Kontur.Accounting - 14 days free!

Personnel records and employee reports, salaries, benefits, travel allowances and deductions in a convenient accounting web service

Try it

Organizations and individual entrepreneurs use the UTII system at their own discretion. Previously, businessmen were required to inform the tax authorities that they were ceasing their activities or switching to a different taxation regime. To do this, an application for deregistration was drawn up and submitted. But from January 1, 2022, UTII will be abolished throughout the country; the tax office will not be able to cope with so many applications. We'll tell you how to leave UTII after the regime is lifted.

In what cases to apply for deregistration

Organizations and individual entrepreneurs on the “imputation” are registered with the tax authority. To stop paying the single tax, submit an application for deregistration there. Complete and submit the application if:

- you have ceased activity;

- you switch to a different tax regime;

- you stopped one of the activities on UTII;

- you have violated the restrictions and lost the right to apply imputation.

Each reason has a corresponding code that is indicated on the form.

How to properly deregister as a UTII payer

From January 1, many organizations and individual entrepreneurs will lose the right to apply UTII and it’s time for them to think about how to deregister and switch to another taxation system.

Those who will not be able to apply UTII and PSN from 2022 can learn from the material It will be possible to fly off UTII due to the sale of motor oil or a pair of shoes

To be deregistered as a UTII taxpayer, you must submit an application to the tax office.

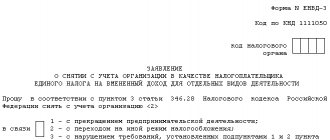

It must be submitted to the tax office where the organization or individual entrepreneur is registered as a UTII payer and where the declarations are submitted. If there are several such tax authorities (for example, several retail outlets in different cities), then the application is submitted to each tax office at the place of registration. Organizations fill out the UTII-3 form, and the UTII-4 form is intended for individual entrepreneurs. There is almost no difference between them; the filling principle is the same.

What you need to pay attention to first is the indication of the reason for deregistration. The form provides four reasons:

- 1 - with the termination of entrepreneurial activity, subject to a single tax on imputed income;

- 2 - with a transition to a different taxation regime;

- 3 - in violation of the requirements established by subparagraph 1 of paragraph 2.2 of Article 346.26 of the Tax Code of the Russian Federation;

- 4 - other.

If an organization or individual entrepreneur ceases the activity for which UTII was applied in the territory of this tax office, then the number 1 is indicated in the application. If, after leaving UTII, there will be a transition to the simplified tax system, then it is better to indicate number 2, while remembering that the transition You can use the simplified tax system only from January 1 and you must submit a notice of transition no later than December 31.

The number 4 is indicated only when one object is deregistered, and not several. For example, one retail outlet has closed, the rest continue to operate on tax territory where the taxpayer is registered. Or one of the types of activities that fell under the imputation ceased. In this case, an appendix to the application is filled out, which must indicate the code of the type of activity (from the appendix to the order) and the address of the place of conduct of the activity.

Remember, the erroneous indication of the number 4 in the application leads to the fact that the UTII taxpayer is not deregistered!

To deregister as a UTII payer from January 1, 2022, applications must be submitted no later than January 10.

If the reason for deregistration in the application contains the number 1 - “due to termination of business activities”, the tax authority will deregister all retail outlets (at all addresses) at which the taxpayer is registered with this tax authority as a UTII payer. In this case, within five days from the date of receipt of the application, the tax authority sends him a notice of deregistration. If the number 4 is indicated as the reason, then no notification is issued.

Applications for UTII-3 and UTII-4 can be sent both through TKS and by Russian Post (by a valuable letter with a description of the attachment). You can also submit them to the tax authorities in person. Do not forget that if a representative submits an application for an individual entrepreneur, he must have a notarized power of attorney.

Sample application for deregistration of UTII-4

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up

Are you switching from UTII? Connect Kontur.Accounting

45% discount in November: RUR 7,590 instead of 13,800 rub. per year of work

Easy bookkeeping

The system itself will calculate taxes and remind you of the deadlines for payments and submission of reports.

Automatic calculation of salaries, vacation pay and sick leave

Technical support 24/7, tips inside the service, reference and legal database

Sending reports via the Internet

Reports and KUDiR are generated automatically based on accounting data

Electronic document management and quick verification of counterparties

Documents, transactions, analytical reports, VAT reconciliation

We close the individual entrepreneur on the “imputation”

- We submit the completed application to the tax office at the place of registration of your individual entrepreneur. In order to receive an application form, you can contact the tax office itself, or find the application form and download it for printing on the official website of the Federal Tax Service. You will need form No. P26001.

- We pay 160 rubles in state duty. Payment can also be made via electronic payments using the tax service. In the future, you will need a receipt for payment of the state fee, so print it out immediately.

- We submit the pre-filled application and receipt directly to the tax office. Or you can again use their electronic service and send the digital version like this.

- We wait five days. After this, the tax office issues you a document certifying that the activities of an individual entrepreneur have been terminated.

- Next, we send the tax document in the form of UTII-4. This must be done within five working days, no later. This form is intended to record the cancellation of payment of this very tax on imputed income.

Do I need to submit an application if UTII has been cancelled?

If you leave UTII from January 1, 2022 along with the whole country, you do not need to submit an application. The Federal Tax Service will automatically remove taxpayers from the imputed regime. At the same time, the deadline for filing a declaration and paying tax for the fourth quarter does not change - submit the report before January 20, 2022 and pay the tax no later than January 25.

Choose a different tax regime to replace UTII. Our free calculator will help with this - enter your parameters to calculate the tax burden on all available regimes and choose the most profitable one. Our experts spoke in detail about how to switch from UTII to another tax regime. If you didn’t find the answer to your question in the article, ask it in the comments, we will definitely answer.

Preparing for the closure of an individual entrepreneur

- Need to submit a report

- Bank accounts need to be closed

- It is necessary to cancel the registration of the cash register

- It is necessary to deregister with the Social Insurance Fund (SIF) and the Pension Fund of the Russian Federation (PFR)

None of these steps should be skipped and it is necessary to take a responsible approach to their implementation, fill out all documents correctly and provide reports. All steps are specifically discussed in separate articles on our website, so please read them carefully. In some cases, important nuances of a particular procedure may be overlooked.

The first four steps were a preparatory stage, which is typical for the procedure for registering the end of a business activity in general. Now we move on to the main processes of closing an individual entrepreneur working on the principle of a single tax on imputed income.

Deadlines for filing an application and deregistration

LLCs and individual entrepreneurs who refuse to use UTII are deregistered within 5 working days. The date of deregistration of a taxpayer varies depending on the prerequisites for terminating activities on UTII:

- upon termination of work - the date specified in the form;

- in case of violation of the conditions and loss of the right - the beginning of the quarter in which the requirements were violated;

- in case of voluntary transition to another regime - December 31 of the current year.

Having received the application, the tax office removes the taxpayer from the register and sends him a notification about this. To do this, the tax office has 5 days. After this, the imputed person must submit a declaration and pay tax for the last period spent on UTII.

When to contact

There are three reasons why a businessman may stop using UTII and will need a UTII application form 4 2022 for an individual entrepreneur.

- The entrepreneur stopped doing business. He will have to be deregistered, close his business, and fully pay taxes, contributions, and other obligatory payments.

- During the quarter, some changes occurred that deprived the individual entrepreneur of the right to “impute”: for example, amendments to legislation, exceeding established indicators, for example, the number of employees, the area of a retail facility, the expansion of the vehicle fleet.

- The regime will turn out to be unprofitable or inconvenient for the entrepreneur, and he will want to try another one - simplified tax system or OSNO.

Regardless of the reason, it is necessary to inform the tax authorities that the entrepreneur no longer wants to use the single tax on imputed income. This should be done within five days using a special form with the KND code 1112017.

Remember that the period is calculated only in working days and begins from the next day after the actual cessation of activity on UTII.

The date of deregistration is indicated by the entrepreneur himself. The exception is situations when an individual entrepreneur is deprived of the right to preferential tax treatment due to non-compliance with established restrictions. In this case, the date of deregistration is the first day of the quarter in which the requirements were violated.

Tax officials cannot fine or otherwise punish an entrepreneur for missing the deadline for submitting a notice of termination of activities on UTII. But under such circumstances, they have the right to deregister an individual entrepreneur no earlier than the last day of the month in which the application with KND code 1112017 was submitted. In accordance with clause 3 of Art. 346.28 of the Tax Code of the Russian Federation, the date of deregistration in this situation is the last day of the month.

Filling out an application

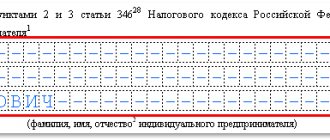

Comply with the requirements for completing the application established by the Federal Tax Service. Fill out the printed application in capital letters from the first cell, placing dashes in the empty fields. To fill out the electronic form, use Courier New font size 16-18.

The detailed procedure for filling out the application is specified in Appendix No. 11 to the order of the Federal Tax Service of Russia dated December 11, 2012 No. MMV-7-6 / [email protected]

- Indicate the TIN and KPP, they are contained in the notification of registration.

- Enter the code of the tax authority where you are registered. It is contained in the registration notice.

- Carefully select the reason for deregistration. Code 4 - other, is used to terminate one of the types of activities subject to UTII or the address of its conduct.

- For Russian organizations, enter the number 1, for foreign organizations - 2.

- Indicate the full name, as in the constituent documents.

- The OGRN is indicated in the registration certificate and in the notice of registration with the statistics service.

- Indicate the date from which you stopped using UTII. From now on you have 5 days to submit your application. If you forcibly terminate your activity, having lost the right to use “imputation”, you do not need to put a date, just put dashes.

- Make an attachment to the application only if you indicate code 4 in the reason for deregistration field.

- Provide information about the person submitting the application. Enter number 3 if this is a manager, and number 4 for his representative. Next, enter your full name from your passport and indicate your tax identification number and contact information.

For individual entrepreneurs, the procedure for filling out an application is similar.

Page 2 should only be completed when certain types of activities under UTII are terminated. One page displays information about only three types of activities; if there are more, fill out several applications.

- Indicate the code of the business activity that you have decided to terminate.

- Fill in the information about the address where the activity was carried out. Including: zip code, region, district, city, street, house and office number.

In the example, we indicated one type of activity; forms for other types must be filled in with dashes.

Appendix to form No. UTII-4

The application is filled out only if the individual entrepreneur indicated code “4” as the reason for deregistration.

“TIN” line , as well as the serial number of the page, are filled in automatically.

In the “Code of business activity type” , select the code of the corresponding type of activity from the directory.

In the “Address of the place of business activity” , the address at which the individual entrepreneur will conduct the imputed activity is indicated: postal code, region code, city, street, etc.

It is not allowed to indicate the address of the place of business activity without indicating the code of the type of business activity.

Late submission of application

If you did not have time to submit your application within 5 days, you can do so later. In this case, the tax authority will deregister you only on the last day of this month (clause 3 of Article 346.28 of the Tax Code of the Russian Federation).

Submit your deregistration application on time. A slight delay does not threaten anything serious, but some entrepreneurs delay submitting an application for several months, believing that they do not owe anything. The Ministry of Finance categorically disagrees with this position. After all, filing an application for deregistration is an important condition for stopping taxation. If you do not submit an application and stop conducting business, the tax office will expect you to file returns and pay taxes and will charge fines and penalties.

Zero declarations cannot be submitted in the absence of activity, since the calculation is based on physical indicators, the absence of which must be proven.

Author of the article: Elizaveta Kobrina

The cloud service Kontur.Accounting is suitable for maintaining records and generating reports on UTII. Account for income and expenses, calculate salaries, pay taxes and submit reports via the Internet. All new users can use the program for free for 14 days.

Declaration on UTII

The UTII declaration when closing an individual entrepreneur differs from the standard one only in the tax period code. Filling out a report using the sample will help you avoid troubles due to mistakes.

Despite the fact that the title pages of declarations for different forms of taxation are the same, it would be a mistake to assume that the remaining sheets are also identical. Thus, according to order No. ММВ-7-3/99, the declaration on the simplified tax system contains sections on income, which are not discussed in the UTII. The rules for filling out reports are different, so you should not consider the guidelines for entering information into one of them to be universal.