The values used by the organization may become unusable over time. In this case, you need to get rid of them, which will also need to be documented. To draw up an order, you can use a sample order for writing off material assets; this document is filled out and signed by the manager. Deregistration is an action that organizations face periodically, so you can use a suitable template to simplify the task of completing the document.

Features of write-off

Valuables that may be subject to write-off include the following groups:

- All kinds of raw materials.

- Organizational reserves.

- Work in progress products.

- Finished products.

Write-off means that the objects specified in the document will be deregistered, and the document will be considered a justification for this action.

The need for a write-off arises for various reasons, most often the following factors include:

- Use of raw materials in production processes.

- The end of the specified service life of an object.

- Natural wear and tear.

- Equipment breakdown.

- Loss of required quality due to exposure to external factors, such as fire or flooding.

- The occurrence of losses due to the content of valuables on the balance sheet - their storage becomes unprofitable for some reason.

All of these circumstances are identified during the inspection by persons who are responsible for material assets. In the listed situations, the content of the valuables ceases to be beneficial for the organization, therefore they are subject to mandatory write-off and deregistration. To perform this operation, it is necessary to draw up a special order, which must be signed by the manager, then it will be possible to carry out all the necessary actions.

Are the materials outdated or become illiquid? We write off the register!

It happens that materials stored in a warehouse become obsolete or become illiquid for other reasons. Such materials are written off.

The decision to write off is made by the head of the organization. However, in order to carry out all the preparatory work, as a rule, a special commission is created <*>. Such commission, among other things:

— examines materials proposed for write-off, determines their actual condition and quantity;

— establishes whether materials are suitable for restoration and (or) further use;

— finds out the reason for the write-off;

— determines whether it is possible to use or sell (hand over to procurement organizations) any parts (individual elements) of materials subject to write-off.

The same commission draws up the corresponding act on the write-off of materials. The form of such an act is not defined; the organization develops it independently (taking into account the requirements for the PUD) and approves it as an annex to the accounting policy.

In the form of the act, in addition to information about the materials being written off, you can include data on usable seized parts, scrap and waste of ferrous and non-ferrous metals, information on precious metals, etc. Alternatively, separate documents can be drawn up for the seized usable parts and the waste generated <*>.

Note 1. If the materials being written off contain precious metals, they must be extracted and handed over to the State Fund. In particular, after approval of the decommissioning act, parts, assemblies and components containing precious metals must be removed from these materials, drawing up a dismantling (removal) act. To recover precious metals, decommissioned materials can be transferred to a third party. After providing such a service, the latter submits the corresponding act <*>.2. In the case when, as a result of the write-off of materials, scrap and waste of ferrous and non-ferrous metals are obtained, they are handed over to procurement organizations <*>.

The final decision on the write-off of unusable materials is made by the head of the organization. As a rule, it is formalized by the manager putting a date and signature on the approval stamp on the materials write-off act. But a corresponding order may be issued <*>.

After approval of the act by the manager, items unsuitable for further use are handed over for disposal.

Note! Discarded materials, as a rule, form production waste. And in relation to them, organizations must fulfill the obligations provided for in the field of waste management <*>.

Write-off acts (usually with a note from the warehouse manager about the accepted scrap) are transferred to the accounting department to make the appropriate entries.

Thus, the write-off of obsolete or otherwise illiquid materials from the warehouse in accounting is reflected as follows: Dt 90-10 “Other expenses for current activities” - Kt 10 “Materials”. If any usable parts, scrap metal or precious metals come from the write-off, they are taken into account by recording: D-t 10 - K-t 90-7 “Other income from current activities”. Waste intended for disposal is not an asset and has no value. In this regard, they come only in quantitative terms <*>.

Note: In a situation where, when writing off obsolete materials or illiquid assets, an organization takes into account parts that can be used in production and (or) waste intended for sale or delivery to procurement organizations, the “input” VAT on written-off materials does not need to be restored. If, during write-off, only waste is generated that cannot be sold, and it is intended for transfer to disposal, then the amount of VAT previously accepted for deduction on these materials is subject to restoration <*>.

Read this material in ilex >>*

* following the link you will be taken to the paid content of the ilex service

Commission and its work

Before the manager makes a decision and draws up an order, the inspection is carried out by a special commission, which usually consists of the chief accountant of the organization and responsible persons; other specialists may also be involved, as necessary. The tasks are as follows:

- Inspect existing materials and determine the reasons why they may be written off.

- Identify those responsible for the fact that the valuables have become unusable, if necessary.

- Determine further actions regarding materials.

- Draw up an act for write-off.

- Submit the document for approval.

- Assess existing materials to determine their cost.

- Monitor the disposal of all decommissioned objects.

After the inspection, the commission makes a decision on write-off, and an act is drawn up, which indicates all the objects to be deregistered, as well as the relevant reasons that serve as justification for this. All members of the commission sign the document, after which it is submitted to the head for signature.

Creation of a commission for writing off material assets

When creating an expert commission, it is necessary to select candidates taking into account the ability to objectively assess the situation and perform the following tasks:

- establish the reasons why assets cannot be used;

- determine the possibility of their write-off;

- identify those responsible for breakdowns (if required);

- estimate the cost of materials;

- monitor the process of recycling valuables;

- draw up a report on the progress of the procedure.

IMPORTANT! The cost of written-off resources must be less than or equal to the size of the balance and cannot exceed this value, as this leads to losses for the enterprise.

Composition of the commission

As a rule, the leader includes:

- chief accountant of the company (deputy, acting);

- employees with whom agreements on financial liability for written-off objects have been concluded;

- other persons with the required skills to perform the procedure.

IMPORTANT! Regardless of its composition, the commission does not have the right to independently write off valuables from the balance of the organization’s balance sheet. The issue of approval of this process is decided solely by the head of the enterprise on the basis of the conclusion drawn up during the inspection.

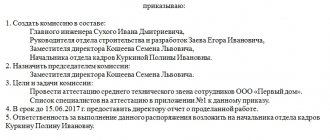

Order on the creation of a commission

The order on the formation of the commission is issued by the director of the organization, drawn up in free form in compliance with the rules for maintaining business documentation.

We recommend reading : Procedure for compensation by an employee for material damage

It is recommended to include workers in an odd number (in case of controversial issues in the voting procedure). Accordingly, the document must indicate the conditions under which the issue will be resolved in this way: for example, when less than 2/3 of the participants are in favor of one or another solution to the issue.

ATTENTION! In some situations, the commission’s conclusion may be biased: for example, if, when examining complex technical equipment, the appointed employees do not have sufficient knowledge to assess its condition. Then the company will have to use the services of third parties. This possibility must be taken into account and stated in the order.

Drawing up an order

There is no official formal form for this order, so the manager can use a suitable sample or draw up an act in free form. The main thing is that it contains all the necessary data:

- Date and number.

- Reasons for the write-off.

- Link to the preliminary conclusion of the commission.

- The time frame within which the write-off must be made.

- Information about responsible persons.

- Manager's signature.

Issuing an appropriate order is an important step in regulating production processes, therefore it is necessary to take into account the existing legal requirements when drawing it up, so as not to make mistakes and correctly carry out the entire write-off process.

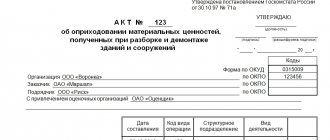

How to correctly draw up an act of write-off of materials

This document must necessarily contain information about the enterprise and the members of the write-off commission: their positions, surnames, first names, patronymics, as well as a detailed list of materials being written off, including their quantity and cost (piece and total), the reason for write-off. The commission is appointed by a separate order of the head of the organization, and the chairman of the commission is also prescribed in it. After entering all the data into the write-off act, each member of the commission must sign the document , thereby certifying that all the information was entered correctly. Also, upon completion of the procedure, the report must be certified by the head of the organization.

The act of writing off materials has a legal status, since on the basis of it the specialists of the accounting departments reflect the book value of the written-off material assets, as well as the direct loss of the enterprise due to their loss. In turn, this information is reflected in the tax records of the legal entity.

The act does not have a unified, standard template, so it can be drawn up in free form or according to a template developed within the organization, in accordance with the characteristics of its activities and needs. The document can be drawn up on a regular A4 sheet or on the organization’s letterhead in a single copy intended for the accounting department of the enterprise (however, if necessary, members of the commission, as materially responsible persons, can request a copy of the act). It is not necessary to certify it with a seal, since it relates to internal document flow and is recorded in a special journal.

Accounting

The procedure for writing off goods subject to disposal will depend on the reasons as a result of which it was damaged or became unsuitable for use.

However, in any case, the cost of such goods is reflected as their shortage in the debit of account 94 “Shortages and losses from damage to valuables” (Instructions for the application of the Chart of Accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n).

If it is determined that the storage conditions of the goods were violated, its damage shall be attributed to the person at fault.

In such a situation, the amount of the deficiency in the part reimbursed by the employee is written off to account 73-2 “Calculations for compensation of material damage.”

If a product has become unsuitable for use as a result of the expiration of its shelf life, then its cost is written off as expenses in the debit of account 91-2 “Other expenses”.

The accounting records of a trading company will look like this:

| Contents of operation | Debit | Credit |

| The cost of damaged (overdue) goods has been written off | 94 | 41 |

| The cost of damaged goods was written off at the expense of the guilty parties | 73-2 | 94 |

| The cost of damaged goods was recovered from the guilty parties | 50 or 51 | 73-2 |

| The cost of expired goods has been written off | 91-2 | 94 |

| The cost of damaged goods was written off within the limits of natural loss | 44 | 94 |

Who conducts

To carry out the inventory, a special commission is appointed by order of the director of the company.

It consists of several specialists, including the chief accountant, the head of the structural unit whose property is being inventoried, as well as employees from other departments, such as a lawyer, chief engineer, etc.

At the same time, the commission should not include financially responsible employees, but they must be present during the inventory.

The commission’s tasks include inspecting the property, counting it, reconciling it with accounting papers and drawing up final documents, including a protocol, an inventory of inventory items and all necessary acts.

Features of drawing up an act, sample

Today, there is no mandatory, unified form of an act for writing off low-value and wear-and-tear items, so employees of enterprises have every right to write an act in any form or, if the organization has a developed and approved sample document, according to its template. In addition, very often company representatives prefer to use the previously generally used form MB-8. This is due to the fact that it is clear and convenient in structure, contains all the necessary information, and there is no need to rack your brains over the composition of the document.

Filling out the header of the MB-8 form

The “header” of the form contains several lines for approval by its director - without his autograph the act will not acquire legal force. Then it is indicated:

- number assigned to the act;

- name of the organization and structural unit in which the write-off occurs, its OKPO code.

Filling out the front page of form MB-8

Under the “header” of the document there is the first table, where the following is entered:

- date of drawing up the act;

- transaction type code (in accordance with the classifier);

- structural unit that writes off inventory items;

- type of company activity (according to OKVED);

- information about the subaccount and analytical accounting code.

Below you enter the date of formation of the commission, the order number and the fact of write-off is recorded.

The second table includes detailed information about the property being written off:

- its name,

- quantity,

- cost,

- date of receipt,

- service life,

- reason for write-off and other characteristics.

Filling out the back page of form MB-8

On the reverse side of the act, there is first a continuation of the previous table, at the bottom of which the totals for the items being written off are summarized. Below it is indicated the total number of items, numbers and dates of their disposal. The last table of the act includes information about disposal.