What amounts are insurance premiums paid from?

In accordance with Article 420 of the Tax Code of the Russian Federation, for organizations and individual entrepreneurs that pay remuneration in favor of individuals, all employees subject to compulsory social insurance are considered subject to insurance contributions.

Insurance premiums are paid from payments to employees:

- Under labor and civil law contracts, the subject of which is the performance of work and the provision of services.

- Under copyright contracts.

- Under agreements on the alienation of the exclusive right to works and under licensing agreements.

What to do with professional income tax payers?

Since January 1, 2022, Federal Law No. 422-FZ of November 27, 2018 has been in force, which introduces an experiment to establish a special tax regime for self-employed citizens. The so-called professional income tax is valid in Moscow, the Moscow region, the Kaluga region and the Republic of Tatarstan.

It is important for companies to know that they can sign civil agreements with a person registered as a professional income tax payer, but as with an individual who is a professional income tax payer. Having received confirmation through the tax service website that the subject is using the new special regime, companies do not need to withhold or accrue any amounts from their income to the Pension Fund, Social Insurance Fund and Compulsory Medical Insurance Fund.

Contribution limit for 2022

The limit for calculating insurance premiums changes every year. The base for calculating insurance premiums is calculated for each employee on an accrual basis from the beginning of the year.

For amounts exceeding the maximum base value, social insurance contributions are not collected; pension contributions are reduced to 10%.

Decree of the Government of the Russian Federation dated November 16, 2022 No. 1951 approved the maximum bases for pension contributions and VNIM contributions for 2022.

| Contribution | Maximum base in 2022 | Base limit in 2022 | % within the base | % when exceeding base |

| For compulsory pension insurance | 1465000 rub. | 1565000 rub. | 22% | 10% |

| For compulsory social insurance in case of temporary disability and maternity | RUB 966,000 | RUB 1,032,000 | 2.9% or 1.8% | — |

| For compulsory health insurance | No | No | 5,1% | — |

| Contributions for injuries | from 0.2 to 8.5 depending on the risk class of the main activity, which was declared in the Unified State Register of Legal Entities (USRIP) | — |

Benefit amounts in 2019

| Name | Amount (amount - excluding regional coefficients), in rubles. |

| Average daily earnings limit (SDZ) = (RUB 755,000 + 815,000) / 730 | 2 150,68 |

| Minimum average daily earnings = minimum wage (at the beginning of vacation) x 24 / 730 | RUB 370.85 |

| Minimum wage 2022 | RUB 11,280.00 |

The maximum possible amount of maternity benefit

| The calculation takes into account the maximum size of the SDZ

|

| The maximum possible amount of the calculated monthly child care benefit | RUB 26,152.27 |

| Amount of monthly child care benefit: 40% of the minimum wage | RUB 4,512.00 |

| Minimum monthly child care benefit | 3 277,45 |

| Minimum monthly allowance for caring for the second and subsequent children | RUB 6,554.89 |

| One-time benefit for the birth of a child | RUB 17,479.73 |

| Social benefits for funerals are paid in the amount of the cost of services according to the guaranteed list of funeral services, but not exceeding | RUB 5,946.47 |

Basic premium rates for most from 2022

For most companies, the basic basic insurance premium rate is set at 30%:

- 22% - for compulsory pension insurance within the limits of the base for calculating insurance contributions,

- 2.9% - for compulsory social insurance in case of temporary disability and in connection with maternity within the base,

- 5.1% for compulsory health insurance.

In excess of the maximum base value, insurance premiums are paid to the Pension Fund at a rate of 10%.

| Compulsory pension insurance (OPI) | Compulsory social insurance in case of temporary disability and in connection with maternity (VNIM) | Compulsory health insurance (CHI) | |||

| Until the maximum base value is reached | Above the limit base | For Russians and foreign highly qualified specialists | For foreigners without Russian citizenship and temporary residents | Above the limit base | |

| 22% | 10% | 2,9% | 1,8% | 0% | 5,1% |

Insurance payments for individual entrepreneurs

Individual entrepreneurs are not required to pay a full list of insurance premiums. They only pay a fixed amount for themselves. Previously, in order to understand how much to transfer, it was necessary to know the size of the minimum wage. However, now the insurance fee has taken on a specific value.

Fixed payments for 2022:

- Compulsory health insurance. 6884 rubles.

- Pension Fund. 29,354 rubles.

These indicators are established for those entrepreneurs whose annual income does not exceed 300 thousand rubles. If this limit is exceeded, additional deductions must be made: 1% of the amount that exceeds 300,000 rubles. So, if an entrepreneur has an annual income of 500 thousand rubles, the additional fee will be (500,000-300,000)*0.01=2000 rubles.

You can calculate contributions for individual entrepreneurs using the official calculator from the Federal Tax Service, located at https://www.nalog.ru/rn77/service/ops/. To calculate the amount, only two types of input data are needed: the tax period and the total income for this time. As a result of the calculations, the amounts of fixed payments relevant for 2022 will be shown in table form, as well as the amount of deductions that are charged for income of more than 300 thousand rubles.

If an entrepreneur needs to calculate tax not for a year, but for a month or quarter, he can do this by entering the exact start and end date of the reporting period.

Contributions for employees hired by an individual entrepreneur are paid at standard rates.

Insurance premium rates for SMEs for 2022

Small and medium-sized businesses pay insurance premiums at reduced rates. In 2022, insurance premiums must be calculated using the same algorithm, but taking into account the new minimum wage.

Rates of insurance premiums paid for SMEs:

- from a salary in the amount of the minimum wage the rate is 30%;

- from salaries above the minimum wage - 15%.

The 15% rate is distributed as follows:

- contributions to compulsory pension insurance – 10% (both from payments within the limit and from payments above the limit);

- contributions to VNiM – 0%;

- contributions for compulsory medical insurance – 5%.

| Amount of payment to an employee per month | Bid, % | ||

| OPS | OSS | Compulsory medical insurance | |

| 13890 rubles and less | 22 | 2,9 | 5,1 |

| More than 13890 rubles | 10 | 0 | 5 |

More on the topic

Reduced insurance premiums for SMEs: we always pay, refusal is impossible

Rates for various activities

The Tax Code regulates certain benefits that are provided to a number of taxpayers when calculating the unified social tax in 2022. Thus, in 2022, the following categories of organizations can reduce rates:

- organizations located in the free economic zone of Crimea and Sevastopol;

- residents of the so-called districts “advanced development”;

- LLC and individual entrepreneur with a pharmaceutical license for UTII;

- LLCs and individual entrepreneurs with income below 79 million rubles according to the simplified tax system;

- Individual entrepreneurs working on patent taxation;

- charitable organizations on the simplified tax system;

- non-profit social organizations working in the fields of culture, medicine, education);

- organizations working in the field of recreation, tourism, IT and technology implementation.

A complete list of taxpayers applying for preferential rates under the UST in 2022, as well as their exact amount, is presented on the Federal Tax Service website. It is important that the tariffs are valid if the organization belongs to the OKVED category, which will need to be confirmed by a certificate and a corresponding application submitted to the FSS.

Preferential rates of insurance premiums in 2022

Preferential rates of insurance premiums for catering

Federal Law No. 305-FZ of July 2, 2022 supplemented Article 427 with a new paragraph 13.1. According to it, in 2022, public catering organizations can apply reduced rates of insurance premiums in the amounts provided for SMEs.

Contribution rates are:

- contributions to compulsory pension insurance – 10% (both from payments within the limit and from payments above the limit);

- contributions to VNiM – 0%;

- contributions for compulsory medical insurance – 5%.

Conditions for applying the preferential rate

Public catering has the right to reduced insurance premium rates, subject to the following conditions:

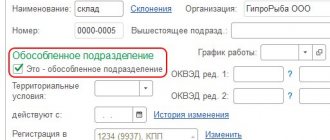

- food and beverage activities must be core. Class 56 OKVED - as the main one in the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs as of the 1st day of the month of entering information into the unified register of small and medium-sized businesses;

- the average headcount according to the SME register must be at least 250 people;

- the amount of income for the previous year should not exceed 2 billion rubles;

- the share of income from the sale of catering services in the total amount of income must be at least 70%;

- average monthly payments to employees for the previous year must not be lower than the average monthly earnings in the region.

More on the topic:

Conditions for concessions on insurance premiums for public catering in 2022

Preferential rates of insurance premiums for IT companies

Reduced insurance premium rates have been established for IT organizations:

- for OPS – 6%;

- for OSS and in connection with temporary disability and maternity – 1.5%;

- for compulsory medical insurance – in the amount of 0.1%.

Conditions for applying reduced insurance premium rates by IT companies:

- the share of income from the implementation of programs, databases, development and modification services, installation and maintenance of programs and databases based on the results of 9 months of the year preceding the year of transition to the payment of insurance premiums at reduced rates is at least 90 percent of the total income organizations during this period;

- the average number of employees is at least 7 people;

- availability of state accreditation.

If the parent IT company has the right to apply reduced rates of insurance premiums, then its branch can also take advantage of the benefit (letter of the Federal Tax Service of Russia dated October 1, 2022 No. BS-4-11 / [email protected] ).

More on the topic:

IT organization: when is it considered newly created and has the right to benefits on contributions?

For profit benefits, IT companies calculate the average headcount

Preferential rates of insurance premiums for payers of remuneration to ship crew members

Organizations that pay remuneration to crew members of ships registered in the international registry of Russian ships have the right not to pay insurance premiums.

To apply a zero contribution rate, the Federal Tax Service may request, in particular:

- a copy of the vessel registration certificate (confirmation of vessel registration) in the RMRS;

- list of ship crew members (ship role);

- collective, labor contracts (labor agreements);

- civil contracts with ship crew members; current qualification documents (diplomas and qualification certificates) to occupy the position of a ship crew member;

- seaman's passport of a ship's crew member;

- charter of service on the ship;

- industry tariff agreement.

Preferential rates of insurance premiums for FEZ participants

Free economic zone (FEZ) is registered in the Republic of Crimea and Sevastopol.

To have the status of a FEZ participant, you must be registered in the territory of Crimea or Sevastopol, be registered with the tax authority and submit a package of documents to the Council of Ministers of the Republic of Crimea or the Government of Sevastopol:

- copies of constituent documents (for legal entities);

- a copy of the certificate of state registration of a legal entity or individual entrepreneur;

- a copy of the certificate of registration with the tax authority;

- investment declaration in the approved form.

Participants of this SEZ have the right to pay contributions at reduced tariffs (subclause 11, clause 1, subclause 5, clause 2, article 427 of the Tax Code of the Russian Federation):

- for OPS – 6%;

- for OSS – 1.5%;

- for compulsory medical insurance – 0.1%.

Preferential rates of insurance premiums for Skolkovo

For organizations that have received the status of participants in a project to carry out research, development and commercialization of their results in accordance with Federal Law of September 28, 2010 No. 244-FZ “On Innovation”, reduced contribution rates are established in the following amounts:

- for OPS – 14%;

- on OSS – 0%;

- for compulsory medical insurance – 0%.

Reduced insurance premium rates for the film industry

For 2018–2023, a reduced tariff of insurance premiums has been established for Russian organizations engaged in the production and sale of animated audiovisual products produced by them and (or) the provision of services (performance of work) for its creation.

Insurance premium rates are:

- for OPS – 8%;

- for OSS in case of temporary disability and in connection with maternity – 2%;

- on OSS in case of temporary disability in relation to payments and rewards in favor of foreign citizens and stateless persons temporarily staying in the Russian Federation (with the exception of highly qualified specialists) - 1.8%;

- for compulsory medical insurance – 4%.

Conditions for applying reduced tariffs:

- the share of income related to this area must be at least 90% of the organization’s total income,

- number – at least 7 people,

- presence in the register.

Reports to extra-budgetary funds for 2022

Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 3p approved three reporting forms and one accompanying explanatory form for them.

Since the new year, some adjustments have been made to the forms. And these changes must be taken into account, since reporting for 2022 must be done using new forms approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507P:

- SZV-STAZH

The updated form must be submitted by March 1, 2022. No changes have been made to completing this form. However, in section 3 in column 14, the title was expanded with the following wording: “information about the periods counted in the insurance period of the unemployed.”

The form includes all employees who received monetary rewards from which insurance premiums were paid. That is, employment contracts, civil contracts, and copyright contracts are taken into account.

If one employee in the reporting year was registered as a full-time employee, was also on leave without pay, took sick leave, etc., then all these periods, in accordance with personnel orders, must be reflected in the SZV-STAZH form, since this affects for calculating the employee's pension.

The accompanying document EDV-1 to the SZV-STAZH form is prepared automatically and does not cause any problems. It removed the line “Other incoming documents” from section 3 “List of incoming documents”.

- SZV-KORR

Using this form, previously submitted information is corrected if the company, independently or as a result of checking the PF, has discovered any errors (for example, some periods were not taken into account in the length of service). An accompanying EFA-1 document is also being prepared for this form.

- SZV-ISH

This form is presented for periods that expired before January 1, 2017, and actually serves to correct errors of previous periods. Form EDV-1 is also filled out for it.

It is worth noting some changes that have occurred in correcting errors in the SZV-M form.

On October 1, 2022, Order of the Ministry of Labor No. 385n dated June 14, 2018 came into force, which amended the Instructions on the procedure for maintaining accounting records and clearly regulated the algorithm for correcting errors in the SZV-M form. It lies in the fact that the Pension Fund, having discovered an error, is obliged to notify the payer of insurance premiums within five days that an authorized person has identified false information. The company, in turn, undertakes to correct the error within five calendar days for the insured person for whom it was identified. If the payer manages to do this within five days, then no fines are applied to him.

That is, the Instructions now clearly indicate that updated information is provided only for those insured persons in respect of whom an error warning was received.

There is another significant innovation, which is associated with the application of sanctions in the event of self-identification and correction of errors. Previously, if the company itself identified an error and eliminated it before it came to the attention of the Pension Fund, there were no grounds for a fine. Now sanctions are not applied if two conditions are simultaneously met: the policyholder independently discovered an error in the previously submitted information and corrected it before the Pension Fund found out about it, and the erroneous information was accepted by the Pension Fund.