Fill out online via the Federal Tax Service

Fill out online through State Services

Fill out online through the Personal Income Tax Service

You must fill out 3-NDFL in accordance with all norms of the Tax Code and current legislation. The form is drawn up for the purpose of paying taxes to the state treasury or to return part of the funds paid.

The 3-NDFL declaration is filled out online, on the tax office website, or independently, using software. In 2022, filling out a tax return is very simple; look at the example of how this procedure is performed using the program:

Fill out 3-NDFL using the program

Who is required to fill out and submit the 3-NDFL declaration

Responsibilities for filling out and submitting the 3-NDFL declaration in 2022 are not assigned to all individuals, but only to those who:

- engaged in entrepreneurial activity in 2022;

- received income from which personal income tax was not withheld by the tax agent;

- sold his property - an apartment or a car;

- won the lottery.

Other cases of mandatory reporting are listed in Art. 228 Tax Code of the Russian Federation.

Individuals claiming property, social and other deductions can also fill out a declaration and send it to the tax authorities, but on a voluntary basis.

Note! For reporting for 2022, Form 3-NDFL must be completed on an updated form, approved. by order of the Federal Tax Service dated October 15, 2021 No. ED-7-11/ [email protected]

ConsultantPlus experts told us what has changed in the form. Get free demo access to K+ and go to the Review Material to find out all the details of the innovations.

A declaration can be submitted to the Federal Tax Service:

- On paper (the form is filled out manually or using a PC and then printed on a printer):

- personally;

- through a representative (in this case, you will need a power of attorney to represent the interests of the taxpayer);

- Russian Post (with a description of the attachment).

- In electronic form via telecommunication channels, for example through the taxpayer’s personal account (PA) on the Federal Tax Service website.

We will find out further how to fill out 3-NDFL online in LC.

Basic filling rules

Rules for filling out the 3-NDFL tax return

Of decisive importance is the correctness of filling out the tax return, the accuracy and completeness of the specified information.

The rules for filling out the 3-NDFL declaration are given in the Order of the Federal Tax Service of the Russian Federation:

- filled out either by hand or printed on a printer, only one-sided printing, no corrections or deformations of the barcode (it is located on each sheet in the upper left corner);

- one specific field is allocated for each indicator;

- cost indicators must be filled out with kopecks (except for income from sources abroad);

- tax amounts - without kopecks in full rubles (if the number of kopecks is up to 50, then we do not take it into account, we take it as 0; if there are more than 50 kopecks, then we take it as 1 ruble);

- text and numeric fields must be filled out from left to right; when filling out cost indicators, they must be aligned to the right.

If an individual fills out a declaration by hand, then capital and printed characters must be used, and if some indicator is missing, then dashes are placed in such cells.

If the declaration is prepared in electronic form, then the absence of dashes for unfilled cells is allowed. There is a requirement for the font: it must be Courier New, height 16-18 points.

All values of the indicators that are used in the declaration are taken from the relevant certificates of income and withheld tax amounts (2-NDFL, issued by a tax agent, for example, an employer - at the request of the employee); from settlement, payment and other documents.

Feature: taxpayers have the right not to indicate income that does not need to be subject to income tax or income from which the tax agent has already withheld tax, if this does not serve as an obstacle to receiving a tax deduction.

For example, if, according to an individual’s calculations, he is entitled to a refund of 10,000 rubles from the budget for treatment in 2014, in order to get it back, he had to pay income tax of at least 10,000 rubles in 2014 (this tax, for example, was withheld by the employer from his salary) , then indicating income from certificate 2-NDFL is mandatory. After all, if the income and tax paid fields in the declaration are left empty, then you will not be able to receive a refund.

If any errors, inaccuracies, incompleteness of reflected information, etc. are found in the submitted declaration, then the taxpayer needs to submit an updated tax return indicating the adjustment number (for example, 1—).

You can download the currently valid tax return forms in the Forms and Forms section.

What programs are there for filling out 3-NDFL online and where to download them

Various websites on the Internet offer users to fill out the 3-NDFL declaration online and help with sending it to the inspectorate. However, trust only proven programs and sites.

On the official website of the Federal Tax Service, you can download the “Declaration 2021” program to fill out 3-NDFL in 2022. With its help, data from documents is entered, after which it automatically calculates all the required values, checks the correct application of deductions and the tax amount. In this program, the declaration is generated in the required format for submission to the tax authority or printed for paper version.

As we noted above, it is also possible to issue a report in the Personal Account on the Federal Tax Service website or through Gosuslugi. Here you can upload an electronic version of the report, filled out in other programs, for example in the same “Declaration”, or you can enter data online directly into your personal account, and then create a document there for sending and send it to controllers.

New uniform 2022

It is not necessary to use the program from the tax.ru website to prepare the 3-NDFL declaration. An individual can download the declaration form in excel format, then fill it out on his computer or print it out and fill it out manually with a pen.

It is important to download the new, current version of the declaration, as changes are regularly made to the form.

In 2022, the form of 3-NDFL has changed significantly. The form has been simplified and numerous changes in tax legislation have been taken into account. The current declaration format can be downloaded below for free in Excel.

Download the new form 3-NDFL for 2022 - excel (to fill out for 2022).

Instructions for completing this form in various cases with completed declaration templates:

- when selling an apartment;

- for individual entrepreneurs;

- for individual entrepreneurs it is zero;

- when buying an apartment;

- on mortgage;

- when selling a car;

- for a personal income tax refund for treatment.

Deadlines for preparing and filing a tax return

The deadline for filing 3-NDFL is established only for cases where an individual entrepreneur or individual wants to show his income for the purpose of paying personal income tax (or non-payment in the case of a zero base).

Individual entrepreneurs, lawyers, notaries, individuals, when selling property or receiving income, are required to submit a 3-NDFL declaration to pay personal income tax by the end of April next year.

Income for 2022 must be reported to the Federal Tax Service by April 30, 2019.

For income tax refunds in connection with the use of any type of deduction, there are no deadlines for filing a return. That is, you can contact the Federal Tax Service on any day during the year following the reporting year.

The declaration completed in the program can be saved in xml format, then printed, signed and submitted to the tax service in paper form in person or through a representative. You can send documents by mail.

Filling out 3-NDFL online: example

The following sections of the declaration must be completed and submitted:

- title page;

- section 1;

- section 2.

Everything else is completed if the data is available, because, as we have already said, the declaration is submitted for a variety of reasons and for each of them it is necessary to fill out the corresponding parts of the report.

Based on the example, we will fill out the 3-NDFL declaration in the personal account of the taxpayer registered on the State Services website.

Fedotov A.A. On January 23, 2022, he sold the apartment to Semenov B.B. for 3.5 million rubles. The cadastral value of the apartment is estimated at 5.2 million rubles. The apartment was bought by Fedotov in August 2022 for 3.3 million rubles. Since the property ownership period of 5 years has not been exceeded, the seller will have to submit a 3-NDFL declaration to the tax authorities and pay tax.

Fedotov decided to fill out the declaration and submit it through the taxpayer’s personal account on the Federal Tax Service website. Let's help him with this.

What is the 3-NDFL declaration and how to prepare it

Before we begin to discuss the conditions under which the document must be completed, we suggest you understand why it was put into effect by tax legislation and what it is.

A tax return is one of the mandatory types of documents for submission to the tax service, which, as a rule, is drawn up in accordance with the specially adopted form 3-NDFL.

The declaration serves to enable the tax inspectorate to monitor all sources of income of an individual, the amount of taxes collected from them, as well as various financial transactions that are related to expenses.

Individuals are often faced with the preparation of a document of this kind when it comes to obtaining a tax deduction. However, in some situations, the document is completed for other reasons.

It should be noted that if the taxpayer submitted a declaration for consideration with a request to accrue a tax discount in the current year and did not receive all the financial compensation, then in order to withdraw the remaining funds, it is necessary to fill out the document again, but only for the new tax period.

Filling rules

Now is the time to move on to the next stage - consider the rules for drawing up the document. We strongly recommend that you do not neglect them, since they are very important and have an impact on the timing of consideration of the declaration. The more errors there are, the longer the applicant for a deduction will wait for the funds to arrive in his bank account.

Information must be entered into form 3-NDFL in accordance with the following requirements:

- Data loss. Under no circumstances should you submit a document with data that is either corrected, lost or damaged. Most often, taxpayers make such mistakes when binding sheets, so first check before this procedure whether the text has been captured.

- Filling. All information required to be entered into the fields of the declaration, as a rule, is taken from documents that are already in the hands of the taxpayer. If an individual does not find the necessary information in them, then he can contact the tax inspector with a request to issue a certificate containing the necessary information.

- Recording format. The data required to be provided in a particular cell must be clearly contained within it and not extend beyond it.

- Writing amounts of money. All monetary amounts are recorded in full. That is, not only the whole part - rubles, but also the fractional part - kopecks.

- Information about income earned outside the Russian Federation. In this situation, funds received within another state are transferred into Russian currency. After this, rounding is carried out (if the fractional part is less than 50 kopecks, then it is not taken into account, and if more, then it is rounded towards the full ruble), only the whole part is written down.

- Income received not in rubles. If an individual received any income in foreign currency, then they must be converted into rubles, using strictly the rate approved by the Central Bank of Russia.

- Top of each page. Without exception, all sheets of the tax return must contain page numbers, surname, initials and identification number of the individual. If an individual is not a private entrepreneur, then it is not necessary for him to put a code on each sheet.

- Bottom of each page. All pages of the declaration, in addition to the title page, must contain certain details - this is the personal signature of the physical sheet and the date of execution of the document. By affixing his signature, the taxpayer confirms that all of the above data is true, and otherwise bears administrative responsibility.

- Writing text. As you know, digital designations are entered into most cells of the declaration, but text still needs to be entered into some of them. You need to start writing text from the very left edge of the cell, without leaving empty cells on the left, which will help eliminate the possibility that the information will not fit into the column allocated for it.

General requirements

In addition to the above rules, individuals must take into account that information must be entered accurately and be reliable.

After entering information into the document, you need to double-check several times whether it exactly corresponds to similar data specified in other documents, and also do not forget that the declaration must be submitted for consideration no earlier than the end of the tax period for which it is being prepared.

In addition, you need to take into account that there are several examples of a document of this kind. You need to use the one compiled for the year preceding today's date.

Filling out 3-NDFL in the taxpayer’s personal account program

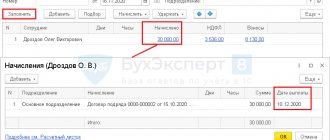

Fedotov A.A. logged into the taxpayer’s personal account through the State Services website. He logged in to it in advance and confirmed his identity at the nearest MFC.

The title book contains information about the individual; it will be filled in automatically based on the account information on the State Services. Fedotov needs to select an inspection code, a year, and when he reports for this year; indicate that he is a resident and a taxpayer.

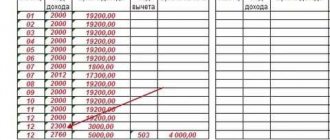

To fill out information about income, Fedotov will indicate the sale price of the apartment, as well as its cadastral value. The program will compare the full sales value and the cadastral value, taking into account a reduction factor of 0.7, and based on this information, fill out the calculation in Appendix 1. As income, Fedotov will select the cadastral value multiplied by 0.7 (5.2 × 0.7 = 3 .64 million rubles), since this figure is higher than the sales price of 3.5 million.

The figure is 3.64 million rubles. transferred to Appendix 1.

Fedotov’s expenses include the purchase price of the apartment, since he kept all the documents confirming its purchase. The value is 3.3 million rubles. the program will display in Appendix 2.

For Appendix 1, you need to fill out information about the source of income, i.e. about Semenov B.B.

Is it possible to fill out 3-NDFL by hand?

Tax legislation has approved two ways to prepare a 3-NDFL declaration - using a special program and by the taxpayer himself. In the latter case, all sheets of the document must be filled out with a black or blue pen. Other ink colors are strictly unacceptable.

If an individual decides to draw up a declaration with his own hand, then he should remember the following nuances of the filling procedure:

- Text. In those cells in which text must be present, it must be written in capital Russian letters, starting from the left edge.

- Lack of data. Sometimes it happens that an individual does not need to provide some information. In such a situation, the cells cannot be left empty, since the tax inspector may think that the individual simply forgot to enter the information. In cells of this kind it is necessary to put dashes. This also applies to those cells that are not completely filled.

- The information does not fit on the page. It often happens that the information that needs to be included in the document is quite voluminous and does not completely fit into the sheet provided for it. In such cases, you need to add an additional sheet, and be sure to put the page number, signature, date, taxpayer identification number and personal data on it. However, the final information must be indicated on the added sheet. For example, the total amount of tax deduction.

- Fractional numbers. Often, in the 3-NDFL declaration, many more cells are provided for entering fractional numbers than required. In such situations, an individual must put a whole part and several dashes in the leftmost cell, write a fraction sign between the cells, and enter a fractional part and also dashes in the next one.

For example, if a taxpayer fills out a document to reduce the tax base in connection with the acquisition of real estate that is in shared ownership, and he needs to enter the value 1/5 in two columns consisting of five cells each, then this is done as follows: 1—-, sign “/”, 5—-.

Tax calculation and submission of declaration

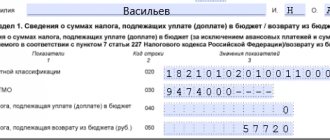

So, all the data for calculating the tax has been entered. The program automatically displays the result and shows that the tax payable is 44.2 thousand rubles.

This amount is displayed:

- in section 2, which provides the calculation of tax based on income from Appendix 1 and expenses/deductions from Appendix 6;

- Section 1, which contains information about the BCC, OKTMO and the amount of tax payable to the budget.

The declaration has been generated, now it needs to be saved.

The saved version can be printed in .pdf format, or you can send it to the tax office without printing it.

To send the report, it is signed with a non-qualified signature by entering a password.

Filling out a report online has its advantages: you don’t need to think about which line of the declaration this or that indicator belongs to - the program itself fills it out line by line, based on the data entered by the taxpayer.

Results

Declaration 3-NDFL must be submitted by persons conducting business activities, receiving income from which the tax agent does not withhold tax, who sold their property during the reporting year, and in other cases. Those who want to exercise the right to deduct certain expenses, such as treatment, education, purchasing housing, etc., can voluntarily submit a declaration.

The declaration is submitted on paper or electronically. Above, we explained with examples how 3-NDFL is filled out online in the taxpayer’s Personal Account. Also, to fill out 3-NDFL, you can download the “Declaration” program from the official website of the Federal Tax Service.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Download for free from the Federal Tax Service website

The program installation file can be downloaded from the official website of the Federal Tax Service, the download link is tax.ru.

This link contains the current version for 2022, changes are made annually, so it is important to download the latest version.

Downloading is free and available to absolutely everyone. You need to download the installation program, then run the file - the program will be installed on your computer.

Installation instructions can also be downloaded as a separate file.

After the 3-NDFL 2022 program is installed, you need to open it and begin filling out the fields and preparing the declaration.

Using this program you can fill out 3-NDFL in the following cases:

- Individual entrepreneur for declaring income from business activities.

- Private practitioners (lawyers, notaries and others) to submit reports on income received for the reporting year.

- Ordinary citizens who have received income and are required to pay income tax on it (meaning the tax that the employer did not withhold) - for example, when receiving interest, dividends, or selling property.

- Ordinary citizens to use deductions (property, social, standard) and return part of the expenses incurred (purchase of real estate, cars, educational expenses, treatment).

- Ordinary citizens to receive a property deduction for sold property (movable and immovable) - sale of apartments, payment of mortgage interest, sale of cars.