Art. 178 of the Labor Code of the Russian Federation guarantees resigning employees financial resources to support them during the period of employment - severance pay. The goal is to financially support a former employee while he is looking for a new job, if he had to leave the old one not through his own will or fault. The employee receives this payment on the day of dismissal.

Question: How to calculate and take into account severance pay and average earnings during the period of employment for an employee dismissed due to staff reduction? View answer

In the article we will look at the subtleties regarding the calculation of this benefit, the procedure for its payment, its relationship to taxes and contributions, and also analyze who has the right to count on it and in what amount, and who does not have to count on this financial support.

What is the procedure for paying severance pay in case of early dismissal during layoffs ?

Benefit amount and payment period

Severance pay is a lump sum payment upon dismissal and is issued or transferred to an employee of the company regardless of the payment of remaining earnings and compensation for unused vacation. The benefit is paid according to certain rules, administrative acts and dismissal orders with corresponding payments are drawn up on the basis of ordinary personnel forms and their unified forms. The following must be indicated:

- reasons and grounds for making a decision;

- amount of benefits and other compensation.

Also necessary in the document is the signature of the employee, confirming that he has read the document.

Compensation upon dismissal, as well as the grounds for its provision, are provided for in labor legislation and regulations or in a collective and labor agreement. The legislation provides for different amounts of monetary compensation - from two weeks' average earnings or more. It depends on the reason for stopping work.

You need to pay taxes and insurance premiums on your severance pay! Find out for free in ConsultantPlus how to do this correctly.

The procedure for dismissal due to staff reduction for temporary and seasonal workers: step-by-step instructions

This procedure applies:

- to temporary workers;

- seasonal workers.

The characteristics of such labor relations are given in Art. 59 Labor Code of the Russian Federation.

For these employees, the procedure for dismissal on this basis has been shortened and simplified:

- We notify employees:

- temporary - 3 days before the order (Article 292 of the Labor Code of the Russian Federation);

- seasonal - 7 days in advance (Article 296 of the Labor Code of the Russian Federation).

- We fill out the order and fill out the work book. We hand the book to the employee and get his signature on the order.

- We pay wages for time worked.

- We pay compensation for unused vacation. According to the norms of Art. 291, 295 of the Labor Code of the Russian Federation, such employees are entitled to 2 days of vacation for each month of work.

- We determine the severance pay taking into account the fact that:

- it is not paid to a temporary worker (Article 292 of the Labor Code of the Russian Federation);

- a seasonal worker is entitled to a payment in the amount of average earnings for 2 weeks (Article 296 of the Labor Code of the Russian Federation), so we count it and pay it.

Other benefits for temporary and seasonal workers are not regulated by the Labor Code of the Russian Federation.

Severance pay upon dismissal due to staff reduction depends on the payroll calculation procedure established for the employee.

ConsultantPlus experts gave examples of calculating payments when laying off an employee. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

Who will be paid for 14 days

A dismissal payment in the amount of two weeks' average earnings is due in the following cases:

- Upon termination of an employment contract for medical reasons. If an employee is recognized as completely disabled or for any reason does not want to transfer to a new workplace, then he is entitled to severance pay upon dismissal for health reasons, two weeks’ pay and wages for the time actually worked. It is important to note that if an employee quits due to health reasons, but at his own request, then compensation is not paid.

- The legislator established severance pay upon dismissal from the army, which is compensation in the amount of two weeks' earnings and is paid upon conscription into the army or assignment to an alternative service replacing it.

- In case of dismissal upon reinstatement of the employee in service by a court decision.

- If an employee refuses to take a position when the company moves to another city or region.

- If you disagree with changes to the terms of the employment contract in the manner prescribed by Art. 74 Labor Code of the Russian Federation.

Composition of payments due upon dismissal

The amounts that should be included in an employee’s calculation upon dismissal can be divided into:

- basic – mandatory for accrual;

- additional - due to the employee depending on the grounds for dismissal and the conditions of local regulations .

Let us remind you that full payment upon dismissal must be made on the date of termination of the employment relationship (Article 140 of the Labor Code of the Russian Federation).

Mandatory include :

- wages - for time worked or work performed that was not previously paid;

- compensation and incentive payments;

- compensation for unused vacation days.

Who will be paid the monthly income?

Compensation in the form of one month's earnings is paid:

- in case of staff reduction or liquidation of an enterprise (clause 1, 2, part 1, article 81 of the Labor Code of the Russian Federation);

- upon cancellation of employment contracts executed with violations (clause 11, part 1, article 77 of the Labor Code of the Russian Federation).

In case of downsizing or liquidation of an enterprise, payment is made along with the settlement and in the first month after the official severance of the employment relationship. But such payments are not available to seasonal workers, conscripts, and part-time workers.

When a larger amount is due

If the employee has not found a new job

For the second month, benefits are paid if the former employee was unable to find a job within 60 days (in case of staff reduction or company liquidation). In some cases, payment for 3 or even 6 months is possible if the employee applied to the employment center (two weeks and 30 days, respectively), but there was no vacancy and he did not find a job (Articles 178 and 318 of the Labor Code of the Russian Federation).

To confirm that the former employee has not taken a new job, he brings the relevant documents to the former employer. Their list depends on the month for which benefits are paid after dismissal.

| Period from the date of dismissal | Amount of payment and list of documents to be presented to the former employer |

| After the second month. After the second and third months - for workers of the Far North and equivalent territories | Average monthly earnings. Documentation:

|

| After the third month. After the fourth, fifth and sixth months - for workers of the Far North and equivalent territories | Average monthly earnings. Documentation:

|

If a citizen gets a job at this time, he will be paid only for the time he was registered with the employment service. In this case, instead of the original work book, they bring a copy of it, certified at the new place of work.

Also, the Labor Code (Articles 181, 278, 279) provides for special payments upon dismissal of the enterprise’s managers, their deputies and the chief accountant at their own request in 2020. In this case, for the period of employment, compensation is three monthly earnings.

An example of calculating compensation for unused vacation

Employee Fedorov V.A. hired at Solnyshko LLC on December 3, 2020, and left on May 25, 2022.

Fedorov was on vacation in July 2022 (28 cal. days). The employee did not have any periods not included in the vacation period. The calculation period for calculating compensation is 12 months preceding the month of dismissal, i.e. from May 2022 to April 2022. During this period, the employee earned 632,400 rubles.

Step 1 - calculate the length of service:

- from 03.12.2020 to 02.12.2021 - 12 months;

- from 12/03/2021 to 05/02/2022 - 5 months;

- from 05/03/2022 to 05/25/2022 - 22 days, which exceeds half a month, which means a full month is taken into account.

Total experience is 18 months

Step 2 - determine the number of vacation days from the start of work. 18 months x 2.33 = 42 days.

Step 3 - determine the number of days of unused vacation.

42 days - 28 days used = 14 days

Step 4 - calculate average daily earnings (ADE).

- the number of fully worked months in the billing period is 11;

- in incompletely worked August it is equal to 2.84 (29.3 / 31 days x (31 days - 28 days));

- SDZ is equal to 1,945 rubles. (RUB 632,400 / (29.3 x 11 months + 2.84 days)).

Step 5 - determine the amount of compensation for vacation.

RUB 1,945 x 14 days = 27,230 rub. When paying compensation, personal income tax must be withheld from it. Thus, Fedorov will receive 23,691 rubles. (RUB 27,230 - 13%).

Dismissal of a manager or chief accountant

It happens that managers or chief accountants quit. Payments will be accrued in the following cases:

- they were removed from office by the founders without any guilt;

- The new owner of the business decided to fire them.

There are several situations when a change of ownership of a company occurs:

- privatization of state and municipal property (sale or provision into private ownership);

- retransfer of property belonging to the organization in favor of the state;

- sale of the enterprise as a whole complex of property.

A change in the composition of the company's participants (inclusion of new participants or withdrawal, exclusion of old ones, including a complete change in composition) does not constitute a change of owner.

The employer in accordance with Art. 278 of the Labor Code of the Russian Federation pays the manager money in the amount established by the employment agreement, but not less than three times the average monthly salary.

But there are also nuances in the payment of benefits upon dismissal of managers, their deputies and the chief accountant - amounts of money are not paid if:

- there are illegal actions on their account;

- they made decisions that negatively affected the financial position of the organization.

Leave compensation upon dismissal: calculation

The number of days of unused vacation is determined based on the fact that a full year of experience giving the right to it corresponds to 28 calendar days, and each full month corresponds to 2.33 calendar days. When the last month of service turns out to be incomplete, then, when calculating compensation upon dismissal, it is taken into account as full if the number of days of work in it exceeds half a month, and is not taken into account when the period worked in it is less than half a month (clause 35 of the Rules on regular and additional holidays approved by the USSR People's Commissariat of Labor on April 30, 1930 No. 169).

There are situations in which it becomes mandatory to pay compensation for leave upon dismissal for a full year, although in reality it turns out to be not fully worked out (clause 28 of the Rules on regular and additional leaves, approved by the People's Commissariat of Labor of the USSR on April 30, 1930 No. 169). These are cases when the employee worked:

- more than 11 months and they have all entered the length of service that grants the right to leave;

- from 5.5 to 11 months, but is forced to resign due to reduction in numbers, due to enlistment in military service, assignment to study or other work, or due to revealed unsuitability for work.

The law does not require rounding the number of vacation days determined by calculation when calculating compensation upon dismissal. Therefore, when calculating leave compensation upon dismissal, you can use a number that has decimal places, or you can reflect in the accounting policy a provision on rounding it to a whole number. When deciding how compensation for leave upon dismissal is calculated, you should keep in mind that rounding should always be done in favor of the employee (letter of the Ministry of Health and Social Development of the Russian Federation dated December 7, 2005 No. 4334-17).

Let's consider calculating compensation for unused vacation step by step.

When they will only pay if agreed upon with the employer

Upon resignation of one's own free will

If the contract is terminated at the request of the employee, then no incentive or compensation payments are provided for by law, that is, severance pay is not provided for voluntary dismissal. But if management wants to reward an employee for long and fruitful work, they will award a bonus on their own initiative; such cases are known.

By agreement of the parties

Typically, dismissal by agreement occurs on an individual basis. The amount of the fee is not established, so payment is made by mutual agreement of the parties. The problem of the amount of payment, how to calculate severance pay upon dismissal by agreement of the parties, is solved within the framework of individual agreements.

But the salary, which was not paid to the employee for the period worked, is issued without fail on the last day of work.

Upon retirement

Labor legislation does not provide for severance pay upon retirement, but in accordance with Part 4 of Art. 178 of the Labor Code of the Russian Federation, similar bonuses are allowed to be prescribed in the employment contract or they may be provided for by internal regulations of the organization itself. Such payments are provided at the request of the employer and are not regulated by law. The organization has the right to establish any number of financial assistance measures without restrictions. This type of help is, rather, gratitude for the work.

Dismissal procedure for staff reduction: step-by-step instructions - 2022

Dismissal due to staff reduction is permitted under clause 2 of Art.

81 Labor Code of the Russian Federation. This type of dismissal for employees is a kind of force majeure, therefore other norms of the Labor Code of the Russian Federation and related laws provide for them preferences and compensation. The procedure for dismissal due to staff reduction is as follows:

- We determine who can be laid off and who cannot, taking into account the provisions of Art. 261 Labor Code of the Russian Federation. Persons for whom additional social protection is established by law cannot be fired due to staff reduction: single parents, large families, disabled people of certain categories, etc.

- We notify the employment service, trade union (if there is one) and the employee himself (in accordance with Article 82 of the Labor Code of the Russian Federation) about future dismissal. A notification is sent to the employment service for each employee indicating his profession, qualifications and earnings. Information is submitted no later than 2 months before the date of dismissal. If the reduction is massive, then within 3 months. The timing and forms of notifications are established by Resolution of the Council of Ministers - Government of the Russian Federation dated 02/05/1993 No. 99.

For permanent employees, the written notice period must also be at least 2 months before the date of the order.

- We prepare documents:

- preparing a dismissal order due to reduction;

- fill out the work book;

- We make entries in personnel documents and the employee’s personal account.

Read more about individual personnel records in the article “Personnel documents that must be in the organization .

- We introduce the order to the employee personally against signature. We issue a work book in person on the day of dismissal (Article 140 of the Labor Code of the Russian Federation).

- We make a settlement with the employee. On the last day at work the following must be paid:

- salary for the period before the day of dismissal, taking into account all established allowances and additional payments;

- compensation for unused vacation in accordance with Art. 127 Labor Code of the Russian Federation;

- severance pay in case of layoff (compensation for dismissal) under Art. 178 Labor Code of the Russian Federation

For standard calculations upon dismissal, read the article “Calculation of compensation for unused vacation according to the Labor Code of the Russian Federation” .

- We pay each laid-off person for a specified period of time for a new job.

Other cases

If an employee was illegally fired and he is reinstated to his previous place of work, then he is entitled to severance pay upon reinstatement at work for the entire period of the employee’s absence (forced absenteeism). The organization is obliged to calculate the average salary (if it was an illegal dismissal) or compensate the difference in wages (if it was an illegal transfer).

Since an individual entrepreneur is not a company or a legal entity, a number of labor laws are not applicable to it. According to the decision of the Supreme Court No. 74-KG16-23 dated 09/05/2016, employees working for individual entrepreneurs count on benefits, but they are not always paid:

- upon liquidation of a business, termination of activities as an individual entrepreneur;

- when staffing is reduced.

However, an individual entrepreneur is obliged to notify the employee of the upcoming dismissal and pay him the amounts due if such conditions and guarantees are included in the employment contract.

The law enforcer proceeds from the fact that this employer is an individual, and severance pay for cumulative accounting of working hours is paid in the same way as for any other accounting.

Table of benefit amounts depending on the circumstances of dismissal

| Grounds for dismissal | Benefit amount |

| Liquidation of a company | In the amount of average monthly earnings for all categories of workers, with the exception of those specified in Art. 178 Labor Code of the Russian Federation:

|

| Reduction in headcount or staff | __//__ |

| Refusal to transfer for medical reasons | Average earnings for two weeks |

| Conscription into the army or alternative service | __//___ |

| Due to the reinstatement of an employee who previously performed work, by a court decision or labor inspectorate | __//___ |

| Refusal to transfer together with the organization to another location | __//___ |

| Recognition based on a medical report as completely incapable of performing relevant duties | __//___ |

| Refusal to work under new conditions | __//__ |

| Violation of the rules for concluding an employment contract established by law, which occurred through no fault of the employee, if such a violation precludes transfer or continuation of activity | Average monthly earnings |

Who pays severance pay upon dismissal?

An employer - a legal entity is obliged to guarantee the payment of severance pay to dismissed employees, except for the grounds for dismissal listed in the law.

Question: How to include a provision for severance pay upon dismissal in an employment contract, including by agreement of the parties? View answer

If the employer is a private entrepreneur , then the issue of payment of severance pay remains at his discretion. These points are discussed during hiring and must be reflected in the employment contract. If the main document, which is intended to regulate the concluded labor relations, does not address this issue, the dismissed person may be left without severance pay, and this will be legal.

Question: Is severance pay subject to personal income tax upon dismissal in connection with the liquidation of an organization, reduction in the number or staff of employees in the amount established by Art. 178 of the Labor Code of the Russian Federation (clause 3 of Article 217 of the Tax Code of the Russian Federation)? View answer

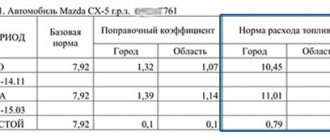

The procedure for calculating the payment and the formula for calculation

The calculation formula looks like this:

Severance pay = average daily wage × number of working days in the month following the month of dismissal.

To calculate severance pay, you need to determine the following values:

- billing period;

- the number of days that the employee actually worked;

- total salary;

- the number of days recognized as workers during the period for which benefits are paid.

Calculated payment period

The 12 calendar months preceding the month in which the employee is laid off are taken.

Actual days worked

All working days when the employee worked are taken into account.

The time spent on annual leave and sick leave is not taken into account.

Benefit amount

To calculate benefits, the following formula is used: Average salary X Number of working days in the month following dismissal.

To calculate average earnings you need to determine:

- The calculation period is the 12 months preceding the month of dismissal. If the dismissal occurs on the last day of the month, then it is included in the billing period.

- The total amount of payments to the employee for the pay period . This means wages, as well as other payments, if any.

Average earnings are calculated using the formula: Amount of payments for the billing period / number of days of the billing period.

For example, the number of working days over the last 12 months is 252 days, wages are 30,000 rubles , no other payments were made. The amount of payments will be: 30,000 X 12 = 360,000 rubles.

This will be true if the employee has worked all the working days of the estimated period. If he went on vacation, sick leave, went on a business trip, or was released from work for some other reason, then to calculate average earnings these periods and payments for them are excluded.

In the example above, the average earnings will be: 360,000 / 252 = 1,428.57 rubles per day.

To calculate the benefit, it must be multiplied by the number of working days of the next month. For example, if there are 22 , then the benefit amount will be: 1428.57 X 22 = 31428.54 rubles.

Examples of calculations

Let us show with examples how benefits are calculated.

Example 1.

Svetlyachkov I.S. worked at Vesna LLC. On 10/16/2020 he was fired due to the liquidation of the organization. Svetlyachkov’s monthly salary was 23,000 rubles, and his vacation was used in full. Upon termination of the contract, Svetlyachkov must be paid:

- wages for days worked;

- severance pay.

In October 2022, 22 working days, of which the employee worked 10. His earnings will be:

23,000 rub. / 22 × 10 = 10,454.50 rubles.

To calculate severance pay, the average earnings are used. Over the past 12 months, Svetlyachkov worked 260 days.

23,000 × 12 / 260 = 1061.54 rubles.

There are 20 working days in November, which means the severance pay will be:

1061.54 × 20 = 21,230.80 rubles.

Example 2.

Romashkina Maria Petrovna was fired on September 31, 2020 due to staff reduction and immediately registered with the employment service. Upon dismissal, she was given a salary for September in the amount of 30,000 rubles. The vacation was fully used, therefore, there was no compensation for it.

During the previous billing year, she worked 249 days. Let's calculate monthly earnings:

30,000 × 12 / 249 = 1445.78 rubles.

In September there were 22 working days, therefore, Maria Petrovna received severance pay in the amount of:

1445.78 × 22 = 31,807.16 rubles.

But this month she was unable to find a job. Due to the fact that she contacted the employment service on time, she is entitled to benefits for another 30 days. There are 22 working days in October, therefore, Maria Petrovna will receive benefits in the amount of:

1445.78 × 22 = 31,807.16 rubles.

She will no longer be paid.

Calculation of average earnings for sick leave

The procedure for determining the average daily salary for calculating benefits for sick leave is somewhat different (Article of the Federal Law of December 29, 2006 No. 255-FZ):

- payments to the employee, for which insurance contributions to the Social Insurance Fund are calculated, are taken into account for the 2 calendar years preceding the year of the onset of the illness, but not more than the maximum amount of income (in 2018 - 815,000 rubles, in 2022 - 865,000 rubles);

- the amount of payments is divided by 730 (the number of calendar days in two years).

The procedure for determining average earnings for sick leave in 2020 due to non-working “presidential” days does not change, because income in 2022 and 2022 is taken into account. And in the future, the calculation algorithm is unlikely to change, because:

- the calculation of temporary disability benefits is regulated by Law No. 255-FZ;

- Amounts for which insurance premiums are not charged are not accepted for calculation (payment for non-working days according to the Decrees does not fall into this category);

- actual earnings in the billing period are divided into 730 calendar days, their number cannot be reduced.

Example 4. Calculation of average earnings for temporary disability benefits

From June 1 to June 9, the company engineer was on sick leave. His income for 2018 is 550,000 rubles, for 2022 – 680,000 rubles. (the income limit in both cases has not been reached). Let's determine the amount of temporary disability benefits:

- (550,000 + 680,000) / 730 = 1,684.93 rubles. – average daily earnings.

- 9 days of sickness for an engineer will be paid in the amount of: 1,684.93 x 9 = 15,164.37 rubles.