Cancel the round seal

The abolition of the seal for legal entities has caused a lot of unrest and misunderstanding in the business industry. First of all, managers and representatives of the economic sector of the organization asked the question: “Has the use of seals been canceled for all procedures, or are there documents that are not valid without certification?” The answers were provided by the law on the abolition of seals No. 82-FZ of 04/06/2015. It describes in detail how an organization should operate from the moment the law is adopted, whether it is necessary to put a stamp on the contract, as well as on tax, accounting and primary reporting documents. Also, the law on the abolition of seals explains the procedure for placing such marks on powers of attorney, allowing the interests of a legal entity to be represented in court.

Should a society have a seal?

The need for the company to use such requisites is prescribed in its charter. Organizations such as LLCs and JSCs are not required to have a round seal based on Federal Law No. 82-FZ of 04/06/2015. Also, from April 7, 2015, enterprises have an obligation to indicate in the charter the fact of having a stamp. If it is absent, it is considered that the legal entity is not obliged to certify documents in this way. Therefore, after the law has come into force, companies that have a mark in their charter indicating the presence of a round seal do not need to make any amendments. As for organizations that were created before April 7, 2015 and do not have the corresponding mark in their documentation, they are recommended to supplement the charter with the required information. The need for this addition is justified by the possible need to put a mark on the papers required by law. As for companies formed after April 7, 2015, they have the right to have a stamp, but this is not obligatory for them.

Cancellation of printing for legal entities

JSC and LLC may no longer use a round seal in their work. The abolition of the seal for legal entities in 2016 became possible with the entry into force of Federal Law dated 04/06/15 No. 82-FZ. Working with printing is now the right, not the responsibility of the company. This amendment appeared in the laws on both joint stock companies and LLCs (clause 7, article 2 of the Federal Law of December 26, 1995 No. 208-FZ, clause 5 of Article 2 of the Federal Law of 02/08/98 No. 14-FZ).

The company refuses to print.

All companies can cancel the seal, not just those created after April 7, 2015. The procedure for refusal depends on whether the charter says about the seal. If the charter provides for the presence of a seal, then it must be amended. If the charter does not say anything about the press, then it is not changed. The Federal Tax Service confirmed this.

So, you will need:

- This should be specifically stated in the charter. This is now directly required by the laws on LLCs and JSCs. The more specific and simpler its provisions, the easier it will be for you to work with counterparties.

An example of wording about the absence of a seal in the organization’s charter:

The Company does not have a round seal, which serves to identify it by indicating on it the full company name in Russian and the location of the Company.

The company may have and use in its work stamps and forms with its name, its own emblem, and may also have trademarks and other means of individualization registered in the prescribed manner. The procedure for using the company’s identification means is determined by this charter and local regulations of the Company.

- As a rule, an organization has more than one seal (the main one, “stamp”), but also additional ones, in the name of which “For documents” or “Human Resources Department”, etc. is added. Giving up the main seal while retaining additional ones is illogical.

If the regulation of work with seals in your organization has been established, then you will have to adjust these documents (for example, the Regulations on the use of seals and stamps, relevant orders assigning persons responsible for the safety and use of seals).

When approving templates for primary accounting documentation and other documents, make sure that there are no “MP” marks on the forms.

If they came to you without a stamp.

To determine the powers of the person who has contacted you, acting on behalf of an organization that does not have a seal, it is recommended to request, in addition to the usual list of documents in such cases, the following:

- a copy of the organization's charter;

- a letter containing an indication that the organization does not have a seal.

Only if they are available, it is possible to accept primary documents without a seal of the counterparty (if printing on them was previously required). If they are not there, then your organization may, in the eyes of the tax authorities, appear to have “failed to exercise due diligence when choosing a counterparty.” As a rule, quite serious consequences follow from this in the form of collection of penalties, fines and arrears to the budget.

The company retains the seal.

Typically, standard charters state that the company has a seal.

- If there is such a record, then nothing needs to be changed; you can continue to use the seal.

- If there is no entry in the charter, then it must be made. The following wording is suitable: “The company has a seal containing its full corporate name in Russian.”

Note: now the seal can be not only round, but also of any other shape. And instead of the full name and location, you can limit yourself to only the short name of LLC or JSC.

In which documents is stamping required?

A company that decides to cancel printing can continue to use it. It is not prohibited. But in the opposite situation, if the stamp is mentioned in the charter, the company is obliged to put it on some documents. Such documents must be named in federal laws.

At the same time, many by-laws now also require a stamp. For example, a seal is required in work books, information about the average number of employees, an application for registering a cash register, etc.

- Specialists from the Federal Tax Service, the Pension Fund of the Russian Federation and the Social Insurance Fund believe that starting from April 7, the company has the right to submit to them any documents without a seal. But it is safer to inform the inspectorate and funds in writing that the company has abandoned its stamp.

- Banks also believe that the signature of the general director on any documents will be enough for them if the company refuses the seal.

And only labor inspectors believe that a seal is necessary on work books, as before (clause 35 of the Rules, approved by Decree of the Government of the Russian Federation of April 16, 2003 No. 225). This means that for the absence of a seal a fine of 30 to 50 thousand rubles is possible (Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

List of documents that require printing.

- a copy of the charter that the company submits for registration of rights to real estate (clause 4 of article 16 of the Federal Law of July 21, 1997 No. 122-FZ);

- act on an industrial accident (Article 230 of the Labor Code of the Russian Federation);

- power of attorney for representation in courts (part 5 of article 61 of the Arbitration Procedure Code of the Russian Federation, part 3 of article 53 of the Code of Civil Procedure of the Russian Federation);

- journal of non-tax audits (Part 10, Article 16 of the Federal Law dated December 26, 2008 No. 294-FZ);

- double warehouse certificate (Article 913 of the Civil Code of the Russian Federation);

- applications for participation in tenders (Article 51, 88 of the Federal Law dated 04/05/13 No. 44-FZ), etc.

Information provided by the Russian Chamber of Commerce and Industry.

When is printing necessary and when is it not?

The company is obliged to affix a seal in the following cases:

- if there is a need to leave the pledge with the pledgor under the protection of the lock and seal of the pledgee,

- when an educational organization certifies education documents,

— if documents are submitted for registration under a lease agreement for a structure or building for a period of more than a year, then they must be certified with a seal, but only on the condition that this method is prescribed in the charter,

— an information message is submitted to the customs authority in a package with other documents on the payment of excise taxes on goods marked by the Customs Union and imported into the territory of Russia from the territory of the union state.

The abolition of the seal for legal entities forced corresponding amendments to be made to a number of laws. Some of the by-laws still presuppose the need for its presence. Cases where by-laws require this mark to be placed on documents should be perceived by a legal entity as optional. But government agencies, banks and other structures may still require stamping on documents.

Is it necessary to put a stamp on orders in 2022 - features of personnel matters

In personnel records management, in some cases, legislation provides for the mandatory use of a seal. Mandatory means its use if the employing company actually has a seal and uses it in its activities as a whole. However, within the framework of personnel documentation, a seal is not always necessary. You cannot do without a seal, if available, in the following aspects of personnel records:

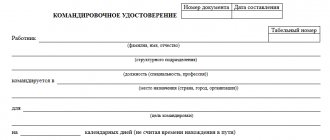

. This document must necessarily contain the seal of the enterprise, especially if it is signed not by its actual owner or director, but by a third party.

Employment contract- Employment history . Entries in workers' work books must be certified by the seals of the enterprise or entrepreneur, if any.

- Copies of documents and certificates. If an employee requires any copy of personnel documents relating to his work, a certificate of income, a certificate of employment.

- Powers of attorney. A power of attorney to perform any actions on behalf of an entrepreneur or director of the company as a whole must be sealed.

If an entrepreneur or enterprise does not have a seal, then even in the above documents they can do without it. Instead, only the signature, surname, first name and patronymic of the corresponding person are affixed there. However, the lack of a seal of a legal entity must be confirmed by the Charter.

In other cases, certification of documentation related to personnel matters with a seal is not necessary. The same applies to orders at an enterprise - the employer is not obliged to put a stamp on them from the point of view of law.

Registration of work books

In accordance with the rules for maintaining a work record book, upon dismissal of an employee, all entries that were made during his work must be certified by a seal. The abolition of the mandatory seal introduced adjustments to this procedure. Now the employee’s information is certified with a stamp belonging to the personnel department. Rostrud believes that replacing a round seal with another is not a violation of the Labor Code and does not infringe on the rights of the employee, since the latter receives confirmation of the fact of working in this organization. It is important to understand that only the mark that contains information about the name and location of the employer is confirmatory.

So, let's choose...

Nowadays, it is no longer the responsibility of companies to put round stamps on documents. And first, you urgently need to look at your Charter.

What to do next:

- You will continue to use the seal. Then check to see if your Charter contains language regarding the use of the seal. If your Charter says about the seal, then everything is in order. If not, it needs to be changed.

- You have decided to stop using printing. If the Charter stipulates a condition on the use of a seal, then changes will have to be made. A separate order is also issued, which prescribes the abolition of the round seal.

To bet or not to bet? That is the question!

When preparing documents confirming the involvement of foreign employees, the employer certifies them only if this is provided for in the charter. As for the staffing table, the abolition of the mandatory seal of business companies entailed a complete absence of the need to certify this document. The changes also affected the principle of drawing up an employment contract. The abolition of the organization's seal now implies that there is no need to certify the employment contract with a stamp.

Printing on primary documents

The Tax Code and the Accounting Law do not contain any information about the need to affix a stamp to the organization’s primary documents, even those that indicate income tax expenses. But there are cases when the mandatory certification is established by the procedure for filling out a specific form, or the form itself, or the format for submitting the primary document, developed by the taxpayer. In connection with this subtlety, taxpayers are recommended to warn their counterparties about the need to certify the document, if this is provided for in the form of this document. Also, the abolition of seals for legal entities forces taxpayers to make sure in advance that the counterparty also needs a seal.

Possible problems

I think that you understand that it is safer to leave the seal, especially while the situation regarding many issues of using the seal has not been resolved. The fact is that, despite changes in civil legislation, not all other laws and regulations have been amended. And in practice, claims during inspections and disagreements with counterparties are possible.

Let's look at a few possible problem areas when canceling round printing.

Agreements with counterparties

Usually, when drawing up a contract, companies put a stamp. Also in the text of the contract itself there may be a requirement to certify it with a seal, additions and changes to it. Therefore, if there is no seal, make sure that there is no such language in the contract.

If old contracts contain language about the use of a seal on primary documents, then this condition must be excluded by drawing up an additional agreement.

Canceling printing and primary documents

The forms of all used primary documents are approved as part of the accounting policy. Therefore, if you refuse to print, this detail must be removed from the forms and new forms must be approved.

It is more difficult to explain the situation to counterparties that there will no longer be a seal in your primary documents. For them, prepare and send a letter in which you indicate the refusal to print. Please attach a copy of your new Articles of Incorporation to your letter.

Let's consider the main options for working with primary documentation:

- If you plan to use standard forms, for example, TORG-12, where the form itself provides such details as a seal, then it is not necessary to put it.

- If, on the contrary, you received a document from your counterparty without a seal, then request a copy of the Charter for confirmation. In this case, the costs of such documents can be taken into account.

- If the seller is you, and the buyer does not use a seal, then when transferring the goods, ask for a power of attorney to receive the goods if they are not received by the employee responsible for acceptance.

Declarations and reports to extra-budgetary funds

Problems are possible if the organization reports on paper. Clause 28 of the Administrative Regulations, approved. by order of the Ministry of Finance of Russia dated July 2, 2012. No. 99n provides for the refusal to accept declarations without a stamp. A similar requirement is contained in clause 24 of the administrative regulations, approved. by order of the Ministry of Labor of Russia dated October 22, 2012. No. 329n.

According to the explanations of officials, there should be no problems when accepting declarations and calculations, and inspectors are obliged to accept reports without a stamp. However, how this will be implemented on the ground is still unclear.

Cash desk, BSO, employees

The most problematic documents where the absence of a seal can have adverse consequences and disputes during inspections:

- the cash book and the cashier-operator's journal are certified with a seal;

- strict reporting forms (Government Decree dated May 6, 2008 No. 359, clause 3) - without a stamp, documents are executed incorrectly and there is a fine for non-use of cash registers, refusal to recognize expenses, or to deduct VAT;

- work books (Instructions, approved by Decree of the Ministry of Labor of Russia dated October 10, 2003 No. 69, Rules approved by Decree of the Government of the Russian Federation dated April 16, 2003 No. 225) - stamping is required, otherwise a fine of up to 50 thousand rubles may apply.

Also, if you refuse to print at the bank, you will have to reissue the card, which will only contain sample signatures.

Having assessed the pros and cons, are you going to stop using printing? Share your opinion in the comments!

Submitting reports to the Federal Tax Service

It is the responsibility of each taxpayer to timely submit a declaration in accordance with the form approved by the Federal Tax Service of Russia and agreed upon with the Ministry of Finance of Russia. If an organization submits reports in paper format, then affixing a stamp is mandatory. This rule is regulated by the instructions of the tax department, which include standards for filling out declarations. The abolition of stamps misled many legal entities, which led to the frequent absence of important details on the submitted declaration and, as a consequence, to its rejection.

In connection with the existence of a rule stating that cases requiring the affixing of a seal must be prescribed in federal laws and the provision of this requirement in by-laws, a paradoxical contradiction arises. Legal force is on the side of the law, that is, conflicting by-laws are not taken into account. However, in order not to risk thinking that the abolition of the seal of business entities also applies to this situation, it is recommended to certify the document with a wet seal until clarifications appear from the competent authorities or changes are made to the orders relevant to this situation. At the same time, as a recommendation, a wish is put forward to include information about the presence of a stamp in the organization’s charter.

Reporting for the Pension Fund of Russia

According to the law on insurance contributions, certification of reports submitted to the Pension Fund of the Russian Federation is not required. This provision also applies to filling out forms such as RSV-1 Pension Fund. But, despite this, in the form itself there is a field that requires a stamp. In this regard, the lack of certification on the RSV-1 Pension Fund leads to a refusal by the receiving authority. Also, making corrections during the process of filling out the calculation requires mandatory certification of the corrections with a seal.

How to submit reports to the Social Insurance Fund and not get rejected

If you study the procedure for filling out reports for submission to the social insurance fund in Form 4-FSS, you will understand that there is a need to confirm the correctness of the data with a seal. In the same way as in the case of data that have undergone changes in the RSV-1 form of the Pension Fund of the Russian Federation, mandatory certification requires the corrected information in the document containing calculations for contributions sent to the social insurance fund. As for the documents requested by the Federal Tax Service, according to the form describing the requirements for the provision of documentation, the organization must submit copies of those papers that are required by the inspection, certified by the signature of the head and the corresponding seal, unless otherwise provided by the legislation of the Russian Federation.

Where can you use printing for personnel documents?

The use of seals is little regulated by law.

The laws for joint-stock companies and limited liability companies do not provide for an obligation, but only the opportunity to use forms and imprints with the name, emblem and other means of individualization (clause 7 of article 2 of Federal Law No. 208 of December 26, 1995 and clause 5 of article 2 Federal Law No. 14 dated 02/08/1998). IMPORTANT!

As established by law, if a JSC or LLC wishes to use stamps, then this information must be included in the charter. Otherwise they will be invalid. For individual entrepreneurs, the use of such an attribute in documents is not provided for in any laws. The entrepreneur uses it if desired.

The law does not specify how many prints are permissible to use in one company. Each organization has the right to independently resolve this issue. If the company is large, then, in addition to the main stamp, additional ones are often used, for example, for personnel documents, delivery notes, etc.

There are generally accepted rules for which documents require a seal from the HR department:

- employee work books and inserts for them;

- copies and extracts from documents related to the work of employees (orders, reports, LNA, etc.);

- certificates from the workplace;

- employment contracts;

- applications for foreign passports.

IMPORTANT!

If we talk about maintaining work books, then previously the rules provided for affixing only the main imprint of the organization. And from September 1, 2022, it is permissible to put both the main company stamp and the HR department cliche. This is established by Order of the Ministry of Labor dated May 19, 2021 No. 320n.

It is placed in the labor office in different cases. In particular, if changes are made to the full name or date of birth of an employee (clause 7 of the Procedure, approved by Order No. 320n), a duplicate of the book is issued (clause 28 of the Procedure). The adjustments made are certified by the head of the HR department and stamped (the main one or the stamp of the HR department). Similar rules apply when issuing a work book to an employee and making an entry on termination of the contract (clauses 35 and 36 of the Procedure). The entry is certified by the signature of the manager or other official and the stamp of the organization or personnel service.

As for the HR department seal in the employment contract, it is optional. This document, even with one signature, has legal force, since the requirements for it do not say anything about a mandatory imprint (Article 57 of the Labor Code of the Russian Federation). Although the law does not require it, government officials recommend putting additional protection in the form of a stamp (for example, orders of the Ministry of Economic Development of the Russian Federation No. 452 dated July 11, 2016 and the Ministry of Health and Social Development of the Russian Federation No. 424n dated August 14, 2008). Both general company seal and personnel seal are allowed.

There is another situation when this attribute is required - certification of the official opponent’s review with the seal of the HR department when defending a dissertation. The document must be certified by the personnel service of the organization in which the opponent works, including his signature. If the review is not completed according to the official rules, the review may be returned for revision.

Is a stamp required on the information message required to pay excise duty?

As for information messages aimed at paying excise duty on labeled goods included in the Customs Union and imported into the territory of the Russian Federation from the territory of the union state, no changes are introduced here (specifically for payers). In this case, the need to certify the information letter with a seal is established by the Tax Code of the Russian Federation. This fact is consistent with the new requirements, which necessitates the mandatory use of a stamp.

What did the abolition of stamps lead to, and for whom is it relevant?

The abolition of the organization's seal applies exclusively to companies with the form of ownership of JSC or LLC. It must be available to non-profit and government organizations. As for legal entities that have the opportunity not to use a seal, if they wish, they can carry out their activities using it. To do this, you just need to state this fact in the charter, and then the abolition of the company’s seal will not raise any questions. Until various departments and ministries give official clarifications, it is not recommended to destroy this document certification instrument. It is best to constantly certify a certain group of documents with a stamp to avoid the possibility of their rejection by the receiving service.

If you leave the seal

Since by law the organization has the right to use a seal, you can simply use the one that the company already has. But there are a couple of important points here. The law directly states that information about the presence of a seal must be reflected in the company's charter. Therefore, everyone who decides to continue to use the seal needs to open their charters and carefully review them. Most likely, you already have this item, since previously a round seal was mandatory for organizations. In this case, you will not have to change the charter; calmly continue to use the seal.

If your charter does not contain such a clause, then it must be included. This information is included in the constituent documents; accordingly, you need to bring the following to the tax office:

- Minutes of the meeting of founders (where the decision on the use of the seal and amendments to the charter is stated);

- New edition of the charter or amendments to it - two copies;

- Application for amendments (form No. P13001, you need to fill out the first section and sheet M);

- Payment of state duty for registration of changes.

It is not established by law how long it takes to put the company’s charter in order. Experts recommend not to delay this. If you affix a seal to documents, but there is still no information about it in the charter, the regulatory authorities may have unnecessary questions, because now the clause on the seal in the charter is the basis for its use when preparing documents.