When to submit form P13001

Form P13001 is submitted by LLCs that have made changes to their Charter, for example, changed their name.

This must be reported to the Federal Tax Service to record changes in the Unified State Register of Legal Entities. Changes may not affect the Charter, then use form P14001. We have already talked about it in our article.

Order of the Federal Tax Service of Russia No. MMV-7-6/ [email protected] dated January 25, 2012 contains instructions and a template for form P13001. See Appendix No. 4 for a sample. P13001 is taken in the following cases:

- changed the company name;

- changed address;

- added new OKVED codes;

- changed the authorized capital;

- made other changes to the Charter.

There is a special case. Form P13001 is submitted when the Charter is brought into compliance with Federal Law No. 312-FZ. All companies opened before July 1, 2009 are required to re-register their Charter. This must be done at the moment when changes were made to the old Charter. That is, companies that have not changed the Charter since 2009 may have such a need and are thinking about it in 2022. Then in P13001 fill out the first page by checking the box in section 2 and prepare sheet M.

Procedure for submitting an application in form P13001

In addition to the application itself in form P13001, the package of documents for registering changes to the Charter includes:

- The Charter in the new edition or amendments to it (two copies);

- minutes of the general meeting of participants or the decision of the sole participant to change registration information;

- a receipt for payment of a fee in the amount of 800 rubles (not paid if you are only bringing the charter into compliance).

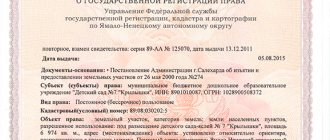

Additionally, in the event that a change of legal address of an LLC is made, the tax inspectorate may request documents confirming the right to use the premises (lease agreement, letter of guarantee from the owner or a copy of the certificate of ownership), although these documents are not in the mandatory list of Article 17 of the Law “On State Registration” "

The receipt for the state duty indicates the applicant’s data; you can fill out the receipt through the service on the Federal Tax Service website.

The authenticity of the applicant's signature on form P13001 must be notarized . The notary mark is affixed on page 3 of sheet “M”.

And finally, about the deadlines for submitting documents on amendments to the Charter to the tax office. Article 5 of the Law “On State Registration” establishes a period of three working days for reporting changes to the Unified State Register of Legal Entities only for information that is not related to changes in the Charter. Formally, there is no deadline for submitting information on form P13001, but in practice, a period of three working days is observed for it as well.

Sample form P13001

The form is quite large, includes 23 sheets. You do not need to fill out everything, but only those that relate to the changes being made. Numbering is continuous. Everyone fills out the first page and puts the number 001, and then the numbering goes 002, 003, 004 and so on.

Let's review all application sheets. You will find complete instructions for filling out in Section 5 of Appendix 20.

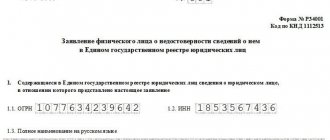

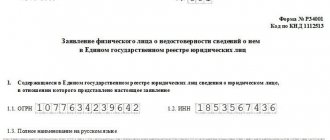

1. Page 1 - fill out everything. Please indicate your OGRN, INN and company name.

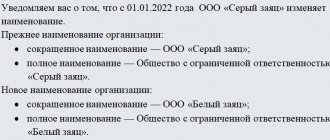

2. A - filled in by those who intend to change the company name. Indicate the new full and abbreviated name. Also be sure to include the page number.

3. B - for those who have changed their legal address. Codes of subjects of the Russian Federation are listed in Appendix 1. And Appendix 2 shows how to correctly fill out addresses.

4. B - needed when changing the authorized capital of an LLC.

5. G, D, E, G - fill in when information about the founder changes, when a new LLC participant is added or an old one leaves. For example, when buying and selling a share in the authorized capital, sheet D must be filled out twice. The first one is for a new participant, in section 1 the number 1 is put. The second is for an exiting participant, in section 1 the number 2 is put.

Important! Each type of founder has its own sheet. For example, for domestic founders-legal entities - sheet D, for foreign companies - sheet D, and so on.

6. Z - through it, changes are made about the mutual investment fund, which includes a share in the authorized capital.

7. And - fill in when reducing the authorized capital by paying off the company’s share.

8. K - fill in when creating, closing or changing information about a branch or representative office of an organization.

9. L - through it you can add new activities or exclude old ones.

Important! If the Charter of the LLC states that the company can conduct any type of activity not prohibited by law, then the addition of new OKVED is drawn up in form P14001.

10. M - fill in everything. Provide information about the applicant, who may be a manager, management company or authorized representative. Be sure to have Sheet M certified by a notary.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

What documents are needed to change the name of an LLC?

The main document that is submitted to the Federal Tax Service when changing the name of a legal entity is form P13014. All the features of filling it out are discussed below.

If, when changing the name of the organization, the text of the charter changes, then it is necessary to prepare its new edition and the decision of the founders. To change the charter, a fee of 800 rubles is charged, so you will also need a document confirming payment.

Thus, if an LLC operates on the basis of a standard charter that does not indicate the name, then when changing the name, only form P13014 is submitted. If the name of the company is spelled out in the charter of the company, then in addition to application P13014 they submit:

- the charter in the new edition or a list of amendments to the charter;

- decision of the sole participant or minutes of the general meeting to change the name of the LLC;

- document confirming payment of the duty.

Requirements for filling out P13001

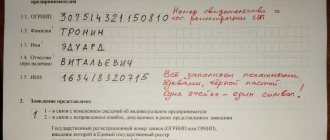

You can fill out the application manually or on a computer. Requirements for filling out by hand:

- fill in block letters;

- black ink;

- we write one character in one cell - even spaces and commas.

When filling out on a computer, the requirements are as follows:

- Courier New font;

- capital letters;

- font size 18;

- we write one character in one cell - even spaces and commas.

Double-sided printing of the application is prohibited. Corrections and additions are also not allowed. Otherwise, the program will indicate that the application was filled out incorrectly.

How to fill out application P13014 when changing the name of an LLC

In 2022, a new universal form P13014 is in force for amending the charter and the Unified State Register of Legal Entities. It replaced the previous statements P13001 and P14001.

Form P13014 was approved by order of the Federal Tax Service of Russia dated November 1, 2021 N ED-7-14/ [email protected] and can be filled out using this link.

The full Form P13014 contains 59 pages, but if you are applying for a name change, only a few of them are completed. These are the title page, sheet A and sheet P. Let's look at each of them in more detail.

Free accounting services from 1C

Title page

When changing the company name of an LLC, only the first page of the title page is filled out. In paragraph 1, indicate the OGRN and TIN codes of the organization. In paragraph 2, you must select the reason for filing the application:

- “1” – if the new name makes changes to the charter;

- “2” – if the charter does not change when changing the name (this is only possible with a standard charter).

If you entered the value “1”, then below you need to clarify in what form the changes are formatted:

- “1” – for a new version of the entire charter;

- “2” – for the sheet of changes to the current edition of the charter.

Sample of filling out the title page of form P13014

Sheet A

Sheet A includes two pages. The first one reflects the change in the name of the LLC in Russian. To do this, in paragraph 1, indicate the new company name twice:

- full, indicating the organizational and legal form - “limited liability company”;

- abbreviated with the abbreviation “LLC”.

In addition, in the field from one cell you must enter the value “1”, which means a change in the information in the Unified State Register of Legal Entities.

Item 2 of sheet A is filled out if the organization changes or enters into the Unified State Register of Legal Entities the name of the LLC in the language of the peoples of the Russian Federation or a foreign language. Moreover, the new name itself is not included in paragraph 2, only the digital language code is indicated here according to the OKIN classifier (adopted by order of Rosstandart dated December 12, 2014 N 2019-st).

The second page of sheet A is filled out only if the English language code is indicated in paragraph 2 of the first page, that is, “016”. There are fields for the full and abbreviated name, which is indicated in English spelling. In the corresponding cells, select the value “1”, which means entering a new name into the Unified State Register of Legal Entities.

If your organization does not have a name in English or it has not changed when the Russian name was changed, then the second page of sheet A is not filled out and is not included in the application.

Using the new form P13014, you can change not only the full and abbreviated name at the same time, but also one of them. The fact is that the law does not establish any restrictions on the identity of names of different types for the same legal entity.

For example, the Resolution of the Federal Arbitration Court of the West Siberian District dated July 16, 2012 in case No. A45-13500/2011 considered a situation in which the plaintiff had completely different brand names.

Quote: “According to the certificate of making an entry in the Unified State Register of Legal Entities on the state registration of changes made to the constituent documents of a legal entity, the plaintiff has the abbreviated name Belkomed LLC and the company names “Doctor ENT” and “Studio 32.”

Sample of filling out sheet A of form P13014, page 1

Sample of filling out sheet A of form P13014, page 2

Sheet P

Sheet P for the applicant is always filled out, including when an application to change the name is submitted. There are two pages: on the first you enter the manager’s details, on the second - your contact phone number and email address. To receive a response from the Federal Tax Service not only electronically, but also on paper, enter the value “1”.

There is no need to sign the application in advance, because the signature must be certified by a notary. But if the director has an electronic signature, there is no need to contact a notary.

Sample of filling out sheet P of form P13014, page 1

Sample of filling out sheet P of form P13014, page 2

Sample of filling out form P13014 when changing the name of an LLC

Which sheets of P13001 should I fill out?

The table shows the most common situations when you need to fill out and submit form P13001 to the Federal Tax Service.

| Situation | Sheets P13001 to fill out |

| Change of company name | Page 1, B and M |

| Change of OKVED | Page 1, L and M |

| Creation of a branch or representative office | Page 1, K and M |

| Bringing the Charter into compliance with the Federal Law | Page 1 and M |

| Change of authorized capital | Page 1, B and M. Sometimes sheet I. Since a change in capital is usually associated with a change in founders, sheets D, D, E, G, Z are also filled out. |

| Other changes made to the Charter | Page 1 and M |

Maintain accounting and tax records in the cloud service Kontur.Accounting. The service will remind you when to submit the report and pay the tax. We give all newcomers free access for 14 days.

New form 13001

It should be noted that form P13001 is an abbreviated name for the application itself. Its full name is “Application for state registration of changes made to the constituent documents of a legal entity.” This document has already been edited by government services quite a few times, but not so long ago - on July 4, 2013, a new form format was approved, which is used by all legal entities wishing to register innovations in their institution.

( Video : “How to fill out p13001 and p14001 to change your legal address?”)

Basically, such a form is compiled for the following changes in the organization:

- change in company name;

- change of legal address;

- editing OKVED if this action leads to changes in the statutory documents;

- change in the size of the authorized capital.

The above list of changes that require state registration is not complete, since when making other changes it is also necessary to notify the tax authorities.

The new form P13001 consists of the text of the application and additions to it, which are displayed on separate sheets of paper (indicated by the letters A-M). It should be remembered that these additions are an important part of the document, therefore, they must have their own numbering and, as a result, are stitched together with the title page. This requirement is strict to fulfill, since such documents are checked by notaries, as a result of which he certifies the document with his signature and seal, and also notes on the form the number of sheets used.

Nuances when filling out and submitting form P13001 for state registration

The main difference between form P13001 and P14001, besides the fact that a state duty of 800 rubles is paid for filing P13001, is that the “13th” makes changes both to the constituent document of the legal entity and to the Unified State Register of Legal Entities. When it’s like “14th” - only in the Unified State Register of Legal Entities.

As with all such forms, double-sided printing is not permitted. Filling out, according to Order of the Federal Tax Service of Russia dated January 25, 2012 N ММВ-7-6/ [email protected] , is carried out either by hand, in black ink and capital letters, numbers and symbols; or by machine, in Courier New font, 18 points high, capital letters, black. Each familiarity, or “cell,” corresponds to one symbol. A space is an empty “cell”.

The remaining rules can be found in the specified Order, Appendix No. 20.

The authenticity of the applicant’s signature on the specified form is certified only by a notary for “paper” submission, or by an electronic signature of the applicant or notary for electronic submission.