Introductory information

A business trip entails many expenses for the employer, which must be reimbursed to the employee. To make and record payments, the accounting department must have supporting documents. Previously, these included a travel certificate, an official assignment and a report on its implementation. However, from January 8, 2015, when sending an employee on a business trip, the employer is not required to issue a travel certificate and official assignment, and the employee is not required to issue a report on the completion of the assignment. As a result, it turned out that there was only one mandatory document left - an order to send the employee on a business trip. This order simply needs to specify the purpose of the trip and its duration.

Nuances of document flow

In addition, from Resolution No. 749 (clauses 6 and 26) the requirements for drawing up a job assignment and a report on the work performed on a business trip, which was subject to agreement with the head of the employer’s structural unit, are excluded.

As a result, companies may refuse to use two documents for which a unified form was usually used, approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1:

- travel certificate in form No. T-10;

- official assignment for sending on a business trip and a report on its implementation in form No. T-10a.

However, the sending organization must still formalize in writing the employer’s decision to send an employee on a business trip, indicating its duration and official assignment (clause 3 of Resolution No. 749).

As a result, the term “official assignment”, presented in the Labor Code of the Russian Federation (Article 166), is reinforced, and the term “official assignment”, which essentially duplicates it, is abolished.

If the posted employee used personal transport for the trip, then forms No. T-10 and No. T-10a will be replaced by a memo. Formally, the deadline for its submission is not regulated by Resolution No. 749. However, it is obvious that it is an attachment to the advance report, which must still be submitted to the employer within 3 days upon return from a business trip. After all, the daily allowance will be determined on the basis of the memo.

Finally, let us recall that in paragraph 1 of Article 252 of the Tax Code of the Russian Federation, a business trip order is classified as documents indirectly confirming expenses incurred. Therefore, this is precisely the appropriate name for the employer’s decision to send an employee on a business trip. And since now form No. T-10a has no independent meaning, the official task (also known as “assignment”) can be described directly in such an order. As a result, the order (instruction) to send an employee(s) on a business trip using unified forms No. T-9 and No. T-9a will also have to be brought into line with the new edition of Resolution No. 749. Moreover, indicating the purpose of the trip in these forms has also lost its relevance .

It is noteworthy that in general, the employee’s consent to a business trip is not required. Details are in paragraph 14 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated January 28, 2014 No. 1 “On the application of legislation regulating the work of women, persons with family responsibilities and minors.” But it is necessary to bring the order on a business trip to the attention of the employee against signature (“I have read the order”).

However, on a voluntary basis, companies can maintain the documentation of business trips in the same form. This will not cause any adverse consequences.

But in general, it must be stated that document flow on business trips has become less regulated by the state. Which in itself makes me happy.

E.Yu. Dirkova

, for the magazine “Regulatory Acts for Accountants”

If you have a question, ask it here >>

The travel period will be confirmed by travel documents

The actual duration of an employee's stay on a business trip is now determined by the travel documents that the employee presents upon return. So, for example, if an employee flies on a business trip by plane, then the start and end dates of the business trip are confirmed by air tickets.

If the employee went on a business trip by personal transport, then upon returning he will need to draw up a memo and indicate in it the dates of departure and arrival. You will also need to attach supporting documents to it (for example, cash receipts for gasoline, parking receipts, etc.).

If an employee loses travel documents, the employer will need to additionally request proof of travel from the transport organization. It is no longer possible to determine the duration of a business trip using a travel certificate.

Documentation of travel expenses

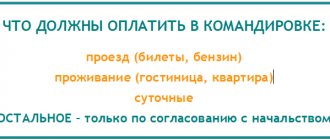

The Labor Code (Part 1 of Article 168 of the Labor Code of the Russian Federation) obliges the employer to compensate the posted worker, among other things:

- travel expenses;

- housing rental costs;

- daily allowance.

If, from January 8, 2015, you refuse to issue travel certificates and official assignments, then there will be no problems with the “exemption” of designated travel expenses from personal income tax and insurance contributions. It will also be possible to recognize expenses when calculating income tax. Let us explain in more detail.

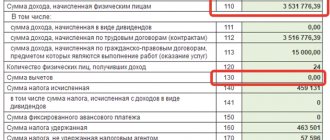

Personal income tax

Travel expenses are not subject to personal income tax provided they are documented (paragraph 10, paragraph 3, article 217 of the Tax Code of the Russian Federation). But if there are no supporting documents, then personal income tax must be calculated. This approach was expressed, for example, in the letter of the Ministry of Finance of Russia dated 02/05/10 No. 03-03-05/18 (see “The Ministry of Finance explained what documents can be used to confirm travel expenses to the place of business trip if the travel ticket is lost”).

At the same time, there is no direct requirement in the Tax Code to have a travel certificate to exempt travel expenses from personal income tax. Therefore, even before the cancellation of travel certificates, judges came to the conclusion that the absence of a certificate is not a basis for additional tax assessment (resolution of the Ninth Arbitration Court of Appeal dated November 23, 2010 No. 09AP-27072/2010). Consequently, if you refuse travel certificates now, after they have been cancelled, then there will be no risks in relation to personal income tax.

Insurance premiums

Travel expenses, in particular daily allowances, as well as actually incurred and documented expenses for travel and rental of living quarters are not subject to insurance contributions (Part 2, Article 9 of the Federal Law of July 24, 2009 No. 212-FZ). That is, one of the conditions for exemption from contributions is also documentary evidence.

Note that previously (until January 8, 2015) the travel certificate was an attachment to the advance report (clause 26 of the “Regulations on business trips”, approved by Decree of the Government of the Russian Federation dated October 13, 2008 No. 749). And in the absence of this application, officials insisted that insurance premiums should be charged (letter of Rostrud dated 10/07/13 No. 17-4/1647; see “The Ministry of Labor reminded what documents need to be drawn up during a business trip in order not to pay from payments to the business traveler employee insurance premiums").

However, now the travel certificate has been cancelled. Therefore, if it is not attached to the expense report, then there will be no violation. Accordingly, there will be no grounds for additional assessment of contributions.

Income tax

As a general rule, expenses of an organization associated with sending an employee on a business trip for the purpose of calculating income tax are recognized as part of other expenses associated with production and sales on the date of approval of the advance report (clause 12, clause 1, article 264, clause 5 clause 7 article 272 of the Tax Code of the Russian Federation).

For profit tax purposes, expenses are recognized as documented expenses (Clause 1, Article 252 of the Tax Code of the Russian Federation). Costs that are documented in accordance with the legislation of the Russian Federation are considered documented.

As in the situation with insurance premiums, the official authorities previously believed: if you do not attach a travel certificate to the advance report, then the costs cannot be included as expenses (for example, letter of the Federal Tax Service of Russia dated November 25, 2009 No. MN-22-3/890). But since the travel permit has now been cancelled, this approach is in principle impossible.

Also, business trip costs must be economically justified and aimed at generating income (Clause 1, Article 252 of the Tax Code of the Russian Federation). And if the purpose of a business trip (which is indicated in the order) is related to the implementation of activities aimed at generating income, then the costs of such a business trip should be recognized as economically justified. Moreover, tax officials have previously expressed that the production nature of a business trip is confirmed not only by a travel certificate, but also by an order to send on a business trip, since these documents, in fact, have the same purpose (letter of the Federal Tax Service of the Russian Federation for Moscow dated March 28, 2006 No. 20-12/25181). That is, there should be no problems in this part either.

Was your travel permit canceled or not?

As of January 8, 2015, as a general rule, drawing up a travel certificate is no longer required (Resolution of the Government of the Russian Federation dated December 29, 2014 N 1595). Taking this into account, the question of whether a travel permit is needed in 2016 should be answered in the negative.

Free legal consultation

We will answer your question in 5 minutes!

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

Ask a Question

According to Article 22 of the Labor Code, the employer also has the right to independently develop the enterprise’s personal identification document, including regulations on business trips, which may provide for the preparation of certificates in the recommended T-10 form or in its own sample. At the same time, it remains mandatory for employees to prepare expense reports in order to confirm expenses incurred and submit primary documents on expenses (invoices, checks, receipts, tickets, etc.).

Despite the fact that the travel permit has been canceled in 2022, control authorities do not recommend that enterprises rush to abandon their use. And here are the reasons. This document (along with the expense report) was necessary, first of all, to confirm the validity of the expenses incurred. Indeed, according to Article 252 of the Tax Code, the taxpayer has the right to legally reduce the income received for expenses, provided that they are justified and documented.

If we are talking about business trips, then the costs include both daily allowance and payment for travel, accommodation and other expenses associated with the trip. The main source document for confirmation remains the expense report. However, in the absence of a certificate, you will need to attach to it indirectly confirming the fact of the trip - an order from the head on a business trip and travel cards (clause 2 of Article 252 of the Tax Code). The actual period of stay of a specialist on a trip is confirmed on the basis of travel documents, and if they are lost, by documents on rental housing (clause 7 of Resolution No. 749). In the absence of hotel documentation, a memo or other document with notes from the host party will be required.

You can continue to issue travel certificates

The employer, in principle, can continue to issue travel certificates and official assignments (for example, for its internal purposes and accounting). There is no ban on this. However, in this case, the travel certificate will no longer be a document confirming the business trip. And it cannot be considered a document that in itself, without other documents (order, tickets), confirms business trip expenses and gives the right to exempt payments to the posted employee from personal income tax and contributions.

Mandatory documents

According to current laws, registration of a business trip begins with management making an appropriate decision and documenting it in the form of an order containing the following mandatory items:

- The name of the document, its number and date of publication.

- Name of the enterprise that issued the document.

- Personal data of the traveler, his position.

- Destination of a business trip.

- Start date and duration of the business trip.

- Purpose of the trip, official assignment.

- The traveler’s method of travel (personal, official or public transport).

- Identification of the person or organization bearing the travel expenses.

This is also important to know:

How to write an explanatory note: sample, types and forms of explanatory notes

The next required document is the employee’s advance report on the funds spent. Within three days from the end of the business trip, the employee is required to submit a report to the organization paying for the business trip, accompanied by documents confirming the business trip.

How can an employer register the refusal of travel permits?

As a general rule, the procedure and amount of reimbursement of travel expenses are determined by the employer’s internal documents or a collective agreement (Part 4 of Article 168 of the Labor Code of the Russian Federation). Therefore, quite often, for these purposes, employers approve the “Regulations on Business Travel”. If the company decides to abandon the use of travel certificates, then the appropriate changes will need to be made to this document and familiarized with it to employees. For this, in particular, you will need:

- exclude mention of travel certificates and official assignments in the document;

- stipulate that the duration and purpose of the business trip are determined by the order sending the employee on a business trip;

- stipulate that if an employee travels by personal transport, upon returning from a business trip he must submit a memo and supporting documents.

We also note that information about the departure of an employee on a business trip is reflected in a special journal (clause 1 of the Procedure for recording employees leaving on business trips from the sending organization and arriving at the organization to which they are sent, approved by order of the Ministry of Health and Social Development of Russia dated September 11, 2009 No. 739n). This journal has a special column in which the date and number of the travel certificate were previously indicated. However, now you don’t have to do this (for example, you can put a dash or not write anything at all). And there will be no violation in this.

We confirm a business trip in the absence of a travel certificate

As we noted, the advance report confirmed the business trip as a fact of economic life in tax accounting. However, he himself could be rejected in whole or in part in the absence of proper supporting documents. Let us recall that previously these included:

- duly issued travel certificate;

- documents on the rental of residential premises (tenancy agreement, payment receipts, cash receipts, etc.);

- documents on actual travel expenses (tickets, insurance for compulsory personal insurance of passengers on transport, receipts for payment for services for issuing travel documents, etc.);

- documents on other expenses related to the business trip (for example, sales and cash receipts for entertainment expenses).

The form of the travel certificate made it possible to use it to obtain a fairly large amount of information. If we look at it more carefully, then, in fact, it was a universal document that allows you to establish:

- where the employee was sent (organization or locality);

- for what purpose;

- for how many days he was sent on a business trip;

- when you actually left the location of the organization, when you arrived at the place of business trip;

- whether the employee interacted with the persons to whom he was assigned.

Thus, the travel certificate made it possible to establish a whole range of facts - starting from the business trip itself (whether it actually took place) and ending with the dates of the employee’s stay at the place of business trip. Among other things, this document confirmed with a high degree of reliability another important point for the organization: whether the employer’s actions were aimed at achieving statutory goals, i.e. whether they are economically feasible for the organization.

By the way, the lack of economic feasibility has recently become one of the favorite arguments of tax authorities when refusing to accept certain expenses for tax accounting. What to hide, the management and beneficiaries of the company are always tempted to use the organization’s money for their own purposes. For example, instead of going on vacation, take a business trip and fly to warmer climes without spending a penny on it from your own pocket.

The need to affix the seal of the organizations visited by the traveler on the travel certificate was one of its goals precisely to combat the non-productive nature of trips. Therefore, it is quite possible to imagine a situation where, in the absence of a travel certificate, the inspector will exclude from the company’s expenses the money spent by the general director on the flight to Sochi, arguing that the company has no counterparties in this city.

One can argue a lot about the legality of a number of requirements of the tax inspectorate, but one must understand that a conflict with inspectors can arise literally out of the blue. And practice shows that the cost of supporting a dispute can be much higher than the efforts that were required to avoid it.

This can happen with business trips. It is necessary to clearly understand that the cancellation of one of the mandatory documents in no way affects the requirements for the advance report as a tax accounting document. In any case, supporting documents must be attached to it, and the same facts must be confirmed with such documents as before.