Contents of line 130 in form 6-NDFL

Line 130 causes confusion even for an experienced accountant. The reason is that the amount that an employer will accrue to its employee as wages may be very different from the amount that the same employee will ultimately receive through the company's cash desk or by bank transfer. In addition, two employees with the same amount in the “Total Accrued” column with the same tax rate may receive completely different amounts.

The amount in hand may depend on:

- applying standard deductions for children;

- deductions under a writ of execution;

- deductions upon the employee's application for alimony;

- deductions for loan repayment from the employer;

- accountable amounts (when an employee incorrectly reports on the funds provided, then part of them may be withheld from his salary).

In each of these cases, the accountant accrues an amount greater than the employee receives in hand. What data will be correct for line 130 of the 6-NDFL reporting form?

According to clause 4.2 of the Procedure for filling out the 6-NDFL report, approved. By Order of the Federal Tax Service No. BS-4-11/450 dated October 14, 2015, line 130 “Amount of income actually received” indicates the amount accrued in favor of the employee - before any deductions and deductions, including personal income tax.

What to check using control ratios in 6-NDFL

Before submitting the 6-NDFL calculation, among the control ratios, check that it is filled out correctly by:

- intra-document relationships, i.e. according to indicators within the calculation itself. For example, income on line 110 must be greater than or equal to deductions on line 130;

- inter-document relationships. For example, by checking the correctness of the transfer of personal income tax according to the registers for accounting settlements with the budget for personal income tax;

- according to data compared with other reporting - calculation of insurance premiums.

Previously on the topic:

Control ratios for the new form of calculation 6-NDFL have been approved

Specifics of filling out line 130 of reporting form 6-NDFL

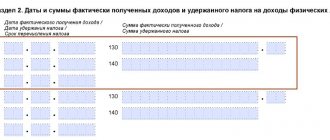

Form 6-NDFL contains two sections. In Section 1, amounts are indicated on a cumulative basis from the beginning of the reporting year, and Section 2 contains data for the last 3 months of the reporting period. Line 130 is in Section 2; accordingly, only those incomes from which personal income tax was withheld in the last quarter are included here.

Line 130 includes all accruals for income subject to personal income tax. These include:

- frame part;

- additional payment for work performed beyond the established working hours;

- bonus part (regular, one-time, annual, quarterly);

- vacation pay;

- hospital benefits;

- material aid;

- one-time benefits;

- interest on loans provided by individuals;

- other income received by the taxpayer as a result of work activities.

The amount entered in line 130 must be paid on the day indicated in line 100 “Date of actual receipt of income.” If an employee received a different type of income on the same day with personal income tax transferred on different dates, then a separate group of lines 100-140 is drawn up for each type.

For example, wages and sick leave benefits were paid on the same day. Tax on wages is transferred to the budget the next day after payment of income, and personal income tax on sick leave is allowed to be paid until the end of the month in which the payment is made.

Another controversial point arises when the amount of the tax deduction exceeds the employee’s income: in fact, no tax is paid on this amount, but the amount of income must be indicated in full in line 130.

How to reflect salary in 6-NDFL

According to the Labor Code of the Russian Federation, employers must pay their employees at least twice a month. Specific terms of payments are established in employment contracts, collective agreements and other local documents. The completion of the personal income tax calculation depends on the date of recognition of income.

Carryover income

If settlements with employees are made in the month following the month of accrual, then the amounts paid must be reflected in 6-NDFL in a special manner. For example, salaries for June are paid in July. In this situation, wages will be reflected in the half-year report in the second section, and the personal income tax withheld from it will be reflected in the 9-month report.

Example 1. In January-June 2022, 15 people worked. During the period under review, employees were only paid salaries. The collective agreement stipulates that payments are made on the 5th and 20th of the month. Personal income tax is not withheld from advances and their payment is not reflected in 6-personal income tax.

Accruals to Zeus LLC for January-June 2022:

- accrued income - 3,100,000 rubles;

- provided tax deductions - 81,200 rubles;

- calculated tax - 392,444 rubles - (30) × 13%;

- tax for June 2022 - 36,520 rubles.

In the half-year report, accrued income (3,100,000) is indicated on line 110, deductions provided to employees (81,200) on line 130, calculated tax (392,444) on line 140. Next, line 120 reflects the number of employees to whom the organization accrued income (15), on line 160 - withheld tax from wages for January - May (355,924). Personal income tax from salaries for June is not included in line 160, since it will be paid only in July and the tax will be withheld at the same time.

In Section 1, personal income tax from salaries for June is also not included, since it will be withheld in July.

Section 2 of the calculation of 6-NDFL of Zeus LLC for the first half of 2022:

Let's consider how Zeus LLC will reflect the December 2021 salary in the report.

The day of final settlement with employees - the 5th - falls on the January holidays. According to the Labor Code of the Russian Federation, in this case, wages must be paid on the last working day of December - the 30th. Then the salary is reflected in the standard manner in the first and second sections of the calculation for 2022. In this case, in field 021 of Section 1 the next working day for payment of income is indicated, and in field 022 - the withheld personal income tax. In section 2, the salary amount will be reflected in lines 110 and 112, and personal income tax from it in lines 140 and 160.

Final payment by the end of the month

If an organization pays employees before the end of the month, then 6-NDFL is filled out in the usual manner. Let's assume the salary for June 2022 is paid on June 30th. In the calculation of 6-NDFL for the half-year, in field 021 of Section 1 the next working day after the payment of income will be indicated - 07/01/2021. In field 022 the withheld personal income tax will be indicated. The salary amount is included in fields 110 and 112 of Section 2, and personal income tax from it is included in fields 140 and 160.

Example 2. At Mercury LLC, the payment of wages - the final payment for the month - is set for the last day of the month. The accrual amounts for April-June 2022 are shown in the table.

| Month | Payment date | Tax withholding date | Amount of charges | Amount of tax withheld |

| April | 30.04.2021 | 05.05.2021 | 115 000 | 14 950 |

| May | 31.05.2021 | 01.06.2021 | 120 000 | 15 600 |

| June | 30.06.2021 | 01.07.2021 | 134 000 | 17 420 |

The tax was withheld on the day the income was paid. The accountant of Mercury LLC reflected the accruals in the calculation of 6-NDFL for the six months. In lines 021, he reflected the date of personal income tax withholding from wages - the working day following the payment days. In lines 110 and 112 he showed the amounts of accruals, and in lines 140 and 160 the withheld tax.

Payments upon dismissal

Upon dismissal, an employee is paid his earnings for the month worked and compensation for unused vacation. In this situation, tax on monthly income and compensation is withheld on the day of payment and transferred on the next business day. If salary and compensation are paid at the same time, then in 6-NDFL they are summed up and reflected together, if on different days, then each payment is reflected separately.

Example 3. An employee of Venera LLC resigned on June 16, 2021. On the day of dismissal, June 16, he was paid wages for June (23,450 rubles) and compensation for unused vacation (11,710 rubles). Payments were made on the same day, so they will fall on one line in section 1.

Simultaneous payment of salary and sick leave

For some payments - annual leave, sick leave, etc. – there are special rules for withholding and transferring income tax. So, for sick leave and vacation payments, the day the tax is transferred is the last day of the month for which they were paid.

Example 4. On 06/05/2021, she paid the employee wages for May in the amount of 28,000 rubles and sick pay in the amount of 4,300 rubles. The tax on wages amounted to 3,744 rubles, and on sick leave - 559 rubles. Since the tax on income for the month must be transferred on the next working day after deduction, and from sick pay - on the last day of the month, payments are indicated separately in 6-NDFL.

Income accrued but not paid

If an organization accrued wages to employees, but did not pay it at the time of filing the calculation, it does not need to be included in 6-NDFL. After paying income to employees, you must submit an updated 6-NDFL for the period in which the salary was accrued.

If at the time of submitting the calculation the salary has already been paid, then it is reflected in 6-NDFL in the standard manner. During the period of salary calculation in 6-NDFL, fields 110, 112 and 140 of section 2 are filled in, and in 6-NDFL for the period of income payment and personal income tax withholding, section 1 and field 160 of section 2 will be filled in.

Payment of bonuses

Regarding bonuses, there are some features of how they are reflected in the report. So, if the bonus is part of the salary and is paid monthly, then its amounts are reflected along with the salary. And if the bonus is a one-time bonus, for example, for a holiday, and it is not tied to the date of salary payment, then it will be reflected separately, because the tax payment deadline is different

Example 5. At LLC Saturn, the bonus regulations establish a monthly bonus of 5,000 rubles. In May 2021, the amount of income accrued to employees, taking into account monthly bonuses, amounted to 360,000 rubles. Payments to employees are made on the 5th and 20th of the month. In May, one of the employees had an anniversary; in honor of this, on May 21, 2021, she was given a bonus of 10,000 rubles. The accountant reflected the indicated accruals in 6-NDFL for the six months.

Payment of income according to GPA

Payments under a civil law contract differ from payments under an employment contract, when personal income tax is withheld from income on the next working day, but from an advance payment it is not withheld at all and is not reflected separately in 6-NDFL. Recognition of income under the GPA occurs on the day of payment to an individual, including advances, tax is withheld on the day of actual payment, and transferred no later than the next day.

Example 6. Uran LLC paid V.V. Vasilkov according to the GPD. June 14, 2022 advance payment in the amount of 22,000 rubles, advance tax - 2,860 rubles. The accountant transferred to Vasilkov V.V. advance minus tax. The final payment in the amount of 10,000 rubles was made on June 30, 2022.

The calculation of 6-NDFL will be as follows.

Partial income taxation

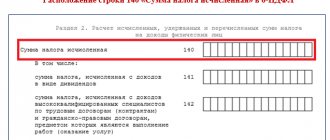

Some income received by individuals is not taxed. However, in 6-NDFL they are indicated in full. For example, gifts worth up to four thousand rubles are not subject to taxation. If the amount of the gift is more than the amount established by law, then the tax is calculated only on the excess amount. Then the second section of the calculation will reflect the entire amount of the gift - line 110, line 130 indicates the non-taxable part of the income. The first section indicates the full amount of the calculated tax.

If the income is completely exempt from income tax, for example, state benefits or gifts worth up to 4,000 rubles, it does not need to be indicated in the report.

Example 7. On June 3, 2022, Neptune LLC gave its employee a gift, the cost of which was 7,000 rubles. And on June 4, the woman received earnings for May 2022 in the amount of 25,000 rubles, from which the accountant withheld tax on the gift. There were no further accruals during the reporting period. The 6-NDFL report for the half-year will be filled out as follows:

In the first section, line 020 indicates the amount of tax on wages and gifts - 32,000 rubles × 13%. On lines 021 and 022, the transfer period and the amount of personal income tax.

In the second section, line 110 indicates the amount of income in the form of salary and gift, and line 130 indicates the tax-free amount of the gift - 4,000 rubles. The tax on wages will be 3,250 rubles (25,000 × 13%), on a gift - 390 rubles ((7,000 - 4,000) × 13%). Since the tax is withheld, it will be reflected in lines 140 and 160.

Line 130 of form 6-NDFL in the absence of income for individuals

If the employer did not make payments to individuals during the reporting period, he can submit a zero report. And if there have been no payments since the beginning of the reporting year, the tax agent may not report on the 6-NDFL declaration at all.

Among the reasons why an organization does not make payments to individuals, the most common are:

- reorganization of the enterprise or its liquidation,

- administrative leave without pay for all employees,

- staff reduction.

However, the tax office may not be aware that payments to individuals at a particular enterprise are no longer made. Inspectors check the fact of tax transfer, wait for the 6-NDFL declaration (which does not arrive, since according to the law, if there are no payments, the form may not be submitted), and as a result, they issue a fine to the company and block the current account.

To avoid such a situation, you need to notify the tax authorities that there is no need to submit 6 personal income taxes: submit the zero form within the deadlines established for filing reports, or contact the tax office with a letter indicating the organization’s right not to submit 6 personal income taxes.

Such a letter is drawn up in any form. It is necessary to refer to paragraph. 3 p. 2 art. 230 of the Tax Code of the Russian Federation and Letter of the Federal Tax Service No. BS-4-11/4901 dated March 23, 2016. A sample letter can be seen here.

The procedure for filling out 6-NDFL for 9 months

In 6-NDFL, reflect all income of individuals from whom you must calculate personal income tax. Do not include in 6-NDFL those incomes that are, in principle, not taxed, for example, child benefits, and those on which individuals pay tax themselves - income from the sale of property or income of individual entrepreneurs.

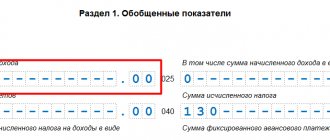

Fill out Section 1 with a cumulative total from the beginning of the year to the end of September.

In line 020, show all income of individuals since the beginning of the year.

In line 030, indicate deductions for income from line 020, and in line 040, the personal income tax calculated from them.

Fill in lines 025 and 045 only if you paid dividends. And line 050 - if there are foreign workers with a patent.

In line 060, indicate the number of people whose income you reflected in 6-NDFL.

Do not count workers who did not have taxable income.

In line 070, include personal income tax withheld since the beginning of the year.

In line 080, show only the personal income tax that you cannot withhold at all. Find examples here

.

Fill in line 090 if you returned tax to employees.

If you apply different personal income tax rates, fill out a separate block of lines 010 – 050 for each. And in lines 060 – 090, indicate the summarized data for all rates.

In section 2, include only payments for the 3rd quarter. For each, determine the date of receipt of income (line 100), the date of tax withholding (line 110) and the deadline for its transfer established by the Tax Code (line 120).

Income for which all three dates coincide, include lines 100–140 in one block. For example, together you can show the salary and the bonus paid with it for the month. But vacation pay or sick leave benefits cannot be shown along with the salary, even if they were paid simultaneously with the salary.

Read about filling out line 130 here.

If the deadline for tax payment under Art. 226 of the Tax Code will come in the 4th quarter of 2022, you do not need to show income in section 2, even if you reflected it in section 1. Thus, you do not need to include in section 2 6-NDFL for 9 months of 2022 the salary for September paid in October 2022 of the year.

Let's look at an example of 6-personal income tax for 9 months of 2022.

Let's say there are 12 employees in an organization. For 9 months of 2022, salaries, bonuses, vacation pay and sick leave benefits were accrued in the total amount of 3,584,692.69 rubles, deductions were provided - 43,200 rubles. Personal income tax on all payments – 460,394 rubles. All personal income tax was withheld and paid to the budget, except for personal income tax of 70,564 rubles. from salary for September 550,000 rubles, deduction – 7,200 rubles.

In January 2022, personal income tax was withheld in the amount of 69,914 rubles. from salary for December 2022 545,000 rubles, deduction – 7,200 rubles. In total, for 9 months of 2022, personal income tax was withheld - 459,744 rubles. (460,394 rubles – 70,564 rubles + 69,914 rubles).

Paid in the 3rd quarter:

- salary for the second half of June 272,500 rubles. – 07/03/2020. Personal income tax was withheld from it from the entire salary for June - 69,914 rubles. (entire salary for June - 545,000 rubles), deduction - 7,200 rubles;

- salary for July 530,000 rubles. – 07/20/2020 and 08/05/2020, personal income tax from it – 67,964 rubles, deduction – 7,200 rubles;

- bonus for July 258,000 rub. – 05.08.2020, personal income tax from it – 33,540 rubles;

- sick leave benefit 5,891.54 rubles. – 08/21/2020, personal income tax from it – 766 rubles. Sick leave issued from 08/13/2020 to 08/19/2020;

- vacation pay RUB 33,927.71 – 08/24/2020, personal income tax from them – 4,411 rubles. Leave was granted from 08/28/2020 to 09/25/2020;

- salary for August 530,000 rubles. – 08/20/2020 and 09/04/2020, personal income tax from it – 67,964 rubles, deduction – 7,200 rubles;

- advance payment for September 300,000 rubles. – 09.18.2020.

The bonus and salary for July are included in one block of lines 100 - 140, since all three dates in lines 100 - 120 coincide. Their total amount is 788,000 rubles, the tax withheld from them is 101,504 rubles. The advance for September is not reflected in section 2 of 6-NDFL for 9 months of 2022. It will be reflected in 6-NDFL for 2022.

Example. 6-NDFL for 9 months of 2022

Let's sum it up

In order to correctly display data in line 130, you need to know four simple rules:

- In line 130 “Amount of income actually received” indicate the amount accrued in favor of the employee - before any deductions and deductions, including personal income tax.

- If the income is subject to personal income tax (even if there are tax deductions), then the entire amount is entered in line 130.

- If the income is not subject to personal income tax, the amount is not entered in line 130.

- If the income is partially subject to personal income tax (for example, a gift), the amount is indicated in line 130 in full.