According to legal requirements, a business entity must annually conduct an inventory of property and financial obligations. In the complex of inventory activities, the inventory of settlements with accountable persons, at whose disposal funds were issued for targeted spending during the financial year, is one of the most important areas.

Frequency of inventory of settlements with accountable persons

An inventory, the object of which is settlements with accountable persons, should be carried out at least once a year, during preparation for the final annual balance sheet.

What documents are checked when conducting an inventory of settlements with accountable persons (Order of the Ministry of Finance dated June 13, 1995 No. 49):

- For each accountable person, it is necessary to check the amounts of money that were issued to account for advances. Study the terms of provision and intended purpose.

- all reports on the basis of which those who received the money for reporting indicated the directions of their use.

Inventory of calculations: concept and goals

Annual inventory of payments - internal audit of property, assets, reports on accountable payments, and other financial and economic transactions.

The purpose of such verification is:

- checking the compliance of actual data with accounting data;

- identification of cases of violation of the documentation of financial and economic transactions, including the preparation and timely submission of reports on issued imprest amounts;

- verification and confirmation of the use of advances issued for specific needs, in accordance with their intended purpose.

The procedure for organizing an inventory of settlements with accountable persons

Before the verification of settlements with accountable persons approved by the inventory commission begins, members of the commission receive, as of the current moment, the latest receipts and expenditure documents, reports on the flow of cash and material assets. At the same time, employees who are responsible for the availability and correct execution of these documents write receipts, the contents of which indicate that by the time the inventory is carried out, all documents on the receipt and issue of property have been transferred to the accounting service.

Receipts of similar content are also drawn up by those employees who have amounts issued on account for the acquisition of property.

The employee who is responsible for the documents used to document the issuance and receipt of funds under the report must be present during the inspection of the inventory commission. In the absence of a responsible employee, the commission works without him. This circumstance does not affect the inventory results. At the same time, the absence of one of the members of the inventory commission during the inventory does not provide grounds for recognizing the results of the inspection as competent.

One of the tasks of the members of the inventory commission is to establish for the employee or the enterprise the debt for the amounts of money that were issued on account. The inventory commission also checks the availability of documents that confirm the expenses of the funds issued and the timing of the issuance of money for reporting to the employees of the enterprise.

What responsibilities are assigned to members of the inventory commission when conducting an inventory of settlements with accountable persons:

- checking the use of advance payments for the intended purpose of their issuance;

- comparison of information reflected in accounting registers with data that contains primary documents on advance payments;

- determination of funds issued on account for which the responsible employee did not provide the required advance report.

Inventory with accountable persons sample inv 24 form and sample

The form of this document is approved in the company's accounting policy. Attention should be paid to the requirements that are established regarding the conduct of control checks by the methodological instructions for inventory (order of the Ministry of Finance of Russia dated June 13, 1995 No. 49). According to paragraph 2.

14 of these instructions, control checks must be carried out before the opening of the facility (warehouse, store, section, storeroom, etc.) where the inventory was carried out.

This rule was established in order to prevent the emergence of new valuables or the removal of valuables verified by the inventory commission, which may lead to the impossibility of verifying the accuracy of the inventory results.

Another rule, provided for in the same paragraph, requires control activities to be carried out with the participation of persons who are financially responsible for the safety of valuables and members of the inventory commission.

Important

Such divisions may be, for example, warehouses where products or other inventory items are stored. The corresponding procedure is carried out upon completion of the inventory.

The same company employees who are part of the inventory commissions take part in it. In addition, materially responsible persons responsible for the safety of inventoried resources participate in control. Control checks should be carried out before the division of the organization in which the inventory was carried out (for example, a warehouse or section) is reopened for work (clause 2.15 of the order of the Ministry of Finance of the Russian Federation “On guidelines for inventory” dated June 13, 1995 No. 49) .

Form inv-24 (form and sample)

Taking into account this purpose, the official form of the inspection report provides for the reflection of the following information:

- name of the company and if there is a structural unit in which the inventory was carried out;

- about inventory (information about commission members, timing of inventory);

- about the person who conducts the control check (position, full name);

- on the presence of valuables according to the inventory list and during a control check (the name, quantity, and amount of valuables are indicated);

- the final test results with a “+” or “-” sign when discrepancies are identified.

Act INV-24 is signed by members of the inventory commission and the person conducting the control check. If the company decides not to use the official form, then it will need to develop its own document to complete the control checks.

Inventory report of receivables and payables (sample)

They are mainly related to the fact that accounting in the budget has its own Chart of Accounts, as well as to the strict limitation of travel expenses. Accounting for accountable amounts in the budget is regulated by clauses 212-219 of Order of the Ministry of Finance No. 157n and is maintained in account 20800.

A large number of analytical accounts are opened for it in accordance with clauses 103-106 of Order of the Ministry of Finance of the Russian Federation No. 174n.

Today, in budgetary institutions, the issuance of money for reporting occurs only on the basis of an application from an employee by order of the head of the enterprise and only upon full repayment of the previous advance.

Attention

Restrictions on the level of expenses for business trips are established by Decree of the Government of the Russian Federation 729. Their size is quite low. Thus, the daily allowance is 100 rubles, and the cost of renting housing is reimbursed in the amount of no more than 550 rubles.

to the knocks.

Inventory of settlements with accountable persons (inv-17 form) 71st account

Form INV-1.

Inventory list of fixed assets This form of inventory list is formed based on the results of the inventory of the materially responsible persons of the organization for compliance of the actual availability and declared characteristics of fixed assets with accounting data. The inventory list is drawn up in two copies and signed by members of the commission and materially responsible persons separately for each storage location.

Inventory inventory of intangible assets This form of inventory is formed based on the results of an inventory of materially responsible persons of the organization to ensure that the actual availability of intangible assets corresponds to accounting data.

Inventory report - sample 2022

Add to favoritesSend by email INV-24 is a unified document used in the process of control verification of inventory results. In this article we will understand what the specifics of the form are and what are the features of its design.

What is INV-24 used for? What are the features of the structure and completion of the document? Where can I download INV-24? Results: What is INV-24 used for? According to the INV-24 form, introduced into business circulation by the Decree of the State Statistics Committee of August 18.

1998 No. 88, an act is drawn up reflecting the results of a control check of the results of the inventory of certain valuables.

A control check based on the fact of inventory is a procedure that is extremely important for enterprises that have divisions in which the turnover of goods and valuables is carried out, presented in a large assortment and in significant volumes.

Inventory

A bank’s refusal to carry out a transaction can be appealed. The Bank of Russia has developed requirements for an application that a bank client (organization, individual entrepreneur, individual) can send to an interdepartmental commission in the event that the bank refuses to make a payment or enter into a bank account (deposit) agreement.

Form INV-24, a sample of which you will find below, is one of the unified forms approved by the State Statistics Committee (Resolution No. 88 of 08/18/98).

How to make settlements with accountable persons

Relevant reports are drawn up for unusable or damaged materials and finished products identified during inventory. Form INV-3. Instructions for filling out the INV-10 form.

Inventory report of unfinished repairs of fixed assets This form of act is formed based on the results of the inventory of unfinished repairs of fixed assets (buildings, structures, machinery, equipment, etc.) for compliance with actual costs and accounting data.

The inventory report is drawn up in two copies and signed by members of the commission and materially responsible persons. One copy is transferred to the accounting department, the other - to financially responsible persons. Form INV-10. Instructions for filling out the INV-11 form.

"management and optimization of a production enterprise"

Inventory act of settlements with buyers, suppliers and other debtors and creditors This form of act is formed based on the results of an inventory of settlements with buyers, suppliers and other debtors and creditors for compliance with actual receivables and payables, confirmed by primary accounting documents, and accounting data. The inventory report is drawn up in two copies and signed by the members of the commission. One copy is transferred to the accounting department, the other remains with the commission. Form INV-17. Instructions for filling out the INV-18 form. Comparison statement of the results of the inventory of fixed assets This form of comparison statement is formed to reflect the results of the inventory of fixed assets and intangible assets for which deviations from accounting data were identified.

403 forbidden

Inventory report of deferred expenses This form of act is formed based on the results of an inventory of deferred expenses to ensure compliance of actual costs, confirmed by primary accounting documents, with accounting data. The inventory report is drawn up in two copies and signed by the responsible members of the commission.

One copy is transferred to the accounting department, the other remains with the commission. Form INV-11. Instructions for filling out the INV-15 form. Cash Inventory Act This form of act is formed based on the results of an inventory of the organization's cash register to ensure compliance with the actual availability of cash, stamps, checkbooks, etc.

with accounting data.

Source: //lcbg.ru/inventarizatsiya-s-podotchetnymi-litsami-obrazets-inv-24-blank-i-obrazets/

What documents relate to local acts that require verification?

- a list of responsible employees who are authorized to receive funds on account;

- a list of employees of the management team of the enterprise who have the power of attorney to give instructions to employees regarding the intended use of advance funds, and to an employee of the accounting service or the cashier of the enterprise - instructions regarding the issuance of amounts of money for reporting.

Expense reports should be checked for:

- compliance of the use of funds with the intended purpose;

- compliance of the deadlines for drawing up the advance report with the deadline for returning the remaining funds;

Important ! The head of the organization closes and approves expense reports.

Verification Prerequisites

One of the prerequisites for conducting an inventory of expense reports is the basis for issuing funds against the report to an employee who has submitted a written statement indicating the purpose and need for a specific amount. More details in Art. Clause 6.3 of Bank of the Russian Federation Instructions No. 3210. The accountable person must return unspent funds to the cash desk by filling out the appropriate form for depositing the accountable amount.

Next, the owner of the enterprise draws up a local act and indicates there the deadline for approval of the advance report by the accounting department. This act must be included in the list of papers for the inventory of accountable persons.

What documents are compiled based on the results of the inventory?

The results of the inventory of settlements with accountable persons are recorded in the Act with the same name of the unified form No. INV-17. The final act is prepared in 2 copies, each of which is signed by members of the inventory commission.

Together with the act, a certificate is prepared, which is the basis for drawing up the act itself in the context of synthetic accounts. This certificate is usually compiled in only one copy.

The help contains the following information:

– the amount of established debt on the part of the accountable person;

– the reason and date when the debt was formed in settlements with accountable persons;

– employee (full name, position) – accountable person.

What must be indicated in the final act:

- accounting account numbers where the debt is reflected;

- accountable person;

- amounts of debts for which the statute of limitations had expired at the time of the inspection;

- the amount of debts that were or were not agreed upon with the persons who received funds on account.

Recommendations . If for some reason a member of the inventory commission is absent, it is necessary to appoint a replacement for him by order of the head of the enterprise.

Violations that were identified during the inventory will need to be eliminated, and those identified will be brought to justice.

Important! Particular attention should be paid to identifying amounts for which the advance report was not received within the prescribed period. The need for this is due to the fact that in the future there will be no additional personal income tax assessments during the next check by tax officials on advance amounts issued.

Something to remember! Tax inspectors can charge additional personal income tax on amounts issued for reporting purposes that were not used for their intended purpose.

Options for returning missing funds issued on account

If, based on the results of the work of the inventory commission, a person was identified as guilty of the unjustified failure to return funds issued on account, then the missing amount can be withheld from the salary of the guilty employee. The employer has the right to do this. But there are certain conditions for keeping it. Firstly, deductions from wages can be made no later than one month from the end of the advance payment period. Secondly, the employee, for his part, agrees with the accusation and the amount of deductions.

If the employer misses the monthly deadline, then you can give the employee the opportunity to return the missing funds on a voluntary basis, or transfer the documents to the judicial authorities. There is another option that applies to debt amounts; it is that after the expiration of the statute of limitations, this amount is recognized as a bad debt. When an employee is dismissed, his debt to the organization may also be considered uncollectible.

The most common types of violations in the procedure for issuing funds on account

- Registration of expenses of employees on a business trip.

- Failure to comply with the requirements for issuing funds on account.

- Failure to comply with the requirements for withholding personal income tax on amounts of money that exceed the established norms for business trip expenses.

- Failure to comply with the requirements for accounting for amounts allocated for entertainment expenses of the organization.

- Failure to comply with the requirements when paying for work performed and materials purchased by accountable persons.

- Failure to comply with the requirements of the procedure for organizing and maintaining synthetic records of settlements with persons who received funds under the report.

Example. At Wind of Change LLC, the chief accountant decided to conduct an inventory of settlements with accountable persons before closing the annual balance sheet.

Based on the results of the inventory, it was revealed that one of the employees, S.S. Kovalev, who was given an amount of 2,500 rubles for the purchase of office supplies for the report, had an amount of 250 rubles left, which he did not return to the accounting department. In accounting, a similar situation is reflected by the following entries:

Dt 94 Accounts Kt 71 Accounts – 250 rub. (later, for violation of cash discipline, this amount of money will need to be withheld from S.S. Kovalev’s salary.

Accounting

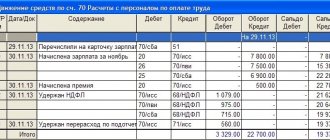

Accounting for mutual settlements with accountable persons is carried out, according to the Chart of Accounts, on account 71 “Settlements with accountable persons”.

Settlements with accountable persons: postings

| Contents of operation | Debit | Credit |

| Amounts issued for reporting | 71 | 50, 51 |

| Expenses are reflected according to the submitted advance report, depending on the specifics | 08, 10, 20, 25, 26, 44, 60, 91 | 71 |

| Unspent sub-report returned | 50, 51 | 71 |

| A report not returned on time was attributed to shortages | 94 | 71 |

| Debt is written off from wages with the consent of the employee | 70 | 94 |

| The debt on the sub-account is reflected, for which it is impossible to repay at the expense of wages | 73 | 94 |

| Accountable debt collected by court decision | 50, 51 | 73 |