About legal entities

For constant growth and competent formation of the economic strategy of the enterprise, the manager must have all the full

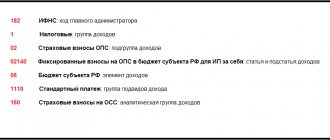

The BCC for 2022 for basic taxes and contributions remained the same. But in connection

Book of income and expenses: form What is a simplified book of income and expenses

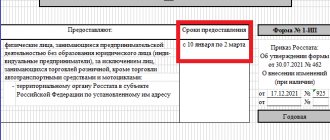

Who needs to submit the 1-IP report From the name of the report itself, it’s easy to guess that the statistics

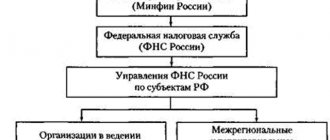

Briefly about the history of the taxation system in Russia The tax system of the Russian Federation began to take shape after the collapse

Kontur.Accounting is a web service for small businesses! Quick establishment of primary accounts, automatic calculation of taxes, sending reports

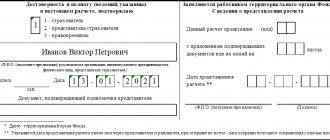

4-FSS is a mandatory quarterly report for all legal entities and individual entrepreneurs who accrue

In accordance with paragraph 3 of Article 1 of the Federal Law of August 3, 2018 No. 303-FZ, from January 1

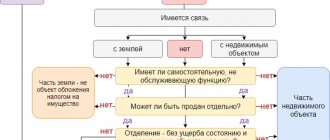

Signs of real estate the object is subject to state registration; there are permits for construction and commissioning;

Please note: starting from reporting for the 4th quarter of 2022 and beyond, the DAM is submitted