What it is?

Insurance payments under compulsory motor liability insurance are the money received by the owner of a car who was injured in an accident through no fault of his own, as compensation necessary to pay for repairs or the purchase of a new car in the event of its complete loss.

In this case, payments are made at the expense of the insurance company of the person responsible for the accident, since the compulsory motor liability insurance policy does not provide for the insurance of one’s own car or even someone else’s, but the liability of the policy owner to other road users, which may arise due to his incorrect actions that resulted in an accident.

Funds transferred by insurers under the contract

The insurance payment is a certain amount of money that the insurance company is obliged to pay to its client upon the occurrence of an insured event under the terms of the MTPL agreement. According to Article 1 of the “Law on Compulsory Motor Liability Insurance”, an insured event provides for civil liability of the owner of the car due to damage to property or harm to human life and health.

The insurance company of the person responsible for the accident takes responsibility for compensating the damage to the victims. Having MTPL insurance in hand, the injured party has the right to receive a sum of money for restoration work, or compensation in kind, that is, repair of the vehicle at the expense of the insurer.

Features of taxation

To figure out whether insurance payments are taxable, let’s first determine what cases and features there may be.

- Firstly, legislation in the field of tax legal relations generally provides for two types of taxpayers:

- individuals, that is, you and me;

- legal entities, which are enterprises.

- Secondly, given that insurance compensation, when received by us, increases our available capital, they are recognized as income of an individual or legal entity.

- Thirdly, an MTPL agreement with an insurer can be concluded by both an individual and an enterprise with vehicles on its balance sheet. Accordingly, insurance payments can be received by both individuals and legal entities, which are recognized as income and serve as the reason for the emergence of an object of taxation.

This means that payers can be both individuals and legal entities. Therefore, the type of tax depends on the category of the subject. And tax can only be levied on the object of taxation for which is calculated based on the amount of income.

However, the fact that there is income and an object of taxation does not mean that tax must be paid in any case, due to the fact that there are many preferences and not all income is ultimately taxable.

For citizens

Individuals pay income tax (NDFL), the procedure for calculation and payment of which is regulated by Chapter 23 of the Tax Code of Russia. Thus, the code states that:

- insurance payments are included in income (Article 208);

- These compensations are not subject to taxation as payments under compulsory insurance contracts (Article 213).

Thus, individuals do not have to pay personal income tax on insurance payments under compulsory motor liability insurance.

Individual entrepreneurs are not legal entities, so they are subject to the same rules that apply to individuals. Consequently, they also do not transfer personal income tax on such income.

For legal entities

Legal entities are subject to income tax, the essence of which is that the object of taxation is defined as the difference between income and expenses. The provisions on the procedure for imposing this tax are enshrined in Chapter 25 of the Tax Code of the Russian Federation. In particular, it was established that:

- non-operating income includes amounts of compensation for losses and damages (Article 250);

- Article 251 specifies an exhaustive list of income not taken into account when determining the tax base, which does not include amounts of compensation for damage;

- Losses from accidents and emergencies are considered non-operating expenses (Article 265).

Thus, insurance payments for compulsory motor liability insurance are included in the income of the enterprise, and expenses for eliminating the consequences of damage to a corporate vehicle are included in the expenses.

Considering that only the difference between income and expenses is subject to income tax, then:

- if the losses are greater than or equal to the compensation received, no income tax will be charged;

- if the losses turn out to be less than the compensation, then only the part of the insurance payment that exceeds the value of the losses received will be taxed.

Payment procedure

The tax payment process includes the following steps:

- calculation of the amount to be paid;

- preparation of relevant documents;

- making a payment to the budget.

How to calculate tax

The personal income tax rate is 13%. Based on this value, individuals must make payments. The payment itself must be paid the following year, after receiving the insurance compensation. To calculate the tax base, it is necessary to subtract the costs of eliminating the consequences of the damage from the total amount of compensation received (the actual coverage of the amount of damage, as well as possible penalties and compensation for moral damage).

Legal entities are required to pay income tax at a rate of 20%. It is calculated as the difference between all income and expenses received by the company.

List of documents

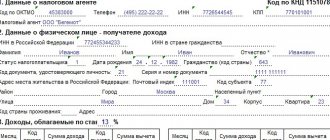

When paying tax, an individual submits a declaration of income received for the previous year, completed in Form 3-NDFL. No additional documents are required.

For a legal entity, when filling out an income tax return, it is required to attach documents on the basis of which income and expenses were recorded.

If we talk about insurance costs, then to confirm them it is necessary to provide contracts for the repair of the company’s vehicle or real estate, and other documentation confirming the costs associated with eliminating the damage.

Step-by-step instruction

The procedure for paying tax on insurance payments is as follows:

- A citizen receives a notification from the insurer that he needs to pay tax on the insurance payment received.

- The declaration completed in Form 3-NDFL must be submitted to the relevant authorities no later than April 30 of the following year. In the “Insurance” section, you must indicate the amount of income from which the fiscal payment is made.

- The personal income tax payment itself must be completed before July 15 of the year in which the income tax return was filed.

Liability for non-payment

Current legislation presupposes the liability of a person who has not paid or has lately made a personal income tax payment. Thus, in accordance with Article 122 of the Tax Code, an unscrupulous taxpayer will be punished with a fine amounting to 20% of the amount of the tax liability.

Thus, the citizen will have to pay not only the tax arrears, but also a fine.

Is it income?

Regardless of the purpose and for what reason the funds are received, this is an increase in economic benefits, and therefore is taken into account as income, except in cases expressly provided for in legislative acts. And insurance payments were no exception:

- on the basis of Article 208 of the Tax Code of the Russian Federation, they are recognized as income for tax purposes by the personal income tax;

- according to Article 250 of the Tax Code of the Russian Federation, they also constitute income for the purposes of corporate income tax.

However, please note that not all income is subject to taxes.

At what rate is taxation carried out?

The personal income tax rate for transferring funds to the treasury is 13% . In practice it looks like this:

- The policyholder's car was involved in an accident. After carrying out the appropriate calculations, the amount of compensation was 20,000 rubles.

- After registering an insured event and providing all documents to the insurer, the client expects payment.

- The insurance company is delaying the transfer of funds, so the vehicle owner is forced to go to court.

- After receiving a court decision to recover funds and pay a penalty for late payment, the policyholder will no longer receive the required 20,000, but a larger amount, including the amount of the penalty.

- This difference is taxed; it is considered as income, since it exceeds the amount needed to restore the vehicle. Of this difference, the driver is required to pay 13% tax.

Procedure for organizations

Business entities do not always calculate income tax on amounts received as compensation under MTPL agreements. It is not the full amount of payments that is taxed, but only the difference between the amount of the insurance payment and the actual costs of restoring the car or purchasing a new one in the event of its complete loss.

The tax rate is set at 20%. For example, if:

- the amount of insurance compensation under compulsory motor liability insurance was 50 thousand rubles;

- and the actual costs of repairing the car amounted to 45 thousand rubles;

- then the object of taxation for income tax will be the difference in the amount of 5 thousand rubles;

- and the tax payment will be 1 thousand rubles.

Tax on insurance payments must be paid in the same manner as when receiving other types of income. The moment of payment depends on which method is used to recognize income and expenses:

- with the accrual method, it does not matter when the funds were actually received and when the costs of repairing the machine were incurred. They must be recognized at the moment in which they occurred. Therefore, the tax should be transferred to the budget immediately without waiting for the money to be received;

- with the cash method, you should pay only after the insurance payment is received into the company’s account.

Also, when calculating and paying the mandatory payment in question, you should act in accordance with the rules established by Article 286 of the Tax Code of the Russian Federation. Thus, income tax is paid by transferring monthly advance payments, calculated based on taxable profit and rate.

Personal income tax on various insurance payments

Each type of insurance contract will be taxed differently.

According to OSAGO

If the owner of a vehicle has an issued MTPL policy, then in the event of a road accident and damage to property or health of third parties, the insurance company will reimburse the costs incurred to compensate for the damage.

When filing an income tax return, the taxpayer must include insurance payments received both in the country of residence and abroad.

At the same time, based on the provisions of Article 213 of the Tax Code, individuals who have received compensation under mandatory insurance contracts are exempt from paying personal income tax, and such proceeds will not be subject to taxes. MTPL insurance is mandatory in Russia; therefore, compensation for damage received by the policyholder should not be subject to a 13% tax.

An exception may be payments the amount of which exceeds the amount of damage caused.

Personal voluntary insurance

Payments received by a taxpayer under voluntary life insurance contracts are not included in the calculation of the tax base when calculating the amount of personal income tax payments. This is stated in Article 213 of the Tax Code of the Russian Federation. This applies to survival contracts, as well as event insurance.

Important! The tax amount is not calculated if monthly payments were made by the taxpayer himself or his relatives and family members.

For property insurance

Compensation for property insurance will be subject to fiscal payments if the amount of compensation payment is greater than the value of the property for which the insurance policy is issued.

If an insured event occurs on real estate, then taxation on insurance payments will be determined as follows:

- If the property is destroyed, the basis for the calculation will be the difference between the insurance coverage paid by the insurer and the value of the property, which is valid on the date of the event specified in the insurance contract, to which the amount of insurance payments under the contract is added.

- In case of property damage - the difference between the amount of insurance coverage and the costs of restoration, which are increased by the amount of insurance payments made by the insured.

I received a letter with taxes - can I not pay and what are the consequences?

You can always not pay, but you must understand that this will be a tax offense for which liability is provided. The amount of the penalty will depend on whether you filed a tax return or not, and can be up to 30-40% of the tax amount. But paying a fine does not relieve you from the obligation to pay the tax itself, so possible “losses” must be summed up.

The deadline for filing a tax return is set until April 30 of the following year, and the tax on this return must be paid no later than July 15. If you miss these deadlines, but still decide to pay the tax, the main thing is to do it before the tax authorities discover the non-payment, then you can avoid a fine.

This topic is becoming more and more relevant, because in a situation where there is less and less money in the treasury, they remember all the debtors of the state.

I received a letter from the insurance company - what should I do?

Here you need to clearly distinguish from whom such a letter came - from the tax office or an insurance company. The fact is that in the vast majority of cases it is the insurer who sends it. And in this case, it has the status of only a notification - a reminder as a gesture of goodwill from the insurance organization.

To pay or not to pay – in any case, it’s up to you to decide.

When will personal income tax still have to be paid?

Obtaining insurance by court order is most often accompanied by a written notice of the need to pay tax. It is not necessary to pay personal income tax on all amounts. The bulk of the damages recovered are not subject to taxation. But you will have to pay tax for:

- a penalty that is awarded for missing the due date for insurance payment;

- a fine issued as punishment for failure to comply with a pre-trial claim.

If the insured is awarded compensation for moral damages, then this money is not considered income and therefore not subject to taxation.

Insurance premium rates in 2022

If an organization does not have the right to apply reduced tariffs, then it charges contributions at the basic tariffs. They are indicated in Art. 426 Tax Code of the Russian Federation.

Tariffs of insurance premiums for payments to employees not exceeding the maximum base:

- For compulsory pension insurance (OPI) - 22%;

- For insurance for temporary disability and in connection with maternity (VNIM) - 2.9%;

- For compulsory health insurance (CHI) - 5.1%.

Tariffs of insurance premiums for payments to an employee in the part exceeding the maximum base:

- For compulsory pension insurance - 10%;

- For compulsory health insurance - 5.1%.

Reduced contribution rates are established, in particular, for the following categories of organizations:

- IT organization (Tariffs: OPS - 8%, VNiM - 2%, compulsory medical insurance - 4%);

- An organization on the simplified tax system that conducts preferential activities according to paragraphs. 5 p. 1 art. 427 of the Tax Code of the Russian Federation (Tariffs: OPS - 20%, VNiM - 0%, compulsory medical insurance - 0%);

- Pharmacy on UTII in relation to payments to employees engaged in pharmaceutical activities (Tariffs: OPS - 20%, VNiM - 0%, compulsory medical insurance - 0%).

Organizations whose annual income does not exceed 79 million rubles have the right to apply a reduced tariff.

Contributions to compulsory health insurance at additional rates are charged to organizations that have employees engaged in work that give the right to early assignment of an insurance pension (listed in paragraphs 1 - 18, part 1, article 30 of Law N 400-FZ). This is indicated by Art. 428 of the Tax Code of the Russian Federation, Letters of the Ministry of Finance dated November 16, 2016 N 03-04-12/67082, Ministry of Labor dated February 25, 2014 N 17-3/B-76.

Do I need to pay personal income tax?

Non-payment of taxes entails the imposition of administrative measures to combat non-payers - the imposition of a fine. An individual will have to not only pay the required 13% of the income received, but also compensate for the established fine.

You can determine whether you need to pay personal income tax or not on your own or by consulting the nearest tax office. In most cases, insurance payment does not entail the obligation to pay personal income tax. However, there are rare exceptions to this rule.

Payment of fees. Reporting on insurance premiums

Payment of contributions by employers

Payment of insurance premiums from payments to individuals assumes that during the billing period (year) it is necessary to calculate and pay contributions in the form of monthly mandatory payments.

At the end of each reporting period - the first quarter, half a year, 9 months, calendar year - you need to summarize the payment of insurance premiums: fill out and submit calculations for accrued and paid premiums for these periods.

At the same time, it is necessary to keep records of accrued payments and contributions for each employee.

A monthly mandatory payment is paid from 2022 to the Federal Tax Service for all employees in the total amount (except for the contribution to the Social Insurance Fund). The amounts of monthly mandatory payments must be transferred in rubles and kopecks.

Monthly mandatory payments for insurance premiums must be paid no later than the 15th day of the month following the month for which they were accrued. If the last day for payment falls on a non-business day, the payment deadline will be the next business day.

Reporting on insurance premiums

On January 1, 2022, new rules for reporting insurance premiums came into force.

Starting from the 1st quarter of 2022, you must submit a new unified calculation of insurance premiums to your tax office. It combines data from four reports to funds at once: RSV-1 PFR, 4 - FSS, RSV-2 PFR and RV-3 PFR. The calculation, format and procedure for filling out are approved by Order of the Federal Tax Service of Russia dated 10.10.2016 N ММВ-7-11/ [email protected]

Important! The deadline for submitting calculations has changed.

Calculation of contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance must be submitted to the tax authority once a quarter no later than the 30th day of the month following the billing (reporting) period (p 7 Article 431 of the Tax Code of the Russian Federation). The innovation is due to the fact that the Tax Code of the Russian Federation has been supplemented with provisions on the collection of insurance premiums (except for contributions for injuries).

From the clarification of the FSS it follows that the calculation must be submitted for periods beginning no earlier than January 1, 2022. Reporting on contributions, including updated ones, for earlier periods is submitted according to the old rules. They are as follows: the electronic 4-FSS must be submitted to the territorial body of the FSS no later than the 25th day, the paper one - no later than the 20th day of the month after the reporting period. RSV-1 in electronic form should be sent to the territorial body of the Pension Fund no later than the 20th day, in paper form - no later than the 15th day of the second month following the reporting period.

The deadline for paying contributions remains the same - the 15th day of the month following the month for which they were accrued.

The changes are provided for by Federal Law No. 243-FZ of July 3, 2016.

Note! For late submission of payment calculations, inspectors are fined under Art. 119 of the Tax Code of the Russian Federation, the minimum fine is 1,000 rubles.