About legal entities

Step-by-step instructions Attention! The VAT rate has been changed from 01/01/2019 from 18% to 20% and from

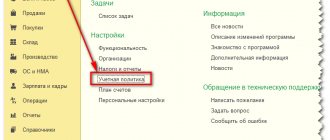

All enterprises are required to formulate and apply in practice an accounting policy (AP), regardless of

A certificate of incapacity for work opened to a dismissed employee within 30 days from the date of termination of the employment contract,

Who carries out the reconciliation Reconciliation is regulated by section 3 of the Order of the Federal Tax Service of the Russian Federation dated 09.09.2005 No.

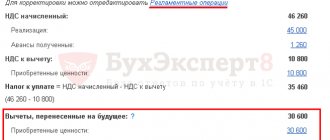

Tax deductions for VAT are good for the company, but if you get carried away with them, you can instead

Declarations on taxes on transport and land have been cancelled. Since 2022, legal entities will not file

What reports are submitted on salary? Salary reports are submitted to four departments: the tax inspectorate, the Pension

Who needs to use the seal The use of the organization's seal is currently optional. It's a public right

08/11/2019 0 20211 8 min. According to the current law, any employer when dismissing an employee is obliged

What does this code mean? Tax identification number is a unique code consisting of 12