About legal entities

Hello, Vasily Zhdanov, in this article we will look at the calculation of liquidity indicators according to RAS. Every

A letter on the application of the simplified tax system for a counterparty is an important part of the business life of an entrepreneur. Thus

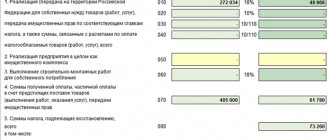

If an organization simultaneously carries out transactions taxable and not subject to VAT, it is obliged to carry out separate

Project “Direct payments to the Social Insurance Fund” in 2020 The pilot project of the Social Insurance Fund has now been introduced

In what situations can the Federal Tax Service request materials under Article 93.1 of the Tax Code of the Russian Federation? Until 04/01/2020

Introduction Today you can easily find on the Internet and even in specialized magazines

March 25, 2022 President of Russia V.V. Putin as part of his address to citizens

HomeCustoms paymentsCustoms VAT Material updated: 01/17/2022 Customs VAT is a payment that is regulated

Legal norms Heads of employing organizations must know what to prepare for during inspections by the State Labor Inspectorate

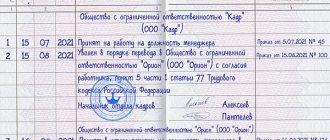

The definition of part-time work is given in Art. 282 Labor Code: this is the employee performing other regular paid work