Regulatory base of deductions

All types of legal deductions from employee income are enshrined in current legislation. First of all, the specifics of applying deductions from wages are prescribed in the Labor Code of Russia, namely in Articles 130, 136–138 and 248 of the Labor Code of the Russian Federation. In addition to labor legislation, the procedure for withdrawals is regulated in the Tax and Family Codes of the Russian Federation, as well as in some federal laws:

- Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings”.

- Law of July 21, 1997 No. 118-FZ “On Bailiffs”.

- Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity.”

- Law of May 19, 1995 No. 81-FZ “On state benefits for citizens with children.”

It is these legal acts that provide the legislative basis for regulating issues related to deductions from the earnings of Russian citizens.

Situations in which tax is not withheld

In some cases, it is not possible to withhold tax. For example, when a store organizes a drawing for prizes, which include its own products. It could be a smartphone. In this case, no money is paid to anyone, so no tax can be collected. In accordance with current legislation, the trading platform is obliged to report the winnings to both the winner and the Federal Tax Service. This should be done before the first month of spring, which follows after the drawing.

Types of deductions from wages

The current regulatory framework provides for the following types:

1. Mandatory deductions from wages are types of investigations from the wages of Russian citizens, which are carried out on the basis of legislative norms. For example, personal income tax, which must be withheld from almost all types of income and receipts in favor of individuals.

Mandatory deductions include not only personal income tax, but also deductions from wages based on a writ of execution: alimony, deductions from the earnings of convicted citizens. The key difference from other types is the presence of a legislative or administrative document on the basis of which deductions are made from debtors. An administrative document means a court decision, enforcement proceedings, a writ of execution, etc.

2. Optional - this is a type of deduction from earnings that is made by order of the employer, by agreement between the employer and the employee.

By decision of the employer, amounts excessively transferred to citizens, for example, as a result of a counting error, may be withheld from the income of subordinates. Also, money may be withheld from workers’ earnings in the following cases:

- by order of the body for resolving individual labor disputes, if the employee’s guilt in causing damage, failure to perform duties, or downtime has been established;

- a court ruling established that the employee’s wages were paid in excess due to his failure to fulfill his official duties;

- by decision of the employer, the unearned advance payment transferred towards future wages is withheld;

- by order of the employer, unspent and (or) unconfirmed advances for travel expenses, accountable amounts, and similar payments are withheld;

- compensation to the employer for material damage by financially responsible persons, etc.

There are many reasons for unnecessary wage garnishments. Let's look at some situations in more detail.

3. Voluntary - any type of deduction from earnings made at the employee’s own request, be it the transfer of additional insurance contributions to the funded part of a labor pension, trade union dues or amounts of voluntary donations.

The main difference from other types is the presence of a statement from the employee, which indicates the conditions, amounts and purposes of the withheld amounts. An approximate sample can be downloaded at the end of the article.

4. Special or individual - this is a separate type of penalties that are provided for by local regulations of employers. For example, a company has introduced a penalty for being late. Please note that such penalties are not provided for in current legislation. Officials consider such deductions illegal. However, some employers continue to introduce a system of fines into the wage system.

General rules and restrictions

The responsibility to withhold funds from citizens' earnings is assigned to persons who accrue and pay income. For the most part, this function is performed by employers.

Withhold money from earnings based on key principles:

- Calculate personal income tax taking into account the requirements of fiscal legislation. Consider the taxpayer’s right to benefits, refunds, tax deductions and concessions.

- Income tax calculated on material benefits or income in kind cannot exceed 50% of earnings. This opinion was expressed by the Federal Tax Service in Letter No. BS-4-11 dated October 26, 2016/ [email protected]

- Calculate the amount to be collected (except for tax) from the amount of salary minus personal income tax. That is, income tax is withheld first. And only then are all other types of enforcement proceedings applied to the amount received.

- The maximum amount of recovery under writs of execution in terms of alimony, compensation for harm to health or damage in connection with the death of the breadwinner is 70%.

- The maximum amount of penalties for writs of execution on other grounds is set at 50% of income.

- When withholding at the request of the employee, no maximum restrictions are established. Any amount specified in the application may be collected. Such standards were outlined by Rostrud in Letter No. PG/7156-6-1 dated September 26, 2012.

- The maximum amount of any other penalties is 20%.

Example. An accounting error was made regarding the employee (a shortage was identified, the advance was overpaid, the report was not confirmed). The employer can withhold no more than 20% of the salary per month until the debt is fully repaid. However, if enforcement proceedings are already in force against this employee, for example, 25% for alimony, then it is unlawful to withhold the overpayment. Maximum withholding limits are not cumulative.

When to check tax withholding:

- At the beginning of the year

- If tax laws have changed

- For Lifestyle Changes: Lifestyle Changes – Marriage, Divorce, Birth or Adoption of a Child, Buying a Home, Retirement, Chapter 11 Bankruptcy

- Wage income - You or your spouse started or stopped working or started or stopped a second job.

- Taxable income not subject to withholding - interest income, dividends, capital gains, self-employment income, individual retirement account (IRA) distributions (including some Roth IRAs)

- Income adjustments—IRA tax deduction, student loan interest deduction, child support expenses

- Itemized Deductions or Tax Credits – Medical expenses, taxes, interest expenses, charitable donations, dependent care expenses, student tax credit, child tax credit, earned income tax credit

Collection procedure: table

What is the correct way and in what order to collect amounts from the earnings of subordinates? The table will help you figure it out:

| Queue number | Types of deductions | Maximum amount of deduction (based on the employee’s income minus personal income tax) |

| First of all | Alimony according to executive documents in favor of minor children, unemployed spouses or elderly parents | 70 % |

| Writs of execution for compensation for harm caused to health | ||

| Enforcement proceedings for compensation of damages in connection with the death of the breadwinner | ||

| Writs of execution for compensation of damage caused by a crime | ||

| First of all | Enforcement proceedings for compensation for moral damage | 50 % |

| Second stage | Enforcement papers and proceedings for withholding severance pay and wages of persons working (working) under an employment contract | |

| Withholding in enforcement cases of payments of remuneration to the authors of the results of intellectual activity | ||

| Third stage | Enforcement proceedings on mandatory payments to the budget and extra-budgetary funds | |

| Fourth stage | Withholding under enforcement documents for all other claims (for example, collection of a bank loan debt, collection of an administrative penalty in the form of a fine, compensation for property or material damage to the employer) |

If several sheets have been initiated against one individual, follow the rules:

- the requirements of each subsequent queue are satisfied only after the requirements of the previous queue are satisfied in full;

- within one queue (including in the presence of several writs of execution), claims are satisfied in proportion to the amount due to each claimant.

IMPORTANT!

No taxes, fees or contributions need to be withheld from amounts due to the claimant, unless otherwise provided by the requirements of the writs of execution.

How to withhold tax under a GPC agreement in 2022 and fill in the withholding date in 6-NDFL?

Payment of income to an individual under a civil law agreement (GPC) is also a reason for calculating and withholding personal income tax, as in the situation with “salary” income.

Learn about the distinctive features of a work contract from the material “Civil contract with an individual.”

It should be noted that for the purposes of personal income tax in general and the calculation of 6-personal income tax in particular, the accrual dates for the specified types of income (p. 100) differ:

- for salary (income received by an employee for performing a job function within the framework of an employment contract), this is the last day of the month for which it is accrued;

- for income under a GPC agreement (payment for work performed) - the day it is received.

Despite the indicated differences in the date of tax calculation, the date of withholding in the situation of payment of income under a civil process agreement is determined similarly to the date of taxation under an employment contract, as the day of payment of remuneration. This means that when filling out the calculation regarding income from GPC, the dates in lines 100 and 110 will coincide.

Meanwhile, the GPC agreement has one feature that affects the reflection of the tax date in 6-NDFL.

If the contractor receives advances from the customer during the period of performance of work (provision of services), they are equated to income and are subject to personal income tax, regardless of their amount, payment period and other conditions.

We will discuss how GPC advances affect the UN date filled out in 6-NDFL in the next section.

Retain without fail

These types of deductions include all amounts withheld by the employer from the earnings of a subordinate on the basis of legislation. That is, part of the earnings was withheld by force of law.

Personal income tax

The employer in this case acts as a tax agent and withholds the calculated income tax in the amount provided for by the Tax Code of the Russian Federation. For Russian citizens (residents of the Russian Federation) the tax rate is 13%.

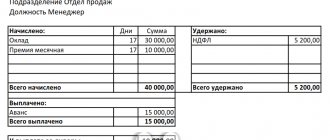

Example 1.

Let's look at an example of how income tax is withheld from wages.

In September 2022, the following were accrued in favor of Ivan Petrovich Berezkin:

- salary in the amount of 50,000 rubles;

- disability benefits - 17,500 rubles;

- vacation pay - 45,000 rubles;

- financial assistance - 4000 rubles.

Berezkin does not have the right to tax deductions from wages.

Personal income tax calculation:

- For salary: 50,000 × 13% = 6,500 rubles.

- For sick leave: 17,500 × 13% = 2,275 rubles.

- For vacation pay: 45,000 × 13% = 5850 rubles.

- Financial assistance up to 4000 rubles. inclusive of personal income tax. Read more: “Is material assistance subject to personal income tax?”

In total, from Berezkin’s total income of 116,500 rubles (50,000 + 17,500 + 45,000 + 4000), 14,625 rubles will be withheld.

IMPORTANT!

Insurance contributions are not deducted from wages. The rule applies to all types of standard insurance coverage for citizens (OPS, OPS, VNiM and NS and PZ). Voluntary contributions, on the contrary, are deducted directly from the salary and other income of a specialist.

Deductions under a writ of execution from wages

Let us note that in terms of seizures under writs of execution we are talking not only about the collection of alimony in favor of minor children or elderly parents, but also about collections in favor of paying off overdue accounts payable (for example, proceedings on a mortgage or consumer loan), payment of administrative fines and other forms deductions under a writ of execution from wages in favor of legal entities and (or) individuals.

IMPORTANT!

In accordance with Art. 138 Labor Code of the Russian Federation, art. 99 of Law No. 229-FZ, deductions under writs of execution in terms of alimony, compensation for harm to the life and health of citizens, compensation for loss of a breadwinner cannot exceed 70% of total income. Research for other types of writs of execution - no more than 50% (writ of execution for repayment of debt under an agreement, loan, compensation for moral damage). Other types of deductions cannot exceed 20% of earnings (for example, compensation for shortfalls, correction of accounting errors, etc.).

Example 2. Writ of execution, alimony.

Let's look at a similar example of how to withhold alimony from your salary.

At the end of August 2022, the employer received three writs of execution against employee Kreditovaya Irina Pavlovna. The total debt amounted to 410,000 rubles, including in favor of:

- enforcement proceedings of Bank of Russia OJSC - 210,000 rubles;

- enforcement case of OJSC "Credit to everyone" - 120,000 rubles;

- executive papers of JSC "Loans bystry" - 80,000 rubles.

According to the terms of the writ of execution, deductions should be made monthly until the loan debt to the bank is fully repaid, but not more than 50% of the amount of income per month.

Earnings for September amounted to 46,500 rubles.

IMPORTANT!

The calculation of the amount of how much to withhold under writs of execution is made after calculating personal income tax! There is no need to issue additional orders or obtain the employee’s consent.

Calculation of deductions:

46,500 – (personal income tax 46,500 × 13%) = 40,455 rubles.

Amount of deductions: 40,455 × 50% = 20,227.50 rubles.

We distribute the amount between banks as a percentage of the total amount of debt:

- Writ of execution of OJSC Bank of Russia: 20,227.5 × (210,000 / 410,000 × 100%) = 20,227.5 × 51.2% = 10,356.48 rubles.

- Executive documentation of Credit to Everyone OJSC: 20,227.5 × (120,000 / 410,000 × 100%) = 20,227.5 × 29.3% = 5926.66 rubles.

- Implementation requirements of JSC Loans bystro: 20,275.5 × (80,000 / 410,000 × 100%) = 20,227.5 × 19.5% = 3944.36 rubles.

Next, the employer will repay debts to banking organizations until the resulting debt in enforcement cases is fully repaid.

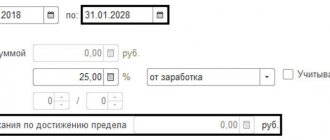

Alimony by agreement

The provision of minor children is not always paid by parents according to writs of execution. In some situations, the employer withholds money from the employee's earnings under a notarial agreement. This agreement is concluded between the parents of a minor child in the presence of a notary. It specifies the amounts, frequency of payments, as well as other conditions.

How to withhold alimony from your salary, example 3.

Sergey Nikiforovich Ivanov entered into a notarial agreement with his wife Ivanova Marya Yakovlevna to pay alimony for their minor children Alena and Peter. The amount of monthly payments in favor of children is 35% of S.N. Ivanov’s income.

Official salary of Ivanov S.N. — 100,000 rubles, worked for a full month.

Calculation:

100,000 – personal income tax 13% = 87,000 rubles.

87,000 × 35% = 30,450 rub. - transferred alimony in favor of minor children.

Let us note that it is possible to withhold alimony in favor of an employee’s minor children on the basis of his application, and not only by agreement or enforcement proceedings.

Application for deduction from wages (sample)

Voluntary contributions

Some amounts may be withheld from employees on a voluntary basis. For example, trade union dues that an employee decided to transfer to a trade union organization. Or voluntary contributions for insurance coverage of citizens. The most common option is to pay contributions to form the funded part of the pension to non-state pension funds.

The group also includes amounts withheld from an employee in order to repay loans, credits and credits previously issued by the enterprise. For example, a specialist received an interest-free loan from an employer. It is repaid through deductions from accrued wages in a fixed amount.

Withholding of any amounts based on a written statement by the employee, as well as by agreement between the employee and his employer, also falls into the group of voluntary penalties.

Income tax withholding

In recent years, changes have been made in tax legislation regarding transfers of funds to the state treasury. At the same time, calculations and deductions remained the same. The changes affected only the terms of accrual to the budget. As a result, payments are made before wages are issued. Holidays and weekends are taken into account. The deadline including vacation pay is no later than the last day of the month. Typically, state-owned companies pay employees twice a month:

- Advance – remuneration for the first half of the month, which was worked out

- The final payment is for the second half of the month, which was worked out

Many people have a question: should tax be withheld from the advance payment? The answer is no, there are no taxes charged on it. They are paid only from the full income of citizens.

How to recover accountable amounts

Overpayment of an advance on travel expenses or on accountable money is a common situation. It is almost impossible to plan future expenses down to the penny, so unspent accountable funds are constantly encountered in the work of an accountant.

In fact, the employee must return the money himself. But this is ideal. If a subordinate does not want to return the accountable money on his own, the employer can withhold the overpayment from his earnings.

IMPORTANT!

You can deduct from your salary not only the amount of overpayment, but also the debt on an unapproved advance report. For example, if the employer did not approve the advance report due to the lack of supporting documentation.

The action plan is outlined in the Letter of Rostrud dated 08/09/2007 No. 3044-6-0. To make deductions from wages of accountable amounts:

- within one month from the date of expiration of the period for compensation of the resulting overpayment, issue an order to withhold money from the employee’s salary.

IMPORTANT!

If the deadline is missed, then it is unlawful to collect accountable amounts from earnings. In such a situation, the overpayment can only be reimbursed through the court.

- After issuing a deduction order, familiarize the debtor with the order against signature. The employee must state in the order that he agrees with the collections from the salary. Otherwise you will have to go to court.

Accountable money that is not returned to the employer is not the employee’s income and is not subject to personal income tax, since it is a debt to the employer.

If the employee does not repay the debt on accountable money within a month from the date of expiration of the period established for their return, charge insurance premiums on the unreturned amount. The premiums can then be offset if the employee does not repay the money. Or return it if the accountant provides supporting documents (Letters from the Social Insurance Fund dated April 14, 2015 No. 02-09-11/06-5250, Ministry of Labor dated December 12, 2014 No. 17-3/B-609).

Understanding Tax Withholding

What wages are subject to tax withholding?

- Your regular salary, commissions and vacation pay.

- Reimbursement and other allowances for expenses paid under a non-accountable plan.

- Pensions, bonuses, commissions, gambling winnings and some other types of income.

How to calculate your tax withholding amount

This value depends on the following:

- The amount of income you earn.

- The three types of information you give your employer on Form W-4, Employee Withholding Tax Credit Certificate. Your tax status : If withholding is at the single rate or a lower rate for married individuals.

- The number of specified tax discounts taken into account when determining the amount of tax withholding by the employer from employees' wages : each specified tax discount reduces the amount of tax withholding.

- If you withhold an additional amount : You can request that an additional amount of tax be withheld from each paycheck.

Note. You must indicate on Form W-4 your tax status and the number of tax credits you have taken into account when determining how much your employer withholds taxes from employee wages. You cannot provide just the dollar amount of taxes withheld.

Resources

- Pay taxes as you go to avoid debt (English)

- Estimated tax

Publications (English)

- Publication 15 (Circular E), Employer Tax Guide (English) - contains PDF withholding tables

- Publication 505, Withholding and Estimated Taxes (English)

- Publication 5307, Tax Reform Essentials for Individuals and Families (English) PDF

Tax forms

- Tax Form 1040-ES, Estimated Tax (For Quarterly Payment) for Individuals

- Form W-4, Employee Withholding Tax Credit Certificate

- Form W-4 P, Withholding Certificate for Pension and Annuity Payments (English)

- Form W-4S, Requesting Federal Income Tax Withholding from Health Benefits (English)

- Form W-4V, Request for Voluntary Withholding (English)

How to keep records

Account for deductions from wages using the following standard entries:

| Operation | Debit | Credit |

| Salary accrued | 20 | 70 |

| Personal income tax withheld | 70 | 68 |

| The amount under the writ of execution was withheld | 70 | 76.41 |

| The amount under the writ of execution is transferred in favor of the recipient | 76.41 | 51 |

| Amounts of unused sub-report are withheld | 70 | 71 |

| Repayment of the issued loan is reflected | 70 | 73.1 |

| Union dues withheld | 70 | 76 |

Tax Withholding Change

To change your withholding taxes, you can use the results of the Withholding Tax Estimator to determine whether you should:

- Complete a new Form W-4, Employee Withholding Tax Credit Certificate, and give it to your employer.

- Complete a new Form W-4P, Tax Withholding Certificate for Pension and Annuity Payments (English), and give it to your employer.

- Make additional or quarterly payments of your estimated tax amount to the IRS before the end of the year.

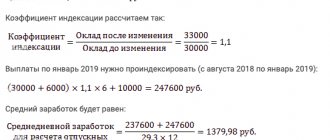

Special types of deductions

Some employers provide a bonus labor system to motivate employees. For example, a guaranteed salary is only a small part of earnings, the rest of the amount is determined based on the specialist’s performance indicators.

The system of fines for employees is becoming increasingly popular (example: wages in large corporations, supermarket chains, holding companies, etc.). This remuneration system is aimed at motivating specialists to achieve their goals. In other words, if the employee did not fulfill the plan or committed any misconduct, the employer has the right to punish the specialist with a ruble.

However, according to the labor inspectorate, such a system is considered illegal, since collecting a fine from an employee is equivalent to non-payment of part of the salary, even if the punishment itself is supported by an order and other documents. For this, the employer can be punished under Art. 5.27 Code of Administrative Offences.