Introduction

Today, on the Internet and even in specialized magazines, you can easily find information on how to prepare a VAT Declaration in the 1C: Accounting 8, edition 3.0 program. Also, many resources have published articles about the organization of VAT accounting in this program and about the existing VAT accounting checks in the program and ways to find errors.

Therefore, in this article we will not once again describe in detail the principles of organizing VAT accounting in 1C: Accounting 8; we will only recall the main points:

- For VAT accounting, the program uses internal tables, which in 1C terms are called “Accumulation Registers”. These tables contain much more information than in the postings on account 19, which allows you to reflect in the program

- When posting documents, the program first performs movements in the registers, and based on the registers it generates postings for accounts 19 and 68.02;

- VAT reporting is generated ONLY according to register data. Therefore, if the user enters any manual entries into VAT accounts without reflecting them in the registers, these adjustments will not be reflected in the reporting.

- To check the correctness of VAT accounting (including the correspondence of data in registers and transactions), there are built-in reports - Express check of accounting, VAT accounting analysis.

However, the average accountant user is much more accustomed to working with “standard” accounting reports - Balance Sheet, Account Analysis. Therefore, it is natural that the accountant wants to compare the data in these reports with the data in the Declaration - in other words, check the VAT Declaration for turnover. And if the organization has simple VAT accounting - there is no separate accounting, no import/export, then the task of reconciling the Declaration with accounting is quite simple. But if some more complex situations arise in VAT accounting, users already have problems comparing data in accounting and data in the Declaration.

This article is intended to help accountants perform a “self-check” of filling out the VAT Return in the program. Thanks to this article, users will be able to:

- independently check the correctness of filling out the VAT Declaration and compliance of the data in it with accounting data;

- identify places where the data in the program registers diverges from the data in accounting.

Initial data

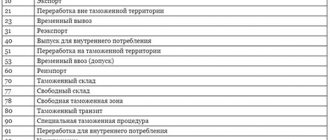

So, for example, let’s take an organization that is engaged in wholesale trade. The organization purchases goods both on the domestic market and through import. Goods can be sold at rates of 18% and 0%. At the same time, the organization maintains separate VAT accounting.

In the first quarter of 2022, the following transactions were recorded:

- Advances were issued to suppliers, invoices for advances were generated;

- Received advances from customers, generated invoices for advances;

- Goods were purchased for activities subject to 18% VAT;

- Goods were purchased for activities subject to 0% VAT;

- Imported goods were purchased, customs VAT was registered;

- Input VAT has been registered for the services of third-party organizations, which should be distributed to operations at 18% and 0%;

- A fixed asset was purchased at a VAT rate of 18%, the tax amount must be distributed among operations at different VAT rates;

- Goods were sold at a VAT rate of 18%;

- Goods were sold for activities subject to 0% VAT;

- Some of the goods on which VAT at a rate of 18% was previously accepted for deduction were sold at a rate of 0% - the restoration of VAT accepted for deduction is reflected;

- The shipment without transfer of ownership and then the sale of the shipped goods are reflected;

- Confirmed 0% rate for sales;

- Regular VAT operations were completed - sales and purchase book entries were generated, VAT was distributed for transactions at 18% and 0%, purchase book entries were prepared for the 0% rate.

An example of filling out line 070 in the VAT return in section No. 3

Limited Liability Company "OknaPlast" is engaged in wholesale supplies of plastic windows according to customer orders. Contracts are concluded with the buyer only upon provision of an advance payment in the amount of 10% to 30% of the contractual delivery amount.

In the second quarter of 2022, OknaPlast LLC:

- We sold goods in the amount of 29,688,800 rubles. (including VAT = RUB 4,528,800);

- An advance payment was received in the amount of RUB 14,903,400. (VAT = 14,903,400 rubles × 18 / 118 = 2,273,400 rubles);

- Purchases from a supplier of plastic and other components in the amount of RUB 10,055,960, including VAT = RUB 1,533,960.

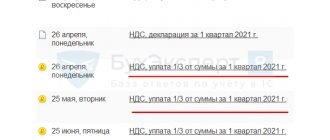

Therefore, in the second quarter:

- accrued VAT amounted to RUB 6,802,200. (RUB 4,528,800 + RUB 2,273,400);

- VAT deductible: RUB 1,533,960;

- VAT payable: RUB 6,802,200. – 1,533,960 rub. = 5,268,240 rub.

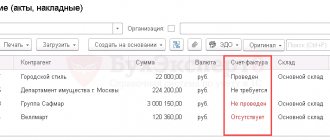

1.Verified data

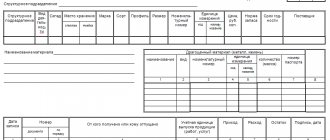

After completing all regulatory VAT operations, the VAT Declaration is completed with us as follows:

Lines 010-100:

Lines 120-210:

Let's start checking the Declaration.

How to submit a VAT return

The VAT return is submitted electronically; for this, the taxpayer must register in the system for providing tax and accounting information. After which the taxpayer will be provided with an electronic signature, with which he will be able to sign documents and send them to the tax office.

The date of reporting is considered to be the date of dispatch, where the taxpayer receives a response about the fact of its acceptance. After a desk audit, the taxpayer receives an acceptance response in the form of a receipt for acceptance of the reporting or a refusal to accept the reporting in the form of a notice of refusal. If there was a refusal, then it is necessary to adjust the previously sent declaration and send it to the tax office again.

Important!!! If, when sending reports, there are technical failures in the system or operator service, then there is no reason for the accountant to send reports untimely, but this will need to be proven.

Filing reports on paper is permitted only to tax agents who are not VAT payers or are exempt from paying it.

2.Check Section 4

To begin with, since we had sales at a 0% rate, let’s check the completion of Section 4 of the Declaration:

To do this, you need to compare the data in Section 4 with the turnover on account 19 according to the VAT accounting method “Blocked until confirmed 0%” in correspondence with account 68.02. To do this, we will generate an “Account Analysis” report for account 19, setting it to select by accounting method:

The credit turnover on account 68.02 in this report shows us the total amount of tax that “fell” on confirmed sales at a rate of 0%. This amount must coincide with line 120 of Section 4 of the VAT Declaration .

3.Check Section 3

Next, we check Section 3 of the Declaration. The main report that we will use when checking Section 3 of the Declaration is Analysis of Account 68.02. For the 1st quarter of 2022, the report looks like this:

- Line 010

This line shows the amounts from the sale of goods, works, services at a rate of 18% and the amount of tax calculated from such transactions. Therefore, the amount of tax on this line must correspond to the amount of credit turnover on account 68.02 in correspondence with accounts 90.03 and 76.OT (shipments without transfer of ownership):

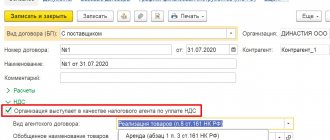

- Line 70

Line 070 indicates the amount of VAT on advances received from customers in the reporting period. Therefore, to check this amount it is necessary to look at the credit turnover on account 68.02 in correspondence with account 76.AB :

- Line 080

The line should reflect the VAT amounts subject to recovery for various transactions. This line includes the amount of VAT on advances to suppliers credited in the reporting period, as well as the amount of VAT recovered when changing the purpose of use of valuables.

VAT on advances to suppliers is accounted for in account 76.VA, so we check the amount of credited VAT against the credit turnover of account 68.02 in correspondence with account 76.VA. The amounts of restored VAT are reflected in accounting as credit turnover on account 68.02 in correspondence with subaccounts of account 19 :

- Line 090

This line is a clarification to line 080 - the amounts of VAT on advances to suppliers credited in the reporting period are shown separately here:

- Line 120

How to check line 120 of the VAT return if the organization maintains separate accounting for VAT? The line must reflect the amount of tax on purchased goods, works, services, which is subject to deduction in the reporting period. Therefore, to check the value of this line, it is necessary to subtract the turnover on the debit of account 68.02 in correspondence with accounts 19.01, 19.02, 19.03, 19.04, 19.07 the turnover on account 19 using the VAT accounting method “Blocked until confirmation of 0%” in correspondence with account 68.02 (amount , specified in line 120 of Section 4 of the Declaration).

- Line 130

The line indicates the amount of VAT on advances issued to suppliers in the reporting period. We check the amounts of accrued VAT using the debit turnover of account 68.02 in correspondence with account 76.VA :

- Line 150

Line 150 indicates the amount of VAT paid at customs when importing goods. The value in this line must match the debit turnover on account 68.02 in correspondence with account 19.05 :

- Line 160

The line is filled in with the amounts of VAT that our organization paid when importing goods from the countries of the Customs Union. This line is checked against the debit turnover of account 68.02 in correspondence with account 19.10 :

- Line 170

And finally, line 170 is filled in with VAT amounts on buyer advances received during the reporting period. This value is reflected in accounting as a debit turnover on account 68.02 in correspondence with account 76.AB :

4.Results of the inspection

If we put together all the checks for Section 3 and reflect them in the “Account Analysis” report for account 68.02, we will get this “coloring”:

Based on the results of the audit, we see that all the amounts reflected in the accounting “found” their place in the VAT Declaration. And each line from the Declaration, in turn, can be deciphered by us from the position of reflecting the data in accounting. Thus, we are convinced that all operations in the program are reflected correctly, without errors, the data in the registers and transactions match and, therefore, our VAT reporting is correct and reliable.

What are the penalties for submitting a VAT return on time?

If an enterprise or individual entrepreneur for some reason does not submit a VAT return on time, then he faces penalties, which amount to:

- 1000 rubles – if the tax has been paid or the amount according to the declaration is zero;

- If the tax has not been paid, then 5% of the amount indicated in the declaration for each month of delay, but not more than 30% and not less than 1000 rubles.

Important!!! An error in the VAT return format is not punishable by a fine. In the Resolution of the Arbitration Court of the North Caucasus District dated December 2, 2016 No. F08-9002/2016, the judges noted that clause 1 of Art. 119 of the Tax Code of the Russian Federation provides for a fine for failure to submit a declaration as such. Violation of the declaration format does not fall under this rule.