Low-value items - disposable tableware A well-drafted act for writing off low-value and wearable items will allow the company to include them in expenses when calculating taxes.

How to properly organize accounting and write-off in such cases?

These questions come before the accountant of every organization, since not a single enterprise can do without the use of this type of materials in production.

Let's take a closer look at how to properly organize accounting for the movement of these things in production.

What is IBP

In almost every type of activity and in industry, there is inventory that does not belong to the main means of production, but is a mandatory accompanying type of materials. Such equipment has a short lifespan during the labor process due to the fact that it quickly loses its usefulness.

In accounting, they were given the term “low-value wearable items,” abbreviated as LBP. Their cost, despite the short period of use, is included in the company’s reserves.

Note! It is the shelf life of inventory that is the main criterion for inclusion in the IBP list. Their number accounts for the entire part of the organization’s materials, the period of use of which is less than 1 year.

Based on these boundaries in relation to the characteristics of materials and things, the following goods can be classified as IBP:

- work clothes and footwear for workers

- quickly wearing parts of office equipment

- catering utensils

- household utensils, detergents and cleaning products, etc.

Such inventory and materials, regardless of the period of suitability and cost, can include various additional devices for narrow purposes, special tools, without which it is impossible to carry out production tasks. Among the names of such items are the following:

- replacement spare parts for machine tools and other equipment

- fishing equipment

- chainsaws

However, this should not include construction tools; mechanisms, equipment used in agriculture; animals used in farming. They are classified as fixed assets, and their service life and cost do not affect their inclusion in the IBP group.

The main features of the IBP for inclusion in the write-off act

Working clothes wear out quickly.

Due to the short service life of MBPs, they must be written off when preparing financial statements.

For this purpose, a special form MB-8 is used, an act for writing off low-value and wearable items.

How can we determine that an item belongs to the IBP and can be included in this document?

How to correctly apply the rationale for things and materials so that they truly are IBP.

From the name of such materials it can be understood that the criteria for including such production equipment in this group are low price and rapid wear.

The time limit for suitability for classifying things as IBP changed periodically. Only the service life remained constant for one year.

Based on these justifications, it can theoretically be assumed that there are 4 main options for evaluating purchased items for the group we are considering:

- The price of the item is below the monetary limit, but its useful life may be more than one year.

- The cost of the inventory is more than the limit, but it is suitable for use for up to 1 year.

- The material does not exceed the cost of purchasing it from the established upper limit, but will last more than 12 months.

- The item lasts less than 1 year and costs less than the price limit.

Quite recently, only by the fourth characteristic of an object could it be included in the IBP. As for the first, second and third groups, previously these were fixed assets. At the same time, in production they often resorted to a price limit, without taking into account the service period.

In this way, IBEs were formed into an independent group, which was dealt with by entire departments of institutes, conducting various studies on them.

Act on write-off of low-value and wear-and-tear items

Related publications

Each company purchases and uses many items that are classified as low-value and high-wear items (LHC).

As the name suggests, the main criteria for classifying items into this category are the short service life and low price of the item. Low-value and wear-out items, for example, include household equipment. Despite the fact that the abbreviation IBP is not currently used or mentioned in the Chart of Accounts, this category has not disappeared from the turnover of companies and must be taken into account. Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a approved unified primary forms for recording labor and its payment, materials, low-value and wear-out items, including form MB-8 - an act for writing off low-value and wear-out items. This act is used to formalize the liquidation of “used” and unsuitable for further use, low-value and rapidly wearing items.

How to draw up an act?

To draw up an act, a special type of information is provided. The form was developed according to the MB-8 form, approved at the legislative level of the Russian Federation. The document code is indicated in the OKUD classifier with the value 0320004. But, despite the same requirements for the execution of this act, organizations can edit it and make their own changes for ease of filling out.

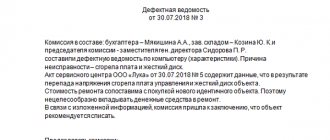

Before you begin to draw up documentation for the write-off of an IBP, a decision must be made about this by the management of the organization. It can also be accepted by representatives of the commission, which includes experts.

The order to appoint competent members of the commission is issued by the head of the organization.

During the work, members of the commission examine quickly worn-out equipment and study the technical documentation attached to it. Thus, the degree of wear and suitability of the inspected tools and other materials associated with the production process is established.

When writing off certain items, the commission is based not only on examination data. All characteristics set out in the technical documentation are taken into account.

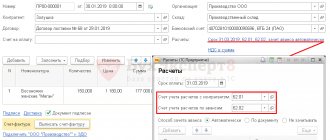

When filling out the columns of the form for writing off IBP, their initial cost is first displayed. It is taken from the costs that were actually spent on their acquisition or production.

If it is decided that such items can be sold, then this can happen either at the same cost or at a price different from the original price of the product. It must be taken into account that when they are sold for an amount exceeding their cost, the difference must be included in the organization’s income.

In other cases, an act is drawn up for the write-off of low-value and wear-and-tear items, the form of which is filled out separately by type of similar items in a single copy. The completed form is transferred to the warehouse together with the MBP to be disposed of.

Storekeepers are required to sign the form to confirm that materials have been written off. From the warehouse, the document goes to the accounting department as a fundamental act for removing unsuitable materials and tools from accounting.

Act on write-off of low-value and wear-and-tear items

The decision to liquidate certain items is made and recorded in the act by a commission, which is created by order of the head of the company. The act is bilateral. Immediately below the name of the form there are lines to indicate the name of the company and structural unit, OKPO code. Below is a small table that contains the following information:

- Date the form was filled out;

- Operation type code;

- Structural subdivision;

- Kind of activity;

- Corresponding account (account, sub-account);

- Analytical accounting code.

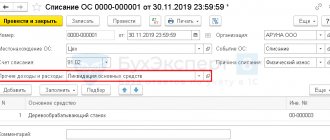

Then, the act for writing off low-value and rapidly wearing items contains information that the commission, which was appointed by order of the manager (the date of the order is indicated), examined the items that are subject to write-off and found them unsuitable for further use.

The main part of the act consists of a voluminous table, including 14 columns. The table contains the following information:

- Name of the item to be written off;

- The nomenclature number assigned to the item;

- Inventory number assigned to the item;

- Unit code;

- Name of the unit of measurement;

- Number of specified items;

- Date when items arrived;

- The price of these items;

- Amount excluding value added tax;

- Amount of depreciation;

- Service life of items subject to write-off;

- Name of the reason for write-off;

- Write-off reason code;

- Passport ID.

The form is double-sided - the reverse side contains a continuation of the table. Then, under the table, the total number of items according to the act, as well as the numbers and dates of disposal acts, is indicated in words.

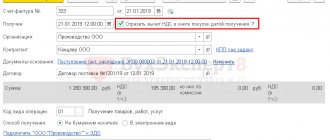

Further, the MB-8 form contains information that items unsuitable for further use, in the presence of the commission, must be turned into scrap, which is subject to capitalization. The following contains a table that includes the following columns:

- Operation type code;

- Kind of activity;

- Structural subdivision;

- Scrap name;

- Nomenclature number of scrap/scrap;

- Name of the unit of measurement;

- Unit code;

- Amount of scrap;

- Price;

- Sum;

- Record number in the warehouse file.

Scrap that is not subject to capitalization must be destroyed. The act is signed by the chairman and members of the commission, and the document is drawn up by the commission in one copy. After the written-off items are handed over to the scrap storage room, the act with the storekeeper's receipt is handed over to the accounting department. For different types of low-value and high-wear items, write-off acts are drawn up separately.

When liquidating inexpensive and not particularly valuable property, for example, furniture or dishes, an MB-8 act is drawn up for the write-off of low-value and wear-and-tear items (IBP). The document is drawn up in one copy for each type of IBP.

What are the accounting entries for IBP?

In the process of forming accounting for IBP, several methods have been developed for reflecting them in transactions:

- Upon receipt, they were received and transferred for use with the cost entered into account 12 “Low-value wearable items.” At the end of each month during the year, 1/12 of the purchase price was written off. Although the period of use could exceed a calendar year, the cost of the MBP was subject to complete write-off within 12 months.

- When an item was handed over to the facility’s workflow, the amount was immediately reduced by 50% due to wear and tear. The remaining half was not touched until the final moment of its decommissioning.

Since the second write-off method was much simpler for an accountant, it was preferred by organizations.

When writing off using the first method, its shortcomings were identified. In the month when the MBP was purchased, its full cost was reflected in the entries and unjustified profits immediately increased.

And although in the future the amount gradually decreased due to wear and tear and, accordingly, contributed to a decrease in profits in the future, this was still not entirely correct.

Both methods of writing off IBP are considered imperfect from a scientific point of view. There is another significant drawback in accounting for IBP, which concerns things with very low prices.

Write-off of IBP for Shchuko

To facilitate accounting for products, accountants ensured that low-value funds were immediately written off as operating expenses in the month they were received.

In this case, there is no need to calculate the percentage of depreciation or amortization, which is a convenient point for accounting.

Theorists were outraged by this write-off procedure, but this did not affect the outcome of the case.

Practice has shown the advantages of this method of writing off IBP, since it immediately reduced the revenue side in the month of purchase and made it easier to account for them.

Since the amount of depreciation is included in production costs, it must be taken into account when determining the tax contribution.

As we have already described, very often in practice accounting is carried out in the two most convenient ways:

- calculation of depreciation in the amount of 50% of the original cost when issuing them from the warehouse for operation, and the second half after receiving the decommissioning certificate for the IBP

- reflect 100% wear and tear when issuing MBP to workers to perform production tasks

The law does not provide for strict restrictions on this matter, therefore the enterprise has the right to independently choose the most convenient method of calculating depreciation of the IBP and apply it throughout the entire calendar year.

To enter information on the depreciation of low-value items with a short useful life, use account 13 “Depreciation of IBP”. According to its credit, in correspondence with the production cost accounts, the amount of depreciation of the IBP is shown, and the debit of account 13 from credit 12 reflects the purchase cost of inventory that has been retired.

They formalize the transfer of the IBP into operation for long-term use using an invoice.

In case of their breakdown, damage, loss of tools and devices, the head of the department must draw up a decommissioning act for the IBP. An exception in these cases concerns circumstances in which the worker’s guilt in the unsuitability of the IBP is established, since the cost of a damaged or lost item must be deducted from his salary.

Form MB-8: fill out online

In the MyWarehouse service you can issue an MB-8 act form in a few seconds. Fill in or select information about the IBP and the reason for the write-off. The system will automatically number and generate the document. Below is an example of filling out MB-8 from MyWarehouse.

Fill out the MB-8 act online!

Register in the online document printing service MoySklad - you will be able to: completely free of charge:

- Fill out and print the document online (this is very convenient)

- Download the act you are interested in in Excel or Word format

All created documents are stored in MySklad - you have round-the-clock access from anywhere.

Next, we will look at how low-value and wear-out items are written off and what exactly applies to them.

What should be included in the act

There are no particular difficulties in documenting the write-off of IBP. For this purpose, the commission or the head of the unit draws up a normative act in the MB-8 form.

The document should reflect the following parameters:

- positions and individual details of commission members

- name of the IBP

- the retiring quantity in units of measurement that is used to account for these materials or products

- reason for write-off

After filling out the information about the recycled IBP, the commission members sign the act. It must also contain the signatures of the accountant for accounting of inventory items and the financially responsible person. After signing by all these persons, the document is endorsed by the chief accountant and the manager.

Form of act for write-off of low-value and wear-and-tear items

There is no unified act. It can be issued in any form, but the MB-8 form is usually used. It contains all the necessary data - no need to think about what to write. A free certificate for writing off low value items and a completed sample can be found below.

MB-8: download to Excel

Get the certificate for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the act you are interested in in Excel or Word format

- Fill out and print the document online (this is very convenient)

Be sure to write down the name of the items being liquidated, item and inventory numbers, unit of measurement, quantity, date of receipt, service life and reason for write-off. A sample act for writing off low value items is further on the page.

The decision to liquidate property is made by a specially created commission. After items are scrapped, the act of writing off low-value and wear-and-tear items is transferred to the accounting department.

How to issue an order on a commission for writing off an IBP

In order to regulate issues related to the write-off of IBP at the enterprise, a permanent commission is appointed by order of the manager. Who needs to be appointed in such cases and what are the nuances of its design?

The commission must include any persons from the administration of the enterprise who are competent in matters of wear and tear and accounting of small-scale equipment. These can be persons from the engineering and technical staff of the enterprise, accounting department, quality control department, laboratory, if there is one in production. The main thing is that people can competently assess and justify the deterioration of the MBP.

The order indicates the positions and individual details of each member of the commission. Then they enter the reason for issuing the decree: “In order to organize work to establish storage periods for documents, carry out their selection for archival storage and use, I order: Create an expert commission.” Next comes a list of the members of the commission, starting with the chairman.

The issue is not regulated by legislative acts. If one of the commission members is absent at the time of decommissioning, a temporary order is issued to appoint another commission member in his place for the duration of his illness or other reason for not going to work.

Form MB-8. Write-off act: sample filling

You can fill out the document manually or on a computer. To avoid mistakes in registration, fill out the MB-8 act. Put a dash in the empty lines - then you won’t be able to enter false information there.

Download form MB-8: sample filling

Get a sample act for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the sample act you are interested in

- Fill out and print the document online (this is very convenient)

The header must have the director’s signature - without it, the document is invalid. In addition, enter the number, as well as the name of the organization and division in which the write-off occurs.

If you are writing off several items that belong to different types, for example, office equipment and furniture, draw up a separate document for each of them. The general form MB-8 of the write-off act is drawn up for items of the same type. For example, you can combine a printer, scanner and phone in one document.

You can quickly fill out the act in the MyWarehouse service. Just enter the information about the IBP on the website and print the finished document.