About legal entities

Statement on indirect taxes: concept and purpose Statement on the import of goods and payment of indirect taxes

How long does parental leave last in 2022 according to the Labor Code of the Russian Federation? Vacation

Have the deadlines for submitting reports for the 3rd quarter changed? The Government of the Russian Federation issued a Decree dated April 2, 2020.

Where to obtain a certificate of a professional accountant To obtain a certificate of a professional accountant, you need to undergo training in

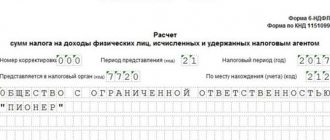

The contents of line 130 in form 6-NDFL Line 130 causes confusion even for an experienced accountant.

Home / Taxes / What is VAT and when does it increase to 20 percent?

Well done, the Federal Tax Service! You have to come up with this so cleverly - in just a few

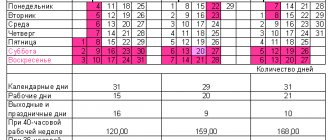

I quarter 2016 January Mon Tue Wed Thu Fri Sat Sun 1 2

Separate divisions in 6 personal income tax 6 personal income tax is mandatory periodic reporting, the submission of which

Types of personal income tax deductions A deduction is the amount by which the tax base is allowed to be reduced