Requirements for accountants

According to the new rules, an accountant must have at least a secondary professional economic education in a training program for mid-level specialists.

An alternative is non-core secondary vocational education. But in this case, the applicant will have to receive additional professional education under a professional retraining program.

No work experience is required to fill the position of accountant. But to fill positions with a category (accountant of the first and second categories), at least one year of experience in a position with a lower (previous) category is required.

The list of required skills for an accountant includes the following:

- ability to draw up (execute) primary accounting documents, including electronic documents;

- ability to carry out a comprehensive check of primary accounting documents;

- ability to use computer programs for accounting, information and reference systems, office equipment;

- the ability to ensure the safety of primary accounting documents before transferring them to the archive.

Accountants' requirements are now mandatory for all employees

Federal Law No. 247-FZ of July 26, 2022 obliges all employees to comply with the requirements of the chief accountant for documenting the facts of economic life.

The requirements of the chief accountant for documenting business transactions are now mandatory for all employees of the company (Article 9 of the Accounting Law of December 6, 2011 No. 402-FZ).

Mandatory requirements are:

- documenting the facts of economic life;

- submission of primary and other documents for accounting.

In turn, employees are required to follow the instructions:

- chief accountant;

- another official who is entrusted with accounting;

- a person with whom an agreement has been concluded for the provision of accounting services.

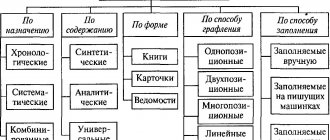

How to organize document flow and draw up primary documents

IP teachers must punch cash receipts

Individual entrepreneurs providing educational services must use CCP. Letter of the Federal Tax Service of Russia dated July 25, 2019 No. ED-3-20/ [email protected]

Law No. 54-FZ obliges all organizations and individual entrepreneurs to use cash register systems when making payments

However, the Law makes an exception for educational activities and allows educational organizations not to use cash register equipment (Clause 13, Article 2 of Federal Law No. 54-FZ).

At the same time, according to the “Law on Education in the Russian Federation,” non-profit associations are considered educational, that is, organizations that conduct educational activities on the basis of an appropriate license (Clause 18, Article 2 of the Federal Law of December 29, 2012 No. 273-FZ).

This means that the exemption from CCT, which is discussed in Law No. 54-Z, applies only to organizations. Individual entrepreneurs engaged in educational activities are required to use cash register equipment and punch a receipt when receiving tuition fees.

Who should use CCP and who should not?

How to correctly confirm your salary

The Moscow City Court pointed to a document, the presence of which in itself is already sufficient to confirm the amount of wages.

The employee filed a claim for the collection of arrears of wages because he believed that he was paid less than what was specified in the employment contract.

The company's position was that salaries were paid in full. In support of this, the court was presented with an employment order, staffing table and pay slips.

The first court considered that the documents presented by the organization were sufficient, but the employee, on the contrary, could not confirm the amount indicated in the employment contract with other evidence.

But the Moscow City Court did not support its colleagues in the Appeal ruling dated January 30, 2022 in case No. 33-1768/2019. Salary is a mandatory condition of an employment contract. It is this document that is decisive for the purposes of confirming its value.

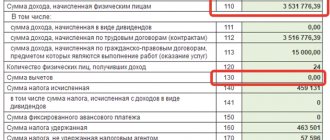

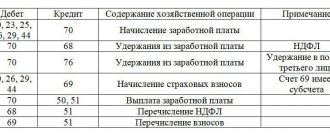

How to reflect the payment of wages in accounting

New rules for changing the “salary” bank

Employees must now notify about a change of salary bank no later than 15 calendar days before payday.

Federal Law No. 231-FZ of July 26, 2022 amended the Labor Code. From August 6, 2022, an employee must submit an application with the details of a new bank to transfer wages to another bank earlier - no later than 15 calendar days before the payment of wages. Previously, this period was 5 working days.

The employer will be punished for refusing to change the bank. Thus, companies will face a fine under Article 5.27 of the Code of Administrative Offenses of the Russian Federation in the amount of 30,000 to 50,000 rubles, and its officials - from 10,000 to 20,000 rubles. The amount of penalties for individual entrepreneurs will range from 1,000 to 5,000 rubles.

Salary payment

Instructions for quickly unblocking an account

If the blocked account has the amount necessary to pay off the arrears, the blocking of the account can be canceled within two days. Letter of the Ministry of Finance of Russia dated June 17, 2022 No. 03-02-08/43737.

The tax inspectorate has the right to block the account of a company that has not fulfilled the requirement to pay taxes, penalties or fines (Clause 2 of Article 76 of the Tax Code of the Russian Federation). The decision to block an account must indicate the amount within which debit transactions are blocked.

But if the total amount of money in the company’s blocked accounts is greater than the amount specified in the decision, the organization can submit an application to the Federal Tax Service to cancel the suspension of transactions on its accounts (clause 9 of Article 76 of the Tax Code of the Russian Federation).

Within two days after receiving such a statement, the inspectorate is obliged to unfreeze the company's accounts in the part that exceeds the amount specified in the decision.

Tax officials must completely unblock the company’s “frozen” accounts no later than one day following the day when they receive documents or copies thereof confirming the fact of payment of taxes, penalties, and fines (Clause 8 of Article 76 of the Tax Code of the Russian Federation). The tax office will notify the company about this with its decision.

If the tax authorities miss this deadline, they are obliged to pay the company interest based on the refinancing rate of the Bank of Russia for each calendar day of violation of the deadline for unblocking the account (clause 9.2 of Article 76 of the Tax Code of the Russian Federation).

How to unblock an account

electronic edition of 100 ACCOUNTING QUESTIONS AND ANSWERS BY EXPERTS

A useful publication with questions from your colleagues and detailed answers from our experts. Don't make other people's mistakes in your work! The latest issue of the publication is available to berator subscribers for free.

Get the edition

Requirements for chief accountants

Chief accountants must now have either a higher education (core or non-core) or secondary vocational education (core or non-core).

If the education is non-core (for example, technical), the applicant will also have to obtain additional professional education. That is, undergo a professional retraining program for accountants.

If you have a higher education, the chief accountant must have at least five years of experience in accounting and financial work. If you have secondary vocational education, at least seven years of accounting and financial work.

The required skills of a chief accountant include the following:

- ability to develop methods of accounting and formulate accounting policies of the organization;

- ability to develop forms of primary accounting documents, accounting registers, reporting forms and draw up a document flow schedule;

- ability to plan volumes and timing of work during the reporting period for reporting purposes;

- ability to assess the materiality of information disclosed in accounting (financial) statements;

- ability to prepare accounting (financial) statements during reorganization or liquidation of a legal entity;

- ability to use computer programs for accounting, information and reference systems, office equipment.

In addition, the new professional standard establishes the obligation for chief accountants to regularly receive additional professional education. In other words, chief accountants are obliged to constantly improve their qualifications.

The volume of the advanced training program for chief accountants must be at least 120 hours over three consecutive calendar years. At the same time, annually the chief accountant is required to devote at least 20 hours to advanced training courses.

Who reports to the chief accountant

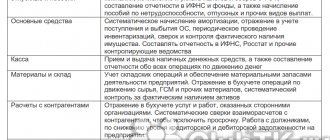

In a large enterprise, the accounting service is divided into departments:

- general (collection of information)

- production (cost and cost calculation)

- material (accounting for tangible assets)

- settlement (calculation of salaries, taxes, social benefits)

- cash desk (working with securities and cash)

This service may also include other departments (at some enterprises they are organized as independent divisions):

Accounting structure

- marketing (forms the retail price)

- labor and salary (takes into account working hours, vacations, sick leave)

- economic planning (plans the technical side of activities)

- contractual (draws up contracts, monitors settlements under them)

- estimated (calculates income/expenses for the future)

The answer to the question of who reports to the chief accountant depends on the management scheme of the enterprise (organization). If the service has several departments from the first list, they are subordinate to the chief accountant. As for the departments from the second list, they are subordinate to the chief accountant only if they are defined in internal documents as structural units of the accounting service. If they are independent departments, they have their own head.

The HR department, legal service, and logisticians do not report to the chief accountant. In practice, any employee must submit to the chief accountant if his demands relate to the provision of documentation necessary for accounting (Law No. 129-FZ). Sometimes the manager also has to obey the chief accountant. The chief accountant may refuse to sign questionable documents without a written order from management.

If there are branches, accounting can be centralized or decentralized. In the first option, all documents are transferred to the accounting department of the head enterprise. With a decentralized structure, a separate accounting service is organized in each branch, headed by a senior accountant, who is still subordinate to the chief accountant.

Requirements for chief accountants of individual organizations

The professional standard sets special (increased) requirements for chief accountants of individual organizations. Such organizations include, in particular:

- joint stock companies;

- insurance organizations and non-state pension funds;

- joint stock investment funds;

- management companies of mutual investment funds.

The chief accountants of such organizations are obliged to:

- have higher education;

- have work experience related to accounting, preparation of accounting (financial) statements or auditing activities for at least 3 years out of the last 5 calendar years;

- in the absence of higher education in the field of accounting and auditing, the work experience of the chief accountant must be at least 5 years out of the last 7 calendar years;

- not have an unexpunged or outstanding conviction for crimes in the economic sphere.

Chief accountants of credit and financial organizations must meet the following special requirements:

- have a higher legal or economic education;

- experience in managing a department or other division of a credit institution whose activities are related to banking operations, at least 1 year;

- If the candidate has another higher education, relevant work experience must be at least 2 years.

Form requirement

Such changes to the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” were made by the Federal Law of July 26, 2019 No. 247-FZ. And now in paragraph 3 of Article 9 of the Accounting Law the following rule has appeared:

Requirements in writing of the chief accountant ... regarding compliance with the established procedure for documenting the facts of economic life, submitting documents (information) necessary for maintaining accounting records ... are mandatory for all employees of an economic entity.

Obviously, it will not be easy for the chief accountant to implement this provision of the law. To make his life easier, it is advisable for him to think through and describe in local regulations the procedure for presenting relevant requirements to employees, as well as the procedure for employees to respond to them. But that's not all!

It is very important that the chief accountant’s request in writing contains the necessary information that will be understandable to the employee. To do this, it is advisable to develop a standard form of written request and approve it as part of the accounting policy. Such a typical form might look like this:

| The form is approved as part of the accounting policy (Appendix No. X) | |

| "AGREED" | To (full name)_________________________ |

| Supervisor ___________________ | Job title _________________________ |

| Date of____________________________ | Division _____________________ |

DEMAND

to eliminate the violation

Based on paragraph 3 of Article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”, paragraph X of the institution’s Accounting Policy for 2022, I ask you to eliminate violations of the established procedure for documenting facts of economic life, submitting documents (information ) necessary for accounting, expressed in _______________________________________________________________________________________________________________________. This violation must be eliminated by __________________________ 2022.

If you fail to comply with this requirement, you may be subject to disciplinary action.

| Chief Accountant _________________________________ | Date ____________________________ |

| AWARE OF | AWARE OF |

| FULL NAME __________________________ Job title______________________ Subdivision__________________ Date ___________________________ | Head of department (full name)_______________________ Date ________________________ |

Chief accountant and management accounting

Management accounting plays a key role in the life of modern Russian companies. Despite this, there is no single idea about in whose hands to entrust its implementation, how to optimally introduce a rich arsenal of financial analytical tools into the dynamic life of the company. The prerequisites for the emergence of this situation and the way to resolve it will be discussed in the essay of Lyudmila Mikhailovna Burmistrova, professor of the Department of Financial Management of the VZFEI.

Today it is difficult to find among managers people who are not familiar with the term

“management accounting”

.

However, as many people there are, there are approximately the same number of options for understanding what it is. Some people prefer to call this term internal company accounting for the owner (as he believes - true, reliable)

. Some people are sure that management accounting is the accounting of goods in various sections; Some people are convinced that management accounting is the same as accounting, only broader. It turns out that management accounting somehow intricately combines management and marketing, sales and purchasing, accounting and planning, and all this is based on the basis of strategic management. As a matter of fact, this is how it is.

Management Accounting

is a system of planning and coordination. This is an integral part of management, including financial management. This extensive and multi-level system includes strategy, mechanism and tools. For the application of management accounting, the size of the organization does not matter. This system adapts to both small businesses and large corporations. Only the set of tools is different. For small ones, you can get by with the bare necessities; for large ones, the arsenal is quite voluminous, and it is constantly being replenished through the efforts of applicants for scientific degrees.

management accounting is a fashionable area today.

still does not have venerable “parents,” although many foreign and domestic scientists claim this role. And since there is no full-fledged authority, everyone claiming this role pushes his own understanding and his own interpretation. Hence the branching into different areas of management activity.

It must be said that in modern management accounting

least accounting.

It would be nice to come up with a new name for this management system. Otherwise, with all its diversity, management accounting falls on the shoulders of the chief accountant - the accountant. A modern accountant knows the budgeting method, develops balanced scorecard systems, calculates key performance indicators, organizes the collection of information on commodity flows, conducts ABC analysis, and finally manages costs. Let’s add to this cash flow management, calculation of the cost of capital, season it with the calculation of the feasibility study of the loan and some other little things and we’ll get a financial manager. So is there a difference between a chief accountant and a financial director (manager)

.

There is practically no difference in the modern division of labor. If the financial director is somewhat dismissive of accounting (internally understanding that this is the limiter of his wild imagination)

, then the chief accountant, with melancholy and internal resistance, is forced to engage in budgeting and financial analysis.

So may or may not the Chief Accountant

, being subordinate to the financial director, be fully responsible for setting up

management accounting

?

Perhaps we will get the answer to this question by turning to history, which is not so distant, and to the experience of setting up management accounting, let’s say, American. Here we really can’t do without the luminary Charles Horngren. This great scientist, in his fundamental work “Accounting: the Managerial Aspect,”

clearly focuses on the chief accountant as a leading manager, assigning him the highest leadership role in the establishment of management accounting.

He is the head of the budget committee, the chief treasurer, and the manager of resources. The chief accountant

in an American company is a more than authoritative figure and occupies a step higher in the hierarchy than the financial director.

With such a management system, the purpose of accounting becomes clear. The entire accounting system works to improve management efficiency. It seems to us that by upending the hierarchical subordination usual for the Russian economy, we will increase the efficiency of financial management. By subordinating the entire management accounting

to the chief accountant, we will create key motivation.

The chief accountant

will take care of setting up accounting in such a way that will allow him to create a system of information flows adapted for analysis and making management decisions of both a tactical and strategic nature.

At the same time, he will have to delve into business processes and issues of financial and management analysis. The role of management accounting is also raised as a system for collecting, systematizing, and processing information for the purpose of analyzing, planning and coordinating the activities of all departments of the enterprise. The financial manager receives assignments from the Chief Accountant

for processing accounting information, develops and proposes financial criteria for assessing business performance. Along with him, other managers of key areas of activity organize their flows of information necessary for effective management.

The question may arise, why exactly the Chief Accountant

should head the entire direction

of management accounting

? Wouldn't it be more effective to create a special division and appoint an appropriate manager? As the long-term practice of implementing management accounting shows, this approach is not effective, since it gives rise to bureaucracy. A division created to improve the efficiency of the entire business works only for itself, creates an aura of irreplaceability and significance, as a result of which it burdens other services with an exorbitant amount of reporting, plans, budgets, without taking into account the difference between management accounting and interference in operational production and commercial activities. Of course, the Chief Accountant can create an exorbitant bureaucratic system. However, there is less danger here, since the Chief Accountant, along with the first person, is responsible not only for the process, but also for the final result of the work of the entire company.

Is the Russian Chief Accountant

to such a turn? Not yet. A Russian accountant is overburdened with tax accounting, essentially playing the role of a freelance tax service employee. The time spent servicing tax control functions, including counter audits, is rapidly increasing and, according to some estimates, has already reached two-thirds of the accounting department’s working time.

When working with a management accounting system, an accountant must use good software products. He will need knowledge in the field of analysis, planning, control, as well as tools for putting this knowledge into practice. Among the software products of Western manufacturers there are many programs designed for management. However, they all suffer from a major drawback: they include already “built-in” management decisions. But the developers used the empirical experience of Western, mainly American, companies, which was also quite distant in time. Even American companies have changed a lot over the past ten years, and Russian ones are not at all similar to American ones. Software products do not adapt to the Russian mentality, to the techniques and methods of farming in Russia. Some will say that this is good, let Russians learn to live by American standards. But, again, American companies are also different. Standard solutions with a shelf life of ten years are not suitable for them either. Our opinion is that it is necessary to use software solutions from domestic manufacturers. And don’t be afraid to give them tasks. We have to agree with the opinion that, despite the presence of world-class programmers in Russia, there is an acute shortage of problem solvers in the country. This is not taught much in college, or rather not taught at all. Among the chief accountants there could be worthy specialists, but they need to relieve their heads from excessively frequent reporting and tax bells and whistles. Having relieved them of constant stress, you can present them with an interesting and exciting job - setting up management accounting in your company. As well as automation of managerial work.

Burmistrova Lyudmila Mikhailovna Candidate of Economic Sciences, Associate Professor, Professor of the Department of Financial Management of the All-Russian Federal Economic Institute, Auditor, President