About legal entities

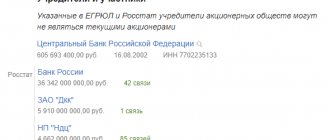

Structure of an extract from the Unified State Register of Legal Entities The generated extract from the Unified State Register of Legal Entities contains the following sections: Name.

What it is? Insurance payments under compulsory motor liability insurance are the money that the owner of the car receives,

Let's start with the fact that from the point of view of the Tax legislation of the Russian Federation it is arrears. So, arrears

The employer’s obligation to organize medical examinations of employees The current provisions of regulations establish the employer’s obligation to carry out

Executing an order to change the surname of an employee Order to change the surname in connection with joining

Any enterprise, regardless of the scope of its economic activity, requires accounting. It is required for

Reasons for salary indexation in 2022 Indexation is an increase in the current salary by

Deadlines for submitting SZV-M adjustments Currently, absolutely all companies and individual entrepreneurs that carry out

The taxation system in the form of a single tax on imputed income (UTII) is one of

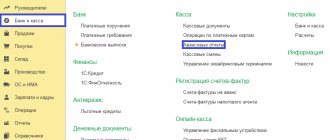

Restoration of VAT previously accepted for deduction - what is it? When purchasing goods (works, services)