If an organization simultaneously carries out transactions that are taxed and not subject to VAT, it is obliged to carry out separate accounting for tax amounts. This is provided for in Art. 170 Tax Code of the Russian Federation. Collection amounts for taxable transactions are accepted for deduction. In another situation, you have to draw up proportions for each tax period according to the amounts of goods shipped. The “5 percent” VAT rule has been developed specifically for these purposes. An example of calculating the amount of tax in different situations will be discussed in detail below.

The essence

Trade organizations often have to combine a general taxation regime with a single tax. The presence of export operations is also the basis for separate accounting. The reason is that when exporting, VAT is deducted on the last day of the month when documents were provided confirming the use of a zero rate for such an operation. The procedure for calculating tax on these transactions is determined by the accounting policy.

Let us consider in more detail how such organizations carry out separate VAT accounting.

To reflect the distribution of the tax amount in the accounting system, subaccounts to account 19 are used. The distribution is carried out in the period in which the goods were registered. Therefore, the proportion is carried out according to comparable indicators - the cost of the goods with and without VAT. Double accounting is also carried out if the organization has operations that are carried out outside the Russian Federation.

Maintaining separate accounting for VAT when exporting: main points

Separate accounting for VAT when exporting products is required. In this case, the raw materials that were used in the process of export operations (the amount of operations) must be submitted to the Federal Tax Service in the form of a declaration with a zero rate.

The norms of the current Russian legislation do not provide for a clearly defined methodology for determining the input VAT of goods for export. A convenient accounting method is chosen by the organization independently. The accounting procedure should be fixed in the relevant documents (in orders related to the accounting policy of the enterprise).

If the organization did not previously assume that it would export goods and applied regular input VAT on a general basis, then the tax that was paid can be restored. To do this, the organization submits a declaration (updated) and pays tax.

Example 1

Let's consider a standard situation. During the quarter, the company shipped products worth 1.2 million rubles, including taxable products worth 0.9 million rubles. The amount of tax presented by suppliers is 100 thousand rubles. Since the cost of the goods, which is not subject to taxation, is 250 thousand rubles, the calculated coefficient is 0.75. Therefore, you can deduct not 100 thousand rubles, but only 75 thousand rubles. (100 * 0.75). And only 25% can be taken into account in the cost of purchased goods: 1.2 * 0.25 = 0.3 million rubles.

Calculations

How to distribute input VAT? An enterprise may have fixed assets and intangible assets registered in the first month of the quarter. In such cases, the proportions are determined based on the share of the cost of shipped goods manufactured on a new machine in the total sales amount for the month in which the object was accepted for accounting.

The cost of services for providing loans and repo transactions is calculated based on the amount of income in the form of accrued interest. The exception is an interest-free loan, the cost of which is equal to zero. Such operations do not affect the proportion

When calculating the Central Bank, the difference between the sale price and acquisition costs is calculated. At the same time, non-VAT-taxable transactions must also be taken into account in the cost of work.

What is the 5 second rule?

Photo by RF._.studio: Pexels

It only takes 5 seconds to change your life. For most people, this attitude does not sound very plausible, because we are accustomed to the fact that everything in life must be obtained through backbreaking labor.

Not only does it work, but it is also one of the best goal achievement methods for procrastinators and anyone who likes to come up with a bunch of excuses when asked why they still haven’t done anything to fulfill their dreams. The 5 second rule works very simply: every time you plan to do something new or something you don't like, start counting down from 5 to 1 and when you're done, take action.

Countdowns are used to take your mind off doubts and force yourself to focus on what needs to be done. Under no circumstances should you look for excuses. Maybe not the first time, but you must fulfill your plans. Who came up with this rule?

A few years ago, Mel Robbins, an expert on leadership and personal growth, was feeling terrible. Her marriage was crumbling, her career was at a standstill, and her self-esteem was frozen. The woman plunged headlong into depression and no longer saw any meaning in her life. One day, watching the countdown to the launch of the spacecraft, she realized that this could not continue. Mel decided to end her suffering on her own.

The 5 Second Rule by Mel Robbins

It all started with counting down from 5 to 1 to get out of bed, changing gears, which helped Robbins regain control of her life. She did not yet know that her unique experience would form the basis of a technique that would change the lives of millions of people.

Mel just wanted to be a better person: to gain self-confidence, improve her relationship with her husband and children, and become more productive. She developed the 5 second rule - a method that allows you to quickly make decisions without putting them off for a long time.

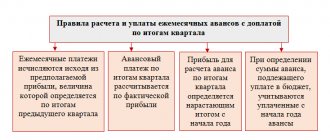

5% rule

For those periods when the share of expenses on non-taxable transactions is less than 5% of the total amount of expenses, the company may not carry out separate accounting. The procedure for calculating the total amount of expenses when calculating the barrier is not established by law. An enterprise can develop its own justified methodology and consolidate it in its accounting policies.

When calculating the share, all sales excluding VAT are taken into account: non-taxable transactions, sales on imputation, expenses for transactions outside the Russian Federation. As for the first group, both direct and general expenses are taken into account. That is, you need to add up all the costs, add VAT on general business expenses in the appropriate proportion, then divide the resulting amount by the amount of costs.

The “5 percent” rule for VAT, an example of the calculation of which will be presented below, cannot be applied to export transactions. This is provided for in Art. 170 NK. For such transactions the VAT rate is 0%. That is, if:

- the barrier has not been reached;

- the enterprise has export operations;

It is necessary to carry out separate VAT accounting.

Comparing expenses

Calculating the cost ratio is not as simple as it seems at first glance. But let's sort it out in order.

At the end of the tax period, the accountant will have to compare the total amount of production expenses and the amount of production expenses directly attributable to preferential sales operations. According to the author, “mixed” expenses that support production of taxable and non-taxable activities do not need to be distributed for the purposes of the upcoming calculation.

This conclusion follows from paragraphs one through four of paragraph 4 of Article 170 of the Tax Code in their interrelation. Indeed, the costs of producing preferential products are nothing more than the cost of resources (goods, works, services, property rights) used to carry out tax-free transactions. In paragraph two, the legislator clearly states that they must be direct. There is no reason to go beyond this approach in order to calculate the share specified in paragraph nine of this paragraph. Paragraph three, in turn, talks about the direct costs of carrying out taxable transactions. And in paragraph four of paragraph 4 of Article 170 of the Tax Code we are talking about indirect costs. In total, such costs are precisely the total costs of production. The clarification “total costs” combines costs for the production of different types of products (goods, works, services, property rights), and does not at all require the preliminary distribution of indirect costs to direct cost items.

An additional argument in favor of this conclusion is the requirement for rational accounting, enshrined in paragraph 7 of PBU 1/98 “Accounting Policy of the Organization” (approved by order of the Ministry of Finance of Russia dated December 9, 1998 No. 60n). Indeed, in our case we are talking about the formation of an indicator below the generally accepted threshold of materiality.

As a result, expenses for non-taxable operations are selected as direct expenses in analytical accounting under account 20 “Main production”, as well as under accounts 21 “Semi-finished products”, 23 “Auxiliary production” and 29 “Service production and farms” - if subsequently they are not subject to closing on a score of 20 or on each other. General production costs are formed taking into account indirect costs, which are reflected in accounts 25 “General production expenses” and 26 “General business expenses”.

Example 1

The plant produces bicycles and wheelchairs for the disabled. The sale of the latter is exempt from taxation (subclause 1, clause 2, article 149 of the Tax Code of the Russian Federation, Decree of the Government of the Russian Federation of December 21, 2000 No. 998). Accounting reflects direct costs for the production of these products in the subaccounts “Bicycles” and “Wheelchairs” of account 20. For the fourth quarter of 2008, direct costs for production amounted to 10,000,000 rubles, of which for wheelchairs - 600,000 rubles, according to bicycles – RUB 9,400,000. In addition, general production expenses were incurred in the amount of RUB 2,000,000. and general business expenses in the amount of RUB 3,000,000.

Based on these data, the control ratio between expenses will be equal to 4% (600,000 rubles: (10,000,000 rubles + + 2,000,000 rubles + 3,000,000 rubles) × 100%). On this basis, the accountant has the right not to keep separate records of “input” VAT in the fourth quarter. He will submit the entire amount of tax presented by suppliers and contractors for deduction.

However, he will show revenue not subject to VAT in section 9 of the value added tax declaration, approved by order of the Ministry of Finance of Russia dated November 7, 2006 No. 136n, under code 1010204. And in column 3 of this section he will reflect the direct cost of preferential products - 600,000 rub. But in column 4 of section 9 there will be a dash.

Now assume that the firm has no direct expenses for non-taxable transactions. In such a situation, the percentage we are interested in will be equal to zero, which is obviously less than 5 percent. This means that it is not necessary to distribute the “input” VAT.

The legislation does not contain clear instructions on the procedure for determining the ratio of expenses for preferential production and total production costs. Therefore, firms have the right to develop their own algorithm for calculating the control ratio

If the control ratio is calculated by a trading company, then its direct costs for non-taxable transactions will be the cost of non-taxable goods sold.

We emphasize that paragraph four of paragraph 4 of Article 170 of the Tax Code requires the distribution of VAT, and not the indirect costs themselves. Meanwhile, a number of experts believe that the costs of preferential transactions should include a share of indirect costs (from accounts 25, 26, and in trade - from account 44). Perhaps the legislation does not contain unambiguous instructions on the procedure for determining expenses, moreover, the conditions of economic activity are infinitely varied. Therefore, we believe that firms have the right to develop their own reasonable approach to calculating the benchmark cost ratio. To avoid disagreements with tax authorities, we recommend that the chosen algorithm be described in detail in the accounting policy.

Please note that the ninth paragraph of paragraph 4 of Article 170 of the Tax Code does not apply to exporters. For the reason that applying a tax rate of 0 percent is not an exemption from taxation.

The 5 Percent Rule: An Example

The enterprise's direct costs for taxable operations in the second quarter amounted to 15 million rubles, and for non-taxable ones - 750 thousand rubles. General business expenses - 3.5 million rubles. The accounting policy provides for the distribution of expenses in proportion to revenue, which in the reporting period amounted to RUB 21 million, respectively. and 970 thousand rubles.

General business expenses for non-taxable transactions: 3.5 * (0.97 / (21 + 0.97))) = 154.529 thousand rubles, or 4.7%. Since this amount does not exceed 5%, the company can deduct the entire input VAT for the second quarter.

"Saving" clause

The ninth paragraph of paragraph 4 of Article 170 of the Tax Code allows you to get rid of separate accounting of “input” VAT. But please note that it is addressed to taxpayers. For this reason, the said paragraph does not apply to UTII payers. After all, these business entities are not considered VAT payers due to the direct indication of paragraph 4 of Article 346.26 of the Tax Code. This point of view is reflected in the letter of the Ministry of Finance of Russia dated July 8, 2005 No. 03-04-11/143 and in the letter of the Federal Tax Service of Russia dated May 31, 2005 No. 03-1-03/897/8. But the judges do not share the opinion of the officials (resolutions of the Seventeenth Arbitration Court of Appeal dated July 18, 2008 No. 17AP-4390/2008-AK, FAS Volga District dated February 5, 2008 No. A65-28667/06-SA2-11, FAS North Western District dated December 7, 2007 No. A05-5928/2007, etc.).

As a result, without the risk of tax disputes, only taxpayers using VAT exemption benefits have the right to apply this rule. And even then only under certain conditions. Alas, these conditions must be confirmed after each VAT tax period, that is, quarterly.

So, separate accounting of “input” VAT may not be carried out if the costs of carrying out preferential operations do not exceed 5 percent of the total production costs. In this case, the taxpayer can deduct the entire “input” VAT. There is no need to include VAT in the cost of goods, works, or services. This means that there is no need to distribute the “general” VAT by calculation between taxable and non-taxable transactions. But no one exempted taxpayers from separate accounting of income.

The following immediately catches your eye. The final distribution of expenses by type of activity will be determined at the end of the quarter. Of course, it is not known in advance whether the specified 5 percent ratio between expenses will be met. Therefore, it is risky to deliberately refuse to separately account for “input” tax amounts. If it turns out that the 5 percent threshold is exceeded, then expense accounting for the quarter will need to be restored. And companies paying monthly advance payments based on the actual profit received (clause 2 of Article 286 of the Tax Code of the Russian Federation) will have to submit corrective declarations. Their expenses will increase due to non-refundable tax amounts.

Accounting algorithm

To understand what VAT rate should be applied to goods and how to determine the amount of input tax, you can use the following sequence of actions:

1. Calculate the amount of VAT claimed that can be deducted. If the purchased goods can be directly attributed to activities exempt from taxation, then VAT is included in its cost. In other cases, the tax amount is deducted.

2. At the next stage, you need to apply the “5 percent” rule for VAT, an example of the calculation of which was presented earlier. First, the amount of expenses for non-taxable transactions is determined, then the total costs are calculated and the formula is applied:

% neoreg. oper. = (Normal / Total) x 100%.

If the resulting ratio exceeds 5%, then separate accounting of the amounts should be carried out.

3. Tax amounts with and without VAT are calculated, then they are summed up and the ratio is determined:

% calc. = (Sum of region / Sum of total) * 100%.

The following determines the VAT on OSN payable:

Tax = VAT charged * % deducted.

4. The marginal cost is calculated:

VAT limit = VAT claimed - VAT deducted

or

Cost = (Amount of goods shipped, but not taxable / Total sales volume) * 100%.

Just like others

As a general rule, “input” value added tax is deductible if there is taxable turnover. At the same time, the Tax Code provides for cases when VAT is included in the cost of goods (clause 2 of Article 170 of the Tax Code of the Russian Federation): – if purchased (imported) goods are used for the production (sale) of non-taxable goods and (or) if the sale of such goods is specified in clause 2 Article 146 of the Tax Code of the Russian Federation; – if the goods are used for the production of products, the place of sale of which is not recognized as the territory of the Russian Federation; – if the goods were purchased by an organization that is not a VAT payer (for example, a “simplified” or “imposed”). Those organizations that initially purchased goods for sale subject to VAT, but then changed their minds, must restore the tax previously accepted for deduction. When VAT is and isn’t Often an organization has both taxable and non-taxable turnover. This happens, as a rule, when it applies special tax regimes along with the general taxation system. Moreover, let us remind you that the transition to “imputation” does not depend on the will of the organization. UTII, as is known, is introduced by decisions of legislative authorities (laws) in each region independently, and its payment and application are mandatory. If a company carries out both taxable and non-taxable transactions in one tax period (quarter), it needs to keep separate records for purchased goods (clause 4 of Article 170 of the Tax Code of the Russian Federation), but under one condition: they are used for taxable and non-taxable revolution at the same time. Keep in mind that if separate accounting is not maintained, then the amount of VAT charged to the company by the seller cannot only be deducted, but also included in income tax expenses (letter of the Ministry of Finance dated January 11, 2007 No. 03-07-15 /02). The Tax Code does not give a clear answer to the question of how to properly maintain separate accounting. The legislator proposed to decide on this issue independently, reflecting the necessary provisions in the accounting policy for tax purposes, but subject to the following condition: you need to start from the share of taxable turnover in the company’s total sales. The Federal Tax Service adheres to the same position in its letter dated May 27, 2009 No. 3-1-11 / [email protected] Do not forget that in order to avoid problems with the tax authorities, when calculating the cost of goods shipped for the quarter, you should take into account their price without VAT (letter from the Ministry of Finance dated August 18, 2009 No. 03-07-11/208 and Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 18, 2008 No. 7185/08).

Arbitrage practice

A complete interpretation of “total expenses” is not provided in the Tax Code. Based on definitions in economic dictionaries, this term can be understood as the total cost of production of goods incurred by the taxpayer himself. The Ministry of Finance explains that when calculating this value, direct and general expenses for conducting activities are taken into account.

Judicial practice also does not allow us to draw an unambiguous conclusion regarding when separate VAT accounting should be carried out. The 5 percent rule, an example of which was discussed earlier, applies exclusively to manufacturing enterprises. According to the judges, trading companies cannot carry out separate tax accounting.

Transactions with securities raise even more questions. In particular, some judges, referring to Art. 170 of the Tax Code, they claim that when selling such assets, the 5% rule can be used. At the same time, the cost of purchasing securities does not affect the proportion. That is, almost always the amount of expenses will be less than 5%, and the payer will be released from the obligation to keep double records.

In other court decisions there is a reference to PBU 19/02, which states that all transactions with the Central Bank in NU and BU relate to financial investments. In addition, organizations do not have expenses associated with the formation of the cost of such assets. That is, income from such transactions is exempt from taxation. Therefore, the organization must submit full VAT for deduction.

Transactions on the sale of a legal entity’s share in the management company of another organization are not subject to VAT. Therefore, in such cases double counting is always carried out.

Everything is deductible

From the provisions of Article 170 of the Tax Code, as from almost any rule, there is an exception. In our case, this is the so-called “5 percent rule”. According to it, if in the total volume of expenses for the quarter the share of expenses associated with operations exempt from VAT is no more than 5 percent, the entire “input” tax can be deducted.

| WHAT YOU NEED TO HAVE TO CREDIT INPUT VAT WHEN USING THE “5 PERCENT RULE” |

| • Certificate of calculation according to the methodology established in the accounting policy for tax purposes. The document must comply with Article 169 of the Tax Code of the Russian Federation and Decree of the Government of the Russian Federation of December 2, 2000 No. 914; • payment order with a bank mark (account statement) or another document confirming payment (receipt for a cash receipt order); • other documents confirming the actual receipt of goods (work, services) depending on the specifics of the expenses (for example, certificates of completed work in construction or hotel bills for the accommodation of posted workers). |

The fact is that the Tax Code gives an organization the right not to apply the provisions of paragraph 4 of Article 170 of the Tax Code of the Russian Federation (except for the “cherished” paragraph) to those tax periods (quarters) in which the share of total costs for the production of goods (work, services or property rights) , the sale of which is not subject to taxation, does not exceed 5 percent of all production expenses. Simply put, paragraph 4 of Article 170 of the Tax Code of the Russian Federation does not apply at all for those whose expenses for non-taxable turnover “fit” into the five percent criterion. It turns out that it is not necessary not only to include separate amounts of “input” tax in expenses, but also to keep separate records of taxable and non-taxable turnover (letter of the Ministry of Finance of Russia dated January 11, 2007 No. 03-07-15/02). The requirements for documents when applying for a deduction of “input” VAT in this situation are no different from the usual procedure provided for in Article 172 of the Tax Code (letter of the Federal Tax Service of Russia for Moscow dated October 20, 2004 No. 24-11/68949). A natural question arises. , how an accountant will determine the non-taxable percentage of turnover. And most importantly, how to prove all this to the tax inspector, who will one day come with an audit. Note that the calculation of the proportion for separate accounting is carried out “by income”, that is, depending on the taxable (non-taxable) sales volume. This is a general rule (clause 4 of article 170 of the Tax Code of the Russian Federation).

Example 3

Before providing funds as collateral, the company hired auditors to check the financial condition of the borrower. The cost of the company's services amounted to 118 thousand rubles. VAT included. Loan amount – 1 million rubles. The cost of financial investments is determined based on the accounting policies of the lender. If it does not provide for the use of the 5% rule, then VAT for auditor services should be taken into account in the cost of the financial investment. In this case, general business expenses will have to be distributed. If there is a reservation, then all amounts are accepted for deduction.

The issue of accounting for input VAT in transactions with debt securities remains open. Using a preferential scheme for transactions with bills of exchange is risky. The Federal Tax Service will most likely challenge such operations, and then they will have to prove their case in court.

Let's get to the bottom of the problem

So, if a company simultaneously carries out taxable and non-taxable transactions, then problematic situations may arise in taxation. First of all, the disputes concern VAT. For example, how to apply input tax to a deduction when combining transactions of different types? Starting this year, officials have adjusted the rules.

In such circumstances, the company is required to maintain separate accounting records. That is, take into account income and expenses separately for taxable transactions, and separately for non-taxable ones.

But it's not that simple. For example, certain types of costs can be allocated to both types of activities: taxable and non-taxable. For example, general business expenses that are incurred to ensure the life of the entity as a whole, regardless of the specific type of transaction. For expenses of this nature, separate accounting for input VAT is applied: the 5 percent rule.

What does it mean? Let's say an organization provides two types of services. The first is classified as non-taxable, and the second is subject to full VAT. Thus, an enterprise has the right to accept input VAT on general business costs in full if expenses for non-taxable transactions do not exceed 5% of total (aggregate) expenses for the corresponding quarter.

Let us note that until 2022, officials took a different position. That is, previously it was possible to accept input VAT as a deduction if expenses within 5% were directed only to non-taxable transactions.

Accounting

From all of the above, we can draw the following conclusion: it is better to determine the method of calculating expenses and indicate it in the accounting policy. In this case, you need to specify the entire list of costs that relate to operations exempt from taxation, and the procedure for their calculation:

- allocate a position on staff for a responsible employee;

- prescribe the procedure for recording time for making calculations;

- determine the principle for distributing the amount of rent and utilities for such operations (for example, proportionally).

To collect information about expenses not related to production, account 26 is used. It can reflect management, general business expenses, depreciation, rent, costs of information, auditing, and consulting services.

Maintaining separate accounting for VAT: what to pay attention to

The vast majority of organizations deal with both taxable and non-taxable value added tax products.

Let us remind you that separate accounting for this tax is carried out according to the output VAT - at the cost of the products that were shipped. In this case, products may be subject to VAT or exempt from it. VAT included in the product price must also be taken into account.

However, there is no single methodology for maintaining separate VAT accounting. That is why you can use a convenient order for organization. The most important thing is that when maintaining separate accounting, transactions subject to VAT and those not subject to VAT are clearly distinguished.

The procedure for maintaining separate VAT accounting chosen by the organization must be enshrined in the general accounting policy of the company.

Failure to maintain correct separate VAT accounting may result in tax authorities recovering all input tax on items purchased for use in transactions that are and are not subject to value added tax. Such actions by tax officials will lead to the organization having shortfalls in VAT, which means fines and penalties cannot be avoided.

The Ministry of Finance believes that if there are no transactions on exempt units of goods from VAT, then this is the basis for exempting the organization from maintaining separate accounting for value added tax.

VAT or UTII for individual entrepreneurs

To begin with, it is worth noting that entrepreneurs who are single tax payers do not pay VAT on transactions that are recognized as taxable. At the same time, the Tax Code states that organizations that carry out transactions subject to VAT and UTII are required to maintain double accounting of property, liabilities and transactions. For such individual entrepreneurs, the VAT accounting procedure is regulated by the Tax Code. It also spells out the work procedure of exporters located on UTII for individual entrepreneurs.

Separate accounting allows you to correctly determine the amount of tax deduction: in full or in proportion. The code states that the procedure for distributing such operations must be prescribed in the accounting policies of the organization. The above ratio is calculated based on the cost of non-taxable goods sold in total sales. Let's consider another problem that presents the “5 percent” rule for VAT.

Calculation example. An enterprise engaged in wholesale and retail trade (paying VAT and UTII) must carry out double tax accounting. Even if work, equipment, or real estate are intended for “imputed” activities, VAT on them is not deductible. If the services received or real estate purchased are intended to conduct transactions subject to VAT, then the tax charged is taken into account in full. If the purchased equipment will be used on “two fronts” at once, then a proportion must be drawn up. One part of the tax is deductible, and the second is included in the cost of goods.

Advice for organizations conducting transactions that are not subject to VAT

If an organization is engaged in operations that are not subject to value added tax on an ongoing basis, then in order to calculate the share of expenses for these operations, accounting should be organized in such a way that the following information is generated separately:

1. About the cost of sales, which are subject to VAT. 2. About the cost of sales, which are not subject to VAT. 3. About other costs associated with implementation:

- subject to VAT (for example, on the sale of fixed assets);

- exempt from VAT (for example, sales of securities).

4. About other expenses that are not related to sales (for example, interest received by the company on loans).

To make it more convenient to keep track of transactions, it is recommended to open separate sub-accounts. In addition, you can maintain separate registers.

We add that the organization should decide on the optimal procedure for calculating the share of general business expenses that fall on operations not subject to value added tax.

For example, the share of general business expenses attributable to operations that are not subject to VAT can be taken equal to one of the following ratios:

- the share of direct expenses for operations that are not subject to VAT in the total direct expenses for all operations that are related to the sale;

- the share of revenue from operations that are not subject to VAT in the total amount of sales revenue.

No less important is the issue of tax policy for separate accounting in relation to transactions that are not subject to VAT. It is worth paying attention to such points that are associated with the grounds for performing such operations, namely:

1. What preferential regimes are associated with taxation. 2. Are there any tax transactions that are not provided for in Article 149 of the Tax Code of the Russian Federation? 3. Availability of the right to exemption from VAT in case of insufficient amount of revenue received. 4. Sales of products (services or works) to other countries.

Proportion

The Tax Code specifies the specifics of accounting for ratios for transactions that are exempt from taxation. The cost of services for providing loans and repo transactions is taken into account in the amount of interest income accrued by the taxpayer. When calculating the cost of shares, bonds, and other securities, the amount of income is calculated in the form of a positive difference between the selling price and the cost of purchasing such assets. If the market price is lower than the cost, then the resulting value will not be taken into account.