Where to get certified as a professional accountant

To obtain a professional accountant certificate, you need to undergo training at the Institute of Professional Accountants (IPB).

IPB is an association of accountants and auditors in the Russian Federation. Has been certifying accountants since 1997.

Having passed the IPB exam, the accountant receives a certificate confirming his high qualifications.

Training and certification itself can be completed not only at the IPB. Now there are professional training centers that have a license to carry out educational activities and are accredited by the IPB RF. This gives them the right to issue and endorse professional accountant certification.

Why do you need a professional accountant certificate?

In recent years, the work of an accountant has become significantly more complicated. And this is primarily due to the large number of changes in legislation, which can be quite difficult to keep track of.

And even more so, the employer has such a problem. When hiring an accountant, he wants to be sure of his professionalism. It is at such moments that a certificate of a professional accountant and membership in the IPA of the Russian Federation are a guarantee of the high level of the hired specialist.

Also, one should not forget that in order to renew the validity of the certificate, it is necessary to improve one’s qualifications (pass 40 hours of training annually), which undoubtedly increases the level of confidence in the accountant.

It is no secret that many people have a desire to go and work abroad. And if you want to find a job in your specialty in a new place, you will simply need the IPB RF certificate. The IPB is a full member of the International Federation of Accountants (IFAC), so to get a job abroad you will need to know the national language and take a course in local taxation.

How many types of certificates are there?

There are several types of certificates:

- Accountant certificate. It confirms the professional level of the employee performing the functions of an accountant, which must correspond to the qualifications of the professional standard “Accountant” of the 5th level.

- Chief accountant certificate. Confirms the professional level of the employee performing the functions of the chief accountant. This must be consistent with the Accountant Professional Standard Level 6 qualification.

- Certificate of the chief accountant of an organization that has separate divisions. This is a qualification of the 7th level of the professional standard “Accountant”.

Read about the new professional standard “Accountant” here.

To obtain a certificate, it is not enough to have the necessary knowledge and skills - there are certain qualification requirements that an individual must meet. They mainly relate to education and practical work experience. You can find out about them on the IPB Russia website in the “Get a certificate” section.

Frequently asked questions ↑

Certification is not an easy procedure to prepare, because it is necessary to comply with a number of requirements established by federal legislation and local documentation.

And therefore, there are often a number of questions remaining about the process itself, the presentation of results, the preparation of documents, etc. Let’s find out what interests employers and employees of enterprises the most.

Sample characteristics

A couple of weeks before the certification, the commission must receive performance characteristics that reflect:

- accountant experience;

- knowledge and experience;

- presence of business and personal qualities;

- description of style and working methods;

- knowledge of regulatory documentation.

Nowadays, characteristics are called letters of recommendation. Here is an example of a profile for an accountant:

Photo: characteristics of an accountant

The following information is entered:

- obligations that are fulfilled better or worse, the cause of difficulties in the work process;

- Are tasks completed efficiently and reliably in difficult situations;

- is the person capable of developing and implementing innovations;

- how professional and active the person is;

- data on advanced training and self-education;

- information about business qualities and style of activity;

- are the recommendations given after the previous certification being implemented;

Approximate tests

When selecting tests, it is worth considering that they should include questions about:

- accounting;

- taxation;

- on the legal basis of accounting.

What is said on the official website of Rostechnadzor about certification for industrial safety, see the article: areas of certification of Rostechnadzor. Read here how occupational safety certification is carried out at an enterprise.

The procedure for obtaining electrical safety certification in Rostekhnadzor for group 5, see here.

What else you need to know about preparing and conducting certification

You can prepare for the exam in several ways:

- take a full-time course at an accredited training center;

- take a distance course at an accredited training center;

- prepare yourself.

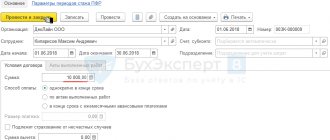

You can view and download the program for training professional accountants in ConsultantPlus. If you do not already have access to this legal system, a full access trial is available for free.

After you have chosen the training method that is suitable for you, you must become a full member of the IPB RF. To do this, you need to write an application, attach documents confirming your qualifications, and pay the entrance fee.

It is possible to take the exam at the territorial IPB or at an accredited training center.

The exam takes place in 2 stages:

1. Interim certification at the center where you studied.

2. Electronic testing on the IPB RF website. You receive the login details for the site from the accredited center where the training took place, or from the IPB representative office.

Testing for a chief accountant may include about 48 questions, for an accountant - 24 questions.

During the exam, you are allowed to use regulations and reporting forms.

International Accountant Certificate of Excellence

Diploma or experience?

Obtaining a diploma in IFRS is very difficult and also quite expensive. However, the law does not currently require accountants to obtain diplomas or certificates. Therefore, the question arises: is this “security” really necessary?

This is what Olga Bulatova, partner, head of the Vocational Training Center in the CIS, thinks about this. “Why should an accountant (not an auditor) receive internationally recognized diplomas? This question can be heard quite often today. Of course, if an accountant does not plan to change jobs in the future and is not very interested in professional growth and salary growth, then there is no need to obtain diplomas, since the process of preparation and delivery is costly both from a financial and time point of view. The diploma is needed for those professionals who would like to:

- obtain and systematize knowledge on IFRS;

- improve your professional qualifications, confirming them with a prestigious diploma recognized internationally;

- increase your competitiveness and value in the labor market, creating potential opportunities in the future to change your job to a more interesting and highly paid one;

- gain confidence in the future."

Tatyana Dolyakova, CEO of the recruitment agency Penny Lane Personnel, comments on the situation on the labor market: “Now employers are increasingly requiring that the applicant have experience in transforming and consolidating reporting under IFRS or GAAP. But an internationally recognized diploma is only mandatory for auditors. For accountants, appropriate education is, of course, an additional plus, but quite rarely it is a decisive factor in selecting a candidate. Still, our employers currently value experience more than certificates. If the candidate does not have experience in reporting according to international standards, then he must at least have education in this field.

And the level of wages primarily depends on the availability of practical skills. Compensation for an accountant with knowledge of IFRS now ranges from $1,300–$1,500 and above, and for a chief accountant from $2,000–2,500, depending on various factors. Such as, for example, knowledge of English, experience in this field.”

However, some employers require that in addition to experience, the employee must also have a diploma confirming his qualifications as an accountant under IFRS. Experts attribute this to the fact that in Russia there is no system for guaranteeing the quality of IFRS education. Although, perhaps, the educational program itself is of quite high quality, but there is no system for confirming the acquired knowledge. Therefore, the employer trusts foreign diplomas more, since it is known that in order to obtain such a diploma, it is necessary to pass a serious exam.

Europe or America?

There are currently two main systems of accounting standards in the world. These are IAS (International Accounting Standards) and GAAP (Generally Accepted Accounting Principles).

IAS standards are developed by the International Accounting Standards Board (IASB), which was created by accounting associations of several countries back in 1973 (then called the Committee). This standard is used by the countries of the European Union, Canada, Australia, Korea, Taiwan, Mexico, India, Malaysia, etc.

GAAP is an American system of standards. It is necessary for companies that want to enter the US market and work with American partners. Also, GAAP reporting is prepared by companies with American capital or those who want to attract investment from US businessmen.

Most Popular

There are many certifications from various accounting and finance associations. In particular, in Russia you can meet specialists with diplomas from CIPA, IFA, ACA, WP and others. But today the most famous are ACCA and CPA. Let's look at them in more detail.

ACCA is the Association of Chartered Certified Accountants - UK. Today it is the most popular international accounting association. To obtain the ACCA Professional Accountant Diploma, you must pass 14 exams. They can be taken within ten years from the date of registration of the candidate. In practice, the entire process usually takes 2–3 years. Exams are held twice a year - in December and June. You can take up to four exams in one session. But please note that the exams are taken in English. The Association has certain requirements for candidates to take the exam. This is: having a certificate of a professional accountant or auditor, or three years of work experience in the field of accounting and auditing, confirmed in writing by the employer, or higher education and two years of work experience in the field of accounting and auditing, confirmed in writing by the employer.

DipIFR is the Diploma in the International Financial Reporting. If you have problems with English or are intimidated by the large number of ACCA exams, then this certificate is for you. The DipIFR program was developed by ACCA in response to the increased need for qualified IFRS specialists. In fact, ACCA has separated the exam on international financial reporting standards from its program into a separate exam, which gives the right to receive an independent diploma. The requirements for applicants are the same as for obtaining an ACCA diploma. In addition, the passed DipIFR can be counted towards one of the exams for the ACCA professional accountant certificate.

In 2003, ACCA announced the establishment of the DipIFR (Rus) diploma in Russian. This has significantly expanded the range of specialists who can receive such a diploma. Head of the Methodological Department of the Educational and Methodological Center, Honored Professor of Moscow State University A.D. Sheremeta - Svetlana Polyakova believes that the DipIFR (Rus) program allows you to combine the advantages of international training programs (in-depth knowledge of IFRS and extensive experience in teaching them) with the advantages of studying in Russian training centers (understanding the state of Russian accounting and ways to reform it).

After completing the courses, diploma applicants will:

- understand the structure of the international accounting system;

- be able to apply disclosure requirements in financial statements;

- be able to prepare financial statements of companies and groups of companies in accordance with IFRS.

The exam can be taken in February, July and December. It lasts three hours and consists of two sections:

- Section A contains one mandatory question on the topic of consolidated financial statements. It is necessary to draw up a consolidated balance sheet or consolidated profit and loss statement based on the data provided for individual companies included in the group - assessed on a 25-point scale.

- section B contains four questions, of which three need to be solved - assessed on a 75-point scale.

It is enough to score 50 points out of a possible 100 for the exam to be considered passed. If you fail to pass the exam on the first attempt, you can retake it an unlimited number of times within two years from the date of the first attempt. The exam is conducted for all candidates on one day, in one place. You can only take a pen, pencil, markers, correction fluid and calculator into the gym. Candidates leave all their belongings, including mobile phones, at the entrance. During the first hour and last 30 minutes you are not allowed to leave the examination hall, and for the remaining time - only with an accompanying person. Throughout the exam, observers walk around the hall. So you can’t count on cheating here. The allotted time to complete the exam tasks is very limited. The exam result is announced after approximately six weeks. The first-time pass rate is quite low. The right to take the exam will cost the candidate 220 US dollars, and each retake will cost 150 US dollars excluding VAT.

CPA – Certified Public Accountant. This is one of the most prestigious certificates. In the United States, only its holders can certify financial statements. Issued by the American Institute of Certified Public Accountants (AICPA). To obtain the certificate, you must pass one exam consisting of the following parts: financial accounting and reporting (US GAAP), auditing, civil and tax laws of the United States.

Exams can be taken twice a year only in the United States. Moreover, in approximately half of the states, only US citizens are allowed to take the exams. The duration of the exam is 16 hours. Examination tasks include multiple choice questions, essays and problems.

CIPA – Certified International Professional Accountant is a Russian-language certification program for professional accountants. It was approved in 2001 by the International Board of Certified Accountants and Auditors (ICBA). The Council unites 23 professional accounting and auditing associations from the countries of the former CIS.

The program is based on the standards of the International Accounting Standards Board (IASB). This is confirmed by the International Accounting Standards Committee Foundation (IASCF), the parent organization of the IASB. The IASCF representative also sits on the board of directors of the CIPA-EN examination network. Exams under the CIPA program are the same for all participating countries, with the exception of the “Taxes and Law” discipline, which is formed separately for each participating country and is based on national legislation and taxation.

IFRS without a diploma

You can simply listen to a course of lectures on IFRS as part of advanced training, which is what most existing auditors and accountants do. As a result, you receive a certificate or diploma from this educational institution and, at best, a good basis for further study of IFRS. Some experts believe that such courses do not contain the required number of tasks in order to develop the necessary practical skills in applying IFRS - you attend lectures and, even without learning something, receive a certificate. But only after confirming your knowledge and skills in a serious exam can you talk about a high-level specialist.

However, Olga Bulatova thinks this way: “There is no need to contrast the proposed forms of training - intensive seminars on IFRS and preparation for passing exams for, for example, DipIFR (Rus). These are complementary training systems, each of which is focused on solving specific problems. When preparing for the exam, the emphasis is on studying and applying IFRS in accordance with the requirements of the exam, while specialized trainings and seminars on IFRS aim, in addition to studying and systematizing knowledge on IFRS, to teach training participants to practically apply the requirements of the standards in Russian conditions. In our practice, the most common situation is when students who have successfully studied with us and passed the ACCA diploma exam continue to improve their professionalism by studying at seminars on IFRS, finance and management.”

Svetlana Polyakova also agrees with this position: “International training programs summarize many years of experience in teaching IFRS, they contain extensive practical material that has been created over the years - this is their strength. However, in order for a Russian accountant to deeply understand the content of IFRS, and most importantly, to develop the skills to apply them in practice, it is necessary to study IFRS in a process of continuous comparison with the principles and rules of Russian accounting and reporting. The weakness of international curricula is that they are not focused on this. Therefore, IFRS training in Russia should be aimed at comparing IFRS with Russian accounting standards, at revealing the advantages that the use of IFRS provides, and at practical techniques for restructuring Russian accounting and reporting based on IFRS.”

It's easier to choose with English

Which of the numerous international qualifications now offered on the Russian market should you choose? The head of the audit training center, member of the Audit Council under the Ministry of Finance, Sergei Sukhanov, says: “For Russian specialists, one of the main restrictions when choosing a program is knowledge of the English language. A certificate or certificate received in English is valued much more. Therefore, if you work in the field of auditing, then you should opt for the ACCA professional scheme or the American CPA qualification. True, it is believed that for people whose command of the language is not excellent, it is easier to take the ACCA.

Those who do not speak English sufficiently should choose from two qualifications - DipIFR (Rus) ACCA or CAP/CIPA. The advantage of ACCA is that this association has been known throughout the world for more than 100 years. And the CAP/CIPA qualification was created just a few years ago and specifically for Eastern European countries. But it covers not only accounting issues, but also taxation and law.”

Find your center

Practical advice for specialists who are going to undergo training under the ACCA DipIFR program is given by the head of the training center and audit office Sergei Sukhanov: “Now even those companies that have a very vague idea about the educational process are preparing for the DipIFR exams. Therefore, pay special attention to the choice of training center and training program. Choose a well-known training center with solid experience in training specialists in the field of economics and, in particular, DipIFR. This will protect you from possible organizational complications, such as cancellation and rescheduling of classes, disruptions in the work of managers to ensure the educational process, as well as unprofessionalism of teachers.

The duration of the programs varies from 64 to 112 academic hours. Even if you understand IFRS, in order to systematize your knowledge, choose a program that devotes enough time to theoretical issues. If you only have a basic understanding of IFRS, short programs are not for you.

Inquire about the qualifications of the teachers. For example, in “STEK” classes are taught by full ACCA members, that is, specialists who have passed 14 professional exams in English. We believe that their knowledge is confirmed by ACCA membership. They also know the exam technology well.

It is believed that almost 50 percent of success in an exam depends on knowledge of the exam technology (not to be confused with cheating - it is excluded). The technology of passing an exam is both the correct distribution of time and the ability to place emphasis in the answer to what points are awarded.”

Elena RAKOVA

Stay up to date with the latest changes in accounting and taxation! Subscribe to Our news in Yandex Zen!

Subscribe

How to obtain a professional accountant certificate

After passing the exam, the Presidential Council of the IPB RF makes a decision to issue certificates based on the results obtained.

If the results are positive, you receive a certificate, and information about it is entered into the Unified Register.

The register gives the employer the right to collect data about the employee: when he became a member of the IPB RF, when he last underwent advanced training. Information about this is stored for 5 years.

If the exam is not passed, the applicant has the right to retake it 2 times. This must occur within 3 months of the date of the 1st test.

The certificate is issued for 3 years. After this, if you paid your membership fees to the IPB RF on time and improved your qualifications in accordance with the requirements, the certificate will be extended for another 3 years and so on. You do not need to take the exams again every time you renew your certificate.

Results

Obtaining a professional accountant certificate is not mandatory in our country.

Perhaps, working in a small company, the knowledge that you have will be enough for you. But if you are full of ambition and do not want to rest on your laurels, and also do not want anyone to doubt your knowledge and professionalism, then a chartered professional accountant is what you need. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Important Basics ↑

It is very important to understand that personnel certification has more advantages than disadvantages. This means that both employers and employees of a legal entity should prepare for it with all seriousness.

Let's figure out why such a procedure is carried out and what it is, referring to the norms of the legislation of the Russian Federation.

What it is?

Certification means determining the qualifications, professionalism and skills of an employee, checking his moral and personal qualities that correspond to the positions held.

For what purpose is it carried out?

Certification is carried out to find out whether the employee meets the position held, as well as the requirements of the company.

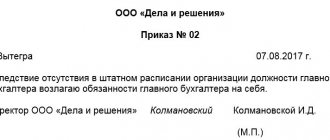

If a person does not pass the certification, the company management will have grounds to terminate the employment relationship with him (Clause 3 of Article 81 of the Labor Code).

This procedure is carried out periodically and is complex. The initiator of certification is the head of the enterprise.

Such verification is also necessary for the citizens themselves, because this is a great chance to increase their salary and take a step up the career ladder.

The employer can evaluate how effective the employees’ activities are. It optimizes the work process and creates additional motivation for staff to improve their skills.

So, the main goals:

- improve the selection, placement and training of personnel;

- improve the quality and efficiency of employees’ work;

- ensure a close connection between material and moral incentives and the result of work;

- form a personnel reserve to obtain a vacant position

- determine whether it is necessary to improve qualifications, professional training and retraining of an accountant

Legal regulation

The training, preparation and certification of a professional accountant is stated in the Regulations on certification checks of associated members of the IPB of the Russian Federation who wish to receive a qualification certificate.

The procedure is discussed in Part 2 of Art. 81 Labor Code of Russia. There is an indication that the procedure is established by regulatory legal documentation, which contains labor law norms, and local documents.

When conducting certification of employees of a budget organization, it is worth relying on Art. 48 of Federal Law No. 79, which was adopted by officials on July 27, 2004.

In Decree No. 2263 and the Regulations on the Certification of Accountants, which was approved by the Institute of Professional Accountants on September 29, 1998, Protocol No. 4 states that persons with secondary or higher education can be certified.