Deadlines for submitting SZV-M adjustments

Currently, absolutely all companies and individual entrepreneurs that make payments to hired employees and persons under GPC agreements are required to report in the SZV-M form.

From 05/30/2021 this must be done using a new form. You will find all the details of filling out the report in this article.

Also see our checklist for filling out the SZV-M.

When filling out this report, we recommend using the SZV-M sample from ConsultantPlus as a basis. Trial access to the legal system is provided free of charge.

From January 10, 2022, this report can be submitted on paper if there are 10 employees or fewer. The report is submitted electronically if the employer employs more than 10 people (Clause 2, Article 8 of the Law “On Individual (Personalized) Accounting..." dated 04/01/1996 No. 27-FZ).

The completed form is submitted to the Pension Fund monthly, no later than the 15th day of the month following the end of the reporting period (Clause 22, Article 11 of Law No. 27-FZ).

In order not to miss important dates for reporting, follow our section “Accountant’s Calendar”.

Important! ConsultantPlus warns: Often, audits by tax authorities or extra-budgetary funds result in a fine. However, you can try to reduce its amount if there are extenuating circumstances. They can be used by both inspectors and courts. Find out what circumstances you need to refer to in order to reduce the fine in K+. Trial access to the system is provided free of charge.

The policyholder can correct self-identified errors in the information accepted by the Pension Fund of the Russian Federation in the SZV-M form without negative consequences for himself until these errors are identified by the fund. Moreover, if an error is detected at the time of acceptance of the report, then sanctions can be avoided by submitting a clarification no later than 5 working days from the date of receipt of the notification to eliminate the discrepancies (clause 38 of the instructions approved by order of the Ministry of Labor of Russia dated April 22, 2020 No. 211n).

Let us remind you that 1 mistake will cost the company 500 rubles. The total amount of penalties is calculated based on the number of insured persons listed in the tabular part of the document (paragraph 4, article 17 of law No. 27-FZ).

What is the basis for filling out the report?

Personnel documents Reception, Personnel transfer, Dismissal.

In each personnel document you have the Record electronic work book flag (1). It is the presence of this flag that determines whether this personnel document will be included in the completion of the next SZV-TD report or not. This flag does not apply to the employee’s chosen method of maintaining a work record book. Next to this flag there is a Register button (2). You can use it to immediately create a SZV-TD report based on this document.

After a report has been created based on a personnel document, a link to it appears in the personnel document (1), as well as a warning in the header of the document that this information has already been transferred to the Pension Fund and a button for the need to change the information sent to the Pension Fund (2) .

In personnel documents (Hiring, Dismissal, Personnel transfer) there is a Document Name field. By default, it is filled with the name Order and will be displayed in the SZV-TD form in column 7 “Name of document”. In the field you can specify another document from the Document names list. If necessary, the list can be expanded.

Documents Registration of labor activity

(BP 3.0: Salaries and personnel – Electronic work books)

(ZUP 3.1: Personnel – Electronic work books)

The document has a button Data until 2022 with which you can enter information about personnel events until 2022, so the event created in this way will also be included in the SZV-TD report. Also, this method is suitable for entering activities that are not available in the form of personnel documents in 1C: Accounting.

So, let’s enter information about employment in 2016 for Mogov’s employee. Let’s first create the document Registration of Labor Activities, then the SZV-TD report based on it.

Documents “Application for provision of information about labor activity” and “Revocation of applications for provision of information about labor activity”

(BP 3.0: Salaries and personnel – Electronic work books)

(ZUP 3.1: Personnel – Electronic work books)

The documents are intended to record information about the employee’s method of choosing an electronic work book (in paper or electronic form), as well as information about canceling an already made choice.

Frequent mistakes when passing SZV-M

In block 4 of this form, it is necessary to list all the company’s employees with whom employment contracts or GPC agreements were in force in the reporting month (only for those GPC agreements from which insurance premiums were calculated). You need to include even those employees who were fired on the 1st day of the month or hired on its last day.

| No. | Errors in SZV-M | Correction method |

| 1 | Forgotten employee |

All employees indicated in the primary report do not need to be listed |

| 2 | Extra employee |

There is no need to list all personnel, otherwise the initial information on them will be reset to zero |

| 3 | Errors in employee data |

|

Find out whether you can avoid paying a fine if the Pension Fund imposed it for a typo in an employee’s data. ConsultantPlus experts spoke about one of these cases considered by the court. You can get trial access to the legal system for free.

About correction of other errors, for example, in the reporting period, form type, etc. read here.

Errors with code 30, 40

If the policyholder received an inspection report from the Pension Fund of Russia with error code 30, it means that inaccuracies were made when indicating the full name and/or SNILS of the individual. They must be written down exactly as on the insurance certificate. In this case, the report is considered partially accepted, i.e. the program will allow employees with correct information to pass, but not those with incorrect information.

Notice! The TIN in SZV-M is optional, but the SNILS of the insured person must always be present (clause 2 and clause 3, clause 2.2, article 11 of Law No. 27-FZ). This is how the Pension Fund identifies a person. Therefore, indicate it without errors.

The fine for incorrect SNILS and/or full name is 500 rubles. for each employee (Article 17 of Law No. 27-FZ).

check the correctness of SNILS on the FSS of Russia website portal.fss.ru, in the “Benefits” section. To do this, you need to enter an 11-digit number without spaces or dashes into the search form. However, this check will not provide any other data, such as full name, amount of pension savings, etc. An employer cannot independently find out SNILS via the Internet, for example, as an INN based on the full name and passport data of an individual, since this is confidential information.

To correct an erroneous SNILS, you need to submit a canceling and supplementing SZV-M on the same day. The first report cancels all incorrect information, the second one adds new information. Although local fund specialists note that it is enough to submit only the form with the “additional” type (read, for example, the message from the PFR branch in the Tver region). So it is better to consult your Pension Fund branch on this issue.

Corrections must be completed by the 10th day (before the 15th day in 2017) of the month following the reporting month. If the policyholder does not make it on time, then penalties will be applied to him under Article 17 of Law No. 27-FZ.

An incorrect full name can be corrected in the same way. By the way, the last name, first name and patronymic must be entered in the nominative case. Otherwise the program will throw an error. But extra dots and spaces in your full name will no longer interfere with passing the SZV-M.

Note! If the policyholder incorrectly indicated both SNILS and full name and TIN for the same individual, then the fine will still be 500 rubles, since the sanctions are established by Article 17 of Law No. 27-FZ in relation to each insured person with false information, and not in regarding each deficiency.

an error with code 30 even if the SZV-M contains only the last name of the insured person, but not the first name.

Also, information on an employee will not be accepted if the status of his individual personal information in the “Insured Persons” register on the date of the document being checked is equal to the value of “UPRZ”. The value "UPRZ" is assigned to an insurance number when it becomes irrelevant (i.e. when it is discontinued).

“SZV-M error 50”: what does this entry mean

If the company received a negative inspection report after sending the electronic report, it is necessary to retake the form again, correcting any inaccuracies.

Digital codes of detected errors are given in the order of the Board of the Pension Fund of the Russian Federation dated December 7, 2016 No. 1077p.

Code 50 means an error whose report cannot be accepted by the fund. For example:

1. The file has an incorrect structure.

The submitted file must be filled out correctly in XML document format with the following structure:

Pension Fund[reg. number]_[TO PFR code]_SZV-M_[file generation date]_[GUID].xml,

where: Reg. number - the number under which the policyholder is registered as a payer of insurance premiums.

PFR TO code - code of the territorial body of the PFR to which the file is sent (indicated according to the classifier of territorial bodies of the PFR).

The date the file was created is the date in the YYYYMMDD format.

GUID is a globally unique identifier that reflects the uniqueness of an electronic document. The GUID value must be identical to the document GUID value. For example: PFR_034-012-008689_034012_SZV-M_20211121_2d2b5a89-157c-44e8-a2a0-639b7ce30a69.xml.

2. An incorrect electronic signature was provided.

3. The TIN of the reporting company is indicated incorrectly.

4. A file with the “Ex” type has been sent, and the primary file for the reporting month has already been submitted.

Correcting an error in the employee's full name in SZV-M

Let's consider the adjustment of SZV-M using a specific example. The accountant of Tsvetochek LLC mixed up the names of two employees. For the rest of the employees, he provided correct information. The Pension Fund partially accepted the document and demanded corrections.

Original form:

Let's fix the error in two steps:

1. Submit the cancellation form: in the third section, change “outcome” to “cancel”. In the fourth section we will indicate the employees for whom the error was made. We will copy the information from the original report with incorrect last names, that is, we will first cancel the incorrect data.

2. We will send a supplementary form: in the third section “about. In the table of the fourth section we will add employees for whom the Pension Fund did not accept information. We do not provide data on other employees; they are already taken into account in the Pension Fund system.

The document submission format depends on the size of the business. If more than 25 people are employed, SZV-M can only be sent digitally. In other cases, employers choose the method of sending the report at their own discretion.

Prepare SZV-M without errors in the “My Business” service. The system takes into account legal requirements, generates reports on up-to-date forms and verifies information about employees. With it, you will avoid fines and concentrate on strategic business development.

Results

You must fill out the report on form SZV-M very carefully. Errors discovered after the deadline for submitting a report can be quite costly for a company, especially if it has many employees.

Sources:

- Federal Law of April 1, 1996 No. 27-FZ

- Order of the Board of the Pension Fund of the Russian Federation dated December 7, 2016 No. 1077p

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

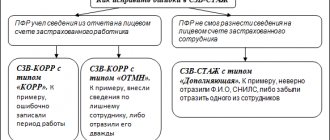

How to fix them

The cost of each error in the report is 500 rubles. Therefore, for companies with large staff, the amount can be impressive. You can correct inaccuracies yourself only if they were discovered and corrected with a new report before the deadline. But when the reporting period has passed, corrections can only be official. And here there are two options:

- In case of non-fatal errors (code 30, 400), the submitted SZV-M is accepted, but an additional report is submitted for inaccurate positions.

- If the errors are serious (code 50), the form is rejected and needs to be replaced.

For the technical implementation of this procedure, three types of SZV-M forms with different codes have been developed. This:

- Initial (iskhd) – for the initial submission of the report.

- Supplementary (additional) – to supplement the report in case of minor errors, or to resubmit it if the original report was rejected.

- Canceling (cancel) – to cancel a report submitted with errors.