Definition of finished products and goods

Finished products mean the final product of the production cycle - products intended for further sale. Finished products are accounted for at actual cost. The formation of the costs themselves is determined by the organization independently, taking into account the costs incurred in the manufacture of a certain type of product.

The expenses that form the cost of finished products may include materials spent, part of the services provided by third parties, labor costs and the transfer of insurance premiums in favor of personnel directly involved in production.

Goods are understood as material assets purchased by an enterprise for the purpose of further sale. The cost of goods consists of the costs of their purchase, delivery, customs duties, non-refundable taxes, sorting costs, installation costs and other costs. When carrying out retail trade, it is allowed to evaluate goods at their selling price.

Goods and finished products represent the organization's inventories (MPS)

Subaccounts

The following subaccounts can be opened for account 45:

- 45.01, reflecting the cost of shipped goods, revenue for which will be received after a certain period of time. Most often, this subaccount is used to account for products for export;

- Transportation of most goods requires additional costs to ensure safety - packaging, containers and other specific means, depending on the type of product. Costs for the purchase or production of packaging materials are reflected in subaccount 45.02;

- There are cases when the recipient bears part of the costs of delivering the products. This information is reflected in subaccount 45.03;

- Most large companies insure their cargo and inventory items for shipment. Consequently, there is a need to pay insurance premiums to third parties. To take into account the movement of insurance premiums, a subaccount 45.04 is opened;

- subaccount 45.05 reflects the cost of inventory items transferred to the commission. The information recorded in this section is relevant until the moment of settlement by the counterparties. Afterwards, the balance of the subaccount is written off to the debit part of account 90 “Sales”.

The composition and number of sub-accounts are determined by the specific accounting policies of a particular enterprise. In addition to those listed, an accountant can open other second-tier accounts.

What are shipped goods?

Accounting generates data on shipped goods and products, which may also include work, services, semi-finished products, materials, and farmed animals. The data is generated on account 45. The need for its appearance is due to the following reasons:

- If there are contracts that stipulate special conditions for the transfer of ownership of products, for example, after payment has been made.

- For intermediary transactions (agency agreements, commissions).

- In goods exchange relations, if the counter goods have not arrived.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |

In what cases is count 45 used (brief description of the count)

Account 45 - Goods shipped - is used if goods are sold with a delay in the transfer of ownership, for example, when exporting products, barter exchange, transferring goods to a commission agent (intermediary, agent) for sale for a commission and under similar agreements.

Until the special conditions of the contract are met, the goods continue to belong to the seller. Hereinafter, the word “goods” should be understood as any transferred property: goods, products, semi-finished products, materials, farmed animals, works, services.

Revenue from such transfer of goods cannot be recognized until a number of conditions specified in the contract are met, for example: when selling for export - until supporting documents are received from the buyer; when transferring for sale on a commission - until the commission agent's report and payment are received goods sold by him.

Account 45 is the active account. In the seller's accounting, the debit of account 45 - Goods shipped - reflects the actual (production) cost and commercial expenses for the shipment/delivery of transferred goods. The loan is written off at cost when conditions are met to reflect actual sales.

The debit balance on account 45 represents the balance of goods shipped but not sold at the end of the period and is included in line 1210 “Inventories” of the seller’s balance sheet.

In the buyer's accounting, these goods (products) are reflected in off-balance sheet accounts until the contract is executed.

Analytical accounting of the account is carried out for individual types of goods shipped and by their location (counterparties).

Sales of shipped goods

The guarantor of payment for the goods for the seller are the terms of the agreement on the transfer of ownership of the shipped valuables. As a rule, the moment of change of ownership occurs when the goods are shipped:

- delivery of goods to the buyer by the seller;

- transfer of valuables to a third-party carrier;

- transfer of goods directly to the seller.

In this case, the fact of sale is accompanied by accompanying documents, such as invoices.

Sometimes the contract includes special conditions on the basis of which the valuables become the full property of the buyer after payment is made. If the transfer of funds does not occur within the specified period, the goods should be returned to the seller. Also, in the event of a delay in payment, the seller has the right to either demand payment or expect the return of valuables.

Such conditions make it possible to qualify contracts as agreements with special conditions for the transfer of ownership of goods. The rights to the transferred valuables can be assigned to the seller until full payment is made. Moreover, at this time the buyer does not have the right to dispose of the received materials at his own discretion.

Postings to account 45 “Goods shipped”

The correspondence of accounts and the main transactions for account 45 are shown in the table below:

Get 267 video lessons on 1C for free:

- Free video tutorial on 1C Accounting 8.3 and 8.2;

- Tutorial on the new version of 1C ZUP 3.0;

- Good course on 1C Trade Management 11.

| Dt | CT | Wiring Description | A document base |

| 45 | 10 | Reflection of the shipment of goods to the buyer | M-15, Invoice |

| 45 | 11 | Sale/shipment of young animals to a procurement/other organization | SP-32, Receipts |

| 45 | 20/23/29 | Reflection of the cost of work performed/services rendered | TTN, Invoice |

| 45 | 21 | Reflection of the cost of semi-finished products sold to third parties (in-house production) | |

| 45 | 41/43 | Reflection of the cost of finished products/goods upon sale/transfer to commission | |

| 45 | 44 | Attribution of commercial expenses for shipped goods/distribution costs to the buyer’s account | Accounting information |

| 45 | 60 | Reflection of contractor/customer services for shipment (excluding VAT) | Invoice |

| 45 | 71 | Reflection of expenses of the reporting person for shipment (excluding VAT) | Advance report |

| 45 | 76 | Reflection of the services of organizations for the shipment of products (excluding VAT) | Invoice |

| 45 | 79 | Reflection of product shipment by internal division (independent balance sheet) | TTN, Invoice |

| 45 | 91 | Write-off of part of other expenses to the cost of shipped goods | Accounting information |

| 76 | 45 | Reflection of the amount of the claim (unreasonable refusal of the buyer to accept) | Claim, Invoice |

| 90 | 45 | Reflection of the fact of sale and payment of products (excluding VAT) | Bank statement, Accounting certificate |

| 91 | 45 | Paid purchased materials have been shipped to the recipient (excluding VAT) | |

| 94 | 45 | Write-off of shortages (identified during shipment) | INV-4, Accounting certificate |

| 99.05 | 45 | Write-off of damage/loss (natural disaster) | INV-4, Accounting certificate, Manager's order |

Shipped goods in accounting (account 45)

In accounting, shipped goods/products are reflected at planned cost, including taking into account sales costs, or actual cost.

In the financial statements, the cost of shipped goods is included in the “Inventories” section, where other finished products are also reflected.

In accounting, the seller's revenue after shipment of the goods is recognized after the transfer of ownership. Typically, the moment of revenue is fixed when the goods are shipped. For organizations maintaining simplified accounting, revenue appears after actual payment of valuables.

If the transfer of goods is accompanied by the presence of an agreement with special conditions for the transfer of ownership rights, then instead of revenue from the organization - the seller, there is an increase in accounts payable for goods shipped.

If subjects are VAT payers, there are 2 options for tax recognition. The tax base for VAT appears when one of the conditions occurs - shipment or payment of goods.

The following options for reflecting VAT are allowed in accounting:

- Dt 45 - Kt 68 - VAT is charged upon shipment of goods. But it is recommended to consolidate this method in the current accounting policy.

- Dt 76 - Kt 68 - deferred accrual of VAT upon shipment.

Dt 90 - Kt 76 - VAT is taken into account upon receipt of payment.

Operations with shipped goods in accounting

| Account debit | Account credit | Contents of operation |

| 45 | 41 | Shipment of valuables to the buyer at actual cost |

| 45 | 44 | Write-off of other expenses for goods shipped (transport) |

| 90 | 45 | Recognition of the moment of actual sale after payment |

| 45 | 68 | VAT accrual on goods shipped |

Example . The Parus organization sells goods in the amount of 47,200 rubles, including 18% VAT equal to 7,200 rubles. According to the terms of the contract, full rights to the goods are transferred to the buyer only after full payment. The cost of the goods was 30,000 rubles. The organization uses the accrual method. The accounting policy establishes the method for determining the taxable base for VAT after shipment of valuables.

Based on the results of the operation, the following entries will appear in the company’s accounting:

- Dt 45 - Kt 41 (30,000 rubles) - the cost of shipped goods is written off;

- Dt 45 (VAT) - Kt 68 (7,200 rubles) - VAT charged;

- Dt 51 - Kt 62 (47,200 rubles) - receipt of payment from the buyer;

- Dt 62 - Kt 90-1 (47,200 rubles) - revenue is recorded;

- Dt 90-3 - Kt 45 (VAT) - reflected the VAT presented to the buyer;

- Dt 90-2 - Kt 45 (30,000 rubles) - reflects the cost of shipped products;

- Dt 90-9 - Kt 99 (10,000 rubles) - financial result based on the results of the operation (profit received).

Example of invoice 45

Two companies entered into an agreement for the supply of goods at a cost of 60,000 rubles. The subsequent sale amount of the batch is 118,000 rubles, including VAT. VAT is equal to 18,000 rubles. The company's commission is 10%.

The supplier company's accountant makes the following entries:

- Debit 45 (45-01) – Credit 41 – cost of production 60,000 rubles;

- Debit 76 – Credit 68 (for the recipient – vice versa) – 18,000 rubles VAT;

- Debit 76 – Credit 90-01 – sales amount 118,000 rubles;

- Debit 44 – Credit 60 – 10% commission.

Shipped goods in tax accounting

Tax authorities and officials of the Ministry of Finance have different positions regarding the recognition of revenue for tax accounting purposes. The first believe that, according to the Tax Code of the Russian Federation, the moment of revenue for such contracts is the receipt of funds as payment. According to the Ministry of Finance, revenue appears during the shipment of materials with the provision of accompanying documents.

The position of judicial practice on this issue is also ambiguous. Therefore, the taxpayer will have to decide for himself whether to recognize revenue from transactions performed. It would also be useful to provide documentary evidence that the buyer does not have the right to dispose of the received values until the funds are transferred. Typically, such evidence is provided by concluded contracts. All this will help prevent the tax inspectorate from trying to classify transactions as an understatement of the tax base for profits if the moment of shipment of goods and payment for it takes place in different reporting periods.

Postings on account 45

Account 45 “Goods shipped” is intended for accounting for goods sold, the revenue for which is recognized later than the moment of shipment. Such situations are possible during export operations, under commission agreements or during transfer without registration of ownership.

Account 45 is active. The cost of goods recorded on the account consists of the actual cost and shipping costs. Accounting on this account is carried out in the context of location (storage) and objects.

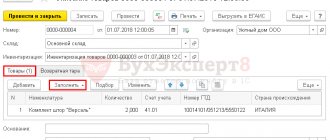

Fragment of the approved Chart of Accounts, Section 4, Finished products and goods

Postings for shipment of goods or products to the buyer

How is the shipment of goods reflected if payment is made later?

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 90.02 | 43, 41 | Finished products or goods have been shipped. The amount of cost depends on the method of estimating output | Cost of finished products | Sales Invoice |

| 62.01 | 90.01 | Reflection of revenue through the sale price of goods including VAT | Sales price of goods including VAT | Invoice, invoice |

| 90.03 | 68.2 | Volume of VAT on goods shipment | VAT amount | Invoice, invoice, Sales book |

| 51 | 62.01 | Reflection of debt repayment for shipped goods | Sales price of goods | Payment order or bank statement |

How is the shipment of goods reflected when the buyer prepays

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 51 | 62.02 | Reflection of crediting of prepayment for future shipment of goods | Prepayment amount | Payment order or bank statement |

| 76.AB | 68.02 | VAT accrual on prepayment amount | VAT amount | Invoice, Sales Book, Payment Order |

| 90.2 | 43, 41 | Posting for shipment of goods or products. Cost is calculated depending on the method of estimating production output | Product cost | Sales Invoice |

| 62.01 | 90.1 | Reflection of revenue through the sale price of goods including VAT | Sales price of finished goods including VAT | Invoice, invoice |

| 90.3 | 68.2 | Calculation of VAT amount on the volume of shipped goods | VAT amount | Invoice, invoice |

| 62.02 | 62.01 | Crediting advance payment against shipment | Prepayment amount | Accounting certificate-invoice |

| 68.02 | 76.AB | The amount of VAT is credited from the previously made prepayment | VAT amount | Invoice, Sales Book |

When shipping the goods, the seller must provide the buyer with a complete package of documents for correct acceptance of the values.

Accounting account 45 is an active account “Shipped Goods”, it is used to summarize information about the availability and movement of shipped products or goods, the revenue for which cannot be accounted for by the enterprise for some time, including for finished products transferred for sale to another organization for a commission.