HomeCustoms payments Customs VAT

Material updated: 01/17/2022

Customs VAT is a payment that is regulated by the legislation of the EAEU (Article 46 of the EAEU Labor Code). It is collected by customs authorities for goods moved across the customs border. Despite the efforts made to harmonize tax legislation, VAT in each EAEU country has its own characteristics. For the state, collecting VAT is an effective way to replenish the budget; its collection provides significant and stable revenues to the budget of the Russian Federation. In addition, customs VAT protects domestic producers, providing them with competitive advantages. This tax is subject to national tax laws.

Customs payments

customs duty

Customs duty

Customs excise duty

VAT rates according to the Commodity Nomenclature of Foreign Economic Activity

The commodity nomenclature of foreign economic activity (TN FEA) is a special classifier of goods developed by the member countries of the EAEU. It is a table of code values, each of which relates to a specific type of product - a HS code. VAT rates are tied to the HS code. This code consists of 10 digits. The customs declarant, having determined the product code, understands the meaning of the VAT rate. Exact compliance of the selected code with the nomenclature is one of the most important tasks of the customs declarant.

Do you need to determine the HS code? Don't know what fees you will have to pay at customs? – We will help you!

Paying tax

Payment of taxes and duties at customs today can be made in various ways: using ATMs, electronic or payment terminals, etc. Depending on the chosen method of paying customs VAT, as confirmation of this fact, the importer can provide the controllers with the relevant documents - receipts or payment orders .

If the taxpayer complies with all the conditions considered, customs VAT can be deducted.

To learn about which persons become payers of customs VAT, read the material “Who is a VAT payer?”

Customs VAT rates

Customs duty and VAT rates differ. Customs VAT rates apply to broader product categories and are regulated by the tax legislation of the Russian Federation (Article 164 of the Tax Code of the Russian Federation). Customs VAT rates for the year can take three values: 0%

— tax exemption,

10%

— preferential taxation,

20%

— full taxation.

| VAT rate | Application |

| There are goods the import of which into Russia is exempt from tax, for which VAT will be 0 percent. Before calculating VAT, you need to find out whether this product is eligible for tax exemption and clarify under which customs procedure the product is placed (Article 150, 164 of the Tax Code of the Russian Federation, Government Decree No. 1042 (as amended on March 20, 2018) On approval of the list of medical goods )). To be exempt from this tax, you must provide documents confirming the intended purpose. | |

| 0% | consumables used for scientific research not produced in the Russian Federation;

When placing goods under customs procedures (Article 151 of the Tax Code of the Russian Federation): |

| In some cases, according to Article 164 of the Tax Code of the Russian Federation, the VAT rate will be 10% | |

| 10% | 1) Food products:

2) Products for children:

3) Periodicals, with the exception of periodicals of an advertising or erotic nature.

|

| 20% | In all other cases (clause 3 of article 164 of the Tax Code of the Russian Federation). |

Why is VAT charged and paid on imports?

“Import” VAT is paid on goods and services purchased from a foreign party. VAT is paid when purchasing a foreign service if this service is sold on Russian territory.

When purchasing abroad goods intended to provide free assistance, cultural property acquired by government agencies of the Russian Federation, materials for the production of immunobiological preparations, VAT is not paid. However, when purchasing medical products of this kind abroad, it is important to additionally make sure that there are no analogues on the Russian market. Only in this case their purchase is exempt from VAT.

Until the end of 2022, the purchase of breeding animals abroad is exempt from “import” VAT if there is permission to import them. There are other goods that are exempt from VAT upon import: their list is determined by Government Resolution No. 1069 dated October 20, 2016.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

To calculate VAT you need:

- Correctly determine the product code according to the Commodity Nomenclature of Foreign Economic Activity;

- Determine the tax rate using the code;

- Determine the import duty rate;

- Determine the excise tax rate;

- Calculate the customs value of goods and excise tax;

- Using the formula, we get VAT = (Tam St. + Tam. St. + Share) x VAT rate%.

Example of VAT calculation

Example 1: Goods are imported for an aircraft plant: Pipes and tubes made of aluminum alloys without further processing after extrusion for the production of aircraft engines. Product code 7608208902. VAT = 20%; Import duty = 0%; Excise tax = 0%; Customs value = 78,000 rubles. VAT = 78,000 x 20% = 15,600 rub.

Example 2: An individual entrepreneur imports a batch of strollers from Israel for people who are unable to move. HS code 8713100000. The stroller is a vital medical equipment (preferential product). Import duty = 0, goods are not subject to excise tax, VAT = 0%. To apply these rates, it is necessary to provide documents confirming the intended purpose of the stroller, issued by the federal executive body, and a registration certificate. If supporting documents are not provided, then VAT = 20%.

Under what conditions is a VAT refund possible?

According to Art. 172 of the Tax Code of the Russian Federation, organizations that have paid “import” VAT can receive a deduction in order to reduce the tax burden.

To refund customs VAT upon import, you will need to fulfill the following conditions:

- the product must be purchased only for the purpose of its further sale on the domestic market under transactions subject to VAT (for example, if the purchase is made for the needs of the company, then no refund is made);

- the product, work or service must be registered with the importer (the law does not contain any special requirements for this condition, but its fulfillment is easily verified);

- the company has on hand documents confirming payment of tax during customs clearance (this could be a foreign trade agreement, customs declaration, invoices, etc.);

- the amount of VAT paid is reflected in the declaration for the tax period in which the right to a refund was created.

If at least one of the conditions is not met, the deduction cannot be granted.

How is VAT paid to customs?

Individuals

are not VAT payers, except in certain cases.

Legal entities

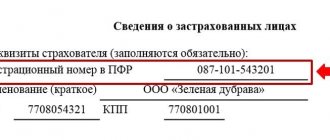

In order to pay VAT and/or other customs payments, you must register with Customs and receive a Unified Personal Account (USA). To avoid unnecessary costs and delays at customs, money must be transferred to the account in advance in the form of an advance payment. You can transfer money by submitting a Payment Order. There are instructions for filling out the Payment Order. In case of overpayment, you can apply for a refund within 30 days. VAT and other payments can be paid without advance payment at the time of filing a customs declaration using the “Round” or “Customs Card” payment system.

To pay VAT, the Budget Classification Code (BCC), consisting of 20 digits, is indicated in the payment instruction in field 104. KBK determines the address and purpose of the payment for payment of duties, fees and VAT, KBK takes the value: 15311009000011000110. Field 107 code of the customs authority administering the payment, consisting of 8 digits without spaces, periods and letters, the code does not have a date format. For ELS, in field 107 the code value is indicated: 10000010.

Documents and information for payment and VAT refund at customs

- List of documents for registration of a Legal entity at customs (View)

- List of documents for registration of an individual entrepreneur at customs (View)

- Payment order for payment of VAT to customs (View)

- Instructions for paying customs duties (Watch)

- Application for refund of advance payments, including VAT (View)

- Application for refund (offset) of overpaid (collected) payments (See)

- Application for return (offset) of cash deposit (See)

Who pays “import” VAT

VAT when purchasing goods and services abroad is paid by the buyer who purchased these goods and is located within the jurisdiction of the Russian Federation. This type of tax is paid regardless of the taxation system used - general, special or simplified. “Import” VAT is paid by all business entities - both organizations of any size and individual entrepreneurs.

VAT on export of goods

A zero VAT rate has been established for the export of goods from Russia; in addition, the exporter can compensate for the VAT paid when purchasing goods. This is done to avoid double taxation and develop foreign trade activities.

For example,

The exporter purchased goods in Russia in the amount of 5,000,000 rubles and paid VAT at the VAT rate of 20%, the VAT amount was 1,000,000 rubles. He sold the goods he exported for 5,500,000 rubles, with a VAT rate of 0% (Article 164 of the Tax Code of the Russian Federation). Since the exporter works under OSNO and is a VAT payer, he has the right to a refund of the VAT paid. To do this, he must provide documents (Article 165 of the Tax Code of the Russian Federation) confirming the fact of export of goods and payment of VAT. After a desk audit, a VAT refund will be issued.

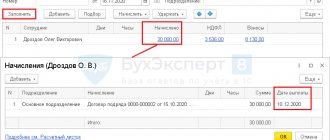

Postings arising when accounting for VAT on imports

For VAT on imports, the entries made in accounting will not differ:

- the accrual of tax payable will be displayed as Dt 19 Kt 68;

- payment for it - Dt 68 Kt 51 (for payments to customs, posting Dt 68 Kt 76 is possible here, if VAT is transferred to the customs authority in advance);

- acceptance for deductions - Dt 68 Kt 19.

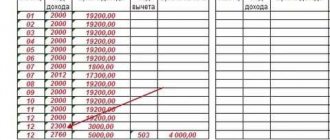

However, in terms of dates, differences in transactions related to countries outside the EAEU and countries participating in this union will be significant. In the first case, they are carried out on the date of release of the goods into the territory of Russia, and in the second - in the month following the month of import, subject to the acceptance by the tax authority of reporting related to imports from the EAEU.

During the period when all the necessary conditions associated with the use of deductions are met, they will be reflected in the regular quarterly VAT return, but different lines of section 3 will be used in it: 150 - for the tax paid at customs, 160 - for the tax paid to the tax office. organ.

Refund of customs VAT when exporting goods

Participants in foreign trade activities have the right to deduct VAT paid by them when importing goods into the Russian Federation only if the exporter is a VAT payer. If the goods are intended for transactions that are subject to VAT, and they are accepted for accounting. A deduction can be made if the goods are intended for operations that are subject to VAT. To confirm your right to a tax deduction, the following documents may be required:

- foreign trade contract with a foreign supplier;

- invoice for payment from the supplier (invoice) invoice;

- customs declaration (copy);

- payment order, bank statements, certified duplicates of payment orders.

The listed documents must be stored for four years.

If an organization is not a VAT payer, then, according to the law, it will not be able to receive a deduction. These are organizations that have chosen tax regimes: simplified taxation system (USNO), unified tax on imputed income (UTI), unified agricultural tax (UST).

Rules for accepting import VAT as deductions

To include import-related VAT in deductions, regardless of which country the import was made from, the following conditions must be met (clause 2 of Article 171, clause 1 of Article 172 of the Tax Code of the Russian Federation):

- the goods are accepted for accounting (and this may also be off-balance sheet accounting);

- the goods are intended for operations subject to VAT;

- tax has been paid.

For imports from a country that is not a member of the EAEU, these conditions are met at the time of import. Since no additional actions are required from the taxpayer, such tax is deducted during the period of importation. The document that serves as an invoice for him when entering data into the purchase book is a cargo customs declaration (CCD).

When importing from a member country of the EAEU, the tax is paid in the month following the month of import, which at the border of tax periods will lead to a transfer of the deduction to a later one. In addition, the possibility of its application here poses additional requirements related to the presence of special mandatory reporting submitted to the Federal Tax Service (import application and declaration). Until it is accepted by the tax authority, the deduction is not considered possible (letter of the Ministry of Finance of Russia dated July 2, 2015 No. 03-07-13/1/38180). A deduction for imports from a member country of the EAEU will be included in the purchase book with reference to the details of the import application.

Services for calculating VAT and customs clearance of goods

Our company “Universal Cargo Solutions” provides services for clearance of goods at any customs office of the Russian Federation, selection of HS codes, determination of the customs value of goods, calculation of customs duties required for payment, including VAT. If necessary, we have the ability to promptly pay customs duties for the client and carry out prompt customs clearance or customs clearance of goods at customs, which significantly reduces time and costs.

We are confident that we will become your reliable partner at customs!

Find out customs VAT or order a service

Rules for applying VAT when importing from a country that is not a member of the EAEU

When importing from a country that is not part of the EAEU, the following principles are significant for VAT:

- Without paying the tax, the goods subject to taxation will not be released from customs (clause 1 of the appendix to the order of the State Customs Code of the Russian Federation No. 131).

- The calculation of its amount occurs simultaneously with the registration of a cargo customs declaration (CCD), and it is in this document that its value should be sought (clause 12 of the appendix to the order of the State Customs Committee of the Russian Federation No. 131).

- The tax should be paid to the customs authority, and this may not be done by the importer himself (clause 2 of the appendix to the order of the State Customs Committee of the Russian Federation No. 131).

- No additional reporting is required.

The tax base will be (clause 5 of the appendix to the order of the State Customs Committee of the Russian Federation No. 131):

- customs value of the goods;

- customs duties (if applicable);

- excise tax (if the product is subject to it).

It must be calculated with a preliminary breakdown of goods into groups by name and distinguishing among them those subject to and not subject to excise taxes, as well as those that are products of processing of materials sent for this purpose from Russia (clause 7 of the appendix to the order of the State Customs Code of the Russian Federation No. 131).

In what cases is it possible to be exempt from VAT when importing goods from countries outside the EAEU? For the answer to this question, see the Ready-made solution from ConsultantPlus. And if you do not have access to the legal reference system, sign up for temporary demo access. It's free.

VAT refund procedure

You can submit documents for reimbursement of import VAT within three years from the date of acceptance of imports for accounting (Article 172 of the Tax Code of the Russian Federation).

From the moment the reporting is submitted, the tax office begins a desk audit, the period of which is three months. In the process of carrying out verification activities, documents submitted in support of the claimed deduction are examined. The tax office may conduct a counter-check and request information on the transaction from the foreign counterparty.

In accordance with paragraph 3 of Art. 88 of the Tax Code of the Russian Federation, all explanations drawn up at the request of tax authorities during a desk audit must be transmitted exclusively electronically in formats approved by the Federal Tax Service.

If all the documents are drawn up correctly, based on the results of the audit, a decision is made to refund the VAT (in full or in part). If there are grounds for refusal, a decision to prohibit the deduction.

VAT refund is possible in several ways:

- transferring funds to the company’s bank account;

- the deduction goes towards offsetting future payments or paying off existing tax debt.

From March 31, 2017, updated application forms are used when applying for a VAT refund or offset of overpaid tax (Order of the Federal Tax Service of Russia dated February 14, 2017 No. ММВ-7-8 / [email protected] ).

Payment of customs duties and refund of VAT deductions

Get a free consultation

Call us or fill out the feedback form and we will contact you as soon as possible.

8 800 700 0952 Feedback