on the websites of the territorial departments of Rosstat in the “Electronic reporting” section.

- You can make a search request in Google or Yandex, for example: “TOGS Kazan code” - and the required information will be available in the search engines’ response to your request.

- You can request the necessary codes from the statistical reporting operator or the certification center where the company issued an electronic digital signature for sending documents via the Internet. Some of the operators post convenient interfaces on their websites with which you can find the required TOGS code. A similar service is available, for example, on the website.

Fresh materials

- Clarification on 4 FSS When it is necessary to adjust 4-FSS The calculation presented in the FSS in form 4-FSS does not need adjustments if...

- Social tax 2022 Tax accrualIn accounting, the amounts of advance tax payments are reflected in the credit of account 69 (68)…

- Registration of a separate division Registration of a separate division Neither branches nor representative offices of the company, like other divisions, are independent legal entities.…

- Intent to conclude an agreement Sample letter to the Customer on the extension of the contract with a Sample Additional agreement on the extension of the validity period...

What is a checkpoint?

KPP – reason code for registration. This number is assigned automatically when an organization is registered with the Federal Tax Service and is issued a taxpayer identification number (TIN).

The company can register with the tax inspectorates at the place of its main activities, as well as where separate divisions and owners of vehicles and property operate. A company has the right to register for a variety of reasons, as well as choose any tax authority. All these actions are confirmed by a specific checkpoint, which means there may be several of them, but they will all be tied to one TIN.

The registration reason code is a mandatory requisite when filling out all kinds of documents, but individual entrepreneurs do not have it. This allows individual entrepreneurs to simply indicate 0 or a dash in the checkpoint column when filling out declarations.

It shows the main reason for registration with the Federal Tax Service, as well as the legal entity’s affiliation with a specific registration authority.