A certificate of incapacity for work opened to a dismissed employee within 30 days from the date of termination of the employment contract must be paid by the employer. The employer's obligation is fulfilled when staffing is reduced. Sick leave certificates for employees who are not employed by another employer are accepted for payment. The fact that there is no hiring is confirmed by the work book of the laid-off employee. The period of incapacity for work is not paid by the employer if the person receives benefits from the employment center. In this article we will discuss sick leave after dismissal due to staff reduction in 2022.

Sick leave after dismissal due to staff reduction: how is payment made?

The employer pays for the certificate of incapacity for work issued in connection with the illness of the employee himself. Sick leave issued when family members of a redundant employee fall ill is not subject to payment. An employee has the right to sickness benefit in the amount of 60% of average earnings, regardless of his or her total length of service.

When calculating the amount, the procedure corresponds to the conditions for paying sick leave to employees of the enterprise. To calculate benefits, the earnings received by employees in the previous 2 years are used. If the person’s total length of service is less than 6 months, payment is made based on the minimum wage.

What determines the size of sick leave benefits during reduction?

Besides

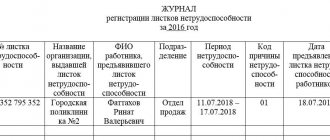

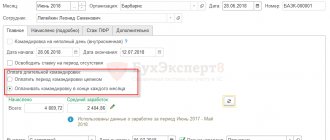

In addition to correctly calculating the amount of the benefit, the employer should pay attention to the issuance of sick leave for the dismissed employee, since the responsible persons of the enterprise must fill out the reverse side of the sick leave. During layoffs and subsequent illness of an employee, information about the dismissal should be entered in the “Special Notes” column: reason, date, order number.

The amount of sick leave benefits depends on the average daily earnings, length of insurance coverage and the time of onset of the disease. If the illness occurs while the employee is still working, the amount of the benefit will be calculated according to the general rules. If the illness occurs after dismissal, the benefit amount will not exceed 60% of average earnings.

The average daily earnings used to calculate sick leave benefits are calculated based on the amount earned during the pay period (find out how to calculate the average daily earnings for sick leave here). Average daily earnings are compared with the minimum and maximum average daily earnings, calculated using a formula, taking into account the established basic income for the 2 years preceding the disease.

If the insured person's average daily earnings are greater than the basic one, the basic one is taken into account when calculating benefits. If the average daily earnings are less than the minimum daily average, then the minimum value established by law is taken to calculate the benefit. Read about the calculation of sick leave at the minimum wage in 2022 in the article https://otdelkadrov.online/6712-pravila-rascheta-minimalnoi-oplaty-bolnichnogo-lista-v-year-godu-prakticheskii-primer.

Deadlines for presentation and payment of certificates of incapacity for work

When receiving payment, the employee and employer must comply with the documentation deadlines.

| Condition | Fixed time |

| The onset of a disease confirmed by sick leave | The opening date must not be later than 30 days after the day of reduction |

| Deadline for submitting sick leave | No later than 6 months from the date of dismissal |

| Benefit payment period | Within 10 days from the date of presentation of the document |

| Payment deadline when applying for payment to the Social Insurance Fund | Within 10 days from the date of submission of the application and sick leave |

| Deadline for receiving accrued benefits | 3 years from the date of accrual |

Violation of the deadlines for document flow entails the refusal of the Social Insurance Fund to recognize the legality of the payment of benefits.

How is the payout amount calculated?

The calculation of benefits after termination of employment for a reduction in headcount or staffing is carried out in the general manner, that is, by multiplying the average daily salary of the former employee received by him during the 2 years before dismissal by the number of days of incapacity for work.

Formula. Benefit amount = average daily salary × number of days on sick leave.

It should be borne in mind that in case of illness that occurs before the day of termination of the employment relationship, the percentage that is taken into account in payments is affected by the employee’s length of service:

- persons with less than 5 years of work experience are paid 60% of the average daily earnings;

- if the experience is from 5 to 8 years - 80%;

- with more than 8 years of experience – 100%.

If, at the time of illness, the employment contract with the employee had already been terminated, the benefit is paid in the amount of 60% of the average salary (Part 2, Article 7 of Federal Law No. 255-FZ).

Also, do not forget that temporary disability benefits are subject to personal income tax in the amount of 13%, withheld by the employer.

Example.

Afanasyev I.G. 18 days after dismissal due to reduction, he provided the former employer with a sick leave certificate, according to which the employee was temporarily unable to work for 8 days; the sick leave certificate was opened after the termination of the employment contract. Average daily earnings Afanasyev I.G. was 2,050 rubles.

The benefit calculation will look like this:

2,050 rubles * 60% * 8 days = 9,840 rubles.

From this amount it is necessary to deduct personal income tax in the amount of 13%:

9,840 – 13% = 8,560.80 – the amount of benefits that must be paid to Afanasyev I.G.

If an employee falls ill after termination of the employment contract, the benefit is fully paid from the Social Insurance Fund.

After the former employee submits a certificate of incapacity for work, the employer is obliged to pay benefits within 10 days.

Read more about how sick leave is calculated and paid after dismissal here.

Withholding personal income tax and paying contributions from accrued benefits

The employer has the obligation to withhold and transfer personal income tax to the budget from the amounts of accrued payments. Benefits paid in connection with illness are not considered non-taxable payments and are subject to taxation. When withholding tax, standard and other deductions are not applied due to their expiration on the day of termination of the employment contract.

Insurance premiums due for accrual from payments to employees are not accrued on the certificate of incapacity for work of a dismissed employee. The procedure applies to the entire document, regardless of the source of payment.

| ★ Best-selling book “Calculating sick leave and insurance premiums in 2018” for dummies (understand how to calculate insurance premiums in 72 hours) 3000+ books purchased |

Is it possible to lay off an employee who is not at work due to illness?

You cannot fire an employee due to staff reduction while he or she is not on sick leave. Even if the position must be eliminated by the time he returns to work, his job is retained during his illness. This is stated in Article 22 (Part 1) of the Labor Code of the Russian Federation. Read about which employees cannot be laid off according to the law here.

The employment contract must be terminated on the day the person returns to the company after completing his sick leave. The next day, a new staffing table needs to be approved, where this position will no longer exist. On the day of dismissal, the employee receives the right to the payments and compensation due to him.

Documentation of payment for employee illness after layoff

In connection with a person’s illness or injury, a medical institution provides a standard form of sick leave. A document issued to a person without a specific place of employment does not contain the name of the enterprise. When paying for the period of illness of a dismissed person, the employer independently enters the name of the enterprise on the list of incapacity for work. Benefits are paid subject to certain conditions being met. Read also the article: → “When sick leave is not paid. 2 examples”

| Condition | Explanations |

| A document base | Certificate of incapacity for work opened by a medical institution within 30 days after layoff |

| Additional documents | Statement from the employee, a copy of the work record book indicating that the employee was not hired during the period of incapacity for work |

| Duration and end date of sick leave | The expiration date of incapacity for work is not taken into account |

| Sick person | An employee of an enterprise dismissed due to layoffs |

| The need for prior notice to the employer | Absent |

Contacting the employer within a period exceeding 6 months leads to refusal of payment. The period can be restored if there are special circumstances. Valid reasons include missing a deadline due to insurmountable natural circumstances, moving to another area, illness lasting more than six months, or other reasons. The restoration of the period is carried out in court.

Payment nuances

When optimization and staff reduction are planned, employees must be notified about this 2 months in advance. A person cannot just be laid off - he will be given another 60 days to work. And if during this period a person went for treatment, and then did not have time to return from it before the layoff, then according to the law he does not have the right to fire him.

When he recovers, he returns to his workplace after finishing his sick leave and already writes a letter of resignation from work. But no one can automatically fire him while he is on legal sick leave. They will wait for him until he recovers, even if the dismissal date has already arrived.

The sick leave certificate itself, if properly completed, can be submitted to the employer within six months. The employee brings the sheet to the employer, and he is obliged to submit the necessary data to the Social Insurance Fund 10 days in advance. The very fact of job loss does not in any way affect the final amount of payment, since it is determined based only on the insurance period and the average daily wage of the employee.

FZ-255 plays in favor of the laid-off employee. Payment is due if the illness overtakes the person within 30 days - the period established by law. The amount largely depends on the income level of the patient. The average daily income for the last two years is taken into account. However, you need to know that the amount of compensation will be only 60%, even if taking into account the length of service the full amount is due. Moreover, income tax will be withheld from the payment amount.

Payment of maternity benefits

The Labor Code of the Russian Federation prohibits layoffs of women during pregnancy. The grounds for terminating an employment contract with a pregnant employee are:

- Liquidation of an enterprise or termination of the activities of an individual entrepreneur.

- The employee’s own desire, for example, in connection with her husband’s transfer to service or work in another locality.

- Dismissal of an employee when a temporarily absent employee is hired for a position. When a permanent employee starts work, the employer must present vacant positions to the temporarily hired person who is pregnant. If the employee refuses, he is dismissed due to the termination of the contract.

After dismissal, the employee has the right to register with the employment center. When receiving sick leave for pregnancy and childbirth, payments from the employment center are terminated and resumed after the end of the period.

Payments of maternity benefits to employees during liquidation are made by the social insurance fund. Unlike other grounds for dismissal, the employee will receive benefits based on income. Average earnings are calculated based on the income received by the employee over the previous 2 years. The right to sick pay is available for 12 months from the date of registration with the employment center and recognition as unemployed.

| Grounds for dismissal | Payment of maternity benefits |

| Liquidation of an enterprise or termination of the activities of an individual entrepreneur | Payment is made by social insurance authorities |

| Personal initiative of the employee | Payment is not made, except in cases of opening a certificate for maternity leave within 30 days from the date of dismissal |

| Dismissal under the terms of a fixed-term contract due to the departure of a permanent employee | Similar to voluntary dismissal |

What does the Labor Code say?

By virtue of Article 180 of the Labor Code of the Russian Federation, the company’s management is obliged to notify employees of the upcoming dismissal due to job reduction at least 60 days in advance, and in some cases - to offer a vacant vacancy, of course, if it is available.

At the same time, in the remaining 2 months, employees continue to perform their duties at the same pace, and can also enjoy other labor guarantees - in particular, the same vacations and sick leave.

Also, Article 81 of the Labor Code of the Russian Federation states that if on the day of dismissal an employee is on vacation or suddenly falls ill, it is impossible to dismiss him, since such actions deprive the worker of the guarantees established by law, namely, maintaining a job during his absence within Article 183 of the Labor Code of the Russian Federation.

That is, it turns out to be a kind of legislative contradiction. On the one hand, it is allowed to dismiss an employee after notification of a reduction in the vacancy, but on the other hand, during a period of illness this is prohibited.

It is this contradiction that leads to personnel errors, which are then corrected in court.

One more legislative aspect should be noted, namely, the norms of the Federal Law of December 29, 2006 N 255: on the basis of Article 5, an employee who falls ill within a month from the date of dismissal is also entitled to compensation for days of incapacity for work, but in an amount that depends on the time of onset of the illness and general experience.

Workers' rights

It is impossible to predict days of incapacity for work. That is why, at the legislative level, workers who are officially employed and make monthly contributions to the Social Insurance Fund are entitled to a kind of guarantee.

It consists in:

- maintaining a full-time job until full recovery or disability is established;

- compensation for all sick days in an amount calculated based on the total length of service, that is, from 60% to 100%.

At the same time, within the framework of Article 5 of Federal Law No. 255, sick leave can be issued not only in case of loss of ability to work by the employee himself, but also in other cases.

In particular:

- to care for a child or a close relative;

- when taking leave for childbirth;

- if necessary, stay in quarantine, but only in cases strictly defined by law.

Also, by virtue of Article 81 of the Labor Code of the Russian Federation, an employee is not subject to dismissal at the initiative of management on any of the grounds of this article, with the only exception, which implies the liquidation of the company or termination of the activities of the individual entrepreneur.

That is, it is possible to terminate the employment relationship with an employee in case of staff reduction on the date specified by the previously issued order only upon liquidation of the company. In all other cases, there are several options.

Employer Responsibilities

The main responsibility of the company’s management from the moment the decision is made to optimize the staff is maximum respect for the labor rights of employees and the possibility of continuing cooperation in several ways.

This may include:

- transfer of a worker to other vacant positions, even if they are lower in qualifications or wages, but only with consent;

- granting a preferential right to remain in the regime of the norms of Article 179 of the Labor Code of the Russian Federation;

- payment of benefits due to layoffs;

- notification of the Trade Union, as well as the employment center, about the upcoming release of several units.

That is, in anticipation of the termination of cooperation, the employer must provide the dismissed employee with all opportunities for retraining or finding another job, and only after exhausting the above steps - dismiss, and even then in compliance with the norms of Article 81 of the Labor Code of the Russian Federation, that is, only after the employee has recovered.

Notice and reduction during the period of incapacity for work

If an employee falls ill at the time of the planned notice of layoff, a corresponding valuable letter with an enclosed inventory is sent by mail. The signature put by the person on the delivery notice indicates receipt of information about the upcoming staff reduction.

The occurrence of an illness or injury may prevent dismissal on the day about which the employee was notified 2 months in advance. An employee cannot be fired on the day he is absent from work due to illness, which requires postponing the date of termination of the contract. Sick leave may be opened due to a child becoming ill. Payment for sick leave opened before the day of layoff is made in full according to the total length of service.

The employee is on sick leave at the time of layoff: actions of the employer

If the date of dismissal of an employee occurs while he is on sick leave, then the employer will not be able to terminate the employment contract with him until the employee completes his sick leave. It does not matter when exactly the layoff notice was sent to him before. The employer will be obliged to pay the employee benefits, as in the previous case, in the generally established manner.

IMPORTANT! The period for which severance pay and possible compensation from the employment center are calculated for an employee who has been laid off while on sick leave begins to count not from the date of layoff, but from the actual date of dismissal of the employee.

The next scenario is an employee being laid off and his subsequent illness. Does he have the right to count on any compensation in this case?

Payment for disability occurring after liquidation

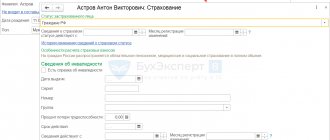

An employee dismissed due to the liquidation of an enterprise has the right to payment for the period of incapacity from the Social Insurance Fund. During liquidation, all employees are subject to dismissal, including pregnant employees and persons with children under 3 years of age. The FSS makes the payment to the person’s account or sends the required amount by postal order to the applicant’s registered address. To receive payment, the person provides:

- A copy of your identification document.

- A certificate of incapacity for work issued within a month from the date of liquidation.

- A copy of the work book with a record of liquidation, confirming the lack of employment.

- Certificates of income for the previous 2 years. An employee who has not received a certificate of income from the enterprise’s accounting department attaches an application asking the Social Insurance Fund to send a request to the Pension Fund of the Russian Federation about the amounts received by the person.

- An application addressed to the head of the FSS department with a request for payment of benefits.

An employee has the right to receive sickness benefits even in the event of a difficult financial situation of an enterprise that is in the process of bankruptcy. An employee dismissed due to the liquidation of a bankrupt enterprise that was not removed from the register due to the end of the procedure receives payments through the Social Insurance Fund. To receive the required amount, a certificate issued by the bankruptcy trustee and a copy of the court decision on the initiation of bankruptcy proceedings for the enterprise are required.

After termination of the employment contract

As a rule, it is quite difficult to obtain paid sick leave after dismissal due to staff reduction, but in some circumstances, within the framework of the law, the law allows such an outcome.

Is there a certificate of incapacity for work?

The procedure for registration and issuance of certificates of incapacity for work is covered by the norms of Order of the Ministry of Health and Social Development of Russia dated June 29, 2011 N 624n, where paragraph 1 states that a person who has been fired has the right to receive a certificate of incapacity for work over the last 30 days along with citizens who have a permanent place of work .

That is, if a former employee at a medical institution presents a work record book, they have no right to refuse to issue a work record.

Registration procedure

Of course, getting a certificate of incapacity for work at a clinic is quite simple, because you just need to present a work book with a record of dismissal and ask for a certificate to be issued in accordance with Article 5 of Federal Law No. 255.

But sick leave is not enough to pay compensation from a former employer:

- you will need to show a work book, which will confirm that the former employee was never employed;

- You will need to submit a sick leave note, to which is attached an application requesting payment on the basis of Federal Law No. 255.

What about B&R benefits?

As a rule, after 30 days have passed from the date of dismissal, pregnant women can no longer count on paid sick leave under the BiR, but there is an exception to this situation.

In particular, by virtue of Article 6 of the Federal Law of May 19, 1995 N 81, in the event of dismissal due to reduction due to the liquidation of the company, a woman has the right to claim sick leave payment for the next 12 months, but not from the former employer, but from the state by submitting a sheet for payment to the Employment Center, of course, provided that the status of unemployed has already been received.

If children are sick

In most cases, exemption from work in the form of sick leave is issued to a sick person not only in case of personal illness, but also to care for a relative.

If the employee has already been fired, nothing further prevents him from providing assistance to the same child.

That is why the sheet is issued after the termination of the employment relationship only in the event of an employee’s personal illness, and not in connection with caring for a child.

That is, if the baby gets sick a few days after the termination of the legal relationship, you will have to forget about paying for days of incapacity under the preferential procedure defined by Article 5 of Federal Law No. 255.

Documentation

Sick leave when an employee is laid off, of course, is the basis for payment of compensation due to incapacity for work, but only before his dismissal.

After issuing an order to terminate cooperation, you will also need:

- employment history;

- application requesting payment for sick days.

Payment

The amount of disability benefits is determined taking into account the norms of Article 7 of Federal Law No. 255, which provides payment limits in direct proportion to the total length of service.

However, it is precisely in the situation of compensation for sick leave after dismissal that length of service no longer matters, since within the framework of Part 2 of this article, the amount of the benefit is equal to 60% of the former average earnings for the last 24 months.

Who pays?

It is not at all difficult to understand how sick leave is paid, given the fairly detailed provisions of Federal Law No. 255, but difficulties arise with the institution that is obliged to comply with the law.

Meanwhile, Part 3 of Article 3 of Federal Law No. 255 states that the financing of compensation for the period of incapacity for dismissed persons is carried out by the Social Insurance Fund, but the employer serves only as an intermediary who hands out the money to the employee.

Is income tax withheld?

Sick leave cannot be classified as income, given that the compensation is intended for treatment, however, Article 217 of the Tax Code of the Russian Federation states that payment for days of incapacity for work as an exception is still subject to taxes.

When registering with the employment service

Article 5 of Federal Law No. 255 stipulates that a worker has the right to count on payment for sickness for 30 days from the date of dismissal, but it does not say that the issuance of sick leave depends on registration with the Employment Center.

That is, an ordinary employee does not have to register with the Labor Exchange to receive compensation. By the way, receiving unemployed status will not give him the right to sick pay.

But for pregnant women there are different requirements. After all, in order for the sick leave to be paid according to the BiR, they must have official unemployed status and be dismissed only due to reduction due to the liquidation of the company no later than a year from the date of registration of the sheet for permission from the burden.

For what length of service is sick leave paid 100%? Is it possible to take two sick days during vacation? Find out here.

Example

After the layoff, the person went on sick leave two weeks from the date the order was issued due to injury; two months later he fully recovered and was able to report to his former employer with a certificate of incapacity for work in his hands. How many days will the period of illness be compensated for, since the employee needed a month and a half for treatment?

In this situation, under Article 5 of Federal Law No. 255, sick leave can only be paid within 30 days from the date of termination of cooperation, which in this situation will be 16 days.

Sick leave issued when laying off civil servants

Persons recognized as civil servants have similar rights to other employees. When an illness occurs, the organization pays benefits:

- According to a sheet opened within 30 days from the date of reduction at the rate of 60% of average earnings.

- For sick leave, which begins before the day of layoff or falls on the last day of employment, in the amount of average earnings depending on length of service.

- If the length of service is less than 6 months - based on the minimum wage.

A special procedure is provided for persons who are contract employees in the RF Ministry of Defense or the Ministry of Internal Affairs. Employees are not subject to the terms of the Labor Code of the Russian Federation or payments from the Social Insurance Fund. Payment for the period of incapacity for work is carried out according to departmental legislative acts. After layoffs, payment for sick leave is not carried out. Also, be sure to check out the example of filling out a sick leave form after layoff.

Sick leave if an employee is laid off in 2022

Within the framework of Article 183 of the Labor Code of the Russian Federation, until the complete termination of labor relations, the employer is obliged to comply with the norms of the Labor Code of the Russian Federation, including payment for days of incapacity for work.

But in a number of cases, it is illness that can create certain difficulties for carrying out the reduction procedure, which must also be observed in full accordance with Article 180 of the Labor Code of the Russian Federation.

Rules and procedure for registration before dismissal

So, in general, the reduction procedure consists of the following stages:

- issuing an order to optimize staff without identifying candidates for release;

- notification of the trade union about the reduction at least three months in advance if the dismissal is massive;

- sending information about the layoff of certain persons to the Labor Exchange two months in advance;

- issuance of a reduction order 60 days in advance;

- giving notice to persons who will be dismissed two months in advance;

- issuing a dismissal order after 60 days.

At the same time, the employer can issue an order or draw up and send a report to the above organizations, regardless of the employee’s health condition, but he can serve a notice or dismiss him only if certain standards stipulated by law are observed.

If the notice was received by the employee during illness

Article 180 of the Labor Code of the Russian Federation does not say anywhere that notice of release must be served in person; on the contrary, it only refers to the warning period.

That is why, if at the time of creating the notification the employee is ill and is absent from work, the specified document can also be sent by mail via registered letter, the date of delivery of which will be the moment of familiarization.

If the employee was notified earlier

If an employee falls ill after receiving the notification, but within a two-month period, there is no reason to panic. After all, with a mild cold, after 5-10 years the worker will already be back at work, therefore it will be possible to fire him when the cutoff date arrives on the basis of a previously issued order.

Due to a child's illness

Also, do not worry if an employee’s child falls ill within a two-month period.

After all, until the moment of release, the norms of Federal Law No. 255 apply to her in full, therefore, sick leave must also be paid.

Moreover, if a woman’s baby falls ill literally a few days before dismissal, the termination date will be postponed, which will again lead to full payment for days of incapacity for work.

If you plan to receive benefits under BiR

By virtue of Article 261 of the Labor Code of the Russian Federation, it is impossible to terminate cooperation with a pregnant woman, with the exception of two cases:

- complete liquidation of the company;

- termination of a fixed-term contract due to the departure of the main employee.

In all other cases, the issue of laying off a pregnant worker is not even discussed, especially in anticipation of the labor and employment leave.

On maternity leave

Similar norms are enshrined in Article 261 of the Labor Code of the Russian Federation in relation to an employee on maternity leave.

That is, until the baby turns 3 years old, the woman cannot be fired.

Under Article 256 of the Labor Code of the Russian Federation, the employer is obliged to retain her previous position in full, that is, both the amount of earnings and the range of responsibilities that are determined by the agreement on mutual cooperation.

For pensioners

Workers who have received a pension are no different from their younger colleagues, so no benefits are provided for them upon release.

However, following the norms of Article 179 of the Labor Code of the Russian Federation on the preemptive right to leave, it can be assumed that it is the pensioner who can be retained in his previous position due to the fact that he already has higher qualifications, although a younger specialist can show high labor productivity.

Thus, the question of choosing candidates for dismissal remains with the employer.

Is income tax withheld from sick leave? Read our article. How is sick leave paid for a fixed-term employment contract? About this - here.

To a civil servant

Within the framework of clause 8.2, part 2, article 37 of the Federal Law of July 27, 2004 N 79, a civil servant may be dismissed if his position is reduced in a manner that is similar to the procedure provided for by article 180 of the Labor Code of the Russian Federation.

That is, an employee, just like an ordinary worker, is warned of dismissal two months in advance and has the right to count on severance pay, not to mention payment for days of incapacity for work.

Moreover, by virtue of clause 3 of Article 37, it is again impossible to lay off an employee during illness, which is why the contract will have to be extended until he recovers.

At IP

The procedure for dismissal due to a reduction in vacancy for individual entrepreneurs is somewhat different from large employers.

Thus, according to Article 307 of the Labor Code of the Russian Federation, if the layoff procedure is not specified in the employment contract with the individual entrepreneur, the worker may be left without severance pay and a two-month notice period.

At the same time, under Article 81 of the Labor Code of the Russian Federation, an individual entrepreneur still does not have the right to dismiss an employee during illness, just like employers of large companies.

What documents may be needed?

As a rule, before the termination of cooperation, an employee can only confirm a period of incapacity with a sick leave certificate; the law does not require him to draw up other documents.

But the employer will need to issue an additional order to postpone the dismissal date until full recovery.

By the way, initially the employee must notify management that he is sick.

Moreover, a telephone call will be enough, on the basis of which a report will first be issued on the need to postpone the date of dismissal, and then an order.

Do you need to join the stock exchange?

Article 178 of the Labor Code of the Russian Federation stipulates that in order for a dismissed employee to be helped with further employment, and also to have the opportunity to receive benefits for the third month, it is necessary to register with the Employment Center no later than two weeks from the date of termination of cooperation.

Accordingly, until the employee has an order to terminate the employment relationship, they will not be able to recognize him as unemployed.

By the way, payment of sick leave by a former or current employer does not depend on registration with the Labor Exchange, and in the event of days of incapacity for work occurring after dismissal within two months, it does not extend the period during which it is possible to claim severance pay.

That is why, theoretically, in order to pay for sick leave, it is not necessary to obtain unemployed status, given that the employer will pay benefits for two months, but practically it is desirable, given that the Labor Exchange will provide all possible assistance in further employment.

Deadlines for submitting the certificate

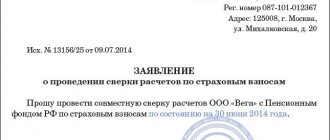

By virtue of Article 12 of Federal Law No. 255, benefits due to the onset of illness must be paid if the application is made no later than six months.

That is, in fact, an employee can file a certificate of incapacity for work even several months after being laid off, and the employer does not have the right to refuse to pay him compensation even under the pretext of lack of funds or another reason.

How do you pay?

The procedure for calculating sick leave is regulated by the norms of Federal Law No. 255, namely Article 7, which provides for the amount of compensation in direct dependence on the existing length of service and the grounds for issuing the leave.

General procedure

Thus, before dismissal, the employee’s benefit amount will directly depend only on his total length of service and average earnings for the last two years, minus the days during which the average tariff was already paid.

Moreover, if in any month over the last two years there was no earnings at all or was less than the minimum, the minimum wage as of the calculation date is taken as the basis.

But for women, the provision provides for a preferential payment procedure.

In particular, the B&R benefit is always calculated in the amount of 100% of the average wage. And if there is no work experience over the last 24 months, the woman can choose another year, provided that the earnings were above the minimum wage.

How is sick leave paid for a work injury? Details are in the article. How to calculate the extension of sick leave for pregnancy and childbirth? Read here.

How many corrections are allowed by the employer on a sick leave certificate? Find out here.

Who pays and how?

Many workers believe that the employer must pay for the period of incapacity, but this is not entirely true.

Thus, within the framework of Article 3 of Federal Law No. 255, the enterprise pays only for the first three days of illness, but the remaining period is covered at the expense of the Social Insurance Fund, to which employees make monthly contributions.

That is, in fact, the final payment is made directly by the employer, who, after receiving the slip, first calculates it within 10 days and sends it to the Social Insurance Fund, and then transfers the required amount to the employee’s account on the day that corresponds to the date of the planned payment of wages under Article 15 of the Federal Law No. 255.

How to calculate the size?

For all cases of calculating days of incapacity for work, regardless of the grounds for drawing up the sheet, the norms of Article 14 of Federal Law No. 255 are used.

It says that initially a calculation period of 24 months is taken, from which the time falling during periods when the worker already had an average salary is excluded, which is relevant for annual leave or sick leave at other times.

Naturally, average earnings are also calculated for the specified period, excluding the above days.

The resulting average amount is then divided by the appropriate number of days, thus calculating the average earnings per day, which in turn is multiplied by the number of days of disability.

Is it subject to personal income tax?

An exhaustive list of income and other transfers exempt from taxation is regulated by Article 217 of the Tax Code of the Russian Federation, according to which temporary disability benefits are exceptions subject to personal income tax.

Example

To calculate disability benefits, the standards of the Government of the Russian Federation of June 15, 2007 N 375 are used, according to which 730 is initially taken as the base calculation period, that is, the same two years (365+365).

Then the following periods are excluded from the specified base:

- 28 days annual leave;

- days of previous illnesses, for example, 15 days.

730-28-15= 687 days.

Now the earnings for the specified period are taken:

- 18000 X 24 = 432000;

- average earnings per day 600 rubles;

- 28 x 600 = 16800;

- 15 x 600 = 9000;

- 432000 – 16800 – 9000 = 406200;

- 406200 / 687 = 591 rubles.

For example, an employee was sick for 7 days: 591 x 7 = 4137

Thus, the employee’s days of incapacity for work will be paid in the amount of 4,137 rubles.

Peculiarities of document flow for individual entrepreneurs

An individual entrepreneur, as an employer, has the right not to comply with notice periods and payment procedures when laying off workers. The requirements of the Labor Code of the Russian Federation are established only for legal entities. The entrepreneur independently determines the notice period and the possibility of paying severance pay. Conditions for different types of contracts can be included in labor or collective agreements or approved by orders.

A certificate of incapacity for work for an employee, opened within 30 days after the dismissal of an individual entrepreneur, is paid in accordance with the established procedure. Similarly to legal entities, the employee is required to provide sick leave, a work book and an application.

If the employee falls ill before notification of the upcoming payment

Download notice of termination of employment contract due to staff reduction for free in word format

A situation may arise when the notice period for an upcoming layoff falls during the employee’s sick leave period. And the employer is obliged to inform him personally and against signature. But he has no right to call a person to work.

In such cases, notice may be given as follows:

- by telegram,

- by registered letter with notification,

- send a company commission to the employee’s home.

The text of the notification must contain information that by signing, the employee confirms consent.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.