Types of personal income tax deductions

A deduction is the amount by which the tax base is allowed to be reduced for tax purposes. The Tax Code provides for several types of personal income tax deductions:

- standard;

- social;

- investment;

- property;

- tax deductions when carrying forward losses from transactions with securities and transactions with financial instruments of futures transactions traded on the organized market;

- professional.

With one deduction, everything seems to be clear: if a person has a child, he can write a statement to the employer. If you purchased an apartment, you can wait until the end of the year and return the personal income tax from the purchase (or part of it) through the Federal Tax Service, or receive a deduction at your place of work during the year.

What to do if a person has purchased an apartment within a year and paid for his child’s education at the institute. Is it possible to receive two tax deductions at the same time? Yes, you can. The most important thing is that a person has a basis for receiving deductions.

However, there are several nuances when providing deductions:

- The employer has the right to provide some deductions, and you can contact the tax authorities for them. Some can be obtained exclusively through the inspection, having previously filled out the 3-NDFL declaration and collected a package of documents.

- Some deductions can be carried forward to subsequent years, others cannot.

- Most deductions have limits.

Taking into account all the listed nuances, how can you claim several tax deductions at the same time? Let's find out further.

Property deduction

Property deduction may be associated with the purchase of property and its sale. In the second case, the deduction is either the purchase price of the property or a fixed amount (1 million rubles for housing, 250 thousand rubles for other property). This deduction cannot exceed the sale price of the assets. Therefore, the deduction is provided within the year in which the transaction was made.

How to draw up 3-NDFL when selling an apartment? What sheets need to be completed? Where can I get the numbers to fill in? All these questions were answered by experts from the ConsultantPlus legal reference system in the situation “How to fill out the 3-NDFL declaration when selling real estate (apartment).” Use trial access to view the material. It's free.

Another thing is the deduction for the purchase of housing with a limit of 2 million rubles. An individual can return up to 260 thousand rubles. You can choose a deduction until you fully use it—one year, two years, or ten years, if necessary. This is the type of deduction that is allowed to be carried forward to subsequent periods.

Property deduction can be issued at the place of work. Then the employer will simply stop withholding tax. Or you can contact the tax office for it. Then funds in the amount of personal income tax from the purchase price, but within the amount paid for the year, will be returned to the taxpayer after checking the declaration and supporting documents. If the personal income tax paid for the year does not cover the amount spent on the purchase of housing, then the return procedure can be repeated in subsequent years.

Since 2022, a simplified procedure for obtaining property and investment deductions has been in effect. We wrote about the details here.

Basically, all options for choosing deductions when drawing up 3-NDFL or registering at the place of work are based on the existence of the right to a property deduction associated with the purchase of housing. After all, other types can be used only in the year in which they are due, such as standard ones, or in the year when certain expenses were incurred, such as social ones.

Social deduction

Social deduction is a reduction in the personal income tax tax base by the amount of expenses:

- expenses incurred for treatment and education of yourself and close relatives;

- spent on charity;

- contributed under voluntary insurance contracts;

- related to the funded part of the pension.

Social deductions are limited to 120 thousand rubles. Moreover, they are taken into account in the total amount, and not each separately.

The following deductions stand out:

- for the education of children - there is a limit of 50 thousand rubles. taken into account separately from other social deductions;

- for expensive treatment - they reduce the base to 0 without restrictions.

Investment deduction

The investment deduction is not yet so popular among our fellow citizens. It consists of returning the amount of money deposited into an individual investment account. It has a limit of 400 thousand rubles. You can apply for an investment deduction only through the tax office; it is not provided at your place of work.

Next, we’ll look at the most common options for getting 2 tax deductions at the same time.

Deduction when purchasing property

Who can receive a property deduction

Deductions are provided for citizens who are tax residents of the Russian Federation, i.e. permanently residing in the Russian Federation for more than 183 calendar days a year. In addition, they must pay 13% personal income tax on their income, with the exception of income from dividends.

The property must be located on the territory of the Russian Federation, and the owner must have all the title documents. For a new building, it is enough to obtain an act of acceptance of the transfer; for secondary housing, an extract from the Unified State Register of Real Estate.

When real estate is purchased after marriage, both spouses are immediately entitled to a tax refund. The only obstacle can be a marriage contract.

How much can you get back from the budget?

The buyer of real estate can return:

- 13% of the cost, but not more than 260,000 rubles. (RUB 2,000,000 * 13%) and

- 13% of the amount of interest paid on a mortgage or target loan, but not more than RUB 390,000. (RUB 3,000,000 * 13%). Depending on the date of purchase, the size of the deduction and the procedure for transferring its balance change.

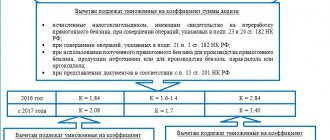

| Date of purchase | Property deduction | Property deduction from mortgage interest |

| From 01/01/2003 to 01/01/2008 | The deduction limit is 1,000,000 (the maximum tax refund is 130,000 rubles), the lost balance is not transferred to other objects. | no size limit |

| From 01/01/2008 to 01/01/2014 | The deduction limit is 2,000,000 (the maximum tax refund is 260,000 rubles), the lost balance is not transferred to other objects. | no size limit |

| after 01/01/2014 | The deduction limit is 2,000,000 (maximum tax refund is 260,000 rubles), the lost balance can be transferred to other objects. | limit 3 million rubles. |

The balance of the deduction can be transferred to other properties only when purchasing an apartment after 2014. This will not work with mortgage interest - this deduction is given only for one property.

When to apply for a deduction

Option 1 - Within the next year after receiving the title documents (in the case of a purchase and sale agreement - this is the Unified State Register of Real Estate, in the case of a DDU agreement - the transfer and acceptance certificate).

Whenever you purchase an apartment or other housing, after receiving ownership rights, you can claim a tax refund even after 2 years, even after ten years.

But at the same time, you can only return the tax for the last three years. For example: you bought an apartment in 2016, but decided to apply for a property deduction only in 2021, 5 years later. This means you can file tax returns for 2022, 2022, 2022. And further, if you have an unused deduction, for 2022 and subsequent years.

Pensioners can return personal income tax for four years at once: for the year in which the purchase was made and the three preceding ones.

Option 2 - Apply for a deduction to the employer in the year of the purchase and registration of documents for the property. Only citizens working under an employment contract can afford this. Please note that the date you applied for a refund does not affect the rule for distributing deductions from 2014.

SberSolutions will help you prepare your declaration and send documents to the tax office without leaving your home.

Apply for a deduction

How to get a property deduction

If you choose the second return option, you must act through your employer. To do this, you need to receive a notice of the right to deduction from the tax office and take it to your place of work. Accounting will stop withholding personal income tax from current earnings, and will also return the tax withheld from the beginning of the year.

Submitting a declaration yourself allows you to return a large amount at once . To do this, during the year we collect income certificates from all employers, prepare documents confirming the purchase, and fill out the 3-NDFL declaration. A desk tax audit should not exceed 3 months, then another 30 days remain for transfer to a bank account.

With the introduction of a simplified procedure for obtaining personal income tax deductions in May 2022, the need to prepare and submit declarations has not completely disappeared. The simplification applies only to certain expenses:

- costs of new construction, acquisition of an apartment, house, room, shares in them, land for individual housing construction;

- interest on mortgages and other targeted loans;

- as well as for an individual investment account.

In addition, the simplified scheme will only work if the bank and local authorities transfer information about the purchase of real estate to the Federal Tax Service. Therefore, you should not rely on such conditional process automation. It is safer and faster to apply for a personal income tax refund yourself.

What errors prevent you from receiving a refund:

- Submission of documents by a person who does not have the right to deduction . Close relatives of the seller cannot receive a tax deduction. Recipients of maternity capital do not have the right to include it in the amount for deduction.

- Errors in paperwork. You can confirm the purchase costs with a handwritten receipt, receipt, payment slip or bank statement. The receipt does not need to be certified by a notary, but if you are confirming expenses with a purchase and sale agreement, it must be certified and contain a clause stating that the seller received the money.

- Missing the deadline for filing a declaration. There is no statute of limitations for property deductions, but there is a limit on the number of years for which you can submit Form 3-NDFL and get the money back. Therefore, if you did not file a deduction immediately, but want to do it later, then remember that you can submit a declaration for no more than three previous years.

- Using the wrong form 3-NDFL . The Federal Tax Service periodically updates declaration forms, so it is important to use the form that was in force in the corresponding reporting year.

Receiving property and social deductions at the same time

Example 1

Petrov A.B., employed at PromInform LLC, where he earned 650 thousand rubles in 2022. Personal income tax was withheld from his income in the amount of 84,500 rubles. and transferred to the budget. At the beginning of 2022, he received treatment in a hospital on a paid basis. His expenses amounted to 130 thousand rubles. Also, despite the difficult year, he purchased an apartment for 5 million rubles. At the beginning of 2022, he decided to apply for a tax deduction for treatment and an apartment at the same time. We will help you do this with the greatest benefit for him. At the same time, we take into account that:

- Petrov A.B. will be able to return a maximum of 84,500 rubles for 2022.

- The deduction for treatment will be only 120 thousand rubles, since it was not expensive according to the conditions of the example. And it is better to declare them immediately in 2022 in the declaration for 2022, since they are not carried over to subsequent periods.

- The deduction for the apartment will be 2 million rubles. But 2022 revenue does not cover this amount. Therefore, the deduction will be carried forward to 2022 and, if necessary, further.

Filling out the 3-NDFL declaration

In the 3-NDFL declaration, to register social deductions, A. B. Petrov must fill out Appendix 5, and for property deductions, Appendix 7.

Starting with reporting for 2022, an updated declaration form is in effect, approved by order of the Federal Tax Service of Russia dated October 15, 2021 No. ED-7-11 / [email protected] We wrote about the innovations here.

In line 140 of Appendix 5 the amount of RUB 120,000.00 will appear, which will then be transferred to the total lines 190 and 200.

In line 080 of Appendix 7 you need to show the amount of 2 million rubles, in line 150 - 530,000 rubles. The amount of RUB 1,470,000 will be transferred to the following periods. - line 170.

Of course, Petrov A.B. could not divide his deduction, so as not to fill out many sections, but completely include 650 thousand in Appendix 7. But then 13% from 120 thousand rubles, which is 15,600 rubles, he would lost.

Deductions related to treatment may fall on line 110 (if the treatment is classified as expensive) and line 141 (if medications were purchased according to a prescribed form) of Appendix 5.

Similarly, a tax deduction for an apartment and education is claimed at the same time. Only training expenses can include:

- in line 130 of Appendix 5 - a limit of 120 thousand in total for all social deductions when paying for your own education, either for a spouse or for brothers and sisters;

- line 100 of Appendix 5 - 50 thousand without taking into account other social deductions when expenses are incurred for the education of children or wards.

How to fill out a declaration taking into account deductions for previous years?

Deduction for previous years of declaration and the amount carried over from the previous year.

These concepts raise many questions when filling out the 3-NDFL tax return for the return of a property tax deduction.

To understand once and for all, you need to answer the questions:

- What it is?

- Where does it come from?

- How is it calculated?

- How to fill out 3-NDFL?

- What exactly and where should I write in the declaration?

What is a deduction?

The phrase “deduction for previous years of declaration” refers to the topic of property deduction. This means that you can return income tax or personal income tax when purchasing any housing: a house, apartment, room, land.

And again new questions arise. What is income tax? And how can I return it?

Income tax is the portion of funds that individuals pay to the government on their income. It would be correct to call it the personal income tax, or personal income tax. The rate of this tax for Russian citizens is 13%.

As a rule, personal income tax is withheld by tax agents, who are employers. For example, if a citizen receives a salary of 10 thousand rubles, the employer will most likely withhold 13% tax from him, which is 1,300 rubles. And he will receive 8,700 rubles in his hands.

This income tax is refundable. Today there are five types of tax deductions:

- standard;

- social;

- property;

- professional;

- deductions for securities.

In order to take advantage of the property deduction and return the withheld income tax, you must fill out a 3-NDFL declaration.

Where does the deduction for previous years of declaration come from?

To date, the amount of property deduction is 2 million rubles. And 13% of this amount can be returned. And this is 260 thousand rubles.

Now you need to compare this with salary. Let it be 25 thousand rubles per month - or 300 thousand rubles per year. The withheld personal income tax for the year will be 39 thousand rubles. Now let's compare tax relief and income tax. The benefit is more than six times your actual income for the year. How to be?

For the past year, you can only get a refund on the real amount of income - three hundred thousand rubles. That is, 39 thousand is returned. What benefit will remain unspent? You need to subtract 2 million 300 thousand, and you get 1 million 700 thousand rubles.

How to fill out the 3-NDFL declaration when selling an apartment?

How to get a tax deduction for previous years, read here.

How to fill out the 3-NDFL declaration for the annual return of mortgage interest, read the link:

When can you use it again? Only next year, when new income appears and, accordingly, withheld personal income tax.

Now attention! 300 thousand rubles is a deduction for previous years of the declaration. One million 700 thousand rubles is the amount that carries over to the next year.

How to calculate the amount of deduction for previous years of declaration?

Where does the amount transferred from last year come from?

A simple example has already been discussed. You need to complicate the problem and make a calculation. So, we bought an apartment worth 3 million rubles. Accordingly, you can take advantage of a property deduction of 2 million rubles. In the first year, the year the apartment was purchased, the buyer’s salary was 300 thousand rubles. The next year he earned 400 thousand rubles. And a year later his income became 500 thousand rubles.

In the example, the declaration is submitted specifically for this third year, while it is assumed that a refund has already been received for all previous years.

You should add up the income for previous years. This amount will be a deduction for previous years of the declaration. It should be repeated that 500 thousand rubles were earned in the year for which the 3-NDFL declaration is now being submitted. That is, this is the current amount of income, and not for the previous period.

Well, another small problem, now for subtraction. From the 2 million tax credit, all income for three years must be deducted. The result will be 800 thousand rubles. This amount will be the balance carried over to the next year.

Here, income for the current year was taken into account, since it will be used in the current declaration when calculating the refund amount. Therefore, next year the deduction will decrease by the amount received. In the example, the deduction for previous years of the declaration is 700 thousand rubles. The amount carried over to the next year is 800 thousand rubles. You should remember the conditions of this problem.

Next, using a specific example, we will consider what exactly needs to be written down and on what lines, and what numbers should be reflected in the declaration form.

You should consider a living example of exactly which lines should be filled out in the 3-NDFL declaration. The conditions of the problem remain the same. Income for the previous three years was 300, 400 and 500 thousand, respectively.

So, the declaration for the first year is filled out.

An apartment was purchased last year, and this is the first time a deduction has been received for this period. In the column “Amount of actual expenses incurred for the purchase of housing”, write the amount of the tax deduction equal to the cost of the apartment - or 2 million if the cost exceeds this amount.

In the example, an apartment was bought for 3 million. Possible deduction – 2 million rubles.

The size of the tax base is income for the year - 300 thousand rubles.

The balance of the property tax deduction carried over to the next year is 1 million 700 thousand rubles.

What should the declaration look like for next year?

“The amount of expenses actually incurred for the purchase of housing” - the number from last year’s declaration is repeated here.

“The amount of property deduction accepted for accounting for the previous tax period” is a deduction for previous years of the declaration. Since last year the income was 300 thousand rubles, and they received a refund from it, then this number is written here too.

“The balance of the property tax deduction transferred from the previous year” is 1 million 700 thousand rubles.

The size of the tax base is 400 thousand rubles. This is income for the year.

Now all that remains is to calculate the balance of the property tax deduction that carries over to the next year. Income for previous years is subtracted from the tax deduction amount of 2 million rubles. In this case, it was only 300 thousand rubles. Income for the current year is also deducted - 400 thousand rubles. As a result, the balance carried over to the next year is 1 million 300 thousand rubles.

Now the declaration for the third year is being filled out. The amount of actual expenses incurred remains the same - 2 million rubles.

The amount of property deduction accepted for accounting for the previous tax period is a deduction for previous years of the declaration.

Since last year the income was 400 thousand rubles, and the year before 300 thousand rubles, then when these two figures are summed up, the result is 700 thousand rubles.

The balance of the property deduction transferred from the previous year is 1 million 300 thousand rubles.

The size of the tax base in the current year is the income received during the year - 500 thousand rubles.

All that remains is to calculate the balance of the property tax deduction that carries over to the next year. Again you need to subtract. The income for previous years is subtracted from the tax deduction amount of 2 million rubles. This is 700 thousand rubles. And also for the current year - 500 thousand rubles. And the result is a number - 800 thousand rubles.

In all subsequent years, the 3-NDFL declaration is filled out according to the same scheme. And this continues from year to year until the due tax deduction is fully returned.

Was the Recording helpful? No 46 out of 65 readers found this post helpful.

Registration of property and investment deductions at the same time

Example 2

Let's take A. B. Petrov's income as a condition for example 2. But let him in 2022:

- bought an apartment for 5 million rubles;

- replenished an individual investment account with 300,000 rubles.

The amount of his income again does not cover all annual expenses, and we remember that property deductions can be transferred, but investment deductions cannot. In this case, Petrov A.B. in the declaration for 2022 will fully show the investment deduction in line 210 of Appendix 5.

And he will partially claim a property deduction, but in the amount of 350 thousand rubles. (650 thousand – 300 thousand).

Thus, after receiving and checking the declaration for 2022 with the IIS deduction and property deduction issued at the same time, the tax office will return 84,500 rubles to Petrov A.B. In the following years, he will need to submit a declaration to continue to return the deduction for the apartment until the entire amount of 260 thousand rubles is selected. The total amount of tax refunded on these two grounds should be 299 thousand rubles.

If you are lazy and do not fill out Appendix 5 for 2022, then the return for the year will still be 84,500 rubles, but in general the individual will lose 13% from 300 thousand rubles, i.e. 39 thousand rubles.

Social and investment deduction at the same time - how to fill out a declaration

Since both social and investment deductions can only be claimed in the year in which the expenses were incurred, when filling out the declaration you need to remember the limitations:

- established for social deductions in the total amount of 120 thousand rubles. or 50 thousand for a child’s education;

- established for investment deduction in the amount of 400 thousand rubles;

- in the amount of calculated and paid tax for the year.

When making these deductions, Appendix 5 is filled out.

Declaration 3-NDFL for 3 years for treatment, education, deduction for IIS and for children.

Social, standard and investment deductions can only be obtained in relation to the income of the periods in which you incurred expenses. However, given this feature, 3-personal income tax for 3 years can also be submitted. If you spent money on education and put money into an IIS in 2022, then you need to fill it out for 2022. You cannot indicate 2022 expenses on your 2022 return. If you had no income for the year in which payment for treatment was made, then you will not be able to return the previously paid personal income tax, because it simply wasn't there.

At the same time, there is an important detail: if the costs of these deductions exceed the personal income tax withheld by the employer, then the remainder of the unused maximum amount is not carried over to subsequent years, but is burned out.

Taking into account the nuances outlined above, every resident of the Russian Federation can submit 3-NDFL in 3 years. We hope this article was useful, and you will independently submit documents for 3 deductions at once, using the information from our website, and get incredible pleasure from the long-awaited reunion of money with your wallet and from the work done on your own.

Receiving two social tax deductions for education and treatment at the same time

Example 3

Lvova N.T. in 2022 received an income of 350,000 rubles. in StroyKomplekt LLC, from which personal income tax was withheld and paid to the budget in the amount of 43,316 rubles. subject to standard deductions. Last year, she paid for her daughter’s education in the amount of 80 thousand rubles. and expensive treatment for a spouse of 540 thousand rubles, included in the list approved by Decree of the Government of Russia dated 04/08/2020 No. 458. This resolution is valid from 2022.

In this case, there are several options for filling out the declaration, and all of them will lead to the same result.

Option 1:

In 3-NDFL, a citizen of Lvov has the right to reflect a deduction for treatment and education at the same time - it is provided to her by law. That is, she enters:

- in line 100 of Appendix 5, the amount for her daughter’s education is 50 thousand. This is the maximum she can declare;

- in line 110 of the same application - the remaining 300 thousand of her income minus the child deduction provided to her by her employer, i.e. 283,200 rubles. This amount does not cover all the costs of expensive treatment.

Option 2:

Since the amount of an individual’s income is less than the amount of expensive treatment, training expenses may not be shown in 3-NDFL. Line 110 will reflect the maximum deduction amount equal to income minus standard deductions already provided - RUB 333,200.

That is, no matter what option N.T. Lvova chooses to file the declaration, the tax office will return to her only what was transferred from her income during the year - 43,316 rubles.

Example 4

Let's change the condition as follows: Lvova N.T. paid for her education in 2021 in the amount of 80 thousand rubles. and treatment of the husband, which is not expensive, in the amount of 540 thousand rubles. With such input data, the amount of deductions for training and treatment at the same time will be 120 thousand rubles. 3-NDFL can also be filled out in two different ways:

- fully show the expenses for your education, and indicate the expenses for your husband’s treatment in the amount of 40 thousand rubles. (120 thousand – 80 thousand);

- do not show training expenses, but fully declare a deduction for ordinary treatment in the maximum amount of 120 thousand rubles.

The inspection will return Lvova N.T. 15,600 rubles. for 2022.

Example 5

In example 3, we clarified that personal income tax was withheld from Lvova’s salary, taking into account the standard deductions provided. But what about the situation if she were not provided with them at her place of work, i.e., 45,500 rubles were withheld for a year? Is it possible for her to receive several tax deductions at the same time by filing a 3-NDFL declaration at the end of 2022?

Yes, an individual can exercise this right and claim social and standard tax deductions at the same time. You just need to fill out the declaration correctly. Filling out data on standard deductions occurs in section 1 of the same Appendix 5.

During the year, Lvova’s income did not exceed 350 thousand rubles. This means that she is entitled to a standard deduction for her daughter in the amount of 1,400 rubles for all 12 months. Total: 16,800 rub. If the employer did not provide her with these deductions, then line 070 will remain empty, and Lvova will declare the entire amount in line 080 on the declaration.

Lviv tax authorities will return 45,500 rubles.

By the way, this section is also filled out if standard deductions are received from the employer, but then line 070 would have the figure 16800.

How many applications should I submit for two deductions?

When submitting a 3-NDFL declaration to the tax office at the end of the reporting year, an individual will need to fill out only one application for a tax refund. Since 2022, it has been included in the declaration itself, approved by order of the Federal Tax Service dated October 15, 2021 No. ED-7-11 / [email protected] , as Appendix 1 to Section 1. No matter how many deductions a person claims, he will indicate the total amount in the application tax calculated for refund.

NOTE! On one page of the application there are two applications at once: one for a tax offset, the other for a tax refund.

If a person decides to receive deductions from an employer, there may be several applications. A person writes an application for standard deductions either when applying for a job, or when receiving such a right, for example, when a child is born in the middle of the year. For the provision of social and property deductions - upon receipt of a notification from the tax office. That is, these statements could be written at different times. If the right to several deductions arose simultaneously, then one application will be sufficient, which spells out the procedure for their provision.

A ready-made solution from K+ is described on how an employer provides a social deduction for treatment. Get free demo access to the system and read all the most necessary and up-to-date information about personal income tax.

Transfer of deductions for goods, works, services and property rights

The VAT deduction should generally be received during the period in which the right to it arises. It is important to note that the deduction can only be claimed after receiving an invoice from the supplier .

If the invoice was received before the 25th day of the first month of the next quarter (that is, before the deadline established by paragraph 5 of Article 174 of the Tax Code of the Russian Federation for submitting a VAT return), tax deduction can be made in the quarter in which the goods are accepted for accounting. works, services or property rights (Clause 1.1 of Article 172 of the Tax Code of the Russian Federation, Letter dated 02/14/2019 No. 03-07-11/9305). If the invoice is received after the deadline for filing the declaration, VAT can be deducted only during the period of receipt of the invoice, but no later than 3 years from the date of acceptance of the relevant purchase for accounting.

Clause 1.1 art. 172 of the Tax Code of the Russian Federation allows the transfer of this tax deduction subject to general conditions. In paragraph 2 of Art. 171 of the Tax Code of the Russian Federation determines that deductions for goods, works, services, and property rights acquired by a taxpayer in the territory of the Russian Federation can be claimed in tax periods within 3 years after they are registered, but before established by Art. 174 of the Tax Code of the Russian Federation, the deadline for submitting a tax return for the specified tax period.

Transferring a tax refund is not difficult: you need to set aside the invoice (adjustment invoice, AIT), on the basis of which the deduction is granted, and register it in the purchase ledger in the quarter when the company decided to implement the refund. Before this, the document is not registered in the purchase book, and the tax amount is not indicated in the VAT registers and in the declaration.

A deduction for one invoice can be claimed in parts in different periods (letters of the Ministry of Finance of the Russian Federation dated 09/04/2018 No. 03-07-11/63070, dated 01/26/2018 No. 03-07-08/4269).

Results

So, in the article we talked about whether it is possible to receive several deductions at the same time. Yes, this can be done, but you must correctly fill out the 3-NDFL declaration and submit supporting documents to the inspectorate. You can also receive deductions from your employer at the same time. First, the individual at the inspection must receive a special tax notice for property and social deductions and submit it to the place of work. On this basis, the employer will stop withholding tax from the salary, i.e. the employee will receive more money in hand. What is the best thing to do - return personal income tax for the year at once or receive it as part of your salary - each person decides independently. Of course, in the second case, you don’t need to worry about filling out the declaration, but we took this point into account and gave examples of filing deductions in it for various life situations.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service dated October 15, 2021 No. ED-7-11/ [email protected]

- Decree of the Government of Russia dated 04/08/2020 No. 458

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.