Types of mandatory insurance contributions

There are four types of insurance premiums.

The first type is pension contributions (contributions to the Pension Fund). They are divided into contributions to the insurance pension and contributions to the funded pension.

The second type is medical contributions (contributions to the FFOMS).

The third type is contributions to the Social Insurance Fund for compulsory social insurance in case of temporary disability and in connection with maternity. Using these contributions, the Social Insurance Fund pays sick leave benefits and maternity benefits.

The fourth type is contributions to the Social Insurance Fund for insurance against industrial accidents and occupational diseases. Their unofficial name is “injury” contributions.

In 2009 and earlier, the first, second and third types of insurance contributions were included in the unified social tax. Since 2010, they have been regulated by Federal Law No. 212 of July 24, 2009 (hereinafter referred to as Law No. 212-FZ).

The calculation and payment of contributions “for injuries” is regulated by Federal Law No. 125-FZ dated July 24, 1998 (hereinafter referred to as Law No. 125-FZ).

Who pays the fees

- organizations that pay salaries to employees and (or) pay remuneration to contractors - individuals;

- individual entrepreneurs who pay wages to employees and (or) pay remuneration to contractors - individuals;

- individuals without individual entrepreneur status who pay salaries to employees and (or) pay remuneration to contractors - individuals;

- individual entrepreneurs and persons engaged in private practice (lawyers, notaries, etc.); that is, those who work “for themselves” and not for the employer.

It often happens that the same person fits several of the above definitions at once. In this case, insurance premiums must be paid for each reason. The most common example is an individual entrepreneur who works “for himself” and at the same time has a staff of employees. Such an individual entrepreneur must separately accrue contributions on his own income and separately on the salaries of his employees.

What insurance premiums go to extra-budgetary funds. Payers

Insurance premiums (STI) mean regular payments made without fail. They provide a decent pension in the future, payment of sick leave and benefits for children, and free medical care.

Contributions are made by entrepreneurs, employers and self-employed persons.

An individual entrepreneur whose staff includes employees is obliged to transfer funds not only for himself, but also for his employees. STV means amounts intended for insurance: (click to expand)

- pension. Funds are accumulated in the Pension Fund;

- from accidents that may occur during the production process, from occupational diseases. Funds are transferred to the Social Insurance Fund;

- medical (MHIF).

Funds should be transferred unconditionally to extra-budgetary funds:

- Persons paying salaries and other types of remuneration to employees:

- companies and firms with the status of legal entities;

- IP;

- individuals without individual entrepreneur status.

- Businessmen practicing privately according to the rules established by law. Their distinctive feature is that entrepreneurs work independently and do not have official employees or assistants who are paid wages.

Important! When the STV payer can simultaneously be classified into several categories, then he is obliged to pay funds for each basis separately.

What are contributions calculated for?

Employee benefits

Employers-organizations and employers-individual entrepreneurs charge contributions for payments made to employees under employment contracts. Such payments include, first of all, wages, bonuses based on the results of work for a month, quarter or year, as well as vacation pay and compensation for unused vacation.

Payments to contractors

Pension and medical contributions are accrued on payments in favor of individuals who are not members of the state, if such payments are made within the framework of copyright or civil law contracts. There is an exception: the customer of work or services is released from the obligation to charge contributions in the case where the contractor has the status of an individual entrepreneur and pays contributions “for himself.” Also, contributions do not include amounts issued to a citizen for property or property rights acquired or leased from him (for example, contributions are not charged on amounts paid when renting an employee’s personal car).

Contributions to the Social Insurance Fund for insurance in case of temporary disability and in connection with maternity are not accrued for payments under any civil contracts (including copyright and contract agreements).

Contributions to the Social Insurance Fund for “injuries” from payments under civil contracts are accrued only if the payment of contributions is provided for by the contract itself.

Certain features have been established for foreigners and stateless persons receiving income under employment or civil law contracts (see table).

Features of calculating contributions for payments in favor of foreigners and stateless persons

| Payments | Pension contributions | Medical fees | Contributions to the Social Insurance Fund in case of temporary disability and in connection with maternity | Contributions for injuries |

| A foreigner permanently or temporarily resides in the Russian Federation | ||||

| within the framework of an employment contract | accrued | accrued | accrued | accrued |

| within the framework of a civil contract | accrued | accrued | accrued | are accrued if provided for in the contract |

| A foreigner is temporarily staying in the Russian Federation | ||||

| within the framework of an employment contract | accrued (if the foreigner is not a highly qualified specialist) | are not credited | accrued | accrued |

| within the framework of a civil contract | accrued (if the foreigner is not a highly qualified specialist) | are not credited | accrued | are accrued if provided for in the contract |

| A foreigner works in a foreign branch of a Russian company or performs work or provides services abroad under a contract | ||||

| are not credited | are not credited | are not credited | are not credited | |

What are extra-budgetary funds

These are institutions that operate independently of budgets at any level. Their purpose is to satisfy the socio-economic needs of citizens, such as:

- provision of pensioners;

- health protection;

- support for motherhood and childhood.

They help realize the constitutional rights of the population. Transfer of contributions is mandatory for employers. Individual entrepreneurs also pay them for themselves.

In accordance with Article 419 of the Tax Code of the Russian Federation, individuals can also be payers. This applies to self-employed citizens who do not officially work anywhere, but want to have social guarantees.

What are contributions not calculated for?

There is a closed list of payments that are not subject to pension and medical contributions, as well as contributions in case of temporary disability and in connection with maternity. This list includes sick leave benefits, all types of statutory compensation, daily allowances received during a business trip, etc. The full list is given in Article 9 of Law No. 212-FZ.

There is also a list of payments exempt from contributions “for injuries” (Article 20.2 of Law No. 125-FZ). It practically coincides with the list adopted for other contributions.

In practice, many disputes arise due to payments that are not mentioned in the above lists and are not related to work responsibilities. This applies, in particular, to bonuses on the occasion of an anniversary, to the cost of trips paid by the employer, etc. According to policyholders, contributions for such amounts do not need to be charged, but employees of extra-budgetary funds think differently. Such disputes often end in court, and arbitration practice on this issue is very contradictory.

How to calculate the taxable base

Organizations and individual entrepreneurs separately calculate the base for each employee and for each contractor. The taxable base is calculated on an accrual basis from the beginning of the billing period, which corresponds to one calendar year. In other words, the base is determined during the period from January 1 to December 31 of the current year, then the calculation of the taxable base begins from scratch. The base is determined at the end of each month after salary calculation.

The taxable base for contributions in case of temporary disability and in connection with maternity should not exceed the maximum amount. Its value is approved by law and is indexed annually by decree of the Government of the Russian Federation. In 2015, the size of the maximum base is 670,000 rubles. This means that contributions are accrued until the employee’s tax base reaches 670,000 rubles. Payments in excess of this amount are exempt from contributions. Starting from 2016, the countdown will begin again.

The pension contribution base is not limited. But for payments accrued in excess of the base limit, a reduced tariff is provided (see below). Thus, in 2015, the base for pension contributions is 711,000 rubles. After exceeding this amount, a reduced tariff applies.

The base for contributions “for injuries” is also not limited, and a reduced tariff is not provided here.

The total amount of contributions is equal to the taxable base multiplied by the corresponding insurance tariff (rate).

Insurance rates

For most payers in the period from 2014 to 2016, the contribution rates indicated in the table apply.

Tariffs of insurance premiums in 2014-2016 for payers not belonging to the preferential category

| Taxable base | Pension Fund | FSS | FFOMS | Total |

| Does not exceed the limit value | 22% | 2,9% | 5,1% | 30% |

| Exceeds limit value | 10% | 0% | 5,1% | 15,1% |

Reduced tariffs have been established for some categories of payers. Thus, “simplified workers” who are engaged in certain types of activities (food production, textile production, etc.) in 2014-2018 pay only contributions to the Pension Fund at a rate of 20 percent. Contributions to the Federal Compulsory Compulsory Medical Insurance Fund and the Social Insurance Fund for insurance in case of temporary disability and in connection with maternity are set at zero rates.

Increased rates for contributions to the Pension Fund have been introduced for certain categories of employees. For example, in 2015, a tariff increased by 9 percent is applied to the income of employees engaged in underground work, in hot shops and in work with hazardous working conditions. Moreover, the increased rate applies even to income exceeding the limit. The basis for exempting the policyholder from additional tariffs is the results of a special assessment of working conditions.

Tariffs for contributions “for injuries” depend on the occupational risk class assigned to the organization or enterprise. For example, for food wholesalers, the first risk class and the corresponding insurance rate of 0.2% are established.

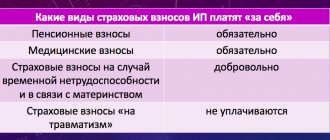

Contributions from the income of entrepreneurs and other “individuals”

There are separate rules for those who work for themselves.

“Individuals” are required to pay pension and medical contributions in a fixed amount, which does not depend on the income of the entrepreneur.

Payments to the pension fund for entrepreneurs and other “private owners” (with the exception of heads of peasant farms) are calculated as follows. If income in the billing period did not exceed 300,000 rubles, then the payment is equal to the minimum wage at the beginning of the year for which contributions are paid, multiplied by the rate of contributions to the Pension Fund and multiplied by 12 months. If income exceeds 300,000 rubles, then the payment is equal to the minimum wage at the beginning of the year, multiplied by the tariff and multiplied by 12 months plus 1% of the amount of income exceeding 300,000 rubles. In this case, the amount should not exceed the maximum minimum wage at the beginning of the year, successively multiplied by 8, by 12 and by the tariff.

For heads of peasant (farm) households, the size of the payment to the Pension Fund does not depend on the amount of income. The payment is equal to the minimum wage multiplied by the tariff and multiplied by 12 months. This value is multiplied by the number of all members of the household, including its head.

The value of the payment to the Pension Fund, established for 2015, is: for individual entrepreneurs and other “individuals” (except for heads of peasant farms), 18,610.80 rubles. plus 1% of income over 300,000 rubles. For heads of peasant (farm) farms, the value of the payment to the Pension Fund is 18,610.80 rubles. regardless of the amount of income.

Fixed payments to the medical fund for everyone, including heads of peasant farms, are calculated using the following formula: the minimum wage at the beginning of the year for which contributions are paid, multiplied by the rate of contributions to the Compulsory Medical Insurance Fund and multiplied by 12 months.

The value of the fixed payment in the Federal Compulsory Medical Insurance Fund, established for 2015, is 3650.58 rubles.

If the calendar year has not been fully worked out, the amount of fixed payments is recalculated based on the time actually worked.

Contributions to the Social Insurance Fund for insurance in case of temporary disability and in connection with maternity are paid only on a voluntary basis. This means that an “individual”, by his own choice, can refuse this type of insurance and not pay premiums. But if he wishes, he has the right to insure himself, and then he will have to transfer fixed payments to the Social Insurance Fund. In 2015, their value is 2075.82 rubles.

Premiums for insurance against industrial accidents and occupational diseases are not paid “for oneself”.

If the activity is temporarily suspended due to leave to care for a child under 1.5 years old, for a disabled person or an elderly person, due to military service on conscription or due to the stay abroad of a spouse of a military man or diplomat, then fixed payments for the period of suspension are not are paid.

Registration and deregistration in extra-budgetary funds

Payers of insurance premiums are persons (organizations, individual entrepreneurs, heads of peasant farms, lawyers, notaries, etc.) who are required to pay contributions for compulsory social insurance. They are also called policyholders

.

Registration of policyholders is carried out by control bodies - territorial branches of the Pension Fund of Russia

and

FSS

.

- At the same time, PFR units keep records of payers of insurance premiums for pension insurance, as well as for compulsory medical insurance ( CHI

). - The bodies of the Federal Social Insurance Fund of the Russian Federation keep records of payers of contributions for disability and maternity.

Payers of insurance premiums must be registered

as policyholders in extra-budgetary funds.

As a general rule, registration of contribution payers is carried out without an application.

When registering a legal entity (LE) or individual entrepreneur (IP), the tax authority (or other registration authority), using the “one window” principle, independently transmits information about new taxpayers to all extra-budgetary funds.

Divisions of the Pension Fund of the Russian Federation and the Federal Insurance Fund of the Russian Federation, in turn, are required to register new policyholders within three days and assign them registration numbers

.

Thus, when registering a new taxpayer, registration with the territorial bodies of extra-budgetary funds is carried out without an application.

, i.e. without personal appeal from legal entities and individual entrepreneurs.

The table reflects information about which fund the registering authority transfers information about the payer to and within what time frame the Pension Fund of the Russian Federation and the Federal Social Insurance Fund of the Russian Federation carry out registration of policyholders.

| Policyholder | Registration period | |

| In the Pension Fund of Russia | In the bodies of the FSS of the Russian Federation | |

| Legal entities | No more than three working days from the date of receipt of information from the tax authority | No more than three working days from the date of receipt of information from the tax authority |

| Individual entrepreneurs, heads of peasant farms | — | |

| Lawyers, notaries engaged in private practice | No more than three working days from the date of receipt of information from the territorial body of the Ministry of Justice of Russia | — |

From a document sent to the policyholder electronically.

A document confirming the fact of registration with the Pension Fund of the Russian Federation (and for organizations - with the Federal Social Insurance Fund of the Russian Federation) is sent to the policyholder in electronic form

with an enhanced qualified electronic signature via TCS, including via the Internet, and to an email address.

Notice of registration with registration number on paper

the payer has the right to receive voluntarily by application. This document is issued upon request within three working days.

Attention!

To find out the registration number, we advise you to request an extract from the Unified State Register (USRLE/USRIP).

The following policyholders are additionally required to register.

- Separate divisions of organizations

- Individual entrepreneurs (heads of peasant farms, lawyers, private notaries) - in case of concluding employment contracts with employees or making payments under civil law contracts

- Separate units

- Individual entrepreneurs

When creating a separate subdivision (SU), the organization must register as an insurer with the Pension Fund of the Russian Federation and the Federal Insurance Fund of the Russian Federation at the location of this subdivision, if the following conditions are simultaneously met:

- the division has a separate balance sheet and current account;

- The division independently calculates payments in favor of employees.

If any of the listed conditions are not met, the policyholder is not registered at the location of the separate unit, and all responsibilities of the separate unit related to the calculation and payment of insurance premiums, submission of calculations of contributions, are performed by the parent organization at its location.

You must submit an application and a package of documents yourself.

To register at the location of a separate unit, the organization must submit the appropriate applications

to the branches of each extra-budgetary fund in the prescribed form:

- application form to the Pension Fund;

- application form to the FSS of the Russian Federation.

To the application, policyholders must attach copies of documents confirming the existence of a separate balance, current account and the accrual of payments and other remuneration to individuals.

Within 30 days from the date of creation of a separate unit.

Applications and documents must be submitted to the territorial body of the FSS of the Russian Federation within 30 days

from the date of creation of a separate division.

The deadline for registering an organization in the territorial branch of the Pension Fund of the Russian Federation at the location of the separate unit has not been established

. However, it is advisable to register the OP before insurance premiums from payments to individuals are transferred for the first time. This will allow you to identify payments from this department.

No later than five days

from the moment of receipt of the application and documents, the bodies of the Pension Fund of the Russian Federation and the Federal Insurance Fund of the Russian Federation must register a separate division as an insurer.

At the same time, in each fund the unit will be assigned an individual registration number (when registering with the Federal Social Insurance Fund of the Russian Federation, it will also be assigned a subordination code). It will be indicated in the registration notice, which is sent to the policyholder by the territorial branches of the Pension Fund of the Russian Federation and the Social Insurance Fund of the Russian Federation.

Attention!

The Pension Fund of the Russian Federation sends two copies of the notice of registration of the OP, one of which must be submitted to the Pension Fund of Russia branch at the location of the parent organization within 10 days from the date of its receipt.

An individual entrepreneur must independently

register with the Pension Fund of the Russian Federation and the Federal Social Insurance Fund of the Russian Federation only in the following cases:

- an employment

or

civil law

with an individual , as well as

an author’s

contract; - in the territorial branch of the Federal Social Insurance Fund of the Russian Federation - upon concluding an employment

contract with the employee.

The procedure for registering lawyers and private notaries is the same as for individual entrepreneurs.

Attention!

Individual entrepreneurs are no different from other employers. They must also enter into employment contracts with employees and maintain their work records.

You must submit an application and a package of documents.

To register as an insurer-employer, an individual entrepreneur must, within the prescribed period, submit to the Pension Fund of the Russian Federation and/or the Federal Social Insurance Fund of the Russian Federation at his place of residence.

a corresponding application with the necessary documents attached.

To register at the Pension Fund

An application and copies of the following documents are submitted at the place of residence:

- an identity document confirming registration at the place of residence;

- certificate of registration as an individual entrepreneur;

- licenses to carry out certain types of activities (if available);

- certificates of registration with the tax authority;

- labor (civil law, copyright) contract with an individual.

For registration at the FSS branch of the Russian Federation

An application is submitted at the place of residence, a passport and copies of the following documents are presented:

- certificate of registration as an individual entrepreneur;

- certificates of registration with the tax authority;

- the employee’s work book with a record of employment with this individual entrepreneur.

Attention!

If an individual entrepreneur who has employees working under employment contracts has already been registered with the funds as an insured employer, then in the future there is

no need

.

The following deadlines for registration in extra-budgetary funds have been established for individual entrepreneurs.

- In the Pension Fund of Russia - within 30 days

from the date of concluding an employment (civil law, copyright) contract with the first employee. - In the Federal Social Insurance Fund of the Russian Federation - no later than 10 days

from the date of concluding an employment contract with the first employee.

No later than five days

from the moment of receipt of the application and documents, the bodies of the Pension Fund of the Russian Federation and the Federal Insurance Fund of the Russian Federation will register the entrepreneur as an insured employer, which will be reported by notifications of registration. The notifications will indicate the registration number in the relevant fund (if registered with the Federal Social Insurance Fund of the Russian Federation, the subordination code will also be indicated).

Attention!

Now an entrepreneur will have two registration numbers in the Pension Fund:

- number assigned upon registration as an individual entrepreneur,

- number assigned to both the employer.

Having hired employees, an individual entrepreneur must pay insurance premiums both for himself and for his employees. In this case, the payment documents will need to indicate the corresponding registration numbers and BCC.

Penalties are applied to policyholders for late registration.

For violation of the established registration period, the following fines are applied to policyholders:

- up to 90 days - in the amount of 5,000

rubles, - for more than 90 days - in the amount of 10,000

rubles.

For carrying out activities by an individual entrepreneur who has entered into an employment contract, without registering as an insured-employer with the Social Insurance Fund, a fine of 10% of the taxable base for calculating contributions for the entire period of activity is levied, but not less than 20 000

rubles

In addition, for violating the registration deadlines, an entrepreneur or an official of an organization may be brought to administrative liability in the form of a fine from 500

up to

1,000

rubles. Administrative liability does not apply to lawyers and notaries.

Attention!

Both the Pension Fund and the Social Insurance Fund can fine the policyholder, or both funds can fine them.

Basically, the Pension Fund of the Russian Federation and the Federal Insurance Fund of the Russian Federation independently deregister policyholders.

The territorial bodies of extra-budgetary funds themselves deregister policyholders based on what they receive from the tax authorities.

data.

This happens in the following cases:

- upon liquidation

or reorganization of an organization; - when an individual entrepreneur ceases his activities;

- when the location

of the organization (place of residence of the entrepreneur) changes, if at the new address it is subordinate to another territorial division of the Pension Fund of the Russian Federation or the Federal Social Insurance Fund of the Russian Federation.

First, the tax authorities enter the relevant information (about termination of activity or change of address) into the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs and send information about this to the branches of the Pension Fund of the Russian Federation and the Federal Social Insurance Fund of the Russian Federation in which the organization or entrepreneur is registered.

After this, these off-budget funds independently withdraw

organization or entrepreneur registered as policyholders.

Information on the time frame for non-budgetary funds to deregister policyholders is given in the table.

| Policyholder | Deadline for deregistration | |

| In the Pension Fund of Russia | In the bodies of the FSS of the Russian Federation | |

| Legal entities | No more than three working days from the date of receipt of information from the tax authority | Within five days from the date of receipt of information from the tax authority |

| Individual entrepreneurs, heads of peasant farms | — | |

| Lawyers, notaries engaged in private practice | No more than three working days from the date of receipt of information from the territorial body of the Ministry of Justice of Russia | — |

When policyholders independently apply for registration.

In some cases, in order to be deregistered, an organization, an entrepreneur, as well as a lawyer and a private notary must themselves apply to extra-budgetary funds to do so. The following policyholders must submit such an application:

- organization upon closure of a separate division

that is registered in extra-budgetary funds; - an individual entrepreneur upon termination of an employment contract

with the last employee.

The Pension Fund of the Russian Federation and the Social Insurance Fund of the Russian Federation deregister such policyholders within the time limits specified in the table.

| Policyholder | Deadline for deregistration | |

| In the Pension Fund of Russia | In the bodies of the FSS of the Russian Federation | |

| Individual entrepreneurs (lawyers, notaries) – employers | No more than three working days from the date of receipt of information from the tax authority | Within 14 days from the date of filing the application for deregistration |

| Legal entities at the location of the separate division | — | |

A document confirming deregistration with the Pension Fund of Russia is sent to the policyholder in electronic form

. To confirm deregistration, receipt by the policyholder of a paper document is not mandatory. This document is issued upon request within three working days.

The procedure for deregistration is not as clearly prescribed by the legislator as the procedure for registration. There is no provision for liability for violating the deregistration procedure. However, you should not delay submitting an application for deregistration, since control authorities will require you to submit reports on the payment of insurance premiums.

To submit an application for deregistration of an organization with the Pension Fund of the Russian Federation and the Federal Social Insurance Fund of the Russian Federation, you need to:

- When closing a division, which has a separate balance sheet, its own current account and itself calculates and pays insurance premiums from payments to individuals.

- If the division has lost the authority to maintain a separate balance sheet, current account or accrue remuneration in favor of individuals.

To deregister an OP, you must submit a corresponding application

to the Pension Fund of the Russian Federation and the Federal Social Insurance Fund of the Russian Federation at the location of the separate unit:

- application form to the Pension Fund;

- application form to the FSS of the Russian Federation.

- Deregistration from the Social Insurance Fund

- Deregistration with the Pension Fund of Russia

- application in the prescribed form;

- notification of registration in the fund;

- copies of documents that confirm the termination of the employment contract with the last employee (copies of the order to dismiss the employee, employment contract, extract from the order register or employee accounting register, etc.).

The application must be accompanied by copies of the decision (order, instruction) on the termination of the activities of a separate division or on the transition to centralized payment of insurance premiums through the parent organization.

The application to the division of the FSS of the Russian Federation must also be accompanied by a notice of registration of the organization as an insurer at the location of the separate division.

In case of termination of employment relations with the last of its employees.

If an individual entrepreneur had hired employees and he terminated his employment relationship with them, he will need to take measures to deregister with the Pension Fund of the Russian Federation and the Social Insurance Fund as an employer.

At the same time, the procedure for deregistration is not as clearly defined as the procedure for registration. For example, there are no deadlines for filing an application for deregistration. There is also no provision for liability for violating the deregistration procedure.

Attention!

While an individual entrepreneur is registered with extra-budgetary funds as an employer-insurant, he, in the opinion of regulatory authorities, retains the obligation to submit reporting documents on the calculation and payment of insurance premiums.

After termination of employment relations with the last of his employees, an individual entrepreneur must submit an application for deregistration to the territorial branch of the Federal Social Insurance Fund of the Russian Federation.

Attention!

If, in addition to employment contracts, an entrepreneur has entered into civil contracts with individuals that continue to be valid and under which the obligation to pay accident insurance premiums remains, then there is no need to deregister.

To deregister from the Social Insurance Fund, you must submit the following documents:

There is no deadline for filing an application for deregistration. It is stipulated that the FSS must deregister an individual entrepreneur within 14 days after submitting documents.

The procedure regulating the registration and deregistration of insurance premium payers with the Pension Fund does not oblige

Individual entrepreneurs contact the Pension Fund when dismissing employees.

But it would be logical for an entrepreneur to de-register with the Pension Fund of Russia branch. After all, when concluding an employment or civil law contract with an individual, the individual entrepreneur submits to the Pension Fund of Russia an application for registration as an insurer.

In any case, we recommend that individual entrepreneurs submit an application to the Pension Fund for deregistration as an employer. Otherwise, according to Pension Fund employees, the individual entrepreneur is obliged to submit zero reports within the established time frame.

How do employers determine the amount to be transferred?

Employers are required to make a mandatory monthly payment of contributions to the Pension Fund, the Federal Compulsory Medical Insurance Fund and the Social Insurance Fund for insurance in case of temporary disability and in connection with maternity. To calculate the payment amount, you need to add up all taxable payments accrued from the beginning of the year until the end of the corresponding calendar month and multiply by the insurance rate. Contributions transferred from the beginning of the year up to and including the previous calendar month should be deducted from this amount. The resulting value is the current monthly payment.

If the employer paid sick leave or maternity benefits to employees during the month, then he can reduce contributions to the Social Insurance Fund for insurance in case of temporary disability and in connection with maternity. As you know, the first three days of sick leave are paid at the expense of the employer, and the rest - at the expense of the Social Insurance Fund. So, from the amount of the monthly payment you can subtract the amount of benefits that are payable at the expense of the Social Insurance Fund. In a situation where benefits exceed contributions, the excess amount can be offset against future payments.

Contributions “for injuries” are also transferred monthly. For some policyholders, the FSS establishes premiums or discounts. In this case, the payment amount increases or decreases based on the amount of the premium or discount.

When and how to transfer contributions

Monthly mandatory payments for pension, medical contributions, as well as contributions for insurance in case of temporary disability and in connection with maternity are transferred no later than the 15th day of the month following the month for which the payment is accrued. Thus, the monthly payment for August must be transferred no later than September 15, the payment for September - no later than October 15, etc.

Contributions “for injuries” from personnel salaries are transferred within the deadline established for receiving salaries for the past month. If the payment of contributions “for injuries” is provided for in a civil contract, then the money is transferred to the Social Insurance Fund within the time period specified in the contract.

Payments must be transferred separately to each fund. At the same time, for two payments to the Social Insurance Fund - “for injuries” and for insurance in case of temporary disability and in connection with maternity - you need to issue two independent payments. Until 2014, pension contributions were also transferred in two payments: to the insurance and funded parts of the pension. Starting from 2014, employers must transfer the entire amount of contributions in one payment, indicating the BCC, intended for accounting for contributions to the insurance part of the pension. Having received contributions, Pension Fund employees independently distribute them into the insurance and savings parts.

“Individuals” transfer pension contributions within the following periods. Contributions in the amount of a single minimum wage, multiplied by 12 and multiplied by the corresponding tariff, must be paid before December 31 of the current year. Contributions calculated from an amount exceeding RUB 300,000 must be transferred no later than April 1 of the following year.

“Individuals” transfer medical contributions no later than December 31 of the current year. And those of them who have voluntarily insured themselves in case of temporary disability and in connection with maternity make transfers to the Social Insurance Fund no later than December 31 of the current year.

If the last date for payment of contributions falls on a weekend or holiday, you can transfer the money on the first working day following it, and this will not be considered late.

Budgetary and extra-budgetary organizations

The budget fund is the main financial system of the state, which is aimed at meeting public needs. The concept of budget also includes targeted budget funds; they are used for specific purposes and cannot be directed to other purposes that do not correspond to their intended purpose.

The role of public funds is to cover costs associated with improvements in production, supporting citizens during crises, and improving the standard of living of the population.

Despite their similar nature, there are a number of differences between targeted budgetary and extrabudgetary funds:

- The main difference is that budgetary funds are part of the budget, while WBFs are not, which is why they are called that.

- The budget of the WBF is established by a separate law for the year, and the volume of finance of target budget funds is regulated by the law on the budget for the year.

- VBFs are created mainly to solve social issues, while budget ones have a narrower focus (development of regions, covering costs, replenishing resources, etc.).

- VBFs are created for a longer period than budget ones.

State budgetary and extra-budgetary funds are an important link in the state financial system. They provide an opportunity to solve problems facing the government, which require significant financial investments. These funds are viewed as a single financial entity that can help improve the state's economy. To do this, it is important to spend their funds wisely.

When to report contributions

For employers, the acceptable deadlines for submitting calculations for accrued and paid contributions to the Pension Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund since 2015 depend on the form in which the reporting is presented: “on paper” or electronically. Thus, you should report to the Pension Fund “on paper” no later than the 15th day of the second calendar month following the reporting period (quarter, half-year, nine months and year). In other words, “paper” calculations generally must be submitted no later than May 15, August 15, November 15 and February 15. If the employer submits calculations electronically, then the report can be made no later than the 20th day of the second calendar month following the reporting month.

In addition, employers are required to report to the Social Insurance Fund. And the way reporting has been done since 2015 also affects the timing. So, “on paper” you should report no later than the 20th day of the calendar month following the reporting period (in general, this is April 20, July 20, October 20 and January 20). If reporting is submitted electronically, then you can report no later than the 25th (that is, five days longer). It is necessary to submit a calculation to the Social Insurance Fund, which contains information on contributions “for injuries” and on contributions for insurance in case of temporary disability and in connection with maternity.

Employers also submit to the Pension Fund so-called personalized reporting - information on insurance premiums and insurance experience. The deadline for its submission is no later than the 15th day of the second calendar month following the reporting period. Moreover, from January 1, 2014, individual (personalized) accounting information is an integral part of the calculation of accrued and paid contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund.

If the last date for reporting falls on a weekend or holiday, you can report on the first working day following it, and this will not be late.

Deduction rules

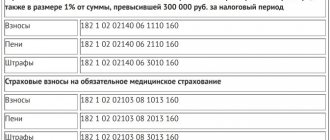

The updated Tax Code - Chapter 34 introduced in 2022 - regulates the relationship between Russian employers and funds: what percentage of contributions to the Pension Fund for employees in 2022, how much to the Mandatory Medical and Social Insurance Funds, and the BCC codes by which transfers are made.

The current fiscal legislation establishes that the employer, be it an organization or an individual entrepreneur who uses hired labor in his activities, is obliged to calculate and pay insurance and social contributions from wages to the state budget, which, depending on their purpose, are sent to the appropriate off-budget funds. The funds are then used as financing:

- pensions and pension savings of Russian citizens;

- free medical care;

- benefits and payments for temporary disability of workers, including maternity.

Let us note that employers must transfer contributions from accidents and occupational diseases to the Social Insurance Fund. The specifics of the application of this type of insurance coverage are enshrined in Law No. 255-FZ.

Use free instructions from ConsultantPlus experts on what you need to know about insurance premiums.

In addition to insurance coverage, employers calculate income tax on wages to the Federal Tax Service, for which a progressive interest rate has been introduced since 2022.

Read more: about new personal income tax rates