Let's start with the fact that from the point of view of the Tax legislation of the Russian Federation it is arrears. So, arrears are the amount of tax (fee) not paid by the taxpayer on time (see paragraph 2, paragraph 1, article 45 of the Tax Code of the Russian Federation). In addition to the above, an excess amount of tax previously reimbursed by decision of the inspectorate, which tax inspectors identified during an on-site or desk tax audit, may also be recognized as arrears. Arrears are formed from the next day after the delay. In some cases, directly specified in the Tax Code of the Russian Federation, a penalty is charged for the amount of arrears for each day of delay until the day of payment of the amount of arrears (principal tax debt) and penalties. If the debtor taxpayer does not repay the debt in full, the penalty will be collected in court. If too much time has passed since the discovery of the arrears, and no enforcement measures have been taken against the debtor, such debt is considered uncollectible and must be written off. Arrears are collected from both individuals and legal entities. This article will discuss the statute of limitations for identifying and collecting tax arrears from legal entities.

What is the result of tax arrears?

Tax arrears can be identified by tax inspectors as part of tax control activities - a desk or on-site tax audit. The fact of identified tax arrears is reflected in the decisions made by the tax authority based on the results of tax audits. Accordingly, the date of detection of arrears is the date of the decision made based on the results of a particular audit. Tax inspectors can identify tax arrears from a taxpayer even outside the framework of tax control measures. For example, inspectors can compare the tax amounts indicated by the taxpayer in the declaration. In such cases, the day the tax arrears are identified will be the day following the day the tax payment is due (a kind of advance payment), and if the taxpayer submits a declaration (that is, the calculation of the advance payment) in violation of the established deadlines, the day the arrears are identified will be the day following after the day of submission of such a declaration. Also, tax arrears can be identified by the taxpayer himself if he discovers that he incorrectly indicated in the payment order the treasury account number and the name of the recipient's bank, because if such an error is made, the tax paid by the taxpayer will not go to the budget, but will remain stuck as an unexplained payment. Also, arrears arise if the taxpayer makes an error in calculating the taxable base and the amount of tax payable to the budget. The taxpayer can determine the date of occurrence of the arrears based on the information reflected in his personal account maintained by the tax authority, since they are reflected on it. As we noted above, a tax arrears can also be formed as a result of an excessively refunded amount of tax; in this case, the date of detection of the arrears will be the date the taxpayer actually receives funds upon tax refund, or the date a decision is made to set off the amount declared by the taxpayer for reimbursement upon tax offset (see paragraph 4, clause 8, article 101 of the Tax Code of the Russian Federation).

Collection period

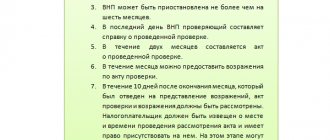

The legislation provides for a time period within which identified arrears can be claimed for payment. This is 20 days from the date of entry into force of the decision on the completed inspection. If unpaid funds were discovered outside of control measures, the period for issuing a demand for repayment of the debt will depend on its total amount. This also includes penalties and fines accrued but not paid. If the total amount is 500 rubles or more, the claim can be submitted within three months. Calculation is carried out from the date of identification of undeducted funds. If the amount is less than 500 rubles, the period is increased to a year.

General period for collecting tax arrears from legal entities

If the tax authority has identified a tax arrears, it must notify the taxpayer-debtor about this no later than three months from the date of discovery of the arrears. If the arrears were identified as a result of a tax audit, the request for payment of the tax arrears must be sent to the taxpayer-debtor no later than ten days from the moment the arrears were identified. The Tax Code of the Russian Federation provides for a minimum period for collecting debts on taxes, fees, penalties, and penalties after the taxpayer actually receives a request from the tax authority. It is equal to eight working days, but it can be more. At the same time, the maximum term is not established by law at all today. The taxpayer is obliged to fulfill the obligation to pay the arrears within the time period established in the request (clause 6 of article 6.1, paragraph 4 of clause 4 of article 69 of the Tax Code of the Russian Federation).

In addition to the above, the requirement to pay arrears of taxes and accrued penalties must contain the following mandatory requirements:

- amount of arrears;

- deadlines for repayment of arrears;

- the amount of penalties accrued on the amount of arrears;

- measures to collect arrears.

During a tax audit, when tax arrears are identified, the taxpayer must be sent a request to pay the identified arrears within twenty business days from the date of entry into force of the tax authority’s decision based on the results of the tax audit. If the arrears were identified outside the framework of tax control measures, the period for submitting a claim depends on the total amount of debt (including debt for penalties and fines):

- if the debt is 500 rubles or more, the demand is sent within three months from the date of discovery of the arrears;

- less than the specified amount - within one year from the date of discovery of the arrears.

Tax authorities begin forced collection of arrears only in cases where the taxpayer refuses to voluntarily pay it. Forced collection of tax arrears occurs by collecting missing amounts of taxes from the current accounts of taxpayers of legal entities, including forced collection of electronic money. Moreover, the process of forced collection (writing off) of tax debts occurs without the tax authorities applying to the courts.

Also, forced collection of tax debts is carried out through the sale of property of a legal entity. It should be noted that the general limitation period established by the legislation of the Russian Federation for civil legal relations has nothing to do with tax legal relations (see clause 3 of Article 2 of the Civil Code of the Russian Federation). There is no independent rule, similar to the rule on the general limitation periods provided for by the Civil Code of the Russian Federation, in the Tax Code. However, the general statute of limitations for collecting tax arrears is three years. As noted above, tax obligations in our country are truly unlimited. The Tax Code of the Russian Federation provides for deadlines by which, if missed, the debt may be considered uncollectible. Property taxes, such as transport tax, real estate tax, etc., can be assessed by the tax authority only for the last three years, according to the general rules of limitation.

The company does not pay on demand. What is the further procedure for collecting arrears?

The company did not pay the arrears, penalties and fines within the period specified in the demand. Now the inspectorate has two months to make a decision on collecting the arrears. Within 6 days after the decision is made, the inspectors must send it to the company.

Very often the question arises about the statute of limitations for tax arrears. We can talk about the period for extrajudicial collection (this is precisely about the decision after a legal entity has not paid on demand) and about the statute of limitations. So, the period for extrajudicial collection is 2 months from the day when the period for paying the arrears on demand expired. If the inspection does not have time to make a decision on forced collection, it means that it has missed the deadline for extrajudicial collection. In this case, the inspection can collect the arrears only through the arbitration court.

There is a possibility that the inspectorate, simultaneously with the decision on collection, will decide to block the company’s account (Article 76 of the Tax Code of the Russian Federation). This is done to prevent the company from withdrawing money from the account.

It is also possible that the tax authorities will seize the company’s property (Article 77 of the Tax Code of the Russian Federation). But this is more difficult to do, because arrest requires the consent of the prosecutor (the inspectorate makes the decision to block the account itself and does not need anyone’s permission) and sufficient grounds to believe that the company will take measures to hide the property. The company can use the seized property, but cannot sell it.

How is a foreclosure decision enforced? At the expense of the company’s property: first of all, the inspectorate will send an order to the bank to transfer money to pay the arrears. The bank is obliged to execute this order the next day after it receives it.

If there is not enough money in the company’s account to pay the arrears, penalties and fines, the inspectorate will “shake” the company further - electronic invoices, currency invoices, etc.

Time limits for collection of tax arrears by tax authorities

If a tax arrear is detected, the tax authority issues a demand to the debtor to pay taxes, penalties, fines, and interest within the following terms:

- no later than twenty working days from the date of entry into force of the decision made by the tax authority based on the results of the audit (as part of the audit - see paragraph 6 of Article 6.1, paragraphs 2, 3 of Article 70, paragraph 1 of Article 87, paragraph 7, 9, Article 101 of the Tax Code of the Russian Federation);

- the deadline for sending a claim depends on the amount of debt (outside the scope of the audit - see paragraphs 1, 3 of Article 70, paragraph 10 of Article 101.4 of the Tax Code of the Russian Federation).

A demand for tax payment in accordance with paragraph 6 of Article 69 of the Tax Code of the Russian Federation can be served in three ways:

- by handing it over to the head of the legal entity or legal representative in person against signature;

- by sending by registered mail with return receipt requested;

- via telecommunication channels in electronic form.

The request for payment of tax arrears is always sent to the address of the legal entity indicated in the Unified State Register of Legal Entities (see clause 5 of Article 31 of the Tax Code of the Russian Federation). As a general rule, a request from a tax authority sent by mail is considered received by the taxpayer on the sixth working day from the date of sending (see clause 6 of Article 69 and clause 6 of Article 6.1 of the Tax Code of the Russian Federation). The procedure for submitting a claim electronically via telecommunication channels was approved by Order of the Federal Tax Service of Russia dated December 9, 2010 No. ММВ-7-8/700. If an electronic request is sent via telecommunication channels, it is considered received by the taxpayer from the moment he sends an electronic receipt of the document to the tax office. If such a receipt is available, the tax authority no longer duplicates the request in paper form by registered mail. Therefore, if the tax inspectorate, when sending the request electronically, does not receive a receipt from the taxpayer about acceptance, then the request on paper will be sent by mail in accordance with the general procedure (see paragraphs 5, 12 and 19 of the Procedure approved by order of the Federal Tax Service of Russia dated December 9, 2010 No. ММВ-7-8/700).

If the taxpayer debtor does not comply with the tax authority’s demand for payment of tax arrears, penalties, fines, the tax authority no later than two months from the date of expiration of the payment period specified in the request, makes a decision to collect tax debts from the bank account the taxpayer has with the debtor (clause 3 Article 46 of the Tax Code of the Russian Federation). No later than six months after the end of the deadline for fulfilling the requirement to pay arrears, penalties, fines, the tax authority has the right to submit an application to the arbitration court with an application to collect tax arrears from the taxpayer, but only in cases expressly mentioned in subparagraph. 1-4 p. 2 tbsp. 45 of the Tax Code of the Russian Federation. According to sub. 2 p. 2 art. 45 of the Tax Code of the Russian Federation, in this case, the tax authorities have the right to apply to the arbitration court only if the arrears are identified as part of a tax audit and have been registered with the legal entity for more than three months. Indisputable collection of arrears in such situations is impossible. In terms of collection of tax debts from members of a consolidated group of taxpayers, the deadline for filing a claim is, as a rule, extended to six months after the expiration of the six-month period for indisputable collection of debts from the bank accounts of this category of persons (see subparagraph 5, paragraph 11, article 46 of the Tax Code Code of the Russian Federation). In practice, the tax inspectorate also misses the deadline for filing a statement of claim in court; if there is evidence of a valid reason for missing the deadline, the court will reinstate it (see paragraph 1, paragraph 3, subparagraph 5, paragraph 11, article 46 of the Tax Code of the Russian Federation, article 117 Arbitration Procedural Code of the Russian Federation).

If it is impossible to collect tax debts from a legal entity, the tax authority:

- makes a decision on the collection of tax arrears at the expense of the taxpayer’s property no later than one year after the deadline for fulfilling the requirement to pay the debt (clause 7 of article 46, clause 1 of article 47 of the Tax Code of the Russian Federation);

- applies to the arbitration court with an application to collect tax arrears from the taxpayer within a period of one to two years after the expiration of the deadline for fulfilling the demand.

Constitutional Court: courts cannot collect legally written off tax debts from individuals

The Constitutional Court verified the constitutionality of paragraph 1 of Art. 15 and art. 1064 Civil Code, paragraphs. 14 clause 1 art. 31 of the Tax Code and Part 1 of Art. 45 of the Civil Procedure Code on the complaint of Ilya Mashukov.

From the court ruling it follows:

- Mashukov was an individual entrepreneur from January 13, 2011 to December 10, 2014.

- Interdistrict Inspectorate of the Federal Tax Service No. 1 for the Republic of Khakassia conducted an on-site inspection and came to the conclusion that Mashukov “without due diligence” entered into business relations with counterparty organizations that actually did not have suppliers who were real payers of value added tax.

- Mashukov unreasonably claimed tax deductions on invoices issued by these counterparties, which led to an understatement of VAT payable to the budget.

- Based on the results of the inspection, the inspection assessed Mashukov an additional 37.5 million rubles. VAT, 5.7 million rubles. penalties and imposed a fine of 749,880.10 rubles. The higher tax authority agreed with this.

- On January 9, 2014, the tax authority demanded that Mashukov pay the tax by January 31 of the same year.

- Mashukov filed a complaint, following the consideration of which the AC of the Republic of Khakassia suspended the inspection’s decision.

- This was followed by a dispute, as a result of which the AS of the East Siberian District refused to recognize the decision of the tax authority as illegal. In 2015, a Supreme Court judge refused to transfer Mashukov’s cassation appeal for consideration by the Economic Disputes Collegium of the Supreme Court.

Since Mashukov had not paid the tax by March 2015, the inspectorate turned to the magistrate with an application to issue a court order, but it was refused. At the same time, it was explained to the tax authority that it has the right to apply for recovery to the court through a claim proceeding.

- 19 important positions of the Constitutional Court for 2022

March 4, 8:45

On August 11, 2015, the Abakan City Court of the Republic of Khakassia left the tax authorities’ claim without consideration, citing the fact that clause 3 of Art. 48 of the Tax Code allows for appropriate recovery in lawsuit proceedings only in the event of cancellation of a court order, and not in case of refusal to issue it. At the same time, the court considered that the inspection could send an application for issuing a court order to the magistrate after correcting the shortcomings specified in the refusal determination.

In October 2015 (after the Code of Administrative Proceedings came into force), the tax authority again appealed to the Abakan City Court with a claim to collect mandatory payments and sanctions from Mashukov, but it was rejected due to the expiration of the six-month period provided for going to court.

The Judicial Collegium for Administrative Cases of the Supreme Court of the Republic of Khakassia left this decision unchanged and noted that the tax authorities did not petition to restore the missed deadline.

As a result, on May 13, 2016, the Federal Tax Service made a decision to recognize Mashukov’s debts on taxes, penalties and fines as hopeless for collection and write-off.

Attempt to prosecute

By a resolution dated May 22, 2015, the senior investigator for particularly important cases of the investigative department of the Investigative Committee for the Republic of Khakassia opened a criminal case against Mashukov under Part 2 of Art. 198 of the Criminal Code (“Evasion of an individual from paying taxes, fees...”). In July 2015, the case was dropped due to the expiration of the statute of limitations.

In 2022, the Abakan City Court and the Supreme Court of the Republic of Khakassia declared the decisions to initiate and terminate a criminal case illegal. The authorities clarified that the case was opened outside the statute of limitations for criminal prosecution.

Prosecutor's claim

In an attempt to recover material damage caused to the budget system due to non-payment of taxes, the Abakan prosecutor went to court. The dispute continued in the first, appellate and cassation instances. At first, the courts refused to satisfy the demands, but then the judicial panel for civil cases of the Supreme Court of the Russian Federation sent the case for a new trial to the court of appeal. As a result, the judicial panel for civil cases of the Supreme Court of the Republic of Khakassia and the Presidium of the Republican Supreme Court satisfied the prosecutor’s demands and recovered 37.5 million rubles from Mashukov. (amount of arrears according to VAT).

The appellate court noted that recognizing the decisions to initiate and terminate a criminal case as illegal and writing off the arrears as hopeless for collection does not indicate the absence of losses caused to the budget system.

Complaint to the Constitutional Court

Mashukov appealed to the Constitutional Court because he considered that the provisions he challenged (clause 1 of Article 15 and Article 1064 of the Civil Code, subclause 14 of clause 1 of Article 31 of the Tax Code and part 1 of Article 45 of the Civil Procedure Code) did not comply with the Basic Law, since they allow the recovery from an individual, at the request of the prosecutor, of funds to compensate for damage caused to a public legal entity in the form of tax arrears written off in accordance with the procedure established by law, in the absence of criminal prosecution.

The Constitutional Court noted: in itself, the collection of amounts not received by the budget from tax arrears and penalties through claims of prosecutors and tax authorities does not contradict the Basic Law. This means that pp. 14 clause 1 art. 31 of the Tax Code cannot violate the constitutional rights of the applicant in the aspect in which he challenges its constitutionality.

- The Constitutional Court clarified the application of the zero tax rate for maritime exports

July 2, 19:04

Part 1 art. 45 of the Code of Civil Procedure also cannot be considered as violating the constitutional rights of the applicant, since it provides for the right of the prosecutor to apply to the court in defense of the interests of the Russian Federation.

Thus, the Constitutional Court remains to check the constitutionality of paragraph 1 of Art. 15 and art. 1064 Civil Code. The court noted: the occurrence of damage in the form of loss of the right to fulfill a tax obligation when writing off bad debts may be associated not only with the unlawful behavior of the taxpayer, but also with the behavior of the authorized bodies. Their action or inaction is the objective cause of the harm caused.

Arrears may be considered hopeless for collection in cases where the legal possibility of forced collection of payments was lost, when the tax authority itself missed the deadline for presenting relevant demands due to omissions in the preparation of procedural documents and due to deviations from the rules of legal proceedings when filing a claim. Omissions, even more so, can be a decisive condition for causing harm to the treasury, if the tax authority did not ask to restore the missed deadline for filing a lawsuit, the Constitutional Court continued. It should also be taken into account that it is the Federal Tax Service that should monitor the payment of taxes.

- Extra arrears and correct calculation: tax positions of the Armed Forces

May 28, 17:15

According to the judges of the Constitutional Court, with the mentioned omissions of the authorized bodies, an individual has legitimate grounds to believe that he will not be charged with causing harm on the basis of civil law provisions contested in this case.

As a result, the Constitutional Court recognized that paragraph 1 of Art. 15 and art. 1064 of the Civil Code do not contradict the Basic Law, since they do not imply the recovery of tax arrears from an individual in legal proceedings in the form of compensation for damages, if this arrears are recognized as hopeless for collection on the basis of a legal decision, the adoption of which is conditioned by “the behavior of authorized bodies and is not associated with illegal acts » taxpayer.

The Constitutional Court decided to review the decisions in the Mashukov case, taken on the basis of paragraph 1 of Art. 15 and art. 1064 Civil Code.

- Pravo.ru

- constitutional Court

- News

Time limit for collecting arrears in court

Debt collection through compulsory judicial procedure occurs, as a rule, if the taxpayer and debtor refuses to voluntarily repay it. But according to the general rules of legal proceedings, the creditor does not have the right to take independent measures to force the collection of debt from his debtor. The same is true in cases where a tax authority collects arrears of taxes from a debtor taxpayer, because in these respects the tax authority is a creditor, and the taxpayer is a debtor. That is why creditors have the right to collect debt only through court, but the creditor does not have the right to go to court right away. Before going to court, the creditor needs to try to resolve the existing dispute out of court. The same thing happens when collecting arrears from the taxpayer. First of all, the tax authority must send the taxpayer a demand for payment of arrears and penalties. We indicated above about the rules for drawing up, the procedure for sending and delivering a request for payment of tax arrears by the tax authority.

The only thing that should be noted once again regarding the judicial procedure for collecting tax arrears is that the amount of tax arrears specified in such a request must be repaid by the taxpayer within ten days from the date of its receipt. If the taxpayer does not pay off the tax debt, then the tax authority applies to the arbitration court for forced collection. As after considering any property claim, after considering the claim of the tax authority for the collection of tax arrears, the court issues a writ of execution. Further, the process of its execution looks standard: funds are written off from the taxpayer’s bank accounts in the amount of the amount of tax debt, the taxpayer’s property is seized, and the official is banned from traveling abroad.

If the taxpayer does not pay the arrears for a long time, it may be recognized as uncollectible, and then simply canceled like any uncollectible debt. Even if the general statute of limitations for tax arrears against the taxpayer has not expired, the tax authority does not have the right to oblige the taxpayer to repay the arrears, despite the fact that it continues to be registered with him.

According to sub. 1-4.1 clause 1 art. 59 of the Tax Code of the Russian Federation, tax arrears (tax debts) can be recognized as hopeless in the following cases:

- liquidation of a legal entity;

- declaring a legal entity bankrupt;

- the presence of a court decision, according to which the tax authorities do not have the right to demand payment of arrears of taxes, penalties from the debtor;

- the bailiff issuing a resolution to complete the proceedings on the writ of execution with the return of such a document to the claimant (clauses 3, 4, part 1, article 46 of the Federal Law of 02.10.2007 No. 229-FZ “On Enforcement Proceedings”), provided that This debt arose more than 5 years ago, in the following cases:

- if the amount of debt is equal to or lower than the amount of claims against the debtor established by the legislation of the Russian Federation on insolvency (bankruptcy) for initiating bankruptcy proceedings;

- the court returns the application for declaring the debtor bankrupt or terminates the bankruptcy proceedings due to the lack of funds necessary to compensate for legal costs for the procedures applied in the bankruptcy case.

The Tax Code of the Russian Federation does not establish a statute of limitations, while the periods provided for by the Civil Code of the Russian Federation are not applicable to tax arrears. Hence, many people have a completely reasonable question: on what basis is the period for collecting tax arrears determined? In turn, the period for collecting arrears in court is established by tax legislation and is three years. This is what concerns the statute of limitations for collecting tax arrears in principle, but the collection itself occurs within nine months on average, from the moment the organization goes to court and two years, in the case of collecting tax arrears through the seizure of property. It is worth noting that collecting tax arrears through the court is a rather lengthy process. However, if the taxpayer has incurred a debt to the budget (tax authorities, pension fund, insurance companies), then the legal process, as a rule, occurs much faster.

In court, arrears are recovered from companies that:

- the amount of tax debt over 5,000,000 rubles (see subparagraph 1, paragraph 2, article 45 of the Tax Code of the Russian Federation);

- there was a requalification of the transaction, status or nature of the company’s activities (see subparagraph 3, paragraph 2, article 45 of the Tax Code of the Russian Federation);

- the correct application of prices in transactions between related parties was checked (see subparagraph 4, paragraph 2, article 45 of the Tax Code of the Russian Federation).

Also, through the court, arrears can be recovered from those companies that are interdependent in relation to the companies for which these tax arrears arose initially, and only arose as a result of tax audits and the company’s failure to pay such tax arrears within three months. The grounds for collecting arrears from interdependent organizations are defined in subparagraph 2 of paragraph 2 of Article 45 of the Tax Code of the Russian Federation and are possible in the following cases:

- if the bank accounts of interdependent companies receive proceeds for goods, works or services sold by taxpayer companies that have arrears at the time of a particular transaction, or for which it initially arose;

- if the company that initially had a tax arrears, having learned about the appointment of an on-site tax audit or a desk tax audit, transferred funds or other property to an interdependent company in order to complicate the collection of the tax arrears or make it impossible.

To conclude the topic under consideration, we can summarize that tax arrears are debt, the amount of contributions, deductions, etc. not made by the company by the taxpayer. The establishment of the fact of arrears within the framework of tax audits occurs as a result of the identification of errors in payment documents and by the taxpayer himself - the head of the legal entity. Tax arrears, like any debt, are subject to recovery through the court. The actual collection of funds occurs by debiting funds from the bank accounts of the debtor's legal entity.

Collection methods

As a rule, the Federal Tax Service uses an out-of-court (indisputable) procedure. Collection is made from bank accounts or at the expense of property owned by the payer. The territorial division of the Federal Tax Service generates a requirement indicating the amount of debt and the repayment period. If the payer does not satisfy it, then the control body within 2 months:

- Makes a decision on the collection of funds from a bank or electronic account. Within six days, the document is handed over to the payer against signature. If it is not possible to deliver the decision in person, it is sent by mail.

- Sends an order to the bank to write off funds from the payer’s account with their subsequent crediting to the budget. The financial organization must carry out the operation within one day following the one on which the order from the Federal Tax Service was received.

Along with the adoption of a resolution on collection, the inspectorate may freeze the payer’s account.

Judicial order

The Federal Tax Service has the right to file a claim if the deadline for making a decision on an indisputable recovery has been missed. At the same time, the legislation establishes periods during which the control body can exercise its rights. If the deadline for making a decision on recovery from the payer’s funds in his bank accounts has been missed, the Federal Tax Service can file a claim within six months. Calculation is carried out from the end of the period allotted for fulfilling the requirement. If the deadline for making a decision on recovery at the expense of the property has been missed, then the Federal Tax Service has 2 years.

The concept of arrears and its features

Arrears are generally considered to be a sum of money that:

- not transferred to the budget in a timely manner. For example, it may arise when there is a delay in paying insurance premiums (Article 11 of the Tax Code of the Russian Federation, paragraph 2);

- overpaid to the company's current account from the budget. For example, when refunding VAT (2nd paragraph of Article 173 of the Tax Code of the Russian Federation) or excise taxes (Articles 182 and 203 of the Tax Code of the Russian Federation).

Is it possible to offset an overpayment of income tax against the arrears of personal income tax - see here:

Period of occurrence

In case of violation of payment deadlines, the day of arrears occurrence will be the very next day. Moreover, holidays and weekends are not subject to exception to the rule.

If the reason was an excessive payment to the taxpayer, then, according to Article 101 of the Tax Code of the Russian Federation (clause 8, paragraph 4), the arrears arise on the day the funds are actually received into the bank account or on the day the decision is made on offset between taxes.

Detection of the existence of a violation

The following activities can help identify arrears:

- conducting a tax audit: on-site (the inspector has the right to come directly to the office), desk audit (based on additional documents provided at the request of the regulatory authority) or repeat. The procedure and stages of desk and field tax audits are described in detail here;

- analysis by the inspector of the submitted reports. If there is an accrual due for payment to the budget, but the payment has not been received into the budget within the deadlines established by law, there is a fact of arrears.

What liability and penalties are provided?

Possible liability and fines

From the moment of discovery and until the full repayment of the arrears, penalties must be accrued for each day of late payment.

Here you will learn how to check tax fines by last name and what methods exist for this.

Also, for some taxes, a fine is imposed in a certain amount of the amount of arrears, but not less than a certain threshold value.

For repeated violations of tax laws, a manager or other authorized person may be subject to not only administrative, but also criminal liability.

In this regard, it is necessary to pay the discovered debt as soon as possible. If you haven’t submitted a tax return, you can find out what penalties are imposed for this and what will happen to the taxpayer using the link.