Labor leave: types of leave and duration

Every worker has the right to labor leave according to the Constitution of the Republic of Belarus (Article 43).

This right is ensured by the provision of labor, additional and social leaves in the manner prescribed by the legislation of the Republic of Belarus. Despite the existence of regulations, in practice quite a lot of questions arise on the topic of vacation: what types of vacation are there? How long is the vacation? How to calculate vacation pay correctly? When should holiday pay be paid? And a number of other questions related to this topic.

Vacation pay in different cases: we count it correctly

What can we say, calculating vacation pay is not always simple. It happens that at the estimated time an employee goes on sick leave or takes time off. What to do in this state of affairs, how to calculate vacation pay?

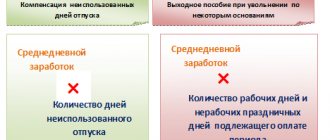

Attention! To calculate vacation pay in accordance with the law, there is a special formula. Vacation pay is calculated by multiplying the average daily earnings by the number of vacation days.

Let's look at an example

Employee Masloedov P.P. vacation starts from 1.06. 2015 Moreover, his average annual salary is 20 thousand rubles. In order to calculate the amount of his vacation pay, you need 20 thousand rubles. divide by coefficient 29.3 and multiply by 30 days. As a result of these calculations, we will come to the amount of 20,477.82 - this will be the amount of P.P. Masloedov’s vacation pay.

One more example

In this example, consider the case when, during the time that is taken as the basis for calculating vacation pay, the employee went on sick leave . So, Starshov M.M. I was going on vacation for two weeks from March 1-14, 2015. In this case, we will take the period from March 1, 2014 as the billing period. until 02/28/2015. Without further ado, let’s take the figure of 20 thousand rubles as his average salary. However, there is a nuance: Starshov M.M. from September 1-8, 2014, he was on sick leave, as a result of which he was paid sick leave in the amount of three thousand rubles. Thus, his salary for September 2014 was only 13 thousand rubles. In this situation, without racking our brains too much, we’ll calculate it like this: 20 thousand rubles. multiply by 11 + 13 thousand rubles. = 233 thousand rubles. Let's calculate the days when Starshov M.M. was at his workplace. To do this, simply multiply 29.4 by 11 + 29.4 divided by 30 (since there are 30 days in September) and multiply by (30 - = 344.96 days. It turns out that they worked 344.96 days in a year. Thus Thus, based on all the above calculations, it is clear that M.M. Starshov’s average daily earnings will be equal to 233 thousand rubles divided by 344.96 = 675.44 rubles, that is, his vacation pay for two weeks will be: 675.44 multiplied by 14 = 9456.16 rub.

Issues related to labor holidays

Typically, the vacation campaign begins at the beginning of the calendar year. The main document regulating the procedure for granting leave for each employee is the leave schedule for the calendar year.

Every worker has the right to receive annual basic leave, the purpose of which is to restore strength and health, as well as rest from work, for a period of at least 24 calendar days. It should be taken into account that public holidays and public holidays falling during the period of labor leave are not included in the number of calendar days of vacation and are not paid (Article 151 of the Labor Code of the Republic of Belarus).

It is worth noting that employees have the right to labor leave from the first day of work, since labor leave is granted for a working year, which is equal in length to a calendar year (12 months), but it is different for each employee - it is counted from the date of his hiring ( Article 163 of the Labor Code of the Republic of Belarus).

Vacation pay – 2022

Compared to last year’s holiday season, the rules for calculating vacation pay have not changed, so let’s pay attention to those about which questions arise more often. Let's consider whether the first month of work is taken into account, whether to leave in the calculation the month in which there were sick leave, downtime, donor days, vacation at your own expense, and other issues.

1. Holidays and duration of leave

Average earnings are maintained during the labor leave, or more precisely for the calendar days for which such leave is granted. At the same time, public holidays and public holidays established and declared by the President of the Republic of Belarus as non-working days are not included in the number of calendar days of vacation (Articles 147, 151, 175 of the Labor Code).

Let us remind you that in 2022 the following holidays and public holidays are non-working days (Decree No. 157).

| date | Name of holidays and public holidays declared non-working days |

| January 1 (Friday) | New Year |

| January 2 (Saturday) | |

| January 7 (Thursday) | Nativity of Christ (Orthodox Christmas) |

| March 8 (Monday) | Women's Day |

| May 1 (Saturday) | Labor Day |

| May 9 (Sunday) | Victory Day |

| May 11 (Tuesday) | Radunitsa (according to the calendar of the Orthodox denomination) |

| July 3 (Saturday) | Independence Day of the Republic of Belarus (Republic Day) |

| November 7 (Sunday) | October Revolution Day |

| December 25 (Saturday) | Nativity of Christ (Catholic Christmas) |

In 2022, most of these days will fall on Saturday or Sunday. However, even in this situation, when determining the duration of labor leave, these days are not included in the number of calendar days of vacation and are not paid. In the time sheet they are designated as a holiday or public holiday.

Please note that Easter, according to the calendar of the Orthodox and Catholic denominations, always falls on Sunday. However, this holiday is not declared a non-working day, so it is taken into account when determining the duration of labor leave and is paid.

2. The first month of work in the calculation of vacation pay

Let us recall the general rule by which the decision is made to include the first month of work in the calculation of vacation pay. If the employee worked for the employer for less than a year before going on vacation, the average salary for vacation pay is calculated based on wages accrued for full months before going on vacation.

A full month is considered to be the calendar month in which the employee worked all working days in accordance with the internal labor regulations or the approved work schedule (shift), as well as the days of his absence in accordance with the law, in cases where the average earnings are maintained at 100% (clause 9 of the Instructions N 47).

Thus, in order to keep the month of employment in the calculation of vacation pay, it is important that the employee works all the days planned by the schedule of a given month, or the average earnings are maintained for the days of absence. The fact of hiring later than the first calendar day of the month does not matter.

Example An employee was granted a leave of absence in May 2022. He was hired on November 2, 2020 (Monday). He has a five-day work week. Due to the performance of military duties, the employee was absent from work on November 25. For this day, he retained his average earnings (Article 340 of the Labor Code). The remaining days stipulated by the work schedule were worked in full. In this situation, for calculating vacation pay, November 2022 is considered a full month because the employee worked all the working days planned by the schedule, with the exception of one. And for the day of absence from work, the average earnings were maintained in accordance with the law. The average daily earnings for vacation pay will be determined for the period from November 2022 to April 2022.

In a situation where none of the months worked is full or vacation is granted in the month of hiring and vacation pay is calculated based on average hourly earnings, another rule applies. According to the explanations of specialists from the Ministry of Labor and Social Protection, when calculating vacation pay based on average hourly earnings, less than a full month of hiring is not excluded from the calculation.

Example An employee was hired by transfer on March 15, 2021. In April, he was released from work due to temporary disability. In May, he is granted labor leave. In this case, neither March nor April are full months. For this reason, vacation pay is calculated based on average hourly earnings for the period from March 15 to April 30.

3. Sick leave, vacation, downtime, donor days, vacation at your own expense in the calculation of vacation pay

All of the above reasons lead to the fact that the employee does not fully work the hours planned by his schedule. However, the issue of excluding a month from the calculation of vacation pay in each of these cases is resolved differently.

We start from the rule of excluding partial months from the calculation of vacation.

A month not fully worked is excluded from the calculation of vacation pay if in it the employee was released from work in accordance with the law and at the same time earnings were partially saved or not saved at all. It is necessary that one more condition be met - the accrued salary for such a month is lower than the salary accrued in full months (clause 12 of Instruction No. 47).

Taking into account these rules, the procedure for including the considered vacation payments in the calculation is as follows.

| The reason why the month was not fully worked out | Vacation pay calculation |

| Sick leave | A month is excluded if the salary (excluding benefits) is lower than the salary for full months. In the case when, after comparing salaries, a month remains in the calculation, temporary disability benefits are not included in earnings (clause 1, subclause 3.9 of List No. 47) |

| Labor leave | The month is included in the calculation. The amount of previous vacation pay is taken into account as part of earnings if the current vacation pay is calculated in the general manner (part 2, clause 5 of Instruction No. 47, sub-clause 2.1 of List No. 47). If vacation pay is now calculated based on average hourly earnings, previous vacation pay is not taken into account (paragraph 2, clause 10 of Instruction No. 47) |

| Leave without pay | A month is excluded if the salary is lower than the salary of full months |

| Downtime is not the fault of the employee | A month is excluded if the salary (excluding salary for downtime) is lower than the salary for full months. In the case when, after comparing salaries, the month remains in the calculation, the salary for the downtime is also not included in earnings (clause 3 of Instruction No. 47, Article 71 of the Labor Code) |

| Donor days | If the average salary is paid by a blood transfusion organization, it is not taken into account in the calculation of vacation pay, because it is not reflected in the employee’s personal account (Part 5, Article 31 of Law No. 197-Z). A month with donor days is excluded from the calculation if the salary accrued in it is lower than the salary of full months. If the average earnings are calculated by the employer, then when calculating vacation pay, as a general rule, the month with donor days and payment for them are taken into account in the calculation of vacation pay (Part 3, Article 31-1 of Law No. 197-Z, subparagraph 2.7 of List No. 47). When calculating vacation pay based on hourly earnings, the average earnings for donor days accrued by the employer are not taken into account (paragraph 2 of clause 10 of Instruction No. 47) |

4. Correction factor for transfer to part-time work

Difficulties may arise with calculating the adjustment factor in a situation where the employee worked part of the calculation period on a full-time basis, and partly on a part-time basis.

Let us remind you that if in the period adopted for calculating vacation pay, the employee is assigned a part-time working day and (or) a part-time working week, the actual accrued wages are taken to calculate the average earnings (clause 13 of Instruction No. 47).

The adjustment factor for employees of commercial organizations is calculated by dividing the tariff rate (tariff salary) or tariff rate of the first category established in the month in which payments are made based on average earnings by the tariff rates (tariff salaries) or tariff rates of the first category in effect in the months accepted for calculating average earnings (clause 27 of Instruction No. 47).

If the first category rate is not applied and employees are given tariff rates (tariff salaries) in a fixed amount, then in the situation under consideration they must be compared under comparable conditions. In our opinion, it is advisable to proceed from the size of the employee’s tariff rate (tariff salary) corresponding to full working time.

The fact is that when an employee is transferred to part-time working conditions, the amount of remuneration does not decrease. The decrease in wages is due to a decrease in the number of hours worked, and not a decrease in piece rates, hourly tariff rates, and tariff salaries (Article 290 of the Labor Code).

Example An employee goes on vacation in May 2022. From 01/01/2021 he is transferred to part-time working conditions. In 2020, the employee’s tariff salary was 500 rubles. (full time). From 01/01/2021, the employee’s tariff salary in proportion to his employment by 0.5 rates corresponded to 250 rubles. In April 2022, the tariff salary corresponding to full-time work increased to 550 rubles, and part-time - 275 rubles. In this situation, there was no reduction in the tariff salary from 01/01/2021. The increase in the tariff salary, which is reflected in the calculation of the adjustment factor, occurred in April. Correction factors are calculated as follows.

| Period | Tariff salary for full-time work, current | Correction factor | |

| in the billing period, rub. | in May (month of vacation provision), rub. | ||

| May 2022 - March 2022 | 500 | 550 | 1,1 |

| April 2022 | 550 | 1 | |

Read this material in ilex >>* *follow the link you will be taken to the paid content of the ilex service

Exceptions to vacations

In exceptional cases, when the provision of full leave to an employee in the current working year may adversely affect the normal activities of the organization, it is allowed, with the consent of the employee, to transfer part of the leave to the next working year.

However, this year the employee will have to be on vacation for at least 14 calendar days. The transferred part of the labor leave, at the request of the employee, can be added to the leave for the next working year or used separately (Article 170 of the Labor Code of the Republic of Belarus).

How to calculate vacation?

Duration of labor holidays.

Time as a philosophical category is “a form of sequential change of phenomena and states of matter, and a period is a detour, a rotation that determines the circle of time” (Soviet Encyclopedic Dictionary, edited by A.M. Prokhorov. - M.: “Soviet Encyclopedia”, 1980. – P. 255, 999)

In many labor law institutions, certain periods of time are specified, but, perhaps, in an institution such as vacation, they play a more prominent role. Following the requirements of part one of Art. 155 of the Labor Code, the key norm is that the duration of the main vacation

cannot be less than 24 calendar days. The mentioned period of 24 calendar days, as emphasized in part three of Article 155 of the Labor Code, is mandatory for all employers.

24 calendar days are classified by the legislator as a type of main vacation and, by their status, are a common “denominator” and very significant among all vacations. All employees received the right to this leave. In addition, 24 calendar days are recognized as the “base” (basis) when the issue of summing up labor leave is decided. All additional vacations are added to 24 calendar days, unless otherwise provided by legislative acts (Article 162 of the Labor Code).

24 calendar days is not the only main vacation, and this is evidenced by part two of Art. 155 TK. The competence of the Government of the Republic of Belarus, in agreement with the President of the Republic of Belarus, is the issue of increasing the main labor leave. Main holidays are of longer duration, i.e. more than 24 calendar days are defined in a special resolution of the Council of Ministers of the Republic of Belarus dated January 24, 2008 No. 100 (hereinafter referred to as Resolution No. 100). It defines longer

,

in particular:

- 56, 42 and 30 calendar days (Appendix 1 to Resolution No. 100) for teaching staff according to the List of organizations and positions of teaching staff, the duration of the main leave of which is 24 calendar days;

- 30 calendar days for workers: professional emergency rescue services, recognized as disabled, under 18 years of age (Appendix 2 to Resolution No. 100);

- 44 calendar days for workers working in zones of radioactive contamination as a result of the disaster at the Chernobyl nuclear power plant, in particular, zones: evacuation (alienation), priority resettlement and subsequent resettlement (Appendix 2 to Resolution No. 100);

- 37 calendar days for workers working in a zone with the right to resettle (Appendix 2 to Resolution No. 100).

In addition to the main holidays, labor legislation provides for additional holidays.

They are provided to employees for varying durations depending on the basis. All these grounds are enshrined in Art. 157-160 of the Labor Code, as well as in Resolution of the Council of Ministers of the Republic of Belarus dated January 19, 2008 No. 73 “On additional leave for work with harmful and (or) dangerous working conditions and the special nature of work” (hereinafter referred to as Resolution No. 73).

Already by the name of this regulatory legal act, one can judge that the legislator has differentiated additional leaves into two types

:

- additional leave for work with harmful and (or) dangerous working conditions, which is provided on the basis of certification of workplaces for working conditions, depending on the class (degree) of harmfulness or danger of working conditions;

- additional leave for the special nature of the work.

First view

additional leave differs in that its duration depends on such a basis as

working

conditions , which, in particular, is confirmed by Appendix 1 to Resolution No. 73, in which working conditions are divided into 4 classes and depending on the class (degree), leave is granted to the following duration:

- 4, 7, 14 and 21 calendar days - for harmful working conditions in the third class of harmfulness, respectively, first, second, third and fourth degree;

- 28 calendar days - for dangerous working conditions in the fourth class.

Second type

additional leave for

the special nature of the work

is granted to fairly “diverse” categories of workers of the following duration:

- from 8 to 42 calendar days - for workers engaged in underground mining, work on the surface of mines (mines), transportation and ore preparation, mineral processing, depending on the types of production and work, professions and positions (Appendix 2 to Resolution No. 73 );

- up to 14 calendar days in a working year - for employees of mountain rescue teams, incl. for each: 60 hours of work in underground conditions and 120 hours of work in open-pit mines for 1 calendar day; 30 hours of work (practical exercises) in oxygen-breathing apparatus for 1 calendar day;

- from 11 to 28 calendar days - for workers engaged in construction, reconstruction, technical re-equipment and major repairs of subways, tunnels and other underground structures, depending on the types of production and work, professions and positions (Appendix 3 to Resolution No. 73);

- from 7 to 28 calendar days - for civil aviation personnel, employees of the republican state-public association "Voluntary Society for Assistance to the Army, Aviation and Navy of the Republic of Belarus" depending on professions, positions and hours flown for the working year (Appendices 4 and 4-1 to Resolution No. 73);

- up to 28 calendar days - to employees of the state-public association "Voluntary Society for Assistance to the Army, Aviation and Navy of the Republic of Belarus" depending on the position and the number of parachute jumps per working year, in particular: one calendar day for each jump - up to 14 calendar days ; from 15 to 40 jumps – 21 calendar days; over 40 jumps - 28 calendar days (Appendix 4-2 to Resolution No. 73);

- from 4 to 18 calendar days - to employees of organizations of the Republic of Belarus sent to work in countries with severe climatic conditions (Appendix 5 to Resolution No. 73);

- from 5 to 7 calendar days - to employees of laboratories of the state institution “Republican Center for Analytical Control in the Field of Environmental Protection”, depending on the types of work and positions (Appendix 6 to Resolution No. 73);

- from 6 to 10 calendar days - for workers employed in forestry, depending on professions and positions (Appendix 7 to Resolution No. 73);

- 18 calendar days - to employees of the state theatrical and entertainment institution "National Academic Bolshoi Opera and Ballet Theater of the Republic of Belarus" depending on professions and positions (Appendix 8 to Resolution No. 73);

- 10 calendar days - to employees of the Belarusian State Musical Theater institution, depending on professions and positions (Appendix 9 to Resolution No. 73).

Additional leaves

are provided to employees:

- up to 7 calendar days – for an irregular working day;

- up to 3 calendar days – for long work experience;

- up to 5 calendar days - working on a contract basis;

- by agreement of the parties - as an incentive - on the basis of a collective labor agreement.

Working year. Calculation and summation of labor holidays.

In Art. 163 of the Labor Code gives the concept of “working year”. The definition of this concept is of fundamental importance: firstly, to establish the duration of vacations; secondly, to pay for vacations; thirdly, for registration of labor holidays.

A working

year

is a period of time equal in length to a calendar year, but calculated for each employee from the date of hiring.

According to part one of Art. 170 of the Labor Code, the employer is obliged to provide the employee with labor leave, as a rule, during each working year (annually). The law emphasizes that paid leave should be provided to the employee not for the calendar year, but for the working year. Each employee has their own working year. The working year begins with the date of hiring and ends with the same date and month, but of the following year.

For example, if an employee is hired on December 15, 2022, then their first work year will begin on December 15, 2022 and end on December 14, 2022.

The boundaries of the working year may shift. For example, during the working year (from December 15, 2016 to December 14, 2022), the employee was suspended from work for three calendar days as he failed to undergo a mandatory periodic medical examination in the prescribed manner. In addition, he was granted leave without pay for 30 calendar days. Thus, the end of this working year for him will shift by 19 calendar days (3 + 30 − 14) and his next working year will begin on January 4, 2022 and end on January 3, 2022.

Consequently, the boundaries of the working year are shifted if the employee is granted unpaid leave lasting more than 14 calendar days. If several social leaves were provided during the working year, then their total duration is determined; if it is more than 14 days, then the boundary of the working year will be shifted by the number of days that exceeds 14.

The duration of all labor holidays is calculated

according to part one of Art. 151 TK in calendar days. Public holidays and public holidays, in accordance with part two of the same article, falling during the period of labor leave are not included in the number of calendar days of vacation and are not paid. It should be noted that we are talking only about holidays established by Decree of the President of the Republic of Belarus of March 26, 1998 No. 157 “On public holidays, public holidays and memorable dates in the Republic of Belarus.” There are 9 of these days - all of them are considered non-working days. All other holidays named in the same Decree, which are working days, are included in the number of vacation days and are paid. The same rules apply to weekends.

As emphasized above, non-working holidays are not included in the number of vacation days. This means that the employee uses his labor leave in the number of calendar days that he is entitled to. Consequently, in this case, the labor leave is extended by the number of days falling on holidays. For example, an employee is granted labor leave from May 1 lasting 24 calendar days. During the period of labor leave there are three holidays: May 1, 9 and 10 (Labor Holiday, Victory Day and according to the calendar of the Orthodox denomination - Radunitsa). Thus, the employee must report to work on May 28.

There is an exception to this rule in connection with the provision of additional leave for the special nature of the work. In particular: a) for workers engaged in underground mining in mines (mines), open-pit mining, work on the surface of mines (mines), transportation and ore preparation, mineral processing; b) for workers engaged in the construction, reconstruction, technical re-equipment and major repairs of subways, tunnels and other underground structures; c) for workers employed in forestry - in the working year for which additional leave is granted for the special nature of the work, the days on which they were employed full-time in said work, the days immediately following them, public holidays and public holidays are included days established and declared by the President of the Republic of Belarus as non-working days, as well as the period of being on labor leave (Resolution No. 73).

When summing up labor holidays

the general rule applies: additional vacations will be added to the main vacation, which is equal to 24 calendar days. And even when the main leave is more than 24 calendar days for such categories of workers as: disabled people, minors working in areas of radioactive contamination, additional leave for work with harmful and (or) dangerous working conditions and for the special nature of the work is added to their main ones vacations consisting of 30, 44, 37 calendar days.

The period of time for which leave is granted.

When providing an employee with paid leave, one must take into account the time periods that are included in accordance with Art. 164 of the Labor Code, into length of service giving the right to annual paid leave. The calculation of this length of service begins from the date of commencement of work in the organization.

According to part one of Art. 164 Labor Code in the working year for which labor leave is granted includes:

— actual time worked;

- time not worked by an employee who retained his previous job and salary or was paid state social insurance benefits;

— vacation time without pay lasting no more than 14 calendar days during the working year;

— time of paid forced absence;

- other time periods.

Actual working time

is calculated from the date of its beginning in the organization, i.e. from the date of hiring and conclusion of an employment agreement or contract. According to parts seven and eight of Art. 133 of the Labor Code, actual working time is taken into account from the moment the employee appears at the place where work is performed in accordance with the PVTR, work schedule (shift) or special instructions of the employer until the moment of actual release from work on that working day (shift). The time spent performing basic and preparatory and final operations (receipt of work orders, materials, tools, familiarization with equipment, documentation, preparation and cleaning of the workplace, delivery of finished products, etc.), breaks provided for by technology, labor organization, should be taken into account as actual time worked. the rules of its technical regulation and protection, and in their absence - by the employer in agreement with the trade union. In order to accurately take into account the actual time worked, each employee, in accordance with parts two and three of Art. 133 of the Labor Code, must, in the manner established by the employer, note his arrival, and upon completion, his departure. Registration of attendance and departure from work is carried out in time sheets, annual time cards and other documents indicating the surname, initials of the employee, calendar days of the accounting period, amount of time worked, incl. overtime, on public holidays, holidays and weekends, and other necessary information. Document forms for recording attendance and departure from work, as well as the procedure for filling them out, are approved by the employer.

Time not worked is equal to time actually worked

under the following circumstances:

- although the employee did not work, he, in accordance with the law or a collective agreement, retained his previous job and salary, or was paid a state social insurance benefit.

Table 1

Periods of time when the employee did not actually work, but which are included in the length of service giving the right to leave

| Period of time | Article TC |

| Performing state or public duties in accordance with labor laws | 101 |

| Labor (main and additional) leaves | 155-160 |

| Social leaves: in connection with training; without pay, if they do not exceed 14 calendar days during the working year; leave with partial or full pay, provided at the initiative of the employer | 208, 211, 212, 216; 189, 191 |

| Advanced training, retraining, vocational training and internship | 102 |

| Business trip | 95 |

| Passing a medical examination and medical examination; days of donating blood and its components and days of rest provided in connection with this | 103, 104 |

| The period of implementation by the employee-author of inventions and rationalization proposals | 105 |

| Downtime due to the fault of the employer; suspension of work or temporary ban on production activities due to violation of labor protection requirements through no fault of the employee | 34, 222 (item 6), 226, 232 |

| Temporary incapacity for work of an employee associated with illness, injury, occupational disease, pregnancy and childbirth, or the period of care by the employee for a sick family member | 164 (clause 2), 189 (clause 3) |

| The period of forced absence due to illegal dismissal and the subsequent reinstatement of the employee | 243, 244 |

| Periods of employee rehabilitation associated with work-related injuries or occupational diseases | 223 |

| Other time periods | Labor legislation; collective or labor agreement (contract) |

In Art. 164 of the Labor Code does not specify periods that are not included in the length of service giving the right to labor leave. Considering that this article of the law does not indicate periods of time that are not included in the working year, it is advisable, guided by the “reverse” principle, to list, if possible, these periods.

table 2

Periods of time that are not included in the length of service qualifying for leave

| Period of time | Article TC |

| The time an employee is absent from work without a valid reason, as well as the time of travel from his place of residence to his place of permanent work and back |

|

| Time of parental leave until the child reaches the age of three years | 164(p.2) |

| Time of unpaid vacations provided for by law or collective agreement, if these vacations exceed 14 calendar days during the working year | 164 (item 3) |

| Time of unpaid forced absence | 164 (item 4) |

| Time away from work due to suspension from work in cases related to illegal behavior of the employee | 49 |

| Time of participation in the strike | 396 |

| Unpaid leave granted at the initiative of the employer | 191, 164 |

Fixation of periods for which vacations are granted

the corresponding working year, is carried out in the employee’s personal card (unified form No. T-2 (not mandatory), which indicates the type of leave, for what period it is provided (the corresponding working year), the start and end date of the leave, the number of days of leave, the basis (order number and date).

MISHCHENKO Maya Stepanovna,

Associate Professor of the Department of Civil Law and Process of the Private Educational Institution “BIP – Institute of Law”,

Candidate of Legal Sciences.

Additional holidays

Additional labor holidays are provided:

- For the special nature of the work, as well as harmful or dangerous working conditions in the manner approved by the government of the Republic of Belarus.

- Vacation for irregular working hours up to 7 days of additional vacation.

- For a long period of work in an organization, 3 days of additional leave may be granted.

- Additional leave may also be granted to certain categories and specific employees individually in accordance with contracts and agreements between employers and employees.

The terms of additional vacations, as a rule, are summed up with the terms of labor. The Labor Code provides for the possibility of replacing part of labor and additional leave with monetary compensation.

Example

After maternity leave - back to work

The employee was hired by the organization on September 6, 2016. From June 29 to November 1, 2022, she was on maternity leave (with payment of the corresponding benefit), from November 2, 2022 to September 7, 2022 - on leave for child care until he reaches the age of 3 years.

The organization has a 5-day work week (weekends are Saturday and Sunday).

Let us further consider, using practical situations, how to calculate the average salary retained by an employee during a labor leave, if it is provided by agreement with the employer:

– immediately after maternity leave;

– during parental leave until the child reaches the age of 3 years;

– immediately after parental leave until the child reaches the age of 3 years;

– a few working days, 2 months, 3 months after parental leave until the child reaches the age of 3 years.

Explanation of general provisions

Maternity leave is granted to women for a duration of 126 calendar days (in cases of complicated childbirth, including the birth of two or more children, 140 calendar days). While on maternity leave, state benefits for state social insurance are assigned and paid in the manner established by law (Article 184 of the Labor Code [1]).

The employer is obliged to provide working women, regardless of their length of service, at their request on the basis of a written application after the end of maternity leave, leave to care for a child until the child reaches the age of 3 years, which can be used in full or in parts of any duration (Art. 185 TK).

While on parental leave until the child reaches the age of 3 years, a monthly state benefit for state social insurance is assigned and paid in the manner prescribed by law |*|.

* Calculation of alimony when paying vacation pay for a future period

The procedure for calculating average earnings saved during vacation

The conditions and procedure for calculating average earnings maintained during labor (main and additional) leave are determined by the Government of the Republic of Belarus or an authorized body (Article 81 of the Labor Code). When calculating it, tenants of all forms of ownership are required to apply the norms of Instruction No. 47 [2].

When calculating average earnings, the wages accrued to the employee for work stipulated by the employment contract are taken into account, taking into account the List of payments taken into account when calculating average earnings, which is an appendix to Instruction No. 47 (hereinafter referred to as List No. 47).

Payments not related to wages, social payments and others provided for in clause 3 of List No. 47, incl. state social insurance benefits and state benefits for families raising children.

To determine the amount of compensation, the average earnings retained during the vacation are calculated based on the wages accrued to the employee for the 12 calendar months preceding the month the vacation begins, regardless of the working year for which the vacation is granted (clause 5 of Instruction No. 47).

Average earnings saved during vacation are calculated by multiplying average daily earnings by the number of calendar days of vacation. In this case, the average daily earnings are determined by dividing the wages accrued to the employee for the months taken to calculate the average earnings retained during vacation by the number of these months and by the average monthly number of calendar days equal to 29.7 (clause 6 of Instruction No. 47).

Average earnings when dividing labor leave into parts are calculated for each part of labor leave in the manner established by Instruction No. 47 (clause 7 of Instruction No. 47).

If the employee worked for the employer for less than a year before going on vacation, average earnings are calculated based on wages accrued for full months before going on vacation. A full month is a calendar month in which the employee worked all working days in accordance with the internal labor regulations or the approved work schedule (shift), as well as the days of his absence in accordance with the law, in cases where the average earnings are maintained at 100% (clause 9 of the Instructions No. 47).

The general procedure for calculating average daily earnings is applied in cases where at least one full month remains in the period taken to calculate the average earnings saved during vacation after excluding months that are not included in the calculation of average earnings |*|.

* Calculation of vacation for an external part-time employee

In cases where the employee was granted leave in the month of his hiring or when in the period accepted for calculating average earnings the employee worked in all months, but none of them is complete (in cases of temporary disability, downtime not due to the employee’s fault, the provision of leave without salary, etc.), average earnings are calculated in the following order:

1) the hourly wage is determined by dividing the wages (taking into account the payments provided for in clause 1 of List No. 47) accrued to the employee during the period adopted for calculating average earnings, taking into account the correction factor applied in the cases and in the manner provided for in Chapter. 4 Instructions No. 47, for hours actually worked during this period;

2) the average monthly wage is calculated by multiplying the hourly wage by the average monthly number of estimated working hours, determined by dividing the corresponding annual estimated working time norm established by law by 12 months;

3) average daily earnings are determined by dividing the average monthly salary (taking into account the correction factor) by 29.7;

4) the calculated average daily earnings are multiplied by the number of calendar days of vacation (days of unused labor leave for payment of compensation).

If the employee has not started work, the average earnings are calculated based on his tariff rate (tariff salary, official salary, salary) defined in the employment contract (clause 10 of Instruction No. 47).

In cases where the 12 months taken for calculating average earnings included months in which, in accordance with the law, the employee was released from work with partial pay or without pay, these months are excluded from the calculation, except for the months in which accrued wages the payment was not lower than the salary accrued in full months. Average daily earnings in this case are determined by dividing the amount of wages accrued for the remaining months by the number of these remaining months and by 29.7 (clause 12 of Instruction No. 47).

For employees who, during the entire 12 months preceding the month of going on leave (payment of compensation), were released from work with partial or no pay (were on parental leave until the child reached the age of 3 years, etc.), average earnings are calculated for the 12 months preceding this period (clause 14 of Instruction No. 47).

Bonuses due to the employer’s remuneration systems, remuneration, incl. based on the results of work for the year, for length of service, and other one-time payments based on the results of work for the year are included in the salary of the month in which they fall according to the personal account (clause 15 of Instruction No. 47).

Remunerations based on the results of work for the year and other one-time payments based on the results of work for the year are taken into account when calculating average earnings in proportion to the months remaining for its calculation in relation to the period taken for calculating average earnings. In this case, to calculate average earnings, the last lump sum payment for each of the grounds, made in the period accepted for calculation, is accepted (clause 16 of Instruction No. 47).

Situation 1

Calculation of the average earnings retained by the employee during the labor leave (see example condition), in certain situations

Labor leave is provided by agreement with the employer immediately after maternity leave, but before parental leave until the child reaches the age of 3 years

The employee was on maternity leave from June 29 to November 1, 2022. Let’s assume that she was granted labor leave from November 2, 2022.

To calculate the average earnings retained by the employee during the labor leave, from the 12-month period (November 2016 - October 2022), you should take the full months in which she worked and received wages - 7 calendar months (from November 2016 until May 2022).

Considering that the employee has been on maternity leave since June 29, 2022, this incomplete month, as well as July - October 2022 (maternity leave and childcare leave until the child reaches the age of 3 years) are excluded from calculation.

The determination of full and partial months and the exclusion of some of them should be carried out in accordance with clause 12 of Instruction No. 47.

Situation 2

Labor leave is provided by agreement with the employer during parental leave until the child reaches the age of 3 years

The employee was on maternity leave until she reached the age of 3 years from November 2, 2022 to September 7, 2020. Let’s assume that she was granted labor leave:

1) in January 2022;

2) in August 2022

1. Since the employee was released from work without pay for more than 2 years, including all 12 months preceding the month of going on vacation (January - December 2022), then to calculate average earnings, the period of 12 months should be shifted to until it contains at least one month or more in which she worked and received wages (in this case, from January to December 2022).

Since the employee has been on maternity leave since June 29, 2022, this incomplete month, as well as July–December 2022 (maternity leave and childcare leave until the child reaches the age of 3 years) are excluded from the calculation .

Thus, in this situation, to calculate the average earnings retained by the employee during her labor leave, we should take the wages accrued to her for 5 calendar months (from January to May 2022).

2. Taking into account the fact that the employee was released from work without pay for more than 3 years, including all 12 months preceding the month of going on vacation (August 2022 - July 2022), to calculate average earnings, a period of 12 months should be shifted until it contains at least one month or more in which she worked and received wages (in this case, the period from September 2016 (month of employment) to July 2022).

Since the employee was hired on September 6, 2016, and was on maternity leave from June 29, 2022, then September 2016 and June 2022 (incomplete months), as well as July 2020 (vacation for pregnancy and childbirth) are excluded from the calculation.

Thus, in this situation, to calculate the average earnings retained by the employee during her labor leave, we should take the wages accrued to her for 8 calendar months (from October 2016 to May 2022).

Situation 3

Labor leave is provided by agreement with the employer immediately after the end of parental leave until the child reaches the age of 3 years

The employee was on maternity leave until she reached the age of 3 years from November 2, 2022 to September 7, 2020. Let’s say she was granted labor leave from September 8, 2020.

The employee was released from work without pay for more than 3 years, including all 12 months preceding the month of going on leave (September 2022 - August 2022). This means that to calculate the average earnings, a period of 12 months should be shifted until it contains at least one month or more in which she worked and received wages (in this case, the period from September 2016 (month of employment ) until August 2022).

Since the employee was hired on September 6, 2016, and was on maternity leave from June 29, 2022, these partial months, as well as July and August 2022 (maternity leave) are excluded from the calculation.

Thus, in the situation under consideration, to calculate the average earnings retained by the employee during her labor leave, we should take the wages accrued to her for 8 calendar months (from October 2016 to May 2022).

"Situation 4

Labor leave was granted by agreement with the employer several working days after the end of parental leave until the child reaches the age of 3 years

The employee goes to work after the end of her maternity leave until she reaches the age of 3 years on September 8, 2022. Let us assume that she is granted labor leave from September 22, 2020, lasting 14 calendar days.

In this case, the procedure for calculating average earnings is determined in the general manner provided for in clause 14 of Instruction No. 47. That is, for calculating vacation pay, 12 calendar months preceding the month of the start of the labor vacation are taken. If there are no accrued wages in this 12-month period, it is necessary to shift the period of 12 months until it contains one or more months in which the employee worked and received wages. After determining the period, average earnings are calculated in the manner prescribed by Chapter. 2 and 4 of Instructions No. 47.”

For reference: to calculate average earnings in 2020, you should use the average monthly number of working hours, calculated on the basis of the estimated norm of working hours established for 2022 by the resolution of the Ministry of Labor and Social Protection of the Republic of Belarus dated November 14, 2019 No. 52 (for a 5-day working week it is 169.3 hours (2,032 hours / 12 months)).

Let's assume that the amount of wages accrued for 10 working days was 1,140 rubles. The hourly wage will be 14.25 rubles. (RUB 1,140 / 80 hours), average monthly earnings – RUB 2,412.53. (14.25 rubles × 169.3 hours), average daily earnings – 81.23 rubles. (RUB 2,412.53 / 29.7).

The total average earnings will be 1,137.22 rubles. (RUB 81.23 × 14 calendar days).

Situation 5

Labor leave was granted by agreement with the employer 2 months after the end of parental leave until the child reaches the age of 3 years

The employee goes to work after the end of maternity leave until the child reaches the age of 3 years on September 8, 2022. Let’s assume that she plans to go on labor leave from November 9, 2020 for 14 calendar days.

The average salary retained by the employee during the labor leave in November 2022 should be calculated based on wages accrued for 1 full month - October 2022. Let us assume that the amount of wages accrued for October 2022 was 2,130 rubles .

The average daily earnings in this situation will be 71.72 rubles. (RUB 2,130 / 1 month / 29.7). The total amount of average earnings retained by the employee during the labor leave will be equal to 1,004.08 rubles. (RUB 71.72 × 14 days).

Situation 6

Labor leave was granted by agreement with the employer 3 months after the end of parental leave until the child reaches the age of 3 years

The employee goes to work after the end of maternity leave until the child reaches the age of 3 years on September 8, 2022. Let’s assume that she plans to go on labor leave on December 18, 2020 for 12 calendar days.

In this situation, the average salary retained by the employee during the labor leave in December 2022 should be calculated based on wages accrued for 2 calendar months (October - November 2022).

Let’s assume that the amount of wages accrued for October and November 2022 was 1,900 rubles. and 1,960 rub. respectively.

The average daily earnings in this situation will be 65 rubles. ((RUB 1,900 + RUB 1,960) / 2 months / 29.7). The total amount of average earnings retained by the employee during the labor leave will be equal to 780 rubles. (65 rubles × 12 days).

Adjustment of wages accepted for calculating average earnings using correction factors is made in accordance with Chapter. 4 Instructions No. 47 |*|.

* Application of correction factors when calculating vacation pay

Example of monetary compensation

For example, in accordance with the law, an employee must go on vacation for 24 days, but he wants to replace part of the vacation with monetary compensation. According to Article 161 of the Labor Code of the Republic of Belarus, an employee must use labor leave for the current year with a total duration of at least 21 calendar days, in which case only 3 days of leave are compensated.

If an employee is offered leave in the prescribed manner and refuses to take it, the employer retains the right to refuse payment of compensation or postponement of leave (Article 173 of the Labor Code of the Republic of Belarus).

Any theory is tested by practice. You can calculate vacation pay in modern 1C 8.

Vacationer's memo

#money #personal budget

Find out how to calculate vacation pay, reschedule vacations, and receive compensation.

Vacation is a long-awaited period in the life of every employee. This is a great opportunity to relax and switch gears, without losing money, because, according to the Labor Code, employees are entitled to vacation pay. How they are calculated, whether it is possible to reschedule vacation or receive compensation for unused vacation days - we will look into it in detail.

How many days of vacation are employees entitled to?

By law, any working resident of Belarus must rest at least 24 days a year. However, in some cases, employees are entitled to additional days. For example, for irregular working hours (up to 7 additional days per year), or for long work experience (up to 3 days per year). Also, those who work in harmful or dangerous conditions can count on longer leave.

The duration of the employee's vacation is specified in the employment contract. The employer has the right to give you longer leave, even if there are no obvious reasons for this. However, the minimum threshold in any case is 24 days a year; less is not allowed by law.

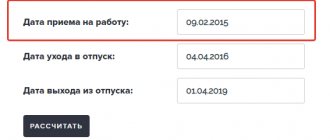

If you have worked for an organization for less than a full year, then your vacation for that year will also be incomplete. It is not difficult to calculate the number of days due to such an employee. First you need to calculate how many months you worked in this partial year. To do this, we determine the number of days from the date of registration for a job until the moment of calculation (holidays and weekends are also counted, that is, we take the number of days from the moment of registration for a job until the moment of calculation). Next, the resulting number must be divided by 29.7 (this is a constant established by the Ministry of Labor, the average number of days in a month). Let's say you worked 168 days. Divide by 29.7 - we get 5 months 19 days. In this case, the worked period is rounded up to 6 months. If the incomplete balance was less than 15 days, it would be necessary to round up to the smaller amount, that is, to 5 months.

Now that the number of months worked is known, you need to calculate the number of days of vacation due. To do this, you need to take the number of vacation days you are entitled to per year, divide by 12 and multiply by the number of months you have worked. Let's say in our example the employee is entitled to the standard 24 days of vacation. In this case, 24/12*6 = 12 days. This is exactly the kind of paid leave that an employee who has worked for six months can count on.

How much vacation pay is due to employees?

Now that you know the number of days of vacation due, you can calculate vacation pay. Their size depends on earnings. To calculate, you need to take the employee’s average salary for the last 12 months (or for the entire period of work, if the employee worked for less than a year), taking into account all bonuses and allowances, and then divide this figure by 29.7. You will get the amount of vacation pay for 1 day of vacation. Next, multiply it by the number of vacation days - and voila!

Let’s say the average salary of our employee is 1,200 rubles. Let's divide this amount by 29.7. It turns out that for each day of vacation this employee is entitled to 40.4 rubles. Multiply by 12 days of vacation - the amount of vacation pay will be 484.8 rubles.

By law, vacation pay must be transferred to the employee no later than two days before the start of the vacation.

How to get compensation for unused vacation

If another working year has passed and you have not taken your required vacation, you can receive monetary compensation, but with two big caveats:

- Firstly, payment of compensation is not the responsibility of the employer. It is carried out by agreement of the parties, that is, both the employee himself and his employer may well refuse this.

- Secondly, compensation can be received not for the entire vacation, but for the remainder of it, exceeding 21 days. That is, it is assumed that the employee must take at least 21 days off in any case, but for the remaining days you can count on a monetary “replacement”. Given that the standard vacation period is 24 days, most workers can receive compensation in just a few days.

The amount of compensation is calculated the same as the amount of vacation pay. Based on average earnings, the amount for one day is determined and multiplied by the number of days.

What to do with unused vacation?

As you can see, there are big nuances to receiving financial compensation for unused vacation. If you still haven’t taken your vacation, you can carry over the unused balance to the next year. However, there is a limitation here too - you must take at least 14 days off this year, and the rest can be postponed for the future.

Please note that your employer cannot force you to reschedule your holiday. He can make such an offer, but the employee decides for himself whether to agree or go on vacation this year.

Vacation transfers, for example, are prohibited for workers under 18 years of age and for those who work in hazardous or hazardous conditions. These categories of workers must go on vacation annually.

Know your rights. Have a nice holiday!

Enter the site

RSS Print

Category : Labor legislation Replies : 25

You can add a topic to your favorites list and subscribe to email notifications.

« First ← Prev.1 Next → Last (3) »

| Elena |

| Hello! such is the question.. An employee at an enterprise is paid vacation pay not before going on vacation, but at the time when the salary is paid... This is a violation, right?? Vacation pay must be paid for 3 k.d....And what should an employee do if this is not done?? |

| I want to draw the moderator's attention to this message because: Notification is being sent... |

| Allegra" [email hidden] , Wrote 26284 messages Write a private message Reputation: 3478 | #2[419454] June 21, 2013, 10:10 |

I want to draw the moderator's attention to this message because:Quote:

Article 171. The employee’s right to postpone or extend labor leave during the current working year. Labor leave may be postponed or extended: 1) in case of temporary disability of the employee; 2) upon the arrival of maternity leave; 3) in the case of an employee being involved in the performance of government duties with the right to be released from work; 4) when the labor leave coincides with leave in connection with training (if the employee took out such leave before the labor leave or during the latter after receiving a call from the educational institution); 5) in cases of non-payment of wages to the employee during the vacation period; 6) with the consent of the parties, as well as in other cases provided for by law or a collective agreement. If the reasons listed in part one of this article occur during labor leave, it is extended by the appropriate number of calendar days or, at the request of the employee, the unused part of the leave is transferred to another period of the current working year agreed with the employer. If the reasons listed in part one of this article occurred before the start of the labor leave, the leave, at the request of the employee, is transferred to another time of the current working year, determined by agreement between the employee and the employer. The employee is obliged to notify the employer of the reasons preventing the use of labor leave as planned, and the time of extension of the leave.

Notification is being sent...

I do not give advice in private messages. Please ask all questions on the forum.| Sergey [email protected] Belarus Wrote 16963 messages Write a private message Reputation: 1819 | #3[419456] June 21, 2013, 10:13 |

Elena wrote:

Vacation pay must be paid for 3 k.d.

Article 176. Deadline for payment of average earnings during labor leave The employer is obliged to pay average earnings during labor leave no later than two days

before the start of the vacation.

Notification is being sent...

Pereat mundus et fiat justitia.| Darpol [email hidden] Belarus Wrote 1160 messages Write a private message Reputation: 103 | #4[419459] June 21, 2013, 10:20 |

Notification is being sent...

An intelligent face is not yet a sign of intelligence, gentlemen.| Yuna [email hidden] Republic of Belarus, Minsk Wrote 456 messages Write a private message Reputation: | #5[537392] February 15, 2022, 11:53 |

Notification is being sent...

| Big_Repa" [email protected] Belarus, Soligorsk Wrote 28475 messages Write a private message Reputation: 2222 | #6[537397] February 15, 2022, 12:28 |

Notification is being sent...

Silence is gold. And all the evil comes from him. Sex is also a form of movement.| Yuna [email hidden] Republic of Belarus, Minsk Wrote 456 messages Write a private message Reputation: | #7[537398] February 15, 2022, 12:31 |

Big_Repa" wrote:

Article 176. Deadline for payment of average earnings during labor leave The employer is obliged to pay average earnings during labor leave no later than two days before the start of the vacation.

In what two days? working or calendar? will there be a violation if we pay on Friday?

I want to draw the moderator's attention to this message because:Notification is being sent...

| tikhan [email protected] Novogrudok Wrote 6518 messages Write a private message Reputation: 1846 | #8[537399] February 15, 2022, 12:41 |

Yuna wrote:

will there be a violation if we pay on Friday?

No

I want to draw the moderator's attention to this message because:Big_Repa" wrote:

Article 176. Deadline for payment of average earnings during labor leave The employer is obliged to pay average earnings during labor leave no later than two days before the start of the vacation.

Notification is being sent...

"Opinions of the authors may not coincide with his point of view." (V. Pelevin)| Yuna [email hidden] Republic of Belarus, Minsk Wrote 456 messages Write a private message Reputation: | #9[537400] February 15, 2022, 12:50 |

Notification is being sent...

| sia-05 [email hidden] Wrote 3 messages Write a private message Reputation: | #10[541159] June 8, 2022, 11:07 |

Notification is being sent...

« First ← Prev.1 Next → Last (3) »

In order to reply to this topic, you must log in or register.