The development of technologies available for use in modern business greatly simplifies routine operations performed on a daily basis. Innovations enshrined at the legislative level can be used by companies absolutely officially. Thus, in 2022, receiving a new product no longer requires the same amount of paperwork that storekeepers and accountants had to deal with at the beginning of the last decade - it is enough to fulfill a number of standard requirements that allow you to switch to digital exchange of documents online. What is an electronic invoice, how to correctly create, fill out, execute and issue an e-invoice, and how does the transition to a new system of rules help organizations and enterprises of various sizes? Let's figure it out.

General overview

The document flow carried out as part of trade transactions between counterparties allows each party to receive official confirmation of the completed transaction, which is necessary for both internal accounting and external reporting. The traditional practice of issuing accompanying physical documentation, a package of which accompanies the shipment of products or a certificate of completion of work, has increasingly faded into the background in recent years. Its place is taken by the issuance of electronic invoices, issued and registered through authorized operators, even in cases where the buyer does not actually belong to the category of value added tax payers.

What are they?

Types of signatures (Federal Law No. 63-FZ of April 6, 2011, hereinafter referred to as Law No. 63-FZ):

- simple

– formed on the basis of passwords, codes and other symbols. Does not protect the document from hacking and adjustments; - enhanced

– formed using cryptographic methods.

Provides protection against amendments to the document after signature: qualified ( UKEP

), - unskilled.

General procedure

To switch to a new format of interaction with counterparties, you will need to perform a standard set of actions:

- Check with the partner in the planned transaction about the availability of appropriate technical equipment, as well as the ability to comply with legal requirements.

- Issue an electronic digital signature of qualified status, which allows you to sign documents digitally, without using a physical medium. Provided by certification centers that have appropriate accreditation.

- Conclude an agreement with one of the service operators who provides data for logging into the official website of the portal, into the personal account of the information system with a register of electronic invoices (ESF) for VAT. The list is indicated on the website of the Federal Tax Service.

Completion of all three stages allows you to move on to maintaining official document flow in an online format.

Storage of electronic documents

The electronic signature certificate is valid for one year, and accounting documents must be kept for five years.

But even after the certificate expires, the document will not lose legal force, since a time stamp is placed at the time of signing. A time stamp is an analogue of the date on the document being signed. It confirms that the electronic signature certificate was valid at the time the document was signed.

So, at the moment of signing the document, a time stamp and the result of the certificate verification are affixed.

Maxim Solovyov, analyst at Synerdocs

You can also confirm the fact that the certificate was valid at the time of signing by referring to the list of revoked certificates on the website of the certification authority.

Direct storage of electronic documents can be organized in at least two ways:

- local storage (documents are stored on local drives/servers of your company);

- storage in the cloud (documents are stored on the servers of the company whose services you used).

Electronic archiving services, for example, are offered by EDF operators.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Current registration rules

In 2022, against the backdrop of changes to the legislative norms regulating the trade sector, the principles for the formation of documents in the category under consideration were also adjusted. The main reason was the launch of a national product tracking system, which had an impact on the way the relevant products were sold. The list includes import supplies of products included in the content of government decree No. 1110 dated July 1, 2021 - the structure is similar to the labeling actively practiced in a number of trade segments, however, it does not provide for “piece by piece” control, but “batch” control, for the implementation of which adjustments have been made original form.

Adjustment invoice

If the cost of shipped goods (work performed, services rendered, transferred property rights) changes, adjustment invoices are issued (clause 3 of Article 168 of the Tax Code of the Russian Federation). When making adjustments, the following rules must be observed:

- changes are made to both copies;

- changes must be endorsed by the seller’s manager or an authorized person (the signature of the chief accountant is not required) and certified by a seal;

- be sure to include a date for making corrections;

- erroneous data is crossed out and new ones are entered, indicating the column, and the explanation “Corrected” must be included.

If there are too many errors, create a new document. The norms of the Tax Code of the Russian Federation do not contain a ban on such an action.

Innovations common to all areas

Speaking about the latest changes and requirements affecting information about digital invoices, the procedure for issuing and signing them electronically, it is worth noting the following nuances:

- An additional line “5a” has appeared in the form, when filling it out, information about the shipping documentation serving as the basis is indicated. As an example, these could be invoices, acts of work performed or services rendered, etc.

- A separate column records the serial number of the data, with section “1a” reserved for the name, and “1b” for the code according to the Commodity Nomenclature of Foreign Economic Activity.

- The name of the eleventh column has been changed, adapted not only for products required to be traced, but also for other types of imported products.

- In the electronic invoice form (invoice) additional columns have been added (12, 12a and 13), which must be filled out when trading operations are related to the sale of traceable products. The first and second sections indicate the code identifier and unit of measurement. For advance copies, as in cases where it is planned to sell goods that do not belong to the specified category, the lines are written down, but not filled in.

Invoice deadlines

The general rule is as follows: an invoice is issued within 5 days from the date of transfer (shipment) of goods, performance of work or provision of services. Days are counted as calendar days. This norm is enshrined in paragraph 3 of Art. 168 Tax Code of the Russian Federation. The rules are the same for both paper and electronic invoices. Also, according to paragraph 3 of Art. 168 of the Tax Code of the Russian Federation, when preparing advance documents, this form is drawn up within the same 5 calendar days, but from the moment of receipt of payment for future deliveries, performance of work, provision of services.

New traceability system

The introduction of new market control rules has become commonplace for domestic business. The main goal is to reduce the volume of counterfeit goods and improve the quality of products available to end consumers. Testing began back in 2020, and from 2021, the list determined by government decree included products from several groups at once, including refrigeration and washing equipment, car child seats, metal office furniture, etc. Introducing new mandatory details into electronic s/f is a consequence of these changes.

Additional sections

The markers whose presence was considered appropriate based on the results of the past test period include:

- Registration numbers of declarations and product lots.

- Units of measurement corresponding to the category.

- Total quantity to be traced.

Generating a paper or digital invoice remained voluntary until 07/1/21, but after that date it became mandatory to have the latest version - including correction copies.

What is required from the seller

To become a participant in the new document flow system, it is enough to contact the TKS operator with a corresponding application containing information about the organization or individual entrepreneur:

- Name (or full name).

- Registration address (or place of residence).

- TIN, information on digital signature certificates, details.

- Contact details.

It is also mandatory to provide consent to exchange information with other services providing identical services. After positive consideration of the application, the applicant is issued an EDF identifier, as well as accounting and other information required for authorization in the center for the exchange of electronic invoices. It is worth noting that if any information changes, the counterparty is obliged to notify the operator within three working days - for subsequent adjustments to be made within the same period based on the received application.

Registration of ESF

The seller’s algorithm of actions provides for the following sequence:

- Drawing up a document in accordance with the approved instructions.

- Signing using a digital signature.

- Sending through the EDI platform.

The use of modern accounting programs allows you to implement the procedure automatically - just enter data on the planned shipment, and the system will independently generate all the accompanying documentation, uploading it to the common database after the user confirms its correctness.

Intermediate stage

Employees of the company, acting as an intermediary, ensuring the stability and uninterrupted flow of documents, accept outgoing requests, record basic details, and check the compliance of the content, including verification of signature samples. After this, the email invoices are forwarded to the operator with whom the buyer of the goods cooperates, who also notes all the necessary data, confirming the validity and correctness of the transaction. The counterparty himself receives a notification after the verification is completed.

Acceptance of electronic invoice

Compliance with basic parameters means the ability to reconcile planned and actual indicators. The client first checks the proposed version with the application for positional and quantitative compliance, after which he carries out the comparison again - but now with the actually arrived list of assortment. The presence of discrepancies is grounds for refusing to confirm the transaction, or for promptly making changes, which are also reflected in the general accounting system. After the plan and fact agree with the initially planned data, the buyer confirms the shipment, also signing an invoice in electronic digital form (EDF); upon adjustment, a new document is generated - ISF.

It is worth noting that in cases where the seller and the client are serviced by the same EDF operator, the cycle is implemented with less time, since it does not require re-fixation at an intermediate stage.

Solutions to possible problems

The legally established Procedure contains not only the main regulatory provisions, but also a kind of FAQ analogue that explains algorithms for solving potential problem situations. Let's consider the main points of the content of paragraphs 23-24:

- One of the participants in the document flow system did not receive confirmations within the time limits defined as normative. This role may include both the buyer or seller, as well as the operator of the EDI platform, who is responsible for logging and supporting trading operations. In such situations, the chain entity experiencing the specified problem must notify the sender of the confirmation notification using any available method.

- Electronic invoices were not presented to the recipient within the period determined by the provisions of the third paragraph of Article 168 of the Tax Code (5 calendar days from the date of shipment). In this case, it is necessary to notify the seller, indicating an increase in the deadlines for the execution of planned EDI activities. If the sender was notified that the operator, for his part, received a digital version of the documentation, he also informs the client.

It is worth noting that the implemented system is focused on conscientious cooperation, within the framework of which each party must make the efforts necessary to successfully complete each document flow cycle.

Despite the rather long period of testing, today it is impossible to say with confidence that all entrepreneurs know what an electronic invoice (ESF) looks like and how to make, send and issue documents in digital form. In cases where it is not possible to prepare accompanying documentation in this way, the usual paper version is used. However, please note that this option does not apply to traceable products. The parameters specified initially and confirmed by the EDF operator are copied by the seller without changes, printed and signed in the proper order. Subsequent re-issuance of such ESF, even when the second counterparty has the opportunity to accept it, is prohibited by the regulations.

Who prepares invoices

The document is presented by the seller (contractor, performer) to the buyer or customer. Drawing up this form is mandatory for business entities engaged in the sale of goods, performance of work or provision of services.

The following are required to prepare an invoice:

- individual entrepreneurs and legal entities subject to the general taxation system (unless their services fall under the exceptions established by clause 2 of Article 149 of the Tax Code of the Russian Federation);

- Individual entrepreneurs and organizations that partially work for OSN (for relevant types of activities).

Taxpayers who have chosen the simplified taxation system or the patent system as their taxation system are exempt from paying VAT, with the exception of certain cases. But if an organization or individual entrepreneur enjoys VAT exemption under Art. 145, 145.1 of the Tax Code of the Russian Federation, but performs transactions that are not exempt from tax, a new invoice is drawn up from July 1, 2022, marked “Without VAT” (clause 5 of Article 168 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated May 24, 2013 No. 03 -07-09/18686). This is necessary if there is interaction with organizations and individual entrepreneurs that are VAT payers. In addition, the parties have the right to apply the invoice on their own initiative.

Features of working with electronic invoices (ESI)

The algorithm of the system makes it possible to fully implement it only on the condition that all three participants - the sender, the recipient, as well as the platform operator, acting as a connecting and controlling link - have the necessary set of technical means, as well as access to the Network. The general principles are enshrined in the content of Order No. 174n of the Ministry of Finance.

In general, we can say that the mechanics are not too different from the usual scheme. The range of responsibilities of the seller is to generate, sign and send a digital document, after which he can only wait for official confirmation from the buyer. He, in turn, issues not only a notification, but also a confirmation for the operator, who is responsible for delivering documentation on time, checking the compliance of parameters, as well as recording trade transactions in the general register.

An important point: the rules for issuing an invoice in electronic form (IS ESF) for individual entrepreneurs and LLCs provide for the issuance of a single copy, which can only be signed by one entity with the appropriate authority and a qualified digital signature.

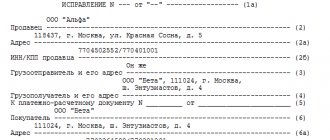

Invoice details

What does the invoice form look like? This is a table with columns about the product and a header providing information about the parties to the contract.

Required invoice details:

- number and date;

- name, address and TIN, checkpoint of the buyer and seller, consignor and consignee, if any (please note, according to the new rules, the address must be written strictly as it is indicated in the Unified State Register of Legal Entities, check on the Federal Tax Service website in the “Check yourself and the counterparty” section);

- number of the payment document if an advance has been received for future deliveries;

- product name and unit of measurement;

- quantity;

- currency (ruble code - 643, US dollar - 840, euro - 978);

- price per unit of measurement;

- full cost;

- excise tax amount;

- tax rate;

- the amount of tax to be paid;

- total cost including taxes;

- country of origin of the goods (codes are set in accordance with the OK classifier (MK (ISO 3166) 004-97) 025-2001; if the goods are produced in Russia, a dash is added;

- customs declaration number (if the goods were not produced in Russia);

- signatures of the manager and chief accountant (or an authorized person - by order or power of attorney) - on a paper document; enhanced qualified digital signature - on electronic.

Invoice Line

“Identifier of a government contract, agreement (agreement)” is used in the case of supplies under a government contract. The filling rules specifically indicate that the line is filled only if there is an identifier. If absent, the line remains blank (there is no need to put a dash).

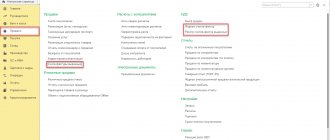

Where to get filling samples

There is essentially no need for demo copies, since we are talking about a standardized file form characterized by an identical set of details. In terms of filling out the documentation, it is practically no different from its paper counterpart, regulated by the provisions of Article 169 of the Tax Code. A physical medium is not required, which makes it practically impossible and inappropriate to present visual materials in the usual sense.

However, some organizations and entrepreneurs practice using instructions that represent a visualization of the work algorithm. Simply put, they provide employees who do not have sufficient practical experience with a picture that displays fields and characteristics that explain the principles of filling them out. However, in this case, you need to take into account that the use of different versions of the software causes differences in interfaces, so it is not possible to find and download a universal sample for filling out an electronic invoice.

When an invoice is not needed

The legislation specifies cases when an invoice is not a mandatory document, and the completion and execution of a transaction is confirmed by other data: an invoice, an invoice for payment. Based on the regulations, the invoice is not filled out under the following circumstances:

- the transaction is not subject to VAT (Articles 149 and 169 of the Tax Code of the Russian Federation);

- when selling goods for cash (in this case, a check or a strict reporting form is sufficient);

- when applying simplified taxation regimes;

- a legal entity - the employer transfers the goods to its employee without providing counterpayment, that is, free of charge (according to the letter of the Ministry of Finance of the Russian Federation dated 02/08/2016 No. 03-07-09/6171);

- when sending goods taxed at a zero rate for export, if the buyer is not a VAT payer, if the shipment took place no later than 5 calendar days from the date of receipt of the advance payment (according to the letter of the Ministry of Finance of Russia dated January 18, 2017 No. 03-07-09/1695).

Advantages and disadvantages of the system

Practice shows that automatic processing of ESF allows you to reduce the time costs required for reconciling documents and identifying possible errors. In addition, the costs associated with organizing printing and delivery of paper copies are reduced. It is also worth noting the simplified algorithm for interaction with regulatory authorities - when a request is received, it is enough to send the data via TKS, without resorting to the standard procedure of copying and certification.

As for the disadvantages, they primarily include problems that arise for participants in trading operations in the absence of access to the Internet, as well as technical problems and failures that arise for reasons beyond their control. Violation of the ESF formation cycle necessitates a return to the usual format. In this case, the issuance of documents retroactively is excluded, since the responsibilities of the operator of the EDI platform include recording all dates for completed transactions.

If you are interested in what an electronic document consists of and how an electronic document is signed

In the last chapter, we found out that an electronic signature (ES) is a special document requisite that allows you to establish the authorship of the document and confirm its immutability. When starting to exchange electronic documents, you must purchase an electronic signature certificate. So, the owner of the signature has in his hands:

- Electronic signature certificate , which confirms that the signature belongs to a certain person;

- Signature keys are a set of a secret (private) key and a public key . When a document is signed, a code is created. What we encrypt with the private key can be decrypted with the corresponding public key, and vice versa.

Let's take a closer look at the document signing mechanism.

The entire complex process of signing and verifying electronic signatures is implemented using special programs (cryptographic information protection tools). The electronic signature is formed as a result of converting information using a secret key and contains an encrypted image of the document, which is why you can immediately determine whether the document has been changed after signing.

You, as an accountant, do not need to delve into the details of the previous paragraph. Electronic signature is most often stored on a special “flash drive” (eToken). For security, the contents of the media are protected with a PIN code that is known only to you.

The signing process itself is quite simple, you need to insert the “flash drive” into your computer and click the “sign” button.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Results

The answer to the question of whether it is necessary to switch to electronic invoices (ESF) for government procurement, working with banks, or performing trade transactions with products classified as traceable, will definitely be positive.

The introduction of digital document management simplifies a number of business processes, facilitates reporting and control. The software solutions offered by , the purpose of which is to automate routine tasks typical of most modern enterprises, will also help make your business even more efficient. Number of impressions: 414