Who needs to use the seal

The use of the organization's seal is currently optional. This is a right of a limited liability company or a joint stock company, and not an obligation, and it follows from the relevant federal laws. In particular, paragraph 5 of Art. 2 of the Federal Law of 02/08/1998 No. 14-FZ “On Limited Liability Companies”, as well as clause 7 of Art. 2 of the Federal Law of December 26, 1995 No. 208-FZ “On Joint-Stock Companies”.

But for non-profit organizations and unitary enterprises, the seal is required by law.

Clause 4 art. 3 of the Federal Law of January 12, 1996 No. 7-FZ “On Non-Profit Organizations” says that a non-profit organization has a seal with the full name of this non-profit organization in Russian.

Clause 3 art. 2 of the Federal Law of November 14, 2002 No. 161-FZ “On State and Municipal Unitary Enterprises” contains an indication that a unitary enterprise must have a round seal containing its full company name in Russian and an indication of the location of the unitary enterprise. The seal of a unitary enterprise may also contain its corporate name in the languages of the peoples of the Russian Federation and (or) a foreign language.

DOCUMENTS “WITHOUT SEAL” or why LLCs and JSCs may not be stamped

In connection with questions that have arisen to date regarding the need to affix a seal to the organization’s documents, we present the appropriate clarifications.

1. Currently, business companies have the right not to have a seal. On April 7, 2015, a law came into force allowing LLCs and JSCs to refuse to use the seal[1].

The adopted federal law removed this obligation from them and made the use of seals a right of society. The laws on LLCs and JSCs now use the following wording: “A company has the right to have a seal, stamps and forms with its name, its own emblem, as well as a duly registered trademark and other means of individualization. Federal law may provide for the obligation of a company to use a seal. Information about the presence of a seal must be contained in the company’s charter.”[2]. Before this law came into force, legislation required organizations to have round seals indicating the name and location.

The amendments were made to the laws on business companies and, accordingly, have no relation to individual entrepreneurs. The legislation, as before, does not oblige individual entrepreneurs to have a seal. The issue of production and use of a seal is decided by individual entrepreneurs independently.

The current legislation provides for cases when the use of a seal is mandatory “if available” (See Appendix 1).

< > If there is a seal, then this must be written down in the charter. It is advisable that from the charter of a business company one can understand whether the company has a seal. Thus, if a company intends to use a seal, its charter will contain appropriate wording. In this case, the company is subject to the obligation to affix a seal in certain cases provided for by law (See Appendix 1). In other cases, the company affixes a seal at its discretion.

If the company refuses a seal, then for the convenience of interested parties it can be directly stated in the charter: “The company does not have a seal.”

< > It is not necessary to print on primary accounting documents. The requirements that primary accounting documents must meet are listed in paragraph 2 of Article 9 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting”. The organization's seal is not mentioned among the required details. This means that the tax office will not be able to make claims due to the absence of a seal imprint in the primary accounting documents.

This conclusion is confirmed by letter of the Ministry of Finance of the Russian Federation dated August 6, 2015 N 03-01-10/45390.

< > Optional stamp on contracts. The company's seal, even if it is present, may not be placed on the contract. The signature of the person who made the transaction is sufficient (Article 160 of the Civil Code of the Russian Federation). It will be mandatory only in cases where it is expressly provided for by law. In such cases, only those companies that have not abandoned the use of the seal are required to affix a stamp on documents.

In addition, the parties to a separate agreement may independently undertake the obligation to affix a seal on the documents being signed. Thus, in order to avoid negative consequences, you should check all existing contracts and continue to use the seal where the contract requires it.

Conclusions:

1) LLCs and JSCs have the right, but are not required, to have a seal.

2) Information about the presence of a seal must be contained in the company’s charter. The absence of such information means that the society does not have a seal.

3) Primary accounting documents can be prepared without a seal.

4) Even if there is a seal, it may not be affixed to contracts.

Annex 1

cases when the use of a seal is mandatory

if available

| Work accident report | Art. 230 Labor Code of the Russian Federation |

| Double warehouse receipt | Art. 913 Civil Code of the Russian Federation |

| Art. 61 Arbitration Procedure Code of the Russian Federation |

| Art. 53 Code of Civil Procedure of the Russian Federation | |

| Federal Law dated October 2, 2007 No. 229-FZ “On Enforcement Proceedings” (Part 2, Article 54). |

| Powers of attorney on behalf of the organization (when appealing the actions of the customs authority), copies of the auditor's report on the reliability of the financial statements, “paper” statements, an extract from the system for recording goods presented to customs officials. | Federal Law of November 27, 2010 No. 311-FZ “On customs regulation in the Russian Federation” (Part 6, Article 39, Clause 6, Part 3, Article 90, Clause 2, Part 5, Article 177, Clause 1, Article 184) |

| Power of attorney attached to applications for participation in an open competition, closed auction, power of attorney for the purpose of obtaining accreditation of participants in an electronic auction, application for participation in a closed auction. | Federal Law dated 04/05/13 No. 44-FZ “On the contract system in the field of procurement of goods, works, services...” (Articles 51, 61, 88). |

| Inspection log | Federal Law dated December 26, 2008 No. 294-FZ “On the protection of legal rights. persons and individual entrepreneurs in the exercise of state control (supervision)…” (Part 10, Article 16). |

| Copies of constituent documents when submitted to the registration authority | Federal Law dated July 21, 1997 No. 122-FZ “On State. registration of rights to real estate and transactions with it” (clause 4 of article 16). |

| Copies of the advance payment notice | Federal Law of November 22, 1995 No. 171-FZ “On state regulation of the production and turnover of ethyl alcohol, alcoholic and alcohol-containing products...” (subclause 5, clause 1, article 10.2). |

| Statements of securities accounts, mortgage notes on the fulfillment of the obligation secured by the mortgage. | Federal Law of July 16, 1998 No. 102-FZ “On Mortgages” (paragraph 5, paragraph 3, article 16, paragraph 5, paragraph 1, article 17, paragraph 2, article 25). |

| Decisions on the issue of securities, certificates of issue-grade securities, decisions on the issue of Russian depositary receipts | Federal Law of April 22, 1996 No. 39-FZ “On the securities market” (clause 1 of article 17, paragraph 11 of part 4 of article 18, clause 10 of article 27.5-3). |

| Documents containing information about the share of the Russian Federation, a constituent entity of the Russian Federation or a municipal entity in the authorized capital of a legal entity, documents submitted by applicants for the purchase of property. | Federal Law dated December 21, 2001 No. 178-FZ “On the privatization of state and mun. property" (paragraph 4, paragraph 1, paragraph 1, paragraph 2, article 16). |

| Employment history | Resolution of the Ministry of Labor of Russia dated October 10, 2003 No. 69 “On approval of instructions for filling out work books,” clauses 2.2, 2.3. |

[1] Federal Law dated 04/06/15 No. 82-FZ “On amendments to certain legislative acts of the Russian Federation regarding the abolition of the mandatory seal of business companies.”

[2] clause 7 art. 2 of the Federal Law of December 26, 1995 No. 208-FZ “On Joint-Stock Companies”, clause 5 of Art. 2 of the Federal Law of 02/08/98 No. 14-FZ “On Limited Liability Companies”

On which documents is stamping required?

There are several legal acts that stipulate the mandatory use of the seal.

So, according to Part 6 of Art. 57 of the Code of Administrative Procedure of the Russian Federation, a power of attorney on behalf of the organization must be signed by its head or another person authorized by its constituent documents and sealed with the organization’s seal. Until October 1, 2022, such a requirement was mandatory, then the phrase “if available” was added to the article, which makes affixing a seal on the power of attorney mandatory if the seal is provided for by the charter.

Subp. 6 p. 5 art. 186.1 of the Tax Code of the Russian Federation requires that an information message submitted to a taxpayer of one state - a member of the Eurasian Economic Union by a taxpayer of another state - a member of the Eurasian Economic Union or a taxpayer of a state that is not a member of the Eurasian Economic Union, selling goods imported from the territory of another state - a member of the Eurasian Economic Union economic union, was signed by the head or individual entrepreneur and certified by the seal of the organization, indicating a number of information reflected in this article.

In Part 4 of Art. 24.10. Federal Law No. 138-FZ dated November 11, 2003 “On Lotteries” states that the application for participation in the competition and the volume of the application for participation in the competition must be sealed with the seal of the participant placing the order.

In Part 7 of Art. 11 of the Federal Law of July 29, 1998 No. 135-FZ “On Valuation Activities in the Russian Federation” states that the report on the evaluation of the object of evaluation must be numbered page by page, bound, signed by the appraiser or appraisers who carried out the appraisal, and also sealed with a personal seal the appraiser or appraisers or the seal of the legal entity with which the appraiser or appraisers entered into an employment contract.

Part 5 art. 22 of the Federal Law of December 2, 1990 No. 395-1 “On Banks and Banking Activities” obliges a credit organization, when opening branches and representative offices on the territory of the Russian Federation, to indicate in the notification the postal address of the branch (representative office), its powers and functions, information about managers, scale and the nature of the planned operations, as well as provide an impression of its seal and specimen signatures of its directors.

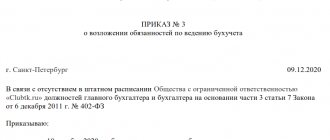

Is it necessary to put the organization’s seal on the order?

Often, clerks and HR department specialists have doubts about whether it is necessary to put the organization’s seal on the order. There are two very clear rules here: 1. An order is an organizational and administrative document issued by the head of a company for its employees. It may contain the following content:

- about hiring;

- on granting regular, student or maternity leave;

- on the transfer of an employee to another position;

- on the payment of bonuses based on performance;

- about dismissal.

Since the order is an internal document created within the company itself, it is not stamped. 2. However, in the event that a copy of the order is requested by an employee of the company, another legal entity or government agencies, the document acquires the status of outgoing. In this case, it must be certified with the seal of the organization.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up

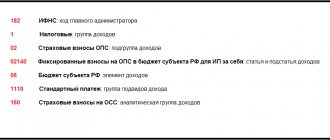

Printing on primary documents

Is an organization's seal required on primary accounting documents? Organizations develop forms of primary accounting documents independently. Props that designated the place for the seal “M.P.” on primary documents may not be marked, since according to Art. 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”, a seal imprint is not mandatory.

Ready-made solutions from SPS ConsultantPlus will tell you how to act in a specific situation: step-by-step instructions, sample documents, links to legal acts.

Is it necessary to put a stamp on the application for confirmation of the type of activity?

According to Russian legislation, legal entities are required to annually submit an application to the Social Insurance Fund confirming the type of economic activity. Since it is written on a standard form with all the company details entered in special columns, there is no need to certify the document with a seal - the manager’s signature is sufficient (with mandatory decoding). When submitting an application, the responsible person of the territorial body of the Social Insurance Fund puts a stamp and signature confirming acceptance of the document. The application must be accompanied by a certificate confirming the main type of economic activity. This document is also drawn up on a special form and, in addition to the signatures of the manager and chief accountant, is certified by the seal of the organization. The seal is placed in the lower left corner, capturing with the imprint the names of the positions of the persons signing the document. In the event that you have lost your seal or it has broken down, you can easily print it on paper in less than 1 hour.

Basic printing requirements

If your organization nevertheless decides to work with a seal, then the main requirement for it is the availability of information about the name of the company. Otherwise, you can indicate any information on the seal. Seal manufacturers, as a rule, also offer to include information about the organization’s Taxpayer Identification Number (TIN) and OGRN in the stamp. The color of the seal can be any, since the law does not establish requirements for the color of the organization’s seal imprint.

It is important that organizations that do not have government powers cannot place an image of the state emblem of the Russian Federation on their seal. Violation of this prohibition may result in a fine of up to 150,000 rubles for the society.

The same responsibility is entailed by the placement on a seal of an image that is similar in appearance to the point of confusion with the state emblem of the Russian Federation (Article 4 of the Law of December 25, 2000 No. 2-FKZ “On the State Emblem of the Russian Federation”, Article 17.10 of the Code of Administrative Offenses of the Russian Federation Federation, Review of judicial practice of the Supreme Court of the Russian Federation for the third quarter of 2012, approved by the Presidium of the Supreme Court of the Russian Federation on December 26, 2012).

Mikhail Zaplatnikov, teacher at “What to do Consult” LLC

If you refuse to print

If you decide not to print, you will need to use electronic documents, holographic seals, or specially prepared forms instead. Actually, precisely because of the development of electronic document management. The situation with making changes to the charter is the same: if you don’t want to use a seal, remove the corresponding clause about it from the charter. You must bring the same documents to the tax office as when entering information about the seal into the charter.

What could happen if changes to the charter are delayed? The situation will be similar to the previous option: the inspection authorities will require a seal to be placed on documents, since the clause on it is not excluded from the charter. The same requirements may be put forward by the company's counterparties.

Even if you refused the seal or made changes to the charter, you should not throw it away - you may still need it, for example, if you need to make changes to old documents. It’s also a good idea to issue an order signed by the manager, indicating that from such and such a date the company does not use the seal. Accordingly, documents dated earlier than this date should have a seal, but new ones should not. This will exclude claims from third parties.

What documents are accompanied by a covering letter and why?

In the course of its activities, the organization comes into contact with a large number of partners and departments. These letters are usually sent:

- to the act of reconciliation of calculations for taxes, fees, fines, etc. in the Federal Tax Service, Pension Fund, Social Insurance Fund;

- to declarations to the Federal Tax Service, Social Insurance Fund;

- to the agreement for signature by counterparties;

- to the commercial offer;

- to reports and executive documentation to counterparties and various departments, etc.

Thus, any important documentation can be accompanied by a letter.

When composing such a letter, the responsible employee of the company assigns it an outgoing number according to the rules of office work and registers it in the journal of outgoing correspondence. The receiving party assigns it an incoming number. Thanks to numbering, you can track the fate of each letter. This is one of the important functions of such correspondence.

In addition, the cover letter must contain a list of the documentation to which it is attached. Thus, you can always confirm that the entire package of documents was sent, and in case of loss, the party receiving it will be to blame.

Also in the text of the letter, in some situations, you can indicate the deadlines for responding and sending back a package of papers, for example, in the case of their signing.

TYPES OF FORMS

6.6 The following types of organizational document forms are established:

- general form;

— letter form;

— a form for a specific type of document.

The regulatory legal acts of the organization establish the types of forms used and their varieties (letter form from structural units, letter form from an official, order form, instruction form, protocol form, etc.).

Samples of document forms are given in Appendix B.

The composition of the types of forms has not changed. However, a provision has emerged that the list of types of forms used in the organization must be enshrined in the local regulatory act (LNA) of the organization. This can be an instruction for the organization's office work or an order from the manager, which simultaneously approves the types of forms used and their samples (layouts).