Whatever the director is, “good” or “bad,” one way or another he pursues the goal of minimizing expenses on “unnecessary” things, in his opinion. Among the many offers that regularly come to his table, he would hardly be able to buy everything with the money that he has (and even the credits would not be enough). In this regard, he often has to think about the profitability of a particular event. It’s a pity, but often directors “flirt” with cutting costs and resort to not entirely legal methods of saving. One of our clients told a story about how in his organization the manager forbade the accountant to pay per diem to a business trip employee with the amendment that he would be reimbursed for food expenses based on the receipts provided. Actually, we were asked about how legal this is and how to avoid facing fines in the future. Not knowing the answer to this question at the very beginning, we tried to analyze the current legislation. Fortunately, the answer was found, and it turned out to be negative. True, no one heeded our advice, but that doesn’t matter anymore.

Today we will tell you how daily allowances differ from food expenses, whether the employer is obliged to compensate for them, what is generally meant by the concept of “travel allowances” and what is the best way to proceed in a situation where an employee needs to be sent to perform his official duties outside the city of his permanent residence.

What exactly is the difference?

Let's start with the fact that compensation for food expenses is the actual reimbursement by the employer of the money that was spent by the employee on the purchase of one or another food industry product for personal needs. From the point of view of labor legislation, the employer will be obliged to reimburse funds in this regard only if a corresponding agreement was previously concluded between him and the employee, and in writing. They could have agreed verbally, but we will not consider this case now. Daily allowances are payments separate from wages, which in theory should compensate the employee for all the inconveniences associated with his actual residence during a business trip in another city or country. The company is obliged, in accordance with the requirements of the Labor Code of the Russian Federation, to provide the employee with the opportunity to rent housing or book a hotel room, as well as provide those funds (daily allowance) that the employee can spend on personal needs if necessary. As we can see, the legislation does not say anything specifically about nutrition. Consequently, we conclude that the management does not have an obligation as such to “buy food” for the employee, because he is already paid the nth amount of money to cover similar costs, which cannot be said about rental housing, which is a separate expense item. In our example, the director decided to “cheat” by not paying daily allowances, but by compensating for food expenses. A priori, in this case, the company's management spends less money. For this, by the way, a posted worker can sue his employer. So, directors, keep this in mind, because the stingy pays twice.

How are meals paid for employees on a business trip?

Please note that all costs for food for an employee on a business trip are reimbursed through the daily allowance system. Therefore, the provision of a receipt from an employee from a restaurant or cafe cannot be taken into account for reimbursement. This fact is explained by legislative principles, which state that it is impossible to return money to employees based on supporting documents. In this case, we are talking about entertainment expenses, which have a different design according to the documents.

Thus, entertainment expenses mean funds spent on organizing receptions for company officials and professional services in restaurants or cafes.

Features of legal registration of entertainment expenses:

- According to accounting entries, such employee expenses are written off as expenses that involve usual types of activities. VAT on expenses incurred by the accountable person is also taken into account.

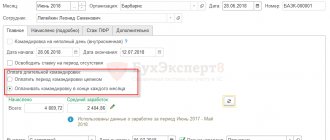

- Since hospitality expenses for food are paid by an employee of the enterprise, he needs to submit documents regarding the purpose and amount of funds spent when drawing up an advance report in accordance with the form numbered AO-1.

- An employee's entertainment expenses during a business trip can reduce taxable profit for the company. This feature is determined by paragraphs of Art. 264 of the current tax legislation.

- The economic explanation of entertainment expenses for the purpose of forming the accounting policy of an enterprise can be confirmed using a report on activities, an estimate or an act of spending funds. According to the written requirements of the Federal Tax Service of the Russian Federation, drawn up on May 8, 2014, information about expenses must be confirmed in the form of primary documents.

The tax base

If the employer nevertheless decides to act according to the law, he will in any case have to take care of how to correctly calculate all taxes. In particular, compensation for food expenses is subject to personal income tax, like any other payment specified in the agreement, not counting the mandatory ones. The Ministry of Finance answers this question in detail in its letter dated October 14, 2009 No. 03-04-06-01/263. There, the curious reader may discover that it is necessary to charge a certain amount of insurance premiums from these compensations, and also take these payments into account as expenses for income tax purposes. The same opinion is shared by the courts of individual districts of the Russian Federation, but there is also an opposition opinion. For example, there is a resolution of the Federal Antimonopoly Service of the North-Western District dated March 23, 2009 No. A05-8942/2008, in which the arbitrators came to the conclusion that compensation for food expenses was made to the employee in the direct interests of the company (after all, he, while on a business trip, carries out direct instructions from the employer). Therefore, these expenses should not be subject to personal income tax. The problem once again boils down to the fact that fragmented judicial practice creates solid ground for interpreting laws in their own interests, which remains in the hands of corrupt structures. Unfortunately, this is the reality of our lives and, at least now, the average citizen will not be able to do anything about it, no matter how much he or she wants.

Replacing daily payments with food expenses

1. Does the employer have an obligation to compensate an employee for food costs on a business trip?

No. When sent on a business trip, the company is legally required to compensate the employee for travel expenses, rental housing, daily allowance or field allowance, as well as other expenses agreed upon by the employer (Article 168 of the Labor Code of the Russian Federation). Accordingly, payment for food for a business trip employee is not included in the list of expenses required to be reimbursed. At the same time, the Labor Code allows compensation for any other costs, subject to their agreement with the employer. To do this, the organization must establish a list of costs and the procedure for compensating them in the relevant local regulations. Therefore, compensation for food costs is a right, but not an obligation.

2. Are daily allowances and meal allowance the same thing? What is the difference?

These are different types of payments that are not related to each other. Payment of daily allowance to an employee when sent on a business trip does not depend in any way on whether he is compensated for food costs, since this is the direct responsibility of the employer. In some court decisions, arbitrators emphasize that the purpose of the daily allowance is to cover additional expenses of an employee during a business trip related to living outside his place of permanent residence (Appeal ruling of the Moscow Regional Court dated September 28, 2016 in case No. 33-26804/2016). This is compensation for the inconvenience that an employee may experience when performing his duties in another city.

Read also “Travel expenses: calculation and payment of daily allowances”

3. If an employer compensates for the actual cost of food during a business trip, does he have the right not to pay per diem?

No, it doesn't. Payment of daily allowances when sending an employee on a business trip is mandatory. In this case, the payment is compensatory and is not related to the employee’s actual performance of his job duties during the business trip. The daily allowance must be paid for each day on a business trip, even if the specialist for some reason did not perform his work duties at that time. According to the position of Rostrud, even if there is downtime due to the fault of an employee, the company is not relieved of the obligation to pay him per diem for the entire period of his business trip (letter dated April 30, 2008 No. 1024-6).

4. Is it necessary to charge insurance premiums for the amount of compensation for meals on a business trip?

Yes need. This position is supported by the Ministry of Labor, citing the following arguments. Compensation for meals to employees is not directly established by labor legislation. Accordingly, these monetary compensations, which reimburse employees for their food costs, are payments within the framework of labor relations and therefore should be subject to insurance premiums in the general manner (letter of the Ministry of Labor of Russia dated March 11, 2014 No. 17-3/B-100).

Read also “Payment of daily allowances for business trips in 2022”

5. Is compensation for meals for an employee on a business trip subject to personal income tax?

There are different points of view on this issue. According to the Ministry of Finance, compensation for meals on a business trip is subject to personal income tax, since it is not included in the list of payments exempt from tax in connection with a business trip established in the Tax Code of the Russian Federation (letter dated October 14, 2009 No. 03-04-06-01/263 ). The Federal Tax Service takes a similar position: reimbursement of expenses for an employee’s meals in public catering establishments during a business trip is his income and is subject to personal income tax (letter of the Federal Tax Service of Russia for Moscow dated July 14, 2006 No. 28-11/62271). However, judicial practice in this area is contradictory; at the moment, arbitrators do not have a clear opinion. Some resolutions indicate that the organization is required to withhold personal income tax from the cost of compensation for meals to a posted employee (Resolution of the Federal Antimonopoly Service of the Moscow District dated April 4, 2013 No. A40-51503/12-90-279). The courts point out that compensation for meals for a posted employee is not mentioned in paragraph 3 of Article 217 of the Tax Code of the Russian Federation, therefore it is unlawful to exempt these payments from personal income tax.

note

Payment of daily allowance to an employee when sent on a business trip does not depend in any way on whether he is compensated for food costs, since this is the direct responsibility of the employer.

There are also opposing court rulings, reasoned as follows: since the employee performed official tasks during a business trip, these costs were incurred in the interests of his employer. Accordingly, compensation for his food expenses is not subject to personal income tax (Resolution of the Federal Antimonopoly Service of the North-Western District dated March 23, 2009 No. A05-8942/2008). Thus, due to the ambiguity of judicial practice, there is a risk that the tax authorities will demand that personal income tax be withheld from the amounts of actual compensation for employee expenses for food on a business trip, and this point of view will be supported by the court. A conservative solution for employers is to impose personal income tax on this type of compensation; otherwise, you need to be prepared to defend your opinion in court.

Read also: “Daily allowance for a one-day business trip”

6. Can compensation for meals on a business trip be taken into account for income tax purposes?

There is no clear answer to this question. The Ministry of Finance is of the opinion that other expenses associated with a business trip do not include compensation for food expenses (letter of the Ministry of Finance of Russia dated October 9, 2015 No. 03-03-06/57885). There are court decisions both supporting and refuting this point of view, so in order to avoid disputes with the tax authorities, it is recommended not to accept such expenses for income tax purposes.

7. Are insurance premiums charged in cases where the cost of food is included in the price of a hotel stay or air ticket?

No, unless the cost of meals is listed as a separate line item and is not mentioned on the hotel bill. This opinion is shared by the Social Insurance Fund (Appendix to letter No. 14-03-11/08-13985).

The letter of the Ministry of Health and Social Development dated August 5, 2010 No. 2519-19 also indicates that insurance premiums are not charged for the cost of an employee’s stay in a hotel (taking into account the inclusion of the cost of breakfast). If the hotel bill does not separately highlight the price of breakfast, but mentions it, then there is a possibility of claims from the tax authorities. Indeed, in this case, you can find out the price of food, for example, by asking the hotel administration. To avoid disputes with auditors, it is recommended to obtain documents from the hotel indicating the cost of accommodation for a business trip employee without mentioning the food included in this cost.

Read also “What contributions are not subject to travel expenses”

8. Is it necessary to withhold personal income tax in a similar case?

No, the same as in the situation with insurance premiums. It is worth noting that, according to the official position of the Ministry of Finance, payment for food is not compensation for the expenses of a posted employee for renting housing. Therefore, if an organization pays an employee for meals in a hotel, then its cost, highlighted as a separate line in the bill for accommodation, is subject to personal income tax (letter of the Ministry of Finance of Russia dated October 14, 2009 No. 03-04-06-01/263). Accordingly, in order not to charge tax, it is necessary that the accommodation documents do not contain any mention of the cost of food included in it.

The employee is "out of order"

Since we have already touched upon the topic of replacing daily allowances to compensate for the daily expenses of a posted employee, it would not be out of place to talk about what a director should do in a situation where an employee, for example, gets sick and therefore cannot perform his job duties. It is logical to assume that the daily allowance is paid to him when he is actually “in service” and does the work that is assigned to him. We want to make a reservation right away - this is a misconception. From the point of view of the Labor Code of the Russian Federation, daily allowances should be paid to an employee exactly in the amount of how many days the employee worked while outside the city of his permanent residence. Even if he fell ill on the first day of his arrival in another city or country and spent the entire period of the business trip “lying in bed,” the management is obliged to accrue him a daily allowance. Here again, the company's management may be tempted to negate the need for expenses from which they will have no return. It is worth noting that a similar approach to solving this issue is a punishable act that can result in a large fine.

Legislative regulation

| Decree of the Government of the Russian Federation dated December 29, 2008 No. 1043 | On the abolition of the daily allowance rate of 100 rubles |

| clause 3 art. 217 Tax Code of the Russian Federation | The fact that travel expenses, confirmed by documents, are not included in the tax base for personal income tax |

| Art. 210 Tax Code of the Russian Federation | On the withholding of personal income tax from compensation for payment of accommodation and travel on a business trip, if the amounts of expenses were not documented |

| Letter of the Ministry of Finance of the Russian Federation dated October 14, 2009 No. 03-04-06-01/263 | On the withholding of personal income tax from the cost of breakfasts included in the invoice for hotel accommodation |

| Letter of the Ministry of Finance No. 03-03-06/1/30978 | On the possibility of taking into account, when calculating income tax, a company’s expenses for a remote employee’s business trip |

For a wide foot

There is another interesting side to the question. Let’s assume that an employee has signed an agreement with the manager, which stipulates the employer’s obligation to compensate for all food costs during a business trip. In order to protect the rights of the company, we want to recommend it to its director, discuss the approximate, or better yet, the exact amount of the money that he can return. It is necessary to do this for the reason that a business trip employee suddenly decides that he can “deny nothing” to himself by visiting expensive restaurants, for example. If the agreement does not contain the exact amount of compensation payments, the company will have to reimburse the costs of any checks presented by the employee. Otherwise, the trial will most likely end in favor of the “runaway” employee.

What else can an employee count on?

Compensation for food costs is not the only thing an employee going on a business trip can ask for. Among the most popular needs are payment for mobile communications, compensation for Internet costs, purchase of additional warm clothing if we are talking about a trip to the Far North, additional money in case the booked hotel room has a number of inconveniences and he will have to rent other housing on his own . In other words, the requirements may be completely different. It is important for the employer to understand that he can refuse many of them, being right. In particular, additional expenses for mobile communications are the employee’s whim, the Internet is also a whim, additional clothing is a whim, etc. At the same time, the employer must provide the employee with exactly the kind of housing that will allow the employee to stay comfortably at the place of business trip, and also pay exactly the amount of daily allowance that is regulated by current legislation. In any case, no one can forbid the director from buying his dear subordinate a hat with earflaps made of arctic fox, so that he does not freeze while working in the Arctic Circle. The main thing is that all expenses are, if possible, agreed upon in advance. This will help solve the main problem of all business trips – who owes what to whom.

Authorization

| Paying for meals on a business trip is not the employer’s responsibility, however, the employer has the right to pay for meals if this is provided for in a collective agreement or local regulations. |

A business trip is a trip by an employee by order of the employer for a certain period of time to fulfill an official assignment outside the place of permanent work (Part 1 of Article 166 of the Labor Code of the Russian Federation).

When an employee is sent on a business trip, he is guaranteed to retain his place of work (position) and average earnings, as well as reimbursement of expenses associated with the business trip (Article 167 of the Labor Code of the Russian Federation).

If an employee is sent on a business trip, the employer is obliged to compensate him (part 1 of article 168 of the Labor Code of the Russian Federation, clause 11 of the Regulations on the specifics of sending employees on business trips, approved by Decree of the Government of the Russian Federation of October 13, 2008 N 749 (hereinafter referred to as Regulation N 749 )):

- travel expenses;

- expenses for renting residential premises;

- additional expenses associated with living outside the place of permanent residence (per diem);

- other expenses incurred by the employee with the permission or knowledge of the employer.

Additional expenses associated with living outside the place of residence (per diems) are reimbursed to the employee for each day of a business trip, including weekends and non-working holidays, as well as for days en route, including during a forced stopover, taking into account the provisions , provided for in clause 18 of Regulations No. 749 (clause 11 of Regulations No. 749).

In our opinion, per diem is a compensation payment to reimburse the employee’s expenses caused by the need to carry out an official assignment outside the place of permanent work. This payment has no specific purpose; the employee has the right to spend the daily allowance at his own discretion.

Payment for food is not included in the list of expenses required to be reimbursed to the employee.

The procedure and amount of reimbursement of expenses associated with business trips are determined by a collective agreement or a local regulatory act of the organization (Part 4 of Article 168 of the Labor Code of the Russian Federation).

Thus, the employer has the right to establish the rule on reimbursement of the cost of food for an employee on a business trip, as well as the amount of reimbursement for the cost of food for an employee on a business trip, in a collective agreement or local regulation.

D.N. Konkova

Ministry of Labor and

social protection

Russian Federation

Should an accountant not carry out obviously erroneous instructions from the director?

If the director intends to “defraud” a posted worker, only he and his company will bear responsibility for this. The accountant in this case is a person who is hardly involved in what is happening. In the event of a conflict situation between a boss and a subordinate regarding cash payments, the accountant can always refer to his immediate supervisor, who gave the appropriate instructions. This is especially true for ordinary accountants (not chief accountants), who, in theory, do not make independent decisions on this or that issue, and therefore do not bear responsibility. So, it’s up to them to decide which side to take.

conclusions

Based on the above, we inform you that “replacing” daily allowance payments with compensation for food expenses is an illegal act, which will inevitably be followed by a fine. Further, all compensatory payments must be reflected in tax and accounting records, which obliges the company's management to tax these amounts. Moreover, the employer has the right not to compensate for the food costs of his subordinates, because these expenses are not included in the number of mandatory payments, while he retains the opportunity to help his employee financially.

Thank you very much for your attention and see you again!

What are the costs of a business trip?

A business trip is one of the important components of the work process and implies certain costs for organizing the employee’s work process outside the employer’s company.

Travel funds, which include expenses for food on a business trip, are returned according to the standardized schedule established in the employment documents. Reimbursement of expenses is made on the basis of the daily expenses of the working enterprise for each day of the business trip. As a rule, the managers of the organization providing employment independently determine the amount of daily compensation that their employees receive.

According to Art. 168 of the Labor Code of the Russian Federation, payment of daily expenses consists of providing a sum of money that has no intended purpose. The Business Travel Regulations also explain that an organization’s worker can use funds not only to pay for food, but also for other expenses during a work trip.

Travel expenses standards:

- Payment of employee expenses for food per day is normatively established only in relation to state-owned enterprises.

- Daily expenses, including payment for food during a business trip, must be reimbursed to the employee for working on public holidays and weekends according to his schedule.

- The managers of the enterprise have the right to formulate travel payments to the worker in any amount up to the maximum amount without taxation.

- The maximum daily payment for expenses to a worker depends on the field of activity of the enterprise.

- Commercial enterprises do not have the right to reduce daily payments for expenses of their employees from the amount prescribed in internal regulations.