Hello. In this article we will talk about what markdown is and why it is necessary.

Today you will learn:

- For what purpose do they use markdowns?

- How is the markdown procedure carried out?

- What is accounting and tax accounting for markdown of commercial products.

What is product markdown

When visiting any large store, you can see counters on which discounted products are placed. But what does markdown mean?

It is necessary to take into account that markdown of goods is a procedure in which the cost of commercial products is reduced.

At the same time, buyers are fully confident that this is a completely simple procedure for the manufacturer. But what could be simpler than reducing the cost?

In fact, not everything is as simple as it seems from the buyer’s side. Markdown is a complex procedure that requires documentation taking into account generally accepted requirements.

It turns out that the manufacturer simply cannot change the price of commercial products, since it is necessary to follow a special markdown procedure.

Revaluation of fixed assets. Examples of revaluation and depreciation

Example of revaluation of an object of fixed assets (revaluation):

Fixed asset with an initial cost of 20,000 rubles. Depreciation on it was calculated at 4,000 rubles.

As a result of the market analysis, the current average market price for this OS was identified, which amounted to 25,000 rubles. That is, the cost increased by 5,000 rubles.

Let's recalculate depreciation:

Wear rate = 4000*100% / 20000 = 20%.

A = 25,000 * 20% / 100% = 5,000 rubles. That is, the cost of depreciation increased by 1000.

Postings for revaluation of fixed assets:

| Sum | Debit | Credit | Operation name |

| 5000 | 01 | 83 | OS revaluation |

| 1000 | 83 | 02 | Overestimation of accrued depreciation |

Example of revaluation of fixed assets (depreciation):

Fixed asset with an initial cost of 20,000.

The amount of accrued depreciation is 4000.

The average market price for similar OS is 16,000 (decreased by 4,000 rubles).

Wear rate = 4000*100% / 20000 = 20%.

Depreciation as a result of revaluation: 16,000 * 20% / 100% = 3,200 (decreased by 800).

Postings for depreciation of fixed assets:

| Sum | Debit | Credit | Operation name |

| 4000 | 91/2 | 01 | OS markdown |

| 800 | 02 | 91/1 | Markdown of accrued depreciation |

At the end of the topic, I would like to note that all changes that arose as a result of the revaluation of fixed assets must be entered into the inventory card of the object.

We continue to study the topic of fixed assets; in the next article we will analyze what an inventory of fixed assets and conservation of fixed assets are.

| Download sample forms for accounting for fixed assets at an enterprise: Form OS-1. Filling out the act of acceptance and transfer of fixed assets Form OS-1a. Filling out the building acceptance certificate Form OS-2. Invoice for internal movement of fixed assetsForm OS-3. Certificate of acceptance and delivery of OS after repairForm OS-4. We fill out the act on write-off of fixed assets Form OS-4A. Vehicle write-off act Form OS-6. Inventory card Form OS-6B. Inventory book Form OS-14. Equipment acceptance and transfer certificate Form OS-15. Certificate of acceptance and transfer of equipment for installation Form OS-16. Defective act Order to write off fixed assets Disposal of fixed assets (entries, examples) Accounting for lease of fixed assets (entries, examples) Accounting for receipt of fixed assets (documents, postings) |

When is a product marked down?

You cannot simply reduce the price of a product, since there are a number of reasons for this.

Let's note the most common ones:

- When demand decreases;

- Obsolescence of commercial products;

- When market value decreases;

- Partial loss of presentation;

- Expiration date.

In practice, the store reduces the price of the product only if the expiration date expires. To attract the buyer, he places the product in the center of the hall on a special counter. At the same time, a special bright price tag is made, which is sure to attract the buyer’s attention and he will pay attention to the discounted product.

Well, don’t forget about well-known promotions, when in the center of the trading floor a representative of a store or shopping center offers to purchase one product and get a second one at a reduced cost.

Few people think that a product at a reduced cost is a discounted product that sells beautifully. Buyers can, even without paying attention to expiration dates and appearance, “sweep” products off the shelf.

As for the partial loss of presentation, in most cases this is torn packaging. This often happens when loading and unloading goods.

It should be taken into account that both sales representatives and non-trade organizations can carry out markdowns. The main mission of cost reduction is to sell goods at a reduced price in order to make a profit and reduce costs.

As a result of this procedure, goods are sometimes sold at a price lower than the purchase price.

Which items can be returned?

Discounted goods must be returned on absolutely legal grounds. The buyer’s request must be satisfied if the following conditions are met:

- the product does not belong to the food category;

- the item is absolutely new, without signs of wear or defects, with all consumer properties retained;

- Products can be returned to the store within the first 14 days after purchase;

- the presentation is fully preserved: factory labels, packaging box, spare parts, if they were included with the product;

- there is a receipt for payment or any other document that replaces it (the law does not prohibit referring to the testimony of witnesses).

Subject to the above conditions, the seller has no right to refuse to accept the item back.

Is it possible to return an item after starting to use it?

If defects in the discounted product appear over a short period, the buyer must submit a defect claim to the point of sale, which sets out the essence of the defect, as well as his legal requirements.

In accordance with the law, they can be as follows:

- replacing the product with the same or another one with recalculation of the cost;

- reduction in the cost of the purchased item;

- free repairs or reimbursement of the price for eliminating defects;

- refund to the buyer of the full cost of the goods.

In addition, the buyer can count on moral compensation if it is fully justified.

If the consumer requires the product to be repaired, but the seller takes too long to do it, or the use of the product due to the repair is still difficult and it needs to be repaired too often, the product must be returned. But since the item has been discounted, you can only count on a refund of the amount paid at the time of purchase. When exchanging a product for a similar one, even if it is already more expensive, the exchange occurs without additional payment. But if you choose another product, the buyer must pay extra or demand part of the amount back.

When returning a defective product, the seller must properly document the procedure. He is obliged to draw up a report stating that the buyer has addressed the defects identified during operation and describe them. To return the goods to the manufacturer, a delivery note is issued indicating the reason for the return, the price per unit of the goods, the consumer's receipt number, and the date.

When the money is returned to the buyer, a statement is drawn up stating that the buyer received it back and the goods were returned to the store.

When returning an item, it is re-evaluated. The store is obliged to exchange the item for a similar one or any other with a recalculation of the price, and if a request for a refund of the amount paid is required, return it within three days.

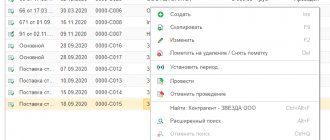

The procedure for marking down goods

If you need to mark down an item, do not worry, as this is a simple procedure that requires attention and adherence to generally accepted rules.

Let's look at how to properly reduce the cost of a necessary product:

- Drawing up an order.

Before starting the cost reduction procedure, it is necessary to prepare a document that establishes the requirements and features of a specific markdown. In practice, the manager is obliged to prepare an order and convey it to employees, who only after this can take a number of measures aimed at reducing the price of a particular product.

Also, do not forget that according to the order, a material person is established who will be responsible for the entire markdown procedure. Such an employee must not only familiarize himself with the order, but also receive it with his personal signature.

- Inventory.

This is the very first and, perhaps, main thing to start with. You must clearly understand how many units of products are in the warehouse and in the shopping center.

Be prepared to draw up a special act in which you need to indicate:

- Name of product;

- Total amount;

- Article number of each product;

- Characteristics;

- Reason for markdown.

At the end of the document, you should summarize the results according to which you can understand how many units of product and for what reason need to be sold as quickly as possible at a reduced cost.

- Determination of market value.

Before marking down goods, it is necessary to determine the real cost of each unit of production. It’s worth noting right away that the procedure for determining market value is not regulated in any way. If you have a large company, it is also worth considering that this is not the responsibility of an accountant.

To determine the market value, a special commission is created, which includes:

- Experts in the quality of this type of product;

- Sales specialists;

- Company employees who can inspect the goods and estimate the possible cost of its sale.

All results of the work are recorded in a special act in the form MX-15. A document of this form can be easily found on the World Wide Web.

Markdown in accounting

New prices for goods can be reflected in accounting in different ways: it all depends on the method of valuing goods adopted in the policy of a particular retail outlet.

Accounting for goods at their acquisition prices (purchase prices)

This accounting method is used by both retail outlets and wholesale organizations.

- If the price of a product is reduced by an amount within the trading margin, there is no need to reflect this in accounting at all.

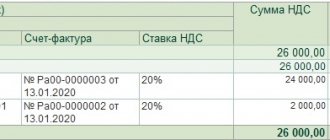

FOR EXAMPLE. The Home Everything store purchased the 10th batch of tablecloths (25 pieces) at a price of 200 rubles. per piece, putting them on sale for 350 rubles. (VAT included). 20 tablecloths were sold at this price, the rest were left in the store. Based on the results of the inventory, it was decided to discount the tablecloths by putting a price tag of 300 rubles on them. 3 more tablecloths were sold. What should the store accountant write down in the journal entries? Entries will vary in time.

In the month of delivery of a batch of tablecloths:

- debit 41, credit 60 – 5,000 rub. (25 pcs. x 200 rub.) – posting of a batch of tablecloths;

- debit 50, credit 90, subaccount “Revenue” – 7,000 rubles. (350 rub. x 20 pcs.) – proceeds from the sale of tablecloths;

- debit 90, subaccount “Cost of sales”, credit 41 – 4,000 rubles. (200 rub. x 20 pcs.) – write-off of the cost of tablecloths sold;

- debit 90 subaccount “VAT”, credit 68 subaccount “Calculations for VAT” - accrual of VAT on goods sold.

In the month of sale of discounted tablecloths:

- debit 50, credit 90, subaccount “Revenue” – 900 rubles. (300 rub. x 3 pcs.) - reflection of revenue from the sale of tablecloths at a new price;

- debit 90 subaccount “Cost of sales”, credit 41 – 600 rub. (200 rub. x 3 pcs.) – write-off of the purchase price of sold tablecloths;

- debit 90 subaccount “VAT”, credit 68 subaccount “Calculations for VAT” - accrual of VAT on goods sold.

- If the amount of the markdown is greater than the trade margin, you cannot change the original discount prices, otherwise you will end up selling at a loss. In this case, the company must have a special reserve for markdowns, which is reflected in accounting as follows: debit 91 subaccount “Other expenses”, credit 14 - creating a reserve for reducing the cost of goods.

ATTENTION! This reserve is created for each unit of inventory according to accounting.

Then amounts from the reserve are written off as goods are sold: debit 14, credit 91 “Other expenses”.

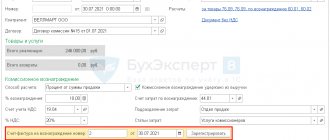

Goods accounted for at sales prices

At the selling price, goods are taken into account, as a rule, in retail trade, separately highlighting trade markups.

- If the amount of the markdown falls within the markup limit, the accountant must make a reversing entry: debit 41, correspondence with the credit of account 42 “Trade margin”.

FOR EXAMPLE. Let’s take as a basis the previous example with the “Everything for the Home” store and discounted tablecloths, changing the accounting conditions: let the store keep records at sales prices, not purchase prices. In this case, the accounting entries will look like this:

In the month of delivery of a batch of tablecloths:

In the month of sale of discounted tablecloths:

- debit 41, credit 42 – 1000 rub. (350 rub./piece - 300 rub./piece) x 20 pieces) – the trade margin on the discounted tablecloths remaining for sale has been reversed;

- debit 50, credit 90, subaccount “Revenue” – 900 rubles. (300 rub. x 3 pcs.) - reflection of revenue from the sale of tablecloths at a new price;

- debit 90 subaccount “Cost of sales”, credit 41 – 900 rub. (200 rub. x 3 pcs.) – write-off of the sales value of sold tablecloths;

- debit 90 subaccount “Cost of sales”, credit 42 – 300 rub. ((300 rub./pc. – 200 rub./pc.) x 3 pcs.) – reduced (trade margin on sold discounted tablecloths reversed.

- debit 90 subaccount “VAT”, credit 68 subaccount “Calculations for VAT” - accrual of VAT on goods sold.

RESULT. If the goods, although they were discounted, were sold above cost, the organization makes a profit. If the markdown turned out to be greater than the cost, the sale turned out to be a loss. Both financial results are recognized in tax accounting based on the results of the reporting period (clause 2 of Article 268 of the Tax Code of the Russian Federation).

IMPORTANT! If the price deviation exceeds a fifth of those accepted on the market, then additional taxes may be assessed during control.

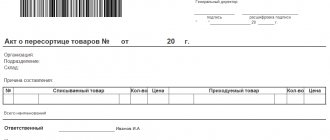

What is a markdown act

A markdown act is a document that records a reduction in the price of commercial products for various reasons.

The approved form contains three pages.

The first is the title page. In this case, you will need to fully indicate the name of the organization and indicate the reason as a result of which the decision was made to sell products at a reduced cost. The main thing is to leave a column on the title page for approval of the markdown act by the head of the company.

On the second and third pages you will need to indicate the characteristics of the product.

Be prepared to note:

- Markdown percentage;

- Cost before and after markdown;

- Difference in cost;

- Reason for cost reduction.

You will also need to provide a detailed description of the appearance of the product. The document is drawn up exclusively in the presence of the assembled commission. Once completed, everyone must sign the completed document.

What is refurbished equipment?

Many people think that this is non-working equipment, used equipment, and some don’t even know what it is! And all this is due to the fact that the “Refurbished” direction is not so developed in Russia.

A product always undergoes a number of checks and tests before going on sale, but in any production you cannot do without defects! And despite quality control, it happens that some models are rejected. This is discovered both during production and after the buyer purchases the product. These models are delivered to the official Ross&Moor service center. After which the old scheme operates, checking and testing the product, restoring it to its original condition and launching it for sale, marked “Refurbished” (refurbished) and, as a result, at a reduced price.

Updated equipment undergoes much more testing than new equipment, so to some extent it can be called even more reliable!

What is the warranty for refurbished equipment?

We provide a limited warranty on refurbished devices - two weeks from the date of purchase.

What is the warranty for spare parts?

We provide a limited warranty on parts - one week from the date of purchase.

Is it worth buying refurbished tablets and smartphones?

Refurbished products are a great way to save money while purchasing a quality product. After all, as a rule, restored electronics do not have any internal or external differences from their “brothers”. Typically, such a product has been updated, modified, modified, repaired, or even simply repackaged.

Therefore, this is the choice of advanced consumers who “know how to count” their money!

The procedure for drawing up a markdown act on goods

The markdown act is the main document that must be drawn up correctly. Let's consider what needs to be taken into account when drawing up the document.

It is worth taking into account that the document is drawn up in two copies.

You will need to attach an inventory document to the first act and submit it to the accounting department.

The second copy of the document remains in the hands of the financially responsible person who is entrusted with the responsibility for carrying out this procedure.

Particular attention should be paid to filling out sections of the act.

In addition to the product data, you will need to indicate:

- Full name of the organization;

- Legal and actual address;

- Full details.

Only after all the documentation will be compiled and marked down.

Employees of the sales floor can change the price tags for discounted goods and offer customers to purchase them at a reduced cost. On the contrary, it is absolutely forbidden to do so!

Procedure for revaluation of inventories

For revaluation you need:

- decision (order, instruction) of the director;

- inventory - based on its results, an inventory list-act is drawn up (instruction of the USSR Ministry of Finance No. 75 and the USSR State Committee for Prices No. 10-17/1500-25 dated 05/05/1986);

How to conduct an inventory and reflect it in accounting, read the articles:

- “Inventory of inventories”;

- “Reflection of inventory results in accounting.”

What nuances need to be taken into account when drawing up an accounting policy, read the article “PBU 1/2008 “Accounting Policy of an Organization” (nuances).”

MIR LLC is an organization engaged in the sale of televisions.

In its sales area, MIR LLC displays samples of the goods it sells. Additional costs appear (installation costs, installation costs, etc.), which increase the cost of the goods on display.

MIR LLC takes these goods into account. 41, but the storage location is indicated not as a warehouse, but as a sales area.

As a result of using the product in the hall, its original qualities will most likely be lost. In accounting, a reserve is recognized for reducing the value of inventories.

Dt 44 Kt 60 (76) - expenses (installation, etc.).

Dt 19 Kt 60 (76) - VAT on expenses is taken into account.

Dt 68 Kt 19 - VAT is accepted for deduction.

Dt 91.2 Kt 14 - a reserve created for the depreciation of the value of goods in the hall.

Dt 14 Kt 91.1 - when selling or otherwise disposing of goods, the created reserve is included in the financial result.

Zvezda LLC purchased materials at the beginning of the year. The accountant reflected them on the account. 10. At the end of the year, before balancing the balance, an inventory was carried out. As a result, it was revealed that the TRS decreased, and the director decided to create a reserve for the difference between the purchase price and the TRS.

In the annual balance sheet, the cost of materials will be reflected minus the reserve.

Let’s assume that in the next reporting period the TPC has increased, then we need to again calculate the difference between the purchase price of materials and the TPC. But in this case, we subtract the second year reserve from the first year’s reserve and make a posting for this amount Dt 14 Kt 91.1.

In the balance sheet, the cost of materials will be taken into account as the difference between the purchase amount and the amount remaining on Kt 14.

If in the future the selling price of unused materials increases, the accountant has the right to overestimate them, but not higher than the original value, since overestimation of the value of current assets is not allowed.

In tax accounting, we do not have the opportunity to create such reserves. But we can take into account the costs of markdowns in advertising costs (non-standardized), for example. This must satisfy the requirements of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation (clause 4 of Article 264 of the Tax Code of the Russian Federation).

Unliquid goods and how to work with them

In order not to solve the problem of how to sell off an illiquid product, it is much easier to prevent its appearance, but not all companies succeed in this, especially those that are new to the market. Preventive measures will help prevent the appearance of illiquid items in warehouses, which include:

- Well-established accounting and timely transfer of information between departments. To implement this point, it is necessary to establish primary accounting and develop a convenient reporting form for receipts, sales and balances of goods. Accounting automation will allow you to avoid the influence of the human factor.

- Reducing product inventories in the warehouse. To do this, it is necessary to conduct an analysis and determine which goods may fall into the category of illiquid items, assess their availability and compare the volumes with the income received from the sale of this item. If the projected profit is minimal, products can be taken out of the warehouse program.

- Determination of the optimal purchase batch. The smaller it is, the less likely it is that illiquid items will appear; however, too small a batch will lead to increased delivery costs, so the optimal purchase size is calculated using a special methodology.

- The correct layout of slow-moving goods on the shelves helps to minimize non-liquid stock. The secret of the display comes down to the fact that stale goods should be displayed in the first row on shelves located at eye level. In addition, discounted products should be placed next to expensive ones. The price difference will be an additional incentive to purchase.

To solve management problems and increase liquidity, you can turn to the services of consulting companies, one of which is Upgrade Capital, which has many years of practical experience in providing services in the field of inventory management.

We are approached not only by newcomers, but also by large companies who want to take the company’s work to a new level. We provide an individual approach to each individual enterprise or trade organization and undertake the provision of consulting and outsourcing services. Our specialists are engaged in the implementation of retail analytics, automation of accounting in the trade sector, and inventory management to prevent the emergence of illiquid positions.

Upgrade Capital's goal is to offer the most effective ways to solve problems without disrupting business processes.

They trust us. We give results.

Return of discounted goods

A product may be marked down due to some defect. Naturally, the seller must notify the buyer about this. As a result, the consumer makes a conscious purchase of a product of inadequate quality. Such a choice may slightly limit his right to exchange, but not cancel it.

Since the list of defects that affected the final cost of the product must be documented.

Accordingly, the buyer's claims specified in this document are not subsequently considered. However, the consumer can contact the seller on other grounds that were not previously agreed upon by the parties to the transaction (Article 18 of the Law).

The interested party may, at his discretion, demand:

- replacing the product with similar products;

- replacing the product with a product of a different brand;

- additional cost reduction;

- elimination of identified defects at the expense of the seller;

- compensation of expenses if the buyer independently eliminated the defects.

Also, the consumer may refuse to fulfill the terms of the sales contract and insist on the return of the money paid . If in the process of purchasing a defective product the buyer suffered additional losses, then he has the right to demand full compensation. As a result of purchasing a technologically complex product, the consumer may refuse it, or require a replacement of the product with a simultaneous recalculation of its cost. He is given 15 days to submit a written complaint.

Otherwise, the buyer’s requirements are subject to satisfaction only if the following factors are present:

- Significant shortcomings have been identified in the product.

- The seller violated the statutory deadlines for eliminating defects.

- The product cannot be used for more than 30 days within one calendar year due to the need to systematically repair the equipment.

If the seller, upon receipt of the goods, checks the quality of the product, then the buyer has the right to be present at this procedure. If there is a dispute about the causes of a defect, the examination is carried out at the expense of the store. If the buyer does not agree with the results of the examination, he can appeal it in court.

However, the consumer must compensate the seller for losses associated with the examination if it is determined that the defects in the goods did not arise through the fault of the store (manufacturer). Separately, it is worth recalling that the law provides for administrative liability for sellers for the sale of low-quality products (Article 14.4 of the Administrative Code). The law also establishes liability for delay in fulfilling the buyer’s requirements (Article 23 of the Law).

Another type of markdown is the offer of additional goods to the main product. In this case, the cost of the second commodity unit is usually zero or a symbolic fee (1 ruble). Based on the provisions of civil law, a gift is part of a set of goods (Article 479 of the Civil Code). Therefore, if this part turns out to be defective, the buyer may demand a reduction in price or gratuitous elimination of identified defects (Article 475 of the Civil Code). If the defects were eliminated at the expense of the buyer, the seller is obliged to reimburse the expenses incurred by him.

Is it possible to?

An analysis of regulations shows that the buyer has the right to exchange or return the purchased product. The procedure for the exchange of quality products is established by Article 25 of the Law. As for the exchange or return of defective products, the exercise of consumer rights occurs on the basis of Article 18 of the Law.

In this case, it may be that the product was purchased during the sale period, and the exchange will be made after its completion. In this case, the buyer should not make an additional payment for the difference in the cost of the product (Article 24 of the Law). However, if the consumer wishes to exchange the product for a product of another brand, then in the event of a price difference, he must make an additional payment in favor of the seller.

If there is a question about a proportionate reduction in the cost of products, then its recalculation should occur at the time of filing the claim.

If a low-quality product was purchased using a consumer loan, then the seller must compensate the buyer not only for the amount of money paid for it, but also reimburse the interest actually paid.

Exceptions to the rule

As already mentioned, the main exception to the exchange of defective products is proper notification of the buyer about the list of defects of the product being sold.

Consequently, the buyer will not be able to replace such a product if he knew about the problem in advance.

In the case of goods of proper quality, the law does not establish any exceptions.

Exchange

Exchange of goods is carried out exclusively in the presence of the buyer. At the same time, the cash register receipt, which is the basis for the exchange, must contain the resolution of the store director.

The consumer is obliged to check the availability of all documents and ensure the integrity and functionality of the provided product.

If there are no additional comments, then it is considered that the seller has fulfilled his obligations.