In what situations can the Federal Tax Service request materials under Article 93.1 of the Tax Code of the Russian Federation?

Until April 1, 2020, the article in question allowed tax authorities to request documents from a company or individual entrepreneur in two cases:

- as part of tax audits of their counterparties (clause 1 of Article 93.1 of the Tax Code of the Russian Federation) - desk or field;

- outside the scope of inspections - if there is a motivated need to obtain information or documentation about a specific transaction (Clause 2 of Article 93.1 of the Tax Code of the Russian Federation).

Thus, inspectors could request documents and information materials on the activities of the taxpayer being inspected from the counterparty or from other persons who possess them when assigning additional control procedures during the consideration of tax audit materials. Outside the framework of tax audits, inspectors had the right to request documents (information) on a certain transaction from the parties to it or from other persons who possess them, only if there is really a justified need for this.

From 04/01/2020, the powers of controllers under Art. 93.1 of the Tax Code of the Russian Federation has been expanded: they have received the right to request documents and information as part of the procedure for collecting large tax arrears.

For information on how an on-site audit is carried out, read the material “Procedure for conducting an on-site tax audit (nuances)” .

It is noteworthy that initially it was only possible to request information outside of tax audits, but not documents. Thanks to this, we had the legal opportunity to respond to tax requirements in a slightly abbreviated version - after all, the concepts of “information” and “documents” are not defined by the legislator as equivalent, and this fact was recognized by many courts.

However, the law “On Amendments to Certain Legislative Acts of the Russian Federation...” dated June 28, 2014 No. 134-FZ changed the situation, and now clause 2 of Art. 93.1 of the Tax Code of the Russian Federation completely legally allows tax authorities to demand everything - both information information and documents. Ignoring the fulfillment of this obligation by the taxpayer may result in the collection of penalties for him, and liability arises under clause 2 of Art. 126 or under Art. 129.1 Tax Code of the Russian Federation.

ConsultantPlus experts explained whether tax authorities can request documents outside the framework of tax audits. Get trial access to the system and upgrade to the ready-made solution for free.

How is a request made under Article 93.1 of the Tax Code of the Russian Federation?

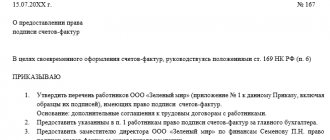

In order for inspectors to have the right to demand documents from a taxpayer as part of a meeting, the order to obtain documents and the requirement to provide documents must comply with all the standards established by tax legislation.

When requesting documentation from counterparties or other persons, tax authorities are guided by:

- Tax Code of the Russian Federation (clauses 3–4 of Article 93.1);

- by order of the Federal Tax Service of Russia dated November 7, 2018 No. ММВ-7-2/ [email protected] ;

- letter of the Federal Tax Service of Russia “On recommendations for carrying out tax control measures related to tax audits” dated July 17, 2013 No. AS-4-2/12837.

These regulations establish the following rules for requesting documentation:

- The tax authority (let's assign it No. 1), which carries out control procedures in relation to the taxpayer, is allowed to request documents from its counterparty not independently, but only through the tax authority with which this counterparty is registered (let's call this inspection No. 2). True, there is one exception - when the counterparty and the taxpayer being audited are registered with the same inspectorate.

Tax authority No. 1 must send a special order to tax authority No. 2 to request documents (information).

- The order must contain:

- date and place of compilation;

- names of two tax authorities - No. 1 and No. 2;

- name of the taxpayer (let's call him “K” - counterparty) from whom you need to request documentation: his name (for individuals - last name, first name, patronymic); TIN, checkpoint, location (or place of residence);

- lists of required documents and information information, and their individualizing characteristics must be indicated;

- data about the transaction that allows it to be identified;

- name of the person in respect of whom the inspection is being carried out;

- the name of the control procedure within which the need arose to request documents and information;

- signature of the head of the tax authority (or his deputy) indicating the rank;

- stamp of the tax authority.

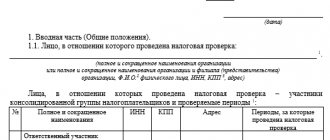

Having received the order, tax authority No. 2, within 5 working days, is obliged to send a request for the provision of documents (information) to person “K”, who is registered with him. To this requirement, tax authority No. 2 is obliged to attach a copy of the order to request documents issued by authority No. 1. The request must contain the same list of information as the order.

Let's note a few important nuances:

- According to Art. 93.1 of the Tax Code of the Russian Federation, tax authorities do not have the right to demand from “K” documentation that he had already provided earlier as part of verification activities (letter of the Ministry of Finance of the Russian Federation dated February 11, 2015 No. 03-02-07/1/5991).

- Even if the number of documents requested from “K” is huge, and significant sums are spent on sending and copying them, it will not be possible to reimburse these expenses. This follows from the letter of the Ministry of Finance of the Russian Federation dated May 10, 2012 No. 03-02-07/1-116.

- 5 days are given to fulfill the requirement. If too many documents are requested, you can send a request to the tax authority to extend the deadline for responding to the request. But it is worth considering that this possibility is enshrined in Art. 93.1 of the Tax Code of the Russian Federation as the right of the tax authority, and not as its obligation.

In what form to submit a notification about the impossibility of submitting documents (information) on time, find out from the publication.

What documents can tax authorities request from you under Art. 93.1 Tax code outside the scope of inspections

The topic of the legality of sending requests for the provision of documents (information) by the tax authority outside the framework of tax audits, regulated by clause 2 of Art. 93.1 of the Tax Code of the Russian Federation is widely represented in the literature and judicial practice.

This is due to the current reduction in on-site tax audits with the increasing role of tax administration, including through the implementation of such a form of tax control as confirmation of the validity of contractual relations, the reliability of the information contained in them, by requesting information (documents) from persons who have the relevant documents (information) (paragraph 2, paragraph 1, article 82 of the Tax Code of the Russian Federation, Resolution of the Arbitration Court of the Moscow District dated November 27, 2018 in case No. A40-39237/2018, Letter of the Federal Tax Service of the Russian Federation dated October 14, 2019 No. SA-4-7/21065 “ On the direction of the review of legal positions reflected in judicial acts of the Constitutional Court of the Russian Federation and the Supreme Court of the Russian Federation, adopted in the third quarter of 2022 on taxation issues”).

Despite the significant amount of materials, when business entities receive the relevant requirements and when preparing responses, questions often arise regarding the legality of submitting certain documents, since the Tax Code of the Russian Federation does not establish clear criteria for the types of documents (information) required.

Judicial practice proceeds from the fact that information is a broader concept than a document; information includes any information regardless of the form of its presentation, and a document is a material object with information recorded on it, including in the form of text. In this regard, information can be obtained, including by submitting documents that are its source (Resolution of the Fourth Arbitration Court of Appeal dated November 28, 2013 in case No. A19-11124/2013).

Letter of the Federal Tax Service of Russia dated June 27, 2017 No. ED-4-2/ [email protected] “On the demand for documents (information) outside the framework of tax audits” prohibits the arbitrary demand for documents (information) outside the framework of tax audits that are not determined by the goals and objectives of the tax audit tax control authorities, since when deciding on the issue of requesting documents (information) outside the framework of tax audits, it is necessary to proceed from the principles of expediency, reasonableness and validity.

Consequently, taking into account the lack of a list of required documents established at the legislative level and in the documents of the Ministry of Finance of the Russian Federation (Federal Tax Service of the Russian Federation), the tax authority requires from persons who have them almost any documents (information) it needs, in addition, documents (information) under clause 2 of Art. .

93.1 of the Tax Code of the Russian Federation, tax authorities are also requested from servicing Banks, since “receipt of the specified documents (documents on opening accounts, persons authorized to sign settlement documents) is due to objective necessity, since these documents can be used as comparative samples of signatures of authorized persons of the taxpayer’s counterparty in if, during a tax audit, the need arises to appoint a handwriting examination” (Resolution of the Arbitration Court of the Ural District dated September 17, 2018 in case No. A60-62503/2017). At the same time, the courts do not accept the references of banks to the presence of secrets protected by law, due to the fact that “the imposition of special responsibilities by the Tax Code of the Russian Federation on banks in connection with their special status in the non-cash payment system does not exempt these organizations from performing other duties that are provided for by the Tax Code of the Russian Federation for all organizations (Resolution of the Arbitration Court of the Ural District dated May 28, 2018 in case No. A60-47589/2017).

The list of documents given in this article is a generalization of both judicial practice materials and relevant requirements received by business entities and is not exhaustive:

| Name of documents (information) | The legality of the request for documents by the tax authority is confirmed by materials of judicial practice |

| Business correspondence | Resolution of the Arbitration Court of the West Siberian District dated May 21, 2019 in case No. A70-9661/2018 |

| Contracts, additional agreements | Resolution of the Arbitration Court of the North-Western District dated May 28, 2018 in case No. A42-7751/2017 |

| Specifications, applications for the supply of goods, | Resolution of the Arbitration Court of the Ural District dated 04/05/2018 in case No. A50-23230/2017 |

| Invoices, invoices | |

| Journal of accounting of received and issued invoices, journal-order No. 01 | Resolution of the Seventeenth Arbitration Court of Appeal dated February 28, 2019 in case No. A71-14251/2018 |

| Explanation of accounts (indicators) | These documents were requested within the framework of specific requirements |

| Money orders | Resolution of the Eighth Arbitration Court of Appeal dated November 12, 2018 in case No. A70-8627/2018 |

| Acts on offset of mutual claims | Resolution of the Seventeenth Arbitration Court of Appeal dated November 15, 2018 in case No. A60-35586/2018 |

| Acts of reconciliation of calculations | Resolution of the Arbitration Court of the East Siberian District dated July 28, 2017 in case No. A19-22283/2016 |

| Work (service) acceptance certificates | Resolution of the First Arbitration Court of Appeal dated March 22, 2019 in case No. A38-8770/2018 |

| Cost information | These documents were requested within the framework of specific requirements |

| Certificates of completed work | Ruling of the Supreme Court of the Russian Federation dated October 26, 2017 No. 302-KG17-15714 in case No. A19-22283/2016 |

| Summary estimate | |

| Cash flow statements | Resolution of the Seventh Arbitration Court of Appeal dated August 23, 2017 in case No. A27-4903/2017 |

| Interest calculation | |

| Consignment notes, waybills | Resolution of the Eighth Arbitration Court of Appeal dated August 21, 2019 in case No. A46-4917/2019 |

| Universal transfer documents | — |

| Waybills | Resolution of the Arbitration Court of the Ural District dated August 1, 2018 in case No. A76-34609/2017 |

| Book of purchases | Resolution of the Arbitration Court of the East Siberian District dated July 28, 2017 in case No. A19-22283/2016 |

| Sales book | |

| Sales (cash) receipts | Resolution of the Fourteenth Arbitration Court of Appeal dated October 17, 2017 in case No. A66-2724/2017 |

| Outgoing and incoming cash orders | Resolution of the Seventeenth Arbitration Court of Appeal dated April 16, 2015 in case No. A50-24114/2014 |

| Turnover balance sheets | Resolution of the Eleventh Arbitration Court of Appeal dated September 18, 2018 in case No. A55-3967/2018 |

| Statements of analytical accounting for accounts | Resolution of the Arbitration Court of the Ural District dated August 1, 2018 in case No. A76-34609/2017 |

| Account cards | |

| Certificates of conformity, technical data sheets | These documents were requested within the framework of specific requirements |

| Powers of attorney | Resolution of the First Arbitration Court of Appeal dated March 22, 2019 in case No. A38-8770/2018 |

| Registers of owners of securities issued by a joint stock company for the period | Resolution of the Arbitration Court of the Moscow District dated 08/04/2016 in case No. A40-205181/2015 |

| Full name, position, telephone numbers of employees whose responsibilities include searching for counterparties and conducting negotiations | Resolution of the Arbitration Court of the Ural District dated 04/05/2018 in case No. A50-23230/2017 |

| Full name, telephone numbers of the employees who delivered the goods, names and registration numbers of vehicles, information about routes (loading and unloading points) | Resolution of the Arbitration Court of the Central District dated January 25, 2017 in case No. A09-6454/2016 |

| Information about the availability of vehicles owned or leased | |

| Copies of employment contracts with additions and changes for the period, job descriptions, orders of appointment and orders for sending an employee on a business trip outside the Russian Federation for the period, documents evidencing being on a business trip outside the Russian Federation. | Resolution of the Arbitration Court of the North-Western District dated January 15, 2018 in case No. A56-22139/2017 |

| The following documents (information) were requested by the tax authority from the servicing Banks | |

| Bank account agreement | Resolution of the Arbitration Court of the North-Western District dated April 16, 2018 in case No. A42-3918/2017 |

| Application for opening a bank account | |

| Signing Key Certificates | |

| Cards with sample signatures and seal impressions | |

| Announcement for cash payment | |

| Information about the Bank’s use of Internet technologies - IP addresses from which the client sent payment orders, MAC and EXTIP addresses for accessing the Bank Client system, information about the telephone number used by the client to connect to the Bank Client system » | Resolution of the Arbitration Court of the North Caucasus District dated July 16, 2018 in case No. A25-2985/2017 |

| Acts of acceptance and transfer of client software and cryptographic tools | |

| Client connection protocol | |

| Information about persons who have the right to dispose of funds and about individuals withdrawing (cashing out) funds from current accounts | |

| Order on hiring an employee in relation to the manager and persons having the rights to sign on a card with sample signatures and a seal imprint | Resolution of the Arbitration Court of the Central District dated November 8, 2018 in case No. A14-23645/2017 |

| Electronic key registration cards, powers of attorney, applications for production and receipt of electronic digital signature keys | |

| Powers of attorney for persons representing the client at the bank | |

Thus, despite the open list of documents that may be requested by the tax authority, in each specific case it is necessary to check the legality, feasibility, reasonableness and validity of the request for documents (information).

The content of the request for the provision of documents (information) must be specific, eliminating the possibility of ambiguous interpretation in the absence of an excessive number of requested documents.

In the following judicial acts, the courts adopted the position of the persons from whom documents (information) were requested:

| Grounds for refusal by a person who has received a request to provide documents (information) to the tax authority | The legality of the refusal to provide documents (information) by the recipient of the request to the tax authority, confirmed by materials of judicial practice and/or clarifications of the Federal Tax Service |

| The requirement does not contain information regarding the correct calculation and payment of taxes by the taxpayer | Resolution of the Arbitration Court of the Ural District dated October 18, 2018 in case No. A47-14049/2017 |

| The tax authority has requested analytical certificates and reports | Resolution of the Ninth Arbitration Court of Appeal dated June 22, 2017 in case No. A40-247282/16, paragraph 4 of the Letter of the Federal Tax Service of the Russian Federation dated September 13, 2012 No. AS-4-2/ [email protected] “On tax audits” |

| The grounds for requesting documents were not specified (it did not follow from the request sent by the tax authority that the documents were being requested by it as part of a tax audit) | Resolution of the Arbitration Court of the Volga-Vyatka District dated 09/19/2018 in case No. A17-9516/2017, Resolution of the Arbitration Court of the West Siberian District dated 06/13/2017 in case No. A27-12323/2016 |

| It is not possible to identify the documents (information) that must be presented to the tax authority by the person | Resolution of the Arbitration Court of the East Siberian District dated February 21, 2018 in case No. A19-5080/2017 |

| The list of documents is non-specific and general in nature, from which it is impossible to determine in what quantity and what was directly requested by the tax authority. The request does not contain the names and details of the requested documents, the composition of “received and issued invoices”, “contracts”, “acts of completed work”, “waybills” is not deciphered; “contracts for the supply of imported goods”, “cargo customs declarations”, “payment documents”. | Resolution of the Eleventh Arbitration Court of Appeal dated March 10, 2009 in case No. A55-17265/2008 |

| The documents were requested not for a specific transaction, but for all transactions with the counterparty for three years | Resolution of the Arbitration Court of the Central District dated April 24, 2017 in case No. A14-14883/2015 |

| The identifying characteristics of the specific transaction in respect of which information is requested are not indicated | Resolution of the Arbitration Court of the West Siberian District dated 02/03/2017 in case No. A75-6717/2016, Resolution of the Arbitration Court of the Far Eastern District dated 03/21/2017 in case No. A51-14515/2016 |

| The requirement does not contain information regarding which specific counterparty the tax authority is requesting documents | Resolution of the Arbitration Court of the Moscow District dated April 30, 2019 in case No. A40-211149/2018 |

| The requested documents are not related to the subject of the bank inspection, since they do not contain information regarding the correctness of the calculation and payment of land tax, transport tax, corporate property tax and personal income tax by LLC; it does not follow from the content of the request that it is issued for the provision of specific documents on transactions, and in relation to the person for whom a tax audit is being carried out. | Resolution of the Arbitration Court of the Ural District dated October 18, 2018 in case No. A47-14049/2017 |

| The tax authority did not provide evidence of the availability of the requested documents from the individual entrepreneur, who verbally explained that he has no economic relations with the taxpayer being audited | Resolution of the Arbitration Court of the Volga District dated 06/08/2018 in case No. A12-34808/2017 |

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Results

According to Art. 93.1 of the Tax Code of the Russian Federation, tax authorities have the right to request documents from a company or individual entrepreneur as part of tax audits of their counterparties, as well as outside the scope of audits - for a specific transaction.

Controllers have the right to request documents (information) for any period and for any counterparty or transaction.

Sources:

- Tax Code of the Russian Federation

- Federal Law “On Accounting” dated December 6, 2011 No. 402-FZ

- Order of the Federal Tax Service of Russia dated November 7, 2018 No. ММВ-7-2/ [email protected]

- letter of the Federal Tax Service of Russia “On recommendations for carrying out tax control activities related to tax audits” dated July 17, 2013 No. AS-4-2/12837

- Resolution of the Federal Antimonopoly Service of the Far Eastern District dated November 2, 2012 No. F03-5016/2012 in case No. A51-3991/2012

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The procedure for requesting documents by the tax authority

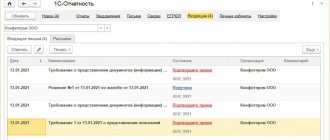

As practice shows, the implementation by tax authorities of this tax control measure is also associated with numerous disputes between the tax authority, the organization being inspected and its counterparties. The procedure for requesting documents (information) from counterparties and other persons is regulated by the provisions of Article 93.1 of the Tax Code of the Russian Federation. The list of specific documents is drawn up with the corresponding requirement of the tax authority for the submission of documents (information).

Important! The form of the requirement to submit documents (information) is given in Appendix No. 17 to the Order of the Federal Tax Service of Russia dated November 7, 2018. No. ММВ-7-2/ [email protected]

If a tax authority official conducting a tax audit is located on the territory of the person being inspected, the requirement to submit documents (information) is transferred to the head (his authorized representative) of the organization or the individual (his authorized representative) personally against signature. If it is not possible to personally deliver the request for documents (information), it must be sent to the person being inspected by registered mail. According to common law, such a shipment (letter) is considered received after six days from the date of sending such a registered letter, or is transmitted electronically via telecommunication channels (TCS) through an electronic document management operator, or through the taxpayer’s personal account.

Important! The audited taxpayer may exercise the right, during the deadline for submitting documents, to send a notification to the tax authority that these documents have previously been submitted to them, indicating in it the details of the document with which they were submitted, as well as the name of the tax authority to which they were previously submitted .