In 2022, the rules for filling out payment orders were updated. Some changes take effect immediately, while others take effect later.

At the beginning of the year there were a lot of questions about processing payments in 1C:

- Why is BIC 004525987 not in the bank classifier, but BIC 004525988 and BIC 024501901 are not in 1C?

- Does this change in payments to public sector contractors apply?

We will tell you in this article how changes in filling out payment orders to the budget are implemented in Accounting 8.3.

Rules for filling out payment orders

WITH 01.01.2021

Order of the Ministry of Finance of the Russian Federation dated September 14, 2020 N 199n comes into force. New rules for filling out payment orders are being introduced gradually:

- 01/01/2021 - TIN ( 60

) TIN of 3 persons is NOT allowed, except in certain cases; - 07/01/2021 - UIN (22

); - 10/01/2021 — INN ( 60

), Basis of payment (

106

), Document number (

108

), Date (

109

); - 10/17/2021 - TIN ( 60

), the TIN of a bank, not an individual, is NOT allowed when transferring money through an operator.

Payment

WITH 01.01.2021

the budget switches to a system of treasury payments. This means that when generating tax payments:

- you need to indicate other bank accounts of the Federal Treasury;

- two account fields are filled in: (17) and (15);

- The BIC of the territorial body of the Federal Treasury is filled in (14).

Example of filling out a payment form

During the transition period from 01/01/2021 to 04/30/2021, you can use old and new accounts.

Insurance premiums

From 01/01/2017, all contributions for compulsory insurance of employees, except for contributions for injuries, must be transferred to the Federal Tax Service. For the convenience of payers, the Federal Tax Service website contains information on which BCC to indicate for payments to the budget. To pay insurance premiums for compulsory pension insurance (20%) for June we use 182 1 0210 160.

Payment order details for OPS (20%) for June 2022:

Where:

- field 104 - budget classification code, for example, insurance contribution for compulsory pension insurance;

- field 105 - OKTMO, territory code according to the all-Russian classifier of territories of municipalities at the place of registration of the taxpayer (tax agent);

- field 106 - for current payments, indicate the TP code (current year);

- field 107 - value of the tax period indicator; can take the corresponding value of the period: MC - monthly payments;

- field 108 — document number, in this case it is set to “0”;

- field 109 - date of the document, in this case it is set to “0”;

- field 110 - payment type, not filled in;

- field 24 - purpose, in this case the number of the policyholder in the Pension Fund of the Russian Federation is indicated.

Filling in the details of the Federal Treasury bank according to the BIC classifier

Since release 3.0.87.28, the program has implemented the ability to fill in the details of the Federal Treasury bank using the BIC classifier.

To do this, in the Federal Tax Service Inspectorate card (Directories - Counterparties - Government Bodies) in the Main Bank Account - Bank , indicate the BIC corresponding to your Federal Tax Service Inspectorate (details are given in the Appendix to the Letter of the Federal Tax Service of the Russian Federation dated October 8, 2020 N KCh-4-8 / [email protected] , hereinafter referred to as Appendix).

In the Account Number , indicate the recipient's account number (treasury account number) - column 6 of the Appendix.

This data can be entered from the Payment order by going to the Federal Tax Service card in the Recipient .

After this, when generating the Payment order document (Bank and cash desk - Payment orders), new payment details are automatically entered in the Recipient's account .

If the Payment order created in 2021 contains old payment details, then the Recipient's Account is highlighted in red.

Using the Correct , the program will display the correct details, which can be updated using the button Substitute recommended values .

Is there a correlation between KBK and other payment details?

In general, the legislator does not establish a direct relationship between the BCC and other details of the payment order. However, regulations requiring taxpayers to correlate the KBK instruction with other fields of payment orders may still be issued.

Thus, the Ministry of Finance of Russia, in letter dated January 16, 2015 No. 02-08-10/800, records the relationship between the BCC and requisite 101 - an indicator of the payer’s status in relation to income tax and land tax for legal entities and individuals. This letter states, in particular, that organizations that are members of consolidated groups of taxpayers (or CTGs) are prohibited from indicating statuses other than 21 and 22 when preparing payments with the BCC:

- 000 1 0100 110 (for tax transferred to the federal budget);

- 000 1 0100 110 (for tax transferred to regional budgets).

In turn, taxpayers who are not registered as participants in the corporate tax group cannot use statuses 21 and 22 when using the corporate tax code established for income tax to the federal or regional budgets.

You should not neglect obtaining data on the correct BCC. If the corresponding details are incorrectly specified in field 104, very undesirable consequences may arise from the point of view of the company’s financial position. What could they be?

Payments to the budget to treasury accounts from 01/01/2021

You can specify payment details for transfers to treasury accounts manually (from release 3.0.86).

To do this, in the Federal Tax Service card (Directories - Counterparties - Government bodies) in the Main bank account - Bank the Show all link and go to the Banks .

Click the Create button to create a new bank (the program will offer to select from the classifier - click No ).

Fill in the bank details manually using the Application, click Record and close .

In the Bank , indicate the created bank, and in the Account Number , enter the recipient's account number (treasury account number) - column 6 of the Appendix.

After this, when generating the Payment order document (Bank and cash desk - Payment orders), new payment details are automatically entered in the Recipient's account .

If there is a problem with loading details into 1C, then you should use the recommendations from the discussion New details for paying taxes are not loaded into 1C.

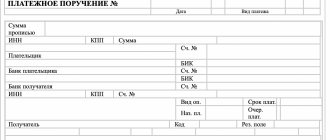

Filling in the fields

INN and KBK details are the most important values in payments. If they are correct, then the payment will most likely go through. Period, payer status, priority - if there are errors in these fields (they didn’t make it in time), then payments almost always go through anyway, but it’s better not to take risks. There are no fines for filling out payment slips incorrectly (it’s your money), but the payment may not go through, in which case you will have to look for it, return it, and possibly pay penalties.

The account (number) of payment orders (above) can be anything and they can be made with the same numbers. But it's better to take turns.

VAT in payment orders is always indicated in the purpose of payment. If it does not exist or cannot exist, it is credited as “Without VAT”.

The order of payment in all examples is fifth, except for salary - there it is third.

Individuals and individual entrepreneurs put “0” in the “Checkpoint” field.

TIN, KPP and OKTMO should not start from scratch.

Since 2015, in the Code field (aka UIN), 0 has been entered in all tax payments (this is the answer to where to get the UIN). A UIN is indicated if the payer’s TIN is not indicated on the payment slips or if payments are transferred at the request of officials. They don’t put anything in the non-tax department.

On the payment order at the bottom in the top line there must be the signature of the manager (IP) or the person acting by proxy. Also, if an organization or individual entrepreneur uses a seal, then it should also be there.

In field 109 (date, below the “reserve field”, on the right) enter the date of the declaration on which the tax is paid. But under the simplified tax system and all funds (PFR, FSS, MHIF) they set 0.

In the detail (field) “110” of the order for the transfer of funds until 2015, the indicator of the type of payment was indicated (“PE” - payment of penalties; “PC” - payment of interest). Now there is nothing indicated there.

From October 1, 2015, instead of “OPERU-1” you need to indicate “Operations Department of the Bank of Russia” in the Recipient’s Bank field for state duties, customs and some other payments.

In the payment order field “Type of op.” (type of operation) is always set to 01.

Fig. Sample of filling out a tax payment order.

Other payments to government contractors

We have public sector contractors. The program does not allow you to open settlement accounts of counterparties indicating the BIC of the UFK instead of the BIC of the bank. How to do this correctly in 1C?

From 01/01/2021, settlements with all budgetary organizations take place through accounts opened with the Treasury (with a transition period until May). Therefore, these changes are relevant for settlements with the budget not only for taxes, but also for other agreements - settlements with public sector counterparties. The algorithm for specifying bank details in 1C: Accounting 8.3 has been implemented since release 3.0.87.28. The algorithm used is that described in Filling out the details of a Federal Treasury bank using the BIC classifier.

Filling samples

All payments

See the full list of payment orders (updated for 2020-2021):

- For a description of the fields and rules for payment orders, see here.

- Sample of filling out a payment order for payment of the simplified tax system in Excel and in Business Pack

- Sample of filling out a payment order (personal income tax for employees) in Excel and in Business Pack

- Sample of filling out a payment order for VAT payment in Excel and Business Pack

- Sample of filling out a payment order for payment of Property Tax in Excel and in Business Pack

- A sample of filling out a payment order for the payment of Income Tax in Excel and in Business Pack

- A sample of filling out a payment order for payment of the Fixed Contribution of Individual Entrepreneurs (PFR and FFOMS) in Excel and in Business Pack

- Sample of filling out a payment order (PFR, Social Insurance Fund contributions for employees) in Excel and in Business Pack

Where can I get a payment order for free? How to fill out a payment order? What types of payment orders are there? I will post here samples of filling out payment slips in Excel for 2020-2021, made using the free Business Pack program. This is a fast and simple program. In addition to payment slips, it also contains a bunch of useful documents. I recommend to all! Especially useful for small organizations and individual entrepreneurs who want to save money. Some additional functions in it are paid, but for payment orders it is free.

To create (for printing) a payment order in 1C Accounting 8, you need to open the “Bank” - “Payment order” menu.

Blank payment form in Excel 29 kb xls.

Individual entrepreneur for himself

Individual entrepreneurs, unlike organizations, can dispose of all proceeds as they wish. Does not have accounting or cash discipline. It is often impossible or unprofitable to withdraw money from the same bank as your current account. Then you can transfer part or all of the funds to any personal account (but only opened in the name of the individual entrepreneur) in another bank - for example, Kukuruza, Sberbank, Tinkoff, Alfa-Bank, etc.

Deadlines It should be noted that non-tax payments can be executed within a week (if you are late, there is no need to redo it), i.e. You can safely bring such a payment to the bank yesterday or the day before yesterday.

Purpose of payment: Top up your own account. Without VAT.

Payer status: Do not indicate anything, because status is needed only for payments to the budget.

Rice..

Fig. Sample of filling out a payment order from an individual entrepreneur to himself in Business Pack.

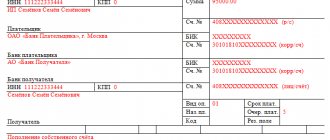

For product/service

A sample payment invoice for a product or service in Excel for 2020-2021 can be issued either with or without VAT. This should be stated on the invoice from your supplier. VAT payment order

Purpose of payment: Funds were transferred to the supplier under contract number 12345, incl. VAT 18% – 1694-92

Purpose of payment: Funds were transferred for services under contract number 12345, incl. VAT 18% – 1694-92

Payer status: Do not indicate anything, because status is needed only for payments to the budget.

Rice..

Fig. Sample of filling out a payment order for a product/service in Business Pack.

Payroll issuance

Sample payment order for salary payment in Excel for 2020-2021.

The employee can choose the bank to receive his salary. To do this, he needs to write a statement.

Purpose of payment: Payment of wages to an employee under an employment contract. Without VAT.

Payer status: Do not indicate anything, because status is needed only for payments to the budget.

Rice..

Fig. Sample of filling out a payment order for salary payment in Business Pack.

Dividend

Please note that this is a payment order for the payment of dividends to the founder in Excel for 2020-2021, and not personal income tax on the dividend. Only an organization can pay dividends and only according to accounting data after the distribution of profits.

Purpose of payment: Payment of dividends to the manager. Without VAT.

Payer status: Do not indicate anything, because status is needed only for payments to the budget.

Rice..

Fig. Sample of filling out a payment order for dividend payment in Business Pack.

To the tax office

Payment order for taxes in Excel for 2020-2021. By law, only the Organization itself (IP) can pay its taxes. It is prohibited to transfer taxes for another person (except when it comes to a tax agent for personal income tax).

Deadlines The date on the tax payment must strictly correspond to today’s date, otherwise the bank will not accept it. The payment is considered executed for the regulatory authorities on the date indicated on it. And when the money arrives at the tax office is no longer important to you. It can take a week.

Where can I get tax details? On the tax website there is a service for generating payment slips with the choice of tax office.

Since 2016, we have not put anything in field 110 (it was 0). See the picture.

In 106 they sometimes require you to write TP. In field 107, some banks ask you to write the period for which the tax is paid - for example GD.00.2016. See the list of periods here.

Purpose of payment: personal income tax on employee salaries. Without VAT.

Purpose of payment: personal income tax on the founder's dividend. Without VAT.

Purpose of payment: Advance payment of income tax for 2015. VAT excluded.

Basis of payment: Advance payment for the simplified tax system for 2015. Excluding VAT.

The payment for penalties and fines is the same as when paying taxes, only the BCC differs by one digit, see here.

Payer status: 01 - for organizations / 09 - for individual entrepreneurs (if paying their own taxes).

Payer status: 02 - for organizations / 02 - for individual entrepreneurs (if personal income tax (on salary or dividend) is paid for employees (founders) as a tax agent).

KBK and what payment period (field “107”) to write, see here.

Rice..

Fig. Sample of filling out a payment order to pay taxes in Business Pack.

Insurance premiums: Pension Fund, Compulsory Medical Insurance Fund and Social Insurance Fund

Attention! Starting from 2022, the new KBK and the new recipient of contributions are not the Pension Fund of Russia, but the Federal Tax Service. Even contributions for December must be transferred according to the new BCC to the Federal Tax Service (except for contributions to the Social Insurance Fund for injuries). Here you can find out the details of your Federal Tax Service.

Also, starting from 2022, it is necessary to indicate the period for which contributions are paid - for example, MS.10.2018.

Since 2016, we have not put anything in field 110 (it was 0). See the picture.

In 106 they sometimes require you to write TP. In field 107, some banks ask you to write the period for which the fee is paid - for example, GD.00.2016. See the list of periods here.

Payment orders for the payment of insurance premiums for compulsory pension insurance (PFR), Compulsory Medical Insurance, Social Insurance Fund in Excel for 2020-2021. By the way, I have good (and free) instructions for RSV-1 and 4-FSS.

Purpose of payment: Contributions are transferred to the Pension Fund for the insurance part of the pension for 2015 for individual entrepreneur Reg. No. 071-058-000000. Without VAT. (IP contributions can be calculated using this free calculator)

Purpose of payment: Contributions to the FFOMS for 2015 for individual entrepreneurs Reg. No. 071-058-000000 are transferred. Without VAT. (IP contributions can be calculated using this free calculator)

Purpose of payment: Contributions are transferred to the Pension Fund for the insurance part of the pension for the 4th quarter of 2015 for employees Reg. No. 071-058-000000. Without VAT. (I recommend a salary calculator, with which you can calculate all contributions and even sick leave and vacation pay)

Purpose of payment: Contributions to the FFOMS for the 4th quarter of 2015 for employees Reg. No. 071-058-000000 are transferred. Without VAT. (I recommend a salary calculator, with which you can calculate all contributions and even sick leave and vacation pay)

Basis of payment: Contributions to the Social Insurance Fund for the 4th quarter of 2015 for employees Reg. No. 071-058-000000 are transferred. Without VAT. (I recommend a salary calculator, with which you can calculate all contributions and even sick leave and vacation pay)

Deadlines. The date on the payment slip for payment of insurance taxes must strictly correspond to today’s date, otherwise the bank will not accept it. The payment is considered executed for the regulatory authorities on the date indicated on it. And when the money goes to the funds is no longer important to you. It can take a week.

Payment order penalties and fines are the same as when paying tax, only the KBK differs by one digit, see here.

Payer status: 08 - for individual entrepreneurs. If the payment of insurance premiums is for the individual entrepreneur himself.

Payer status: 01 - for organizations / 09 - for individual entrepreneurs (If payment of insurance premiums for employees) (letter of the Federal Tax Service dated 02/03/2017 No. ZN-4-1 / [email protected] ) (Order of the Ministry of Finance dated April 5, 2022 No. 58n) .

KBK and what tax period of the payment order to write, see here.

Rice..

Fig. Sample of filling out a payment order for the payment of insurance premiums to the Pension Fund of the Russian Federation in Business Pack.

How long should payments be kept?

Within 6 years after the end of the year in which the document was last used for calculating contributions and reporting (Clause 6 of Part 2 of Article 28 of the Federal Law dated July 24, 2009 No. 212-FZ) or 5 years (clause 459 Order of the Ministry of Culture of Russia dated August 25 .2010 N 558)

Let me remind you that all these payments can be edited in Excel or using this free program: Business Pack.

Other

You can generate a receipt for payment of the state duty on the Federal Tax Service website (for example, an extract from the Unified State Register of Legal Entities). There you can also see the details for the payment for state duty.

Sample Payment Order to Court

Payment orders for writs of execution from 09/27/2021

From September 27, 2021, organizations have an obligation to transfer deductions under writs of execution to the deposit of the bailiff service. This must be done if

- the writ of execution was received not from the claimant (recipient), but from the bailiff service;

- collection refers to one-time payments, i.e. a one-time demand for payment in a fixed amount is issued, while payments from the debtor can be withheld periodically;

- the amount of recovery is more than 100 thousand rubles.

The payment must be transferred within 3 days from the date of payment of income to the debtor (Part 3 of Article 98 of the Federal Law of October 2, 2007 N 229-FZ).

Example of a payment order

On September 27, the Organization received a writ of execution from bailiffs to withhold from employee Kotelkov I.I. debt under the loan agreement in the amount of RUB 300,000.

On October 11, after salary payment, the first payment in the amount of 30,000 rubles. credited to the deposit of the bailiffs according to the specified details of the writ of execution.

Create a payment order in 1C from the Bank and cash desk - Payment orders section. PDF

Please pay attention to filling out the fields:

- Type of transaction - Other write-off ;

- Link TIN, KPP of the payer - change the values of the organization to the TIN of the debtor, KPP - 0;

- Recipient, Recipient's account - from the details specified in the writ of execution;

Make sure to fill out field 16 (Recipient) of the payment order:

In the Counterparties , the bailiff service must have the Counterparty Type - State body .

Follow the Bank accounts and continue filling out fields 16, 24 (Purpose of payment) of the payment order. PDF

- link KBK and OKTMO - flag not necessary to indicate payment details to the budget PDF

- Expense item - predefined - Payment of wages or create your own with the movement type Payroll ;

- Priority - 4 (for alimony - 1 );

- Payment ID - indicate if the writ of execution contains a UIN, for example, in cases where the debtor does not have a TIN.

If the debt is not paid in full, you can set up reminders for periodic payments in Organizational Tasks .

To do this, in the payment header, follow the link Repeat payment? and set the flag.

After receiving a bank statement based on the Payment Order , create a Debit from the current account .

Please indicate:

- Debit account — 76.41.

Please note that for account 76.41 the subaccount Counterparties - FSSP will be filled in. Make sure that in the Payroll the deduction is calculated for the same subaccount.

If the debtor employee does not have a Taxpayer Identification Number (TIN), enter 0 in field 60. When filling out 0 in field 60, 0 in field 22 (or legal registration code), and in field 108 indicate the employee’s identifying information. It could be, for example, the SNILS number (Letters of the Bank of Russia dated 05/19/2021 N 45-19/2414, Letters of the Russian Treasury dated 04/29/2021 N 01-00-07/9973).

The specified BCC is incorrect. To which agency should the application for clarification be sent?

Let's consider the taxpayer's procedure for correcting the corresponding error if an incorrect BCC is indicated in a payment order.

Where should you go if you discover an error in a payment order, in particular when specifying the KBK, with a request to clarify the transfer? There are 2 options:

- to the department to which the payment was originally addressed;

- to the department administering the tax or contribution that corresponds to the BCC specified in the payment order.

You can view a sample application for clarification of payment to the Federal Tax Service in the Typical Situation from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Option 1 is suitable for those cases when the payment order contains a completely incorrect BCC or, for example, is not indicated at all. If the order specifies the authority to which the payment was sent, then the request to adjust the payment must be made there (Clause 7, Article 45 of the Tax Code of the Russian Federation).

In turn, if the payer made a mistake with the BCC, but indicated one that corresponds to one of the existing taxes, contributions or fees, it may be necessary to contact the department that administers the payment for this BCC for correction.

Thus, in the framework of arbitration case No. A40-1065/14, the plaintiff attempted to restore his right to return the overpayment to the budget for insurance premiums, which arose as a result of the indication in the relevant payment orders of the KBC for taxes. That is, the payment, on the one hand, was intended for the Pension Fund of Russia, but the KBK indicated those that involve the transfer of funds to the Federal Tax Service for tax purposes.

As a result, the funds fell into the category of unknown in the Federal Treasury. The company had to pay contributions to the Pension Fund again, but the payer decided to return the amounts that corresponded to the “tax” KBK.

The company applied to the Federal Tax Service with a request to return the corresponding payment. However, the tax authorities refused to accept it, sending the applicant to the Pension Fund. The taxpayer was unable to immediately contact the Pension Fund. By the time the company applied to the fund, 3 years had expired, during which it was legally possible to return the overpayment. As a result, the Pension Fund of Russia refused to reimburse the taxpayer.

The courts of the 1st and 2nd instances confirmed the position of the Pension Fund. However, the cassation instance - the Arbitration Court of the Moscow District - in its decision dated May 27, 2015 No. F05-5994/2015, made a different decision.

The cassation indicated that, according to Art. 160.1 of the Budget Code of the Russian Federation, the authority to make decisions on the return of overpayments is vested in the revenue administrator. Since the payment order for insurance funds, which the plaintiff drew up, indicated the “tax” KBK, the court considered that it was the Federal Tax Service that should have become the administrator of the corresponding income. In this regard, the tax authorities should not have refused the payer to return the erroneously transferred funds.

As a result, the arbitration found that the plaintiff had not missed the 3-year deadline for returning the payment, and ordered the Federal Tax Service to pay the taxpayer the excess payments.

Change in payer status and payment grounds when transferring to the budget from 10/01/2021

The program has added the ability, when transferring funds to the budget, to indicate information about the payment according to the rules in force from 10/01/2021 (Order of the Ministry of Finance of the Russian Federation dated 09/14/2020 N 199n).

Changes have been made in accordance with Order of the Ministry of Finance of the Russian Federation dated September 14, 2020 N 199n (from release 3.0.86):

- the list of payer statuses has been reduced (101);

- the list of payment grounds (106) when transferring to tax and customs authorities has been reduced;

- document number format (108), if the payment basis is “ZD”.

Starting from 10/01/2021 in the Payment order document (Bank and cash desk - Payment orders) Payment details are filled in taking into account the changes.

Please indicate:

- Payer status —select status from the list, taking into account changes; PDF

- Basis of payment - select the basis of payment from the list, taking into account changes; PDF

- When indicating the basis for the payment of the DA (for example, at the request of the Federal Tax Service): Date - date of repayment of the debt upon request;

- Document number —requirement number in the new format;

- Document date —request date.

More details about the payer status - What payer status code should the individual entrepreneur indicate in the payment order when paying fixed insurance premiums from 10/01/2021 - 09 or 13?

What is indicated in field 104

In field 104 of the payment order the following can be recorded:

- KBK, which means “budget classification code” (clause 3 of Appendix 4 to Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n).

- 0 - in the absence of a BCC or in cases where funds are transferred to the accounts specified in clause 2 of Appendix 4 to Order No. 107n.

The application of the 2nd norm is relevant in cases where the payment is credited to the balance account:

- 40501 (opens to federally owned organizations);

- 40601 (opens to organizations in any form of state ownership, except federal);

- 40701 (opens to non-governmental organizations);

- 40503 (opens for federally owned NPOs);

- 40603 (opens for NPOs that are in any form of state ownership, except federal);

- 40703 (opens to NPOs that are not state owned).

Thus, most often it is the BCC that is indicated in field 104. It must be correct. First of all, from a structure point of view.

ConsultantPlus experts explained which BCCs to indicate in a payment order for the payment of taxes and insurance premiums. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

How to prepare a payment order for personal income tax payment

Let's look at how to correctly fill out a payment order for the State Budgetary Educational Institution DoD SDYUSSHOR "ALLUR" according to the fields. The amount of income tax for July 2022 was 105,000 rubles.

Field 4. Date of payment. The tax must be paid within the established deadlines. For benefits and vacations, create a payment slip no later than the last day of the month for which payments were made. When transferring wages or other income, set a date no later than the day following the day of payment of income to the employee (paragraphs 1 and 2 of paragraph 6 of Article 226 of the Tax Code of the Russian Federation).

We fill out fields 6 and 7 without kopecks, since the tax is calculated and transferred in rubles: 105,000-00 rubles.

In prop 22 put “0”.

Set the payer status (detail 101) to “02”, since the organization acts as a tax agent for employees receiving salaries.

KBK (detail 104) for personal income tax payment - 182 1 0100 110.

105 cell. OKTMO for your organization must be clarified with the tax office. Cell 106: basis for payment - TP (current period).

107 field. Tax period: MS.07.2022. If we transfer tax on vacation pay or benefits, write down the month and year for which the transfer occurred. In columns 108 and 109 we enter “0”, since there is no data to fill out. 110 field is empty.

A fully completed sample payment order for personal income tax payment looks like this.

Sample payment order fields in 2022

In electronic form, a payment order can usually be found in two formats: Word and Excel. We also suggest using the online service to automatically fill out all the columns of the payment order.

Payment order, download in Word format : form and sample

Payment order, download in Excel format: form and sample

Obligations of the bank and the payer

When making a payment from a current account in a banking organization, when using a payment order, obligations arise for both the payer and the financial organization. There is a certain procedure for filling out the details; the payer is absolutely obliged to follow them when making non-cash payments. If he intentionally or carelessly violates this rule, the payment order may not be executed. This norm is regulated by Article 864 of the Civil Code of the Russian Federation.

By accepting this document for execution, the bank undertakes to transfer the specified amount of payment from the payer's account to the recipient's account using the specified details. This obligation is regulated by the Civil Code in Article 863 paragraph 1.