Well done, the Federal Tax Service! You have to come up with such a clever idea - in just a few years, create such a system of tax control - where everyone watches everyone.

Banks and financial companies are built into the control system. Auditors and notaries received a technique for identifying problematic clients. Law and accounting firms are also required to participate. Be vigilant - identify suspicious people, stop illegal actions and report where appropriate. For inaction, responsibility will come.

But the most ingenious move is to check the business with the business itself!

We are talking about checking potential counterparties, which - according to the new rules - has become an obligation. Moreover, with a severe penalty for non-compliance - 1) accusation of complicity and 2) refusal to reduce the tax base when calculating taxes.

In accordance with the new verification rules, the usual tactful due diligence has been transformed into strict control.

The question is important. And the article turned out to be big. I divided it into two parts.

So, part one.

Development of methodology for verifying counterparties

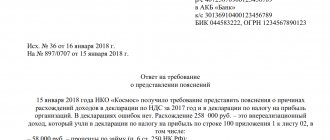

In the last decade, the number of lawsuits affecting work with counterparties has gradually increased. In these proceedings, one way or another, the question was raised as to whether a company has the right to deduct input VAT from its supplier and deduct expenses for calculating income tax.

Please note that VAT and income tax deductions are not the same thing. Nevertheless, they were considered together in legal disputes about the admissibility of accepting expenses for calculating income tax.

In addition, tax authorities began to more actively combat fly-by-night scams, as well as illegal tax deductions and refunds. Judicial practice was accumulating. The main problem was that taxpayers had little understanding of what means could serve as evidence of good faith in the selection of counterparties. The first answer to this question was formulated in Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 12, 2006 No. 53.

Legislators tried to create rules and explain how businessmen and tax officials should behave. Then the concept of unjustified tax benefit was born and other terms were introduced that are still used in legal proceedings surrounding claimed deductions.

The method of selecting taxpayers for on-site tax audits changed even before 2010. The Ministry of Finance and the Federal Tax Service began publishing letters with answers to the pressing question of what actions the company should take to prove to tax inspectors that it was sufficiently prudent when selecting a partner.

2010 brought further clarity. In addition to departmental letters and clarifications, ASK VAT-2, an automated system for monitoring VAT refunds, appeared to help tax authorities. Even then it was obvious that the Federal Tax Service approached solving the problem systematically. It followed that the reaction of entrepreneurs should be systemic.

In 2022, Art. 54.1 of the Tax Code of the Russian Federation, according to which the taxpayer should not abuse the right. Transactions should not be fictitious; they should be carried out by those participants who are specified in the documents. Partners should not have the goal of partially or completely evading taxes.

Why is this necessary?

Trust is certainly a good thing, but building a business only on this is fraught with unpleasant consequences. Their range is very wide:

- financial losses;

- reputational risks (for example, due to non-receipt of payment from the counterparty, the company was unable to fulfill its loan obligations);

- tax audits, additional assessments and sanctions for failure to exercise due diligence when choosing a counterparty;

- refusal to refund VAT;

- legal proceedings, prosecution.

Changing the approach to tax audits

Initially, the emphasis during inspections was on the liquidation of fly-by-night companies. The inspectors sought to detect companies that were opened for a short period of time and without the intention of conducting real business activities. The war against fly-by-night companies became a testing ground where tax officials worked out the methodology for checking counterparties.

Development of inspection methodology

The introduction of ASK VAT-2 provided inspectors with a significant service. The system helped to find online cases when the budget does not have a source for reimbursement of the amount claimed for deduction.

The agency began issuing letters revealing the internal regulations for checking counterparties. Among other things, the so-called risk-based approach was formulated, according to which all taxpayers are divided into groups and a risk factor is calculated for each of them. The severity of tax control depends on the risk factor.

Not only first-tier suppliers are important

From some point to this day, the Federal Tax Service has been interested in due diligence when selecting a supplier, not only at the first, but also at previous levels (See for more details: “Tax Requirements for Verifying Suppliers”).

Accumulated judicial practice has shown that purely nominal compliance with due diligence requirements - for example, a minimum set of documents proving that the partner company exists in principle - is no longer enough. Tax inspectors are now interested in details. You will now be asked whether, when choosing a particular partner, supply chain or a particular business model, you are aware of the extent to which the integrity of the counterparty corresponds not only to yours, but also to the public financial interests (See also: “Supplier selection and due diligence”).

What does the Federal Tax Service want?

The Tax Service strives to ensure that entrepreneurs thoroughly study the state of affairs of their counterparties. The agency considers it necessary for taxpayers to take the trouble to find out for themselves:

- Does the prospective partner have enough expertise?

- does he really have the resources necessary to complete the intended project?

- How long has the company been in existence and will it be able to fulfill your order?

In other words, tax authorities want to shift some of the control procedures onto the shoulders of taxpayers.

Expected changes

To assess the changes that may await us in the future, we should proceed from the results of legal proceedings in 2022. These results show that inspectors are ready to undertake a functional analysis of business relationships . It is needed to understand the role of each link in the business chain. Each participant, as tax experts believe, is required to have a clear answer to the question of both his own role and the roles of the other participants.

The tax authorities encourage businesses to keep their supply chain shorter. And if this is not possible, then it should be as transparent as possible.

What exactly needs to be done to check a counterparty and how to complete this check?

We advise checking counterparties according to 18 points, which should be set out in the Appendix to the Regulations. What are these points? For example, you need:

- request copies of certified constituent documents from the counterparty;

- get information from Transparent Business

- compare the list of individual mass directors with the list of founders of counterparties, etc.

How to determine the most reliable counterparty? If everything is good on a certain point (the director is not a figurehead, the address is real, etc.), then the counterparty receives 0 points on this point.

After information on all 18 points has been received, you need to calculate how many points the counterparty has scored in total. If there is a lot, you can’t work with him, he’s high-risk. But there is a point here.

What if there are no other candidates for cooperation? In this case, we propose to stipulate in the Regulations that

work with a high-risk counterparty is possible only on the basis of a decision of the Commission, adopted by at least two-thirds of the votes of its members present at the meeting of the Commission, and documented in the appropriate protocol. The minutes of the Commission meeting are signed by the chairperson and the Secretary of the Commission.

That is, again, the director of the company was taken out of harm's way - it was not he who made the decision to work with this counterparty, but the Commission. This means that the director is not responsible for the choice.

How can a business respond to the requirements of the Federal Tax Service?

Until now, a considerable number of taxpayers reduce the work of checking counterparties to simply collecting basic information from publicly available sources. This is a necessary, but, alas, in 2022 it is no longer a sufficient part of the work. It includes searching for a counterparty by TIN, searching for tax debts, checking the number of directors and their addresses, checking management in the register of disqualified persons and more. These and other summary data can be found on the company card in the Kontur.Focus system.

When checking potential business partners, an entrepreneur must consider:

- legislative norms

- clarifications from the regulatory agency

- judicial practice

The optimal strategy today would be to develop a system of measures that would include not only identifying and assessing publicly available basic information, but also preparing evidence that the intended counterparty has a sufficient number of labor and other resources to complete the task.

You will need to find answers to the following questions. Does the partner pay all applicable taxes? What documents will confirm this without violating trade secrets? Does the partner involve other contractors in performing the requested work? Do you know the entire contract chain?

conclusions

If your company has not implemented the Contractor Verification Regulations, then no matter how you check individual counterparties, the inspectorate may accuse you of not checking them enough. This means they did not exercise due diligence.

Procedures for obtaining information, identifying risks, collecting and recording information about the counterparty must be prescribed in the relevant Regulations.

A correctly drafted Regulation places the responsibility for obtaining information about contractors on various services and employees of the company, thus removing the head of the company from the area of responsibility.

Step-by-step instructions for checking counterparties

Step 1. Collect information about your future partner

This is the easiest step. This includes an analysis of information from public sources, as well as a request for a package of documents: certificates of state registration of the company, copies of its charter, certificate of registration with the Federal Tax Service, identity cards of the general director and more. Contour.Focus allows you to collect all this in one window, thereby minimizing labor costs.

It would be wise to collect additional data, building on the already accumulated experience of cooperation. The very fact of identifying information that was not included in the analysis does not yet show the full picture of possible risks. It is necessary to collect documents proving the reality of the declared economic activity.

Step 2. Evaluate the collected data against reliability criteria

You should pay attention to the trustworthiness markers in Focus, which are formed on the basis of both letters from the Federal Tax Service and the Ministry of Finance, and judicial practice.

It is necessary to clarify whether the potential partner has the necessary resources, what is his reputation in business circles, and whether his employees have enough qualifications.

Step 3: Document the review

Keep documents demonstrating sufficient care when selecting a counterparty and the characteristics by which you chose it. Business correspondence will also come in handy.

Your company should have internal regulations for assessing and selecting possible business partners and documentation documenting the decision-making process about working together.

Step 4. Observe the counterparty

Monitor the dynamics of the state of affairs of the selected counterparty using the counterparty monitoring function in Kontur.Focus. Check operations and transactions, note for yourself interesting facts in the work of this company. This way, you will promptly notice alarming symptoms that can adversely affect the prospects for cooperation and both the business reputation of the partner and your own.

Finding a business partner is not just a job for financiers and accountants. A wrong choice is fraught with tax risks and, consequently, additional taxes. It is important that this is understood not only by the accountant, but also by the head of the company, its lawyers, logistics department employees and other key employees.

Stages of analysis paragraph

Basically, the actions come down to obtaining all kinds of information about a potential or real counterparty from a variety of sources.

Request for documents and information from the counterparty

First of all, you need to obtain copies of the state registration certificate of the counterparty, the document assigning him a TIN, as well as the Charter (for organizations). You should request these documents from the counterparty itself.

State number (OGRN or OGRIP) and TIN are basic information on the basis of which you can obtain data from open sources, including an extract from the Unified State Register of Legal Entities. At the same time, we note that you should not limit yourself to just an extract - this is not a manifestation of due diligence.

In addition, you can request from the counterparty financial statements , information about licenses, how it calculates the budget, and some other information. A conscientious businessman most likely will not object to providing such information, although the law does not oblige this. In any case, a refusal may indicate that the company has something to hide.

Sometimes business owners do not want to provide such information, citing trade secrets . However, information about the establishment of a company and data from the registry, information about licenses, tax deductions, financial statements and even personnel wages are not considered trade secrets. It is worth explaining this to a potential counterparty, and perhaps then he will meet you halfway.

If the counterparty does not want to provide the requested documents and data, you can invite him to choose another method of confirming his own solvency.

Use of open sources

The most convenient way to analyze data contained in open sources is through special services for checking counterparties, for example, Kontur.Focus. A lot of useful information can be obtained from such systems. They include both information from open registers and databases, as well as information that can conditionally be called unofficial. This is a mention of the company on the Internet, reviews from clients, employees and other information.

In the following table we have collected the main open data sources that can be used for analysis.

Table. Resources for counterparty analysis

| Source | Possibilities |

| egrul.nalog.ru | Register of legal entities and individual entrepreneurs on the website of the Federal Tax Service (extract from the Register without a signature); |

| service.nalog.ru/vyp/ | Service for providing an extract from the Register on the Federal Tax Service website (the extract is signed with an electronic digital signature, authorization is required) |

| service.nalog.ru/disqualified.do / | Information from the Register of Disqualified Persons |

| service.nalog.ru/disfind.do | Information about companies whose management includes disqualified persons |

| vestnik-gosreg.ru/publ/vgr/ | Information about the decision made on the reorganization or liquidation of a legal entity |

| vestnik-gosreg.ru/publ/fz83/ | Information about the upcoming exclusion from the Register of legal entities or individual entrepreneurs |

| service.nalog.ru/addrfind.do | Bulk registration addresses |

| service.nalog.ru/zd.do | Information about legal entities with tax arrears for more than 1 year |

| service.nalog.ru/mru.do | Information about individuals who manage and/or participate in several companies |

| rospravosudie.com | Information about court decisions against a company or individual entrepreneur |

| fssprus.ru/iss/ip | Enforcement proceedings database |

| kad.arbitr.ru/ | File of arbitration cases |

| bankrot.fedresurs.ru | Bankruptcy Register |